Scotia Private Real Estate Income Pool

As of March 31, 2015

Investment Objective

PERFORMANCE & PORTFOLIO ANALYSIS

Specialized exposure to real estate with diversification

and income benefits.

• Invests primarily in North American equity

securities, including REITs, of businesses that own

and/or operate a wide variety of real estate

properties.

• Concentrated portfolio with a focus on providing

income and capital growth.

• Lower correlation to fixed income and equities

thereby providing diversification benefits in an

overall portfolio solution.

Risk Rating

LOW

MEDIUM

Compound returns (%)

Fund

Reasons for Investing

»

HIGH

Time Horizon — Long

FUND DETAILS

Inception Date ...................... November 26, 2012

Total Assets $mil ...................................... 223.51

Income Distribution ................................. Monthly

Capital Distribution ................................ Annually

12-Month Distribution

Yield ......................................................... 3.21%

MER % (as of 12/31/2014) ........................... 0.21

NAV $ ........................................................ 12.44

50% Bloomberg Canadian REIT

Benchmark .. Index, 50% MSCI U.S. REIT Index C$

Calendar Year Returns (%)

1 Mth

3 Mth

6 Mth

1 Yr

3 Yr

5 Yr

10 Yr

Incep.

1.49

11.09

22.32

28.22

--

--

--

13.95

YTD

2014

2013

2012

2011

2010

2009

2008

2007

2006

2005

11.09

24.21

-2.33

--

--

--

--

--

--

--

--

Distributions ($/unit)

YTD

2014

2013

2012

2011

2010

2009

2008

2007

2006

2005

Total Distributions

Interest

Dividends

Return of Capital (ROC)

0.10

----

0.40

0.09

0.30

0.01

0.40

0.04

0.18

0.18

-----

-----

-----

-----

-----

-----

-----

-----

Fund

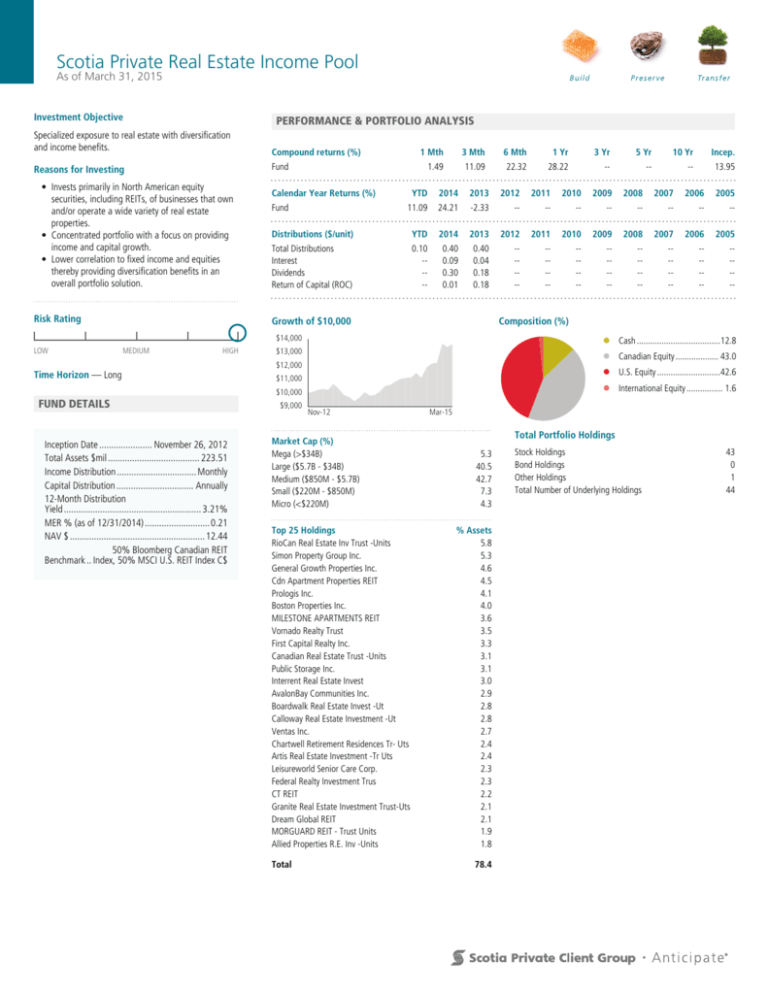

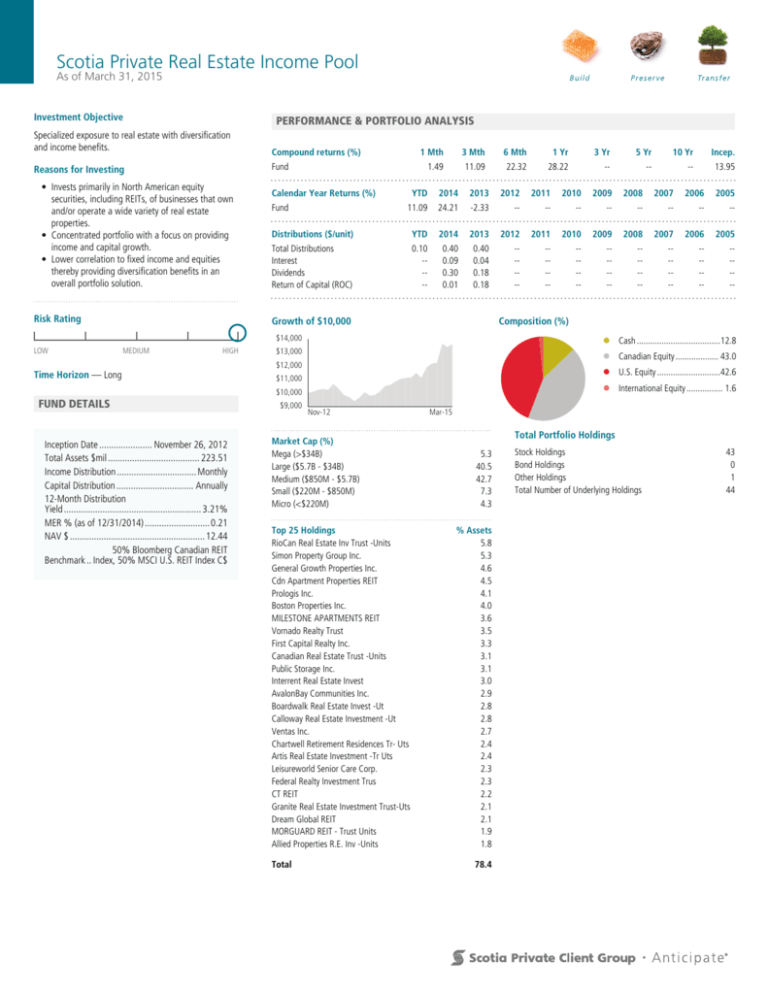

Growth of $10,000

Composition (%)

$14,000

Cash .....................................12.8

$13,000

Canadian Equity ................... 43.0

$12,000

U.S. Equity ............................42.6

$11,000

International Equity ................ 1.6

$10,000

$9,000

Nov-12

Market Cap (%)

Mega (>$34B)

Large ($5.7B - $34B)

Medium ($850M - $5.7B)

Small ($220M - $850M)

Micro (<$220M)

Top 25 Holdings

RioCan Real Estate Inv Trust -Units

Simon Property Group Inc.

General Growth Properties Inc.

Cdn Apartment Properties REIT

Prologis Inc.

Boston Properties Inc.

MILESTONE APARTMENTS REIT

Vornado Realty Trust

First Capital Realty Inc.

Canadian Real Estate Trust -Units

Public Storage Inc.

Interrent Real Estate Invest

AvalonBay Communities Inc.

Boardwalk Real Estate Invest -Ut

Calloway Real Estate Investment -Ut

Ventas Inc.

Chartwell Retirement Residences Tr- Uts

Artis Real Estate Investment -Tr Uts

Leisureworld Senior Care Corp.

Federal Realty Investment Trus

CT REIT

Granite Real Estate Investment Trust-Uts

Dream Global REIT

MORGUARD REIT - Trust Units

Allied Properties R.E. Inv -Units

Total

Mar-15

Total Portfolio Holdings

5.3

40.5

42.7

7.3

4.3

% Assets

5.8

5.3

4.6

4.5

4.1

4.0

3.6

3.5

3.3

3.1

3.1

3.0

2.9

2.8

2.8

2.7

2.4

2.4

2.3

2.3

2.2

2.1

2.1

1.9

1.8

78.4

Stock Holdings

Bond Holdings

Other Holdings

Total Number of Underlying Holdings

43

0

1

44

Scotia Private Real Estate Income Pool

MANAGER BIO

Oscar Belaiche

Manager Since November 20, 2012

1832 Asset Management L.P

Oscar is Senior Vice President & Portfolio Manager at 1832

Asset Management L.P. He joined 1832 Asset

Management L.P in 1997 and currently heads Dynamic’s

awardwinning Equity Income team, managing over $8.0

billion in assets. Oscar graduated in 1980 with an Honours

B.A. in Business Administration from the University of

Western Ontario. He has his Chartered Financial Analyst

designation and is a Fellow of the Institute of Canadian

Bankers.

Tom Dicker

Manager Since November 20, 2012

1832 Asset Management L.P.

Tom Dicker is a Portfolio Manager and member of the

award winning Equity Income team at 1832 Asset

Management LP. He is the co-manager of the Scotia

Private Real Estate Income Pool with a focus on finding

best-in-class businesses among securities in the real estate

sector.

QUARTERLY COMMENTARY

As of March 31, 2015

Global equity markets posted gains during the period. Within North America, the Canadian equity market was stronger

than the U.S., despite the drag from the energy and financial sectors. While concerns over a slowdown in the Canadian

economy weighed on bank stocks, real estate securities outperformed most sectors as a result of strong performance early

in the period, while the retail and industrial subsectors were the top performers. In the U.S., real estate securities

performed well but to a lesser extent than Canadian ones. In the U.S., the residential and office subsectors were the top

performers while hotel and resort securities were negative.

The fund’s cash weighting was held relatively steady during the period. The fund’s slight overweight towards the U.S. was

reduced with the allocation to Canada and the U.S. becoming balanced, while a small portion remained invested globally.

From a sector perspective, retail, residential and specialized Real Estate Investment Trusts (REITs) remained the largest

weightings in the fund at the end of the period. Within Canada, the fund added to residential and industrial REITs while

moderately decreasing retail exposure. In the U.S., industrial exposure was increased and the allocation to specialized

holdings reduced. Geographically, U.S. holdings were the largest contributor to performance, with Canadian holdings also

having a positive contribution to performance. Notable individual contributors included Simon Property Group, Canadian

Apartment Properties REIT and Boston Properties while Morguard REIT was the largest detractor.

Interest rates remain incredibly low from a historical perspective and we believe that a lack of inflationary pressure and a

slow, but positive, growth environment is likely to keep rates lower for longer. We believe this is an ideal setting for real

estate investing and continue to focus on companies with high quality properties, attractive yields and pricing power to

increase rents. In Canada, we continue to find opportunities in sectors with favourable supply and demand fundamentals.

In the U.S., we remain positive on the outlook for real estate securities given strong job growth and favorable supply

conditions. At the end of the period, the fund’s U.S. dollar currency exposure was unhedged but we remain open to

hedging should our fundamental views change.

Tom has over 8 years of investment industry experience,

initially as an analyst and then portfolio manager, with

LDIC Inc. As an analyst he performed fundamental analysis

focused on diversified Canadian equities. As a portfolio

manager he was responsible for the management of equity

and income-oriented funds.

Tom received an Honours Bachelor of Commerce Degree

from the University of Ottawa and holds the Chartered

Financial Analyst designation.

® Registered trademarks of The Bank of Nova Scotia, used under licence.

© Copyright 2015, 1832 Asset Management L.P. All rights reserved.

Scotia Private Client Group®consists of private client services offered by The Bank of Nova Scotia, The Bank of Nova Scotia Trust Company, 1832 Asset Management L.P., 1832 Asset

Management U.S. Inc., ScotiaMcLeod Financial Services Inc., WaterStreet Family Offices®, a division of 1832 Asset Management L.P., and ScotiaMcLeod®, a division of Scotia Capital Inc.

Scotia Capital Inc. is a member of the Canadian Investor Protection Fund and the Investment Industry Regulatory Organization of Canada.

Scotia Private Pools® are managed by 1832 Asset Management L.P., a limited partnership the general partner of which is wholly owned by The Bank of Nova Scotia.

Units of the fund are only available for distribution to residents of Canada, unless the laws of a foreign jurisdiction permit sales to its residents.

IMPORTANT MUTUAL FUND INFORMATION

Important information about the Scotia Private Pools is contained in their simplified prospectus. Commissions, trailing commissions, management fees

and expenses may be associated with mutual fund investments. Please read the prospectus before investing. Mutual funds are not guaranteed or insured

by the Canada Deposit Insurance Corporation or any other government deposit insurer, their values change frequently and past performance may not be

repeated. The indicated rates of return are the historical annual compounded total returns including changes in unit value and reinvestment of all

distributions and does not take into account sales, redemption, distribution or optional charges or incomes taxes payable by any security holder that

would have reduced return.