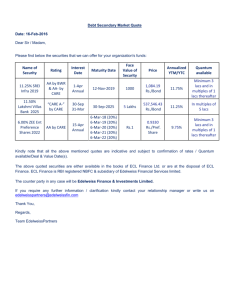

14th Annual Report - Tender Notice

advertisement