in Loyalty

advertisement

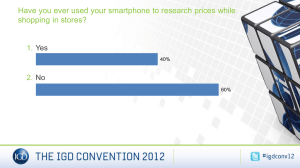

Key Trends in Loyalty Table of Contents Introduction. ...........................................................................................01 Digital/Mobile Integration For Seamless Customer Experiences.............................................................................02 A Holistic View of Customer Engagement: Moving Beyond Points.............................................................................04 Bringing It All Together: Big Data Means Big Insight......................................................................06 The Sharing (Digital) Economy: Platforming Out.......................................................................................08 Some Final Thoughts................................................................................10 References..............................................................................................12 www.snipp.com Key Trends in Loyalty Introduction Traditional loyalty programs are often met with derision, being perceived as clunky, card-based, points-based relics and having little relevance in our increasingly paperless, intuitive, and appdriven world. Colloquy’s 2015 Loyalty census1 bears this notion out, revealing that although loyalty memberships jumped 25.5% to 3.3 billion from 2012 to 2014, more than half of Americans don’t even bother to participate in those memberships, much less become loyal, engaged and enthusiastic program members. Deloitte’s customer survey2 further confirms this, revealing that overall brand loyalty is declining, continuing a 3-year trend. Clearly, stale approaches dominated by top-of-the-funnel3 activities that seem to run out of ideas beyond mere lead generation, are getting resounding thumbs down by consumers who expect more. The good news is that brands are waking up and realizing that Customer Experience is the new battlefield. Across industries, high levels of competition have eroded traditional product and service advantages, to the point where the only differentiation that matters is customer experience. According to a 2014 Gartner survey4, “89% of business leaders believed that customer experience would be their primary basis for competition by 2016 versus 36% four years ago.” Customer experience was the top area of marketing technology www.snipp.com investment in 2014, and is expected to lead innovation spending for 20155. Forward-thinking companies will have to find additional ways to make each customer’s experience unique and memorable, engaging them beyond the mere transaction. One of the major areas that they’ll be focusing on is loyalty programs – but not the antiquated kinds we’ve ignored thus far. As 2015 rolls onward, we’ll notice that loyalty initiatives trend towards being more digitally integrated, holistic, data-driven and collaborative. 89% of business leaders believed that customer experience would be their primary basis for competition by 2016 versus 36% four years ago. Source: 4Gartner 01 Key Trends in Loyalty 1. Digital/Mobile Integration For Seamless Customer Experiences It seems trite to say that the Internet and Mobile have changed the way we as consumers shop and interact with brands. We expect always-on, instantaneous access to every possible digital platform as we browse, purchase and review products -- wherever we may be. Research also shows that customers engaged across multiple channels spend substantially more than in-store only shoppers6. When it comes to Loyalty programs, however, rarely do customers get an integrated experience. 79% of loyalty programs may use mobile platforms, but only 9% offer redemption options across all channels. No surprise then that almost 90% of social media sentiment on loyalty programs was negative7 across industries, with 85% of millennials – who are expected to spend more than $200 billion annually by 2017 – revealing particularly negative attitudes. Going Mobile from Sign-up to Sign-out: Completing the Virtual Cycle Brands are taking the staunch negativity towards traditional paper and card based programs to heart, resulting in heavy digital investments into the integration of mobile into loyalty8, which has been the single biggest trend of last year, and is expected to dominate this year and the next. Digital integration would ultimately allow consumers an unbroken 79% of Loyalty programs use mobile platforms, but only 9% offer redemption options across all channels. 79% Source: 7Capgemini 2015 www.snipp.com shopping and program-redemption experience across mobile, website, and social media platforms. With the renewed interest in mobile payment, along with a significant increase in mobile commerce due in part to the introduction of Apple Pay and Google Wallet – the seamlessness is expected to continue along every stage of the retail and loyalty continuum, including and especially postpurchase relationships with consumers. • Members of Sephora’s “Beauty Insider” loyalty program can sync their loyalty accounts with Sephora’s mobile app, as well as the Apple Passbook mobile wallet. Using mobile devices, customers can track their purchases, view offers, and redeem reward points on the go. The strategy has worked. Sephora’s Passbook users have double the annual spends and purchase twice as often as the average Sephora customer9. • “My Starbucks Rewards10” program with the Starbucks mobile payments app allows consumers to earn and redeem reward points directly from mobile devices. The seamless experience has accelerated adoption of the app with over 8 million active members. Mobile Receipt Processing for Multi-Channel Brands Most industries that lend themselves to loyalty (e.g. ones with repeat purchase potential) have been fairly well saturated with loyalty programs – with one glaring omission. Multichannel brands (e.g. CPG, OTC pharmaceuticals, cosmetics) have traditionally stayed away from loyalty because of the difficulties in validating and rewarding purchases (since they typically do not own the point of sale). However with 02 Key Trends in Loyalty the advent of newer receipt-based solutions (such as SnippCheck, Snipp’s receipt processing solution), the loyalty industry for brands that “sit on shelf” will explode exponentially in the next five years, across category and size of company. Large brands will reduce their reliance on expensive “codeon-pack” programs and move to receipt processing platforms layered over loyalty card integrations where available. Receipt processing also significantly reduces the cost of deploying loyalty programs; as a result, brands that typically could not or would not do loyalty given the cost and complexity of codeon-pack and POS integrations can, and will, experiment and implement loyalty and loyalty-like programs. Brands are taking the staunch negativity towards traditional paper and card based programs to heart, resulting in heavy digital investments into the integration of mobile into loyalty, which has been the single biggest trend of last year, and is expected to dominate this year and the next. Source: 8TIBCO www.snipp.com • Kellogg’s recently announced that its Kellogg’s Family Rewards program, one of the largest multichannel brand loyalty programs in the market, is leveraging receipt processing and load-to-card as alternatives to the code-on-pack submission option for consumers. • Several brands, including Healthy Choice, Smart Choice and NicodermCQ, have started experimenting with different kinds of receipt-based loyaltylike programs. While not fullblown loyalty programs, these programs are typically of an extended duration, keep track of multiple purchases and have differentiated rewards. Building a Smarter Brick & Mortar The era of the smart phone has given way to smart homes, smart cars, and now, smart stores. The use of iBeacons and Indoor Positioning Systems has become a growing trend in large retail stores, allowing brands to directly customize offers and messages based on consumers’ exact locations, via low energy Bluetooth signals. According to Gartner11 , by 2020, retail businesses that use targeted messaging in combination with indoor positioning systems will see a 5% increase in sales. By 2017, seven of the 10 largest retailers will use indoor positioning systems, combined with mobile apps, to aid shoppers in quickly locating departments and products. For loyalty program members, retail apps will be able to go beyond even full-cycle redemption options – they’ll be able to help navigate us through store aisles, alerting us to deals and discounts, reward in-store interactions, and bring greater overall value to program membership. • Macy’s, the department store, is personalizing its traditional brick-and-mortar experience by using iBeacons to send push notifications to in-store shoppers. The messages instantly notify a loyalty program member which of their favorites are available in-store, and then delivers customized discounts on those items. • Duane Reade12, New York City’s dominant chain pharmacy will now be utilizing iBeacon to boost its customer loyalty program – the microlocation data will quickly check a customer’s shopping history and recommend items to purchase based on that person’s precise location within the store. • Sephora, the cosmetics chain, sends alerts and messages to members who are in, or nearby, a Sephora store through an integration with Apple’s Passbook platform. 03 Key Trends in Loyalty 2. A Holistic View of Customer Engagement: Moving Beyond Points It’s clear that we’re bored with listless points-based13 loyalty programs that take forever to see returns, and even the usual frequency cards and buy-four/ get one free promotions. Savvy consumers require a truly distinct loyalty proposition, in which membership and rewards are fully integrated with the brand, and where they are recognized and treated individually. Increasingly savvy brands are also recognizing that they need a more holistic portrait of brand engagement, one that transcends just transactions and encompasses all brand interactions. Branding the Relationship Forward thinking brands are focusing on developing a 360-degree relationship with consumers that does not end with a single transaction, and has profound impact on customer value. This means understanding their needs, their lifestyles, and in some cases, allowing short term gains (sale of product) to be trumped by the long-term goal (enjoyment of the brand experience), in order to really build loyalty and commitment. Some examples of how successful companies are meeting customer needs include: • Supporting Customer Goals: o Nike’s loyalty program, although not formalized, engages with its customers holistically – they committed to developing a deep understanding of their customer and how they went about their fitness regimes, and brought together a community to compete or share their www.snipp.com fitness experiences. As a result they’ve created a loyalty program that has transcended the transaction, and instilled reciprocal commitment from their customers. Savvy consumers require a truly distinct loyalty proposition, in which membership and rewards are fully integrated with the brand, and where they are recognized and treated individually. o Discover recently expanded its existing credit card rewards program for college students by providing a cash incentive for good grades. Not unlike Mom and Dad forking over cash for each ‘A’ on a report card, Discover plans to pay $20 to college students who maintain a 3.0 (or equivalent) or higher during the school year. • Solving Customer Pain Points: o Amazon’s largest success in loyalty is built around solving one of online shoppers’ primary pain points: delivery. Membership of Amazon Prime offers free two-day shipping, plus a selection of free streaming videos and Kindle books. Prime not only integrates tightly with Amazon’s brand and value proposition (promising a reliable customer experience), it also creates a loyalty program for suppliers, who rely on Fulfillment By Amazon for two-day delivery, and thus access to Prime customers. It is estimated that members spend over four times more15 with Amazon Prime than nonmembers. 04 Key Trends in Loyalty • Aligning with Customer Values: o Linking Charitable Giving with Loyalty: Consumers are now looking for opportunities to donate within their loyalty program. In fact, a recent study found that 33%16 of people enjoy having the option of donating reward points or items to charities through their program. Loyalty programs are now offering them the chance to convert program points to donation dollars in order to redeem in a meaningful way. Kroger community rewards17 allows members to contribute www.snipp.com to community charity efforts through their loyalty program. From Brand Interactions To Behaviors: Plugging In to the Internet of Things The growth of the Internet of Things and the increasing connectivity afforded by devices provides brands with unique opportunities to extend their loyalty programs beyond direct brand interactions to incorporate desirable behaviors. For example, health insurance companies can (and do) reward consumers that wear FitBits and meet minimum daily activity targets. Walgreens now lets its members earn points whenever they engage in healthy activities like walking, weight tracking, and getting flu shots, besides simple purchase of products. Similarly, energy utilities can reward consumers who use Nest thermostats and use company-specified heating plans. As more and more devices get connected together, expect to see more companies offering consumers rewards for behaviors that can be tracked by those devices. 05 Key Trends in Loyalty 3. Bringing It All Together: Big Data Means Big Insight The previous sections spoke about how digital and mobile data are being used to provide a compelling, app-based loyalty experience for customers. For brands, however, one of the biggest advantages for making these investments (not that customer loyalty isn’t a big one, let’s be clear) is that it provides an incentive for customers to identify themselves. That, in turn, makes it possible for marketers to get a clear, unified view of brand interactions across channels. Aggregating data gleaned from mobile with loyalty, transactional and location data allows for a more comprehensive view of customers, and provides valuable insights into where best to focus further investment. Let’s Be Profitable: Using Data to Target High Value Customers According to Gartner, CEO’s are expected to focus significantly18 on customer analytics and big data as investments over the next five years. For brands, harnessing analytics allows them to recognize the significant roles of high-value and high-potential customers – for example, 1-2% of customers can account for 20-30% of a brand’s revenue and profitability. Many brands perceived to have the best engagement programs are now placing a disproportionate investment on the small number of customers who provide a disproportionate value to that company. • Southwest Airlines’ loyalty program has been a hallmark of its brand and a driver of loyalty for its cost- conscious travelers. The recent revamping of the program in 2010 better correlates their rewards spend to profitability. While most airlines www.snipp.com attach rewards to the number of miles flown (with extra points for higher-priced seats), Southwest offers rewards based on the amount of money the flyer spends. In this way, their loyalty rewards spend remains similar to that of other loyalty-focused airlines (i.e., 8 to 9 percent of revenue passenger miles), but the program is better positioned to drive profitability. Aggregating data gleaned from mobile with loyalty, transactional and location data allows for a more comprehensive view of customers, and provides valuable insights into where best to focus further investment. • The Target REDcard combines payments, loyalty and a valuable discount program – 5 percent at the point of sale – in a way that is highly compelling for consumers. They have moved past the flat “discount-only” model by building out industryleading data capabilities, using the data to target highest-value consumers (e.g., future moms). Making it Personal: MicroLoyalty Brands can’t afford to treat customers as anonymous dollar signs anymore, not when faced with the unprecedented amounts of data available and the untapped possibilities for the Loyalty of Me. As brands collect more data about individuals across purchase habits and from connected devices, they will be able to craft highly targeted microloyalty programs at the individual level. These programs will be able to create unique and individualized “earn” and “burn” rules based on a composite understanding of an 06 Key Trends in Loyalty individual user’s preferences and tastes, giving rise to entirely new kinds of loyalty programs, where no two members will have the same loyalty program structure. consumers across every age group like personalized touches, and further, 44% of UK consumers go on to purchase another item from the brand if they had a positive, personalized experience. According to Gartner, CEO’s are expected to focus significantly on customer analytics and big data as investments over the next five years. Examples of this kind of personalization in the marketplace today include: Source: 18Gartner; 2015 CEO Survey The returns are powerful. Teradata’s recent survey of UK and German consumers19 reveals that the vast majority (63%) of www.snipp.com • Safeway’s Just for U customer loyalty program (which launched in 2010) offers personalized discounts based on past purchases - creating special deals on those products that an individual customer buys regularly. • Global Hotel Alliance (GHA)20 understood that international travelers were suffering from “points fatigue”, wanting to be recognized and rewarded as individuals, with exclusive, authentic experiences over boring discounts, freebies, or room upgrades. In response, GHA devised over 2,000 authentic “Local Experiences” e.g., a private dinner and sunset cruise on the Arabian Sea, or a day with pandas in Hong Kong. The result was the launch of GHA Discovery, a three-tiered rewards program that, in fewer than four years, saw membership swell to over 4 million members worldwide, with a remarkable average new member sign-up rate of 2,000 per day. 07 Key Trends in Loyalty 4. The Sharing (Digital) Economy: Platforming Out While innovative use of data will be a key to unlocking value in next-generation loyalty programs, many companies lack the talent and technology to get to this next level. Companies in consumerfacing industries without these strengths will need to rely on partners like card issuers, loyalty providers and data aggregators to leverage their data assets. But data gathered within a single brand, without the context of other purchases and demographic information, is not enough to fully understand the customer. The best loyalty players are developing innovative data-sharing collaborations with digital partners, merging outside data with their own, unlocking insights that work from a security and privacy perspective. The big shift is recognizing that companies in almost every industry are already beginning the process of creating new digital ecosystems. According to Accenture21, future success will depend on the digital relationships that enterprises are creating today. 60% of the executives they surveyed plan to engage new digital business partners within their respective industries over the next two years, 40% plan to leverage digital business partners outside their industry, and 48% plan to partner with digital technology and cloud platform leaders. Collaborations to Lock in Costs and Unlock Value Not only do these collaborations increase the value of captured information, but they also can allow for shared liability and costs of digital investments. Increasingly, there are creative ways to share that with partners perceived to be enhancing, not www.snipp.com cannibalistic, of the program and wallet share of the members. For example, the airline model of partnerships (hotels, cars, cruise) will find itself in retail, sports, and consumer goods. The emerging platforms sector – which includes everything from Amazon Prime to mobile loyalty reward programs such as Five Star – is gaining speed. • American Express recently launched Plenti, a coalition loyalty program that has a wide set of program partners including AT&T, Exxon, Macy’s, RiteAid and Hulu amongst others. While it’s too soon to gauge the impact, expect to see many more such broad cross-category partnerships. • UK Grocery chain Sainsbury has slightly out-paced competitor Tesco’s sales growth for the last three to four years, in part due to a new form of loyalty program. Sainsbury is the anchor retailer of the Nectar coalition, which allows consumers to collect points and rewards across a large number of non-competing retailers in the UK (including through a Nectar-branded American Express card). Through Nectar, Sainsbury offers a broader value proposition to its customers, and also captures external data from coalition partners. The best loyalty players are developing innovative data-sharing collaborations with digital partners, merging outside data with their own, unlocking insights that work from a security and privacy perspective. Source: http://techtrends.accenture.com/us-en/ business-technology-trends- report.html 08 Key Trends in Loyalty Virtual Coalitions As receipt processing becomes more of a mainstream action and a larger ecosystem of brands adopt both loyalty programs and promotions based on receipt New models of Digital collaborations will not only increase the value of captured information, but also allow for shared liability and costs of digital investments. processing, the larger brands will begin exploiting the common incoming receipt to identify the right partners to create ‘virtual coalitions’. These coalitions will be based on identifying users that have common user actions that benefit the “brand-set” as a whole, and will be fluid in their constitution. As an example, a leading CPG company could create a “wellness” coalition for a subset of its customers and target those who have a propensity to purchase organic and health-related products, and a separate “value” coalition for another subset of customers based on their purchase habits. Those consumers identified to be a part of the “wellness” coalition could be incentivized to purchase other wellness and health-related products (possibly even including brands that aren’t even officially part of the coalition). In essence, by locking in on such “emotional” clusters, brands can create a much deeper personalization of the program and a more relevant experience for users across all dimensions. Source: 23Accenture; Technology Vision 2015 www.snipp.com 09 Key Trends in Loyalty Some Final Thoughts As Always, Perception Matters Most For many companies on the precipice of investing in adding or updating loyalty programs, the biggest fear lies in the cost – or perceived cost of offering loyalty. In some ways, this fear is borne out: McKinsey’s study22 of 55 publicly traded North American and European companies (across seven sectors in which loyalty programs play a significant role) showed that those that spend more on loyalty, or have more visible loyalty programs, grow at about the same rate – or slightly slower – than those that do not. Loyalty spend also appears to have a negative correlation with the bottom line. As a whole, companies surveyed that had higher loyalty spend had EBITDA margins that were about 10 percent lower than companies in the same sectors that spent less on loyalty. However, although companies that emphasize loyalty programs can initially underperform in terms of revenue growth and profitability, the market appears to give them high marks for the effort. Over the past five years, market capitalization for companies that greatly emphasize loyalty programs has outpaced that of companies that don’t. This may reflect the belief that meaningful loyalty programs can drive long-term value – and that the information amassed through such programs will pay dividends in due time. This could be the case, in particular, if loyalty program payments partners can help these programs leverage and tie their internal data with aggregated (and secure) payments data. combined with the proliferation of smart devices collecting highly contextual data, are allowing businesses to craft experiences that are unique for each user – but only a few are doing it well. Those companies that are integrating personalization with their core product or service in the right way, are, however, finding a significant competitive advantage. Sixty percent of organizations23 Accenture surveyed indicate they are seeing a positive ROI Over the past five years, market capitalization for companies that greatly emphasize loyalty programs has outpaced that of companies that don’t. There’s a Fine Line Between Engaging and Annoying on their investments in personalization technologies. But research24 also reveals that consumers are not as enamored by the sense of perceived invasion that comes with increasing personalization of their online experiences. When it comes to push notifications and microlocation based messaging, part of the challenge is figuring out the right balance between timing and frequency of messages --and not to overdo them25. A harried mother on the way to her kid’s school will probably not appreciate a pop-up message as she passes her favorite boutique. But a special offer tailored to her previous purchase history while she’s at the salon would ‘surprise and delight’ her. Big data analytics solutions, Source: 22McKinsey www.snipp.com 10 Key Trends in Loyalty We’re Still Not Comfortable with Big Brother: Well, Unless it’s Worthwhile Look, we’re aware that every move we make online is being dissected, repackaged and sold – we just don’t like to think about it. If we’re handing over our information When it comes to push notifications and microlocation based messaging, part of the challenge is figuring out the right balance between timing and frequency of messages. voluntarily, however, brands need to make it make us trust that we won’t be on a hundred mailing lists by sundown. Accenture reports that in the era of big data sharing, 67 percent of individuals are willing to share data with companies, but that percentage drops to 27 percent if the business is sharing data with a third party. And in the aftermath of Target’s famous data mining mishap, which identified shoppers who were likely to be pregnant – in some cases before they’d told anyone – it’s fair to say we’re leery. At the same time, consumers appreciate that data sharing can lead to products and services that make our lives easier and more entertaining, educate us, and save us money. Clearly, then, gaining consumers’ confidence will be key. Companies that are transparent about the information they gather, give customers control of their personal data, and offer fair value in return for it will be trusted and will earn ongoing and even expanded access. According to the Harvard Business Review26, when data is used to improve a product or service, consumers generally feel the enhancement itself is a fair trade for their data. But consumers expect more value in return for data used to target marketing, and the most value for data that will be sold to third parties. Basically, if our names are on those mailing lists, we’ll expect some pretty special treatment in return. Source: 25New York Times, 2015 www.snipp.com 11 Key Trends in Loyalty References 1 Colloquy; 2015 Loyalty census: https://www.colloquy.com/latest-news/2015-colloquy-loyalty-census/ Deloitte; 2013 American Pantry Study: http://www2.deloitte.com/us/en/pages/consumer-business/ articles/2013-american-pantry-study-consumer-products.html 2 Forbes; Three Ways Membership Models Can Erode Customer Loyalty, May 2015: http://www.forbes.com/ sites/onmarketing/2015/05/07/three-ways-membership-models-can-erode-customer-loyalty/2/ 3 Gartner; Top 10 Strategic Predictions for 2015 and Beyond: Digital Business Is Driving ‘Big Change’: http:// www.gartnerinfo.com/exp/top_10_strategic_predictions_269904.pdfhttp://www.gartnerinfo.com/exp/top_10_ strategic_predictions_269904.pdf 4 Gartner; Surveys Confirm Customer Experience Is the New Battlefield: http://blogs.gartner.com/jakesorofman/gartner-surveys-confirm-customer-experience-new-battlefield/ 5 BusinessWire; Reimagining the Retail Loyalty Landscape: http://www.businesswire.com/news/ home/20140114005933/en/Reimagining-Retail-Loyalty-Landscape-GE-Capital%E2%80%99s-Retail#. VhTZKROeDGd 6 Capgemini 2015; Fixing the Cracks: Reinventing Loyalty Programs for the Digital Age,: https://www. capgemini-consulting.com/resource-file-access/resource/pdf/reinventing_loyalty_programs.pdf 7 TIBCO; Top 10 Customer Engagement Trends for 2015: http://www.tibco.com/blog/2015/02/23/top-10customer-engagement-trends-for-2015/ 8 Capgemini 2015; Fixing the Cracks: Reinventing Loyalty Programs for the Digital Age,: https://www. capgemini-consulting.com/resource-file-access/resource/pdf/reinventing_loyalty_programs.pdf 9 Capgemini 2015; Fixing the Cracks: Reinventing Loyalty Programs for the Digital Age,: https://www. capgemini-consulting.com/resource-file-access/resource/pdf/reinventing_loyalty_programs.pdf 10 Gartner; Top 10 Strategic Predictions for 2015 and Beyond: Digital Business Is Driving ‘Big Change’: http:// www.gartnerinfo.com/exp/top_10_strategic_predictions_269904.pdfhttp://www.gartnerinfo.com/exp/top_10_ strategic_predictions_269904.pdf 11 eMarketer 2014; Can iBeacon Boost Duane Reade’s Customer Loyalty Program? http://www.emarketer.com/Article/iBeacon-Boost-Duane-Reades-Customer-LoyaltyProgram/1011404#sthash.BSDfx5HT.dpuf 12 13 McKinsey; Making loyalty pay: Lessons from the innovators; McKinsey 2013 www.snipp.com 12 Key Trends in Loyalty MagnifyMoney; Discover Announces New Credit Card Perk for College Students: http://www. magnifymoney.com/blog/college-students-and-recent-grads/discover-announces-new-credit-card-perkcollege-students874242943 14 15 McKinsey; Making loyalty pay: Lessons from the innovators; McKinsey 2013 16 Loyalty360; Build Loyalty by Offering Members Opportunities to Give Back: 17 Kroger; Kroger Community Rewards: https://www.kroger.com/communityrewards Gartner; 2015 CEO Survey: Committing to Digital: https://www.gartner.com/ doc/3026817?ref=SiteSearch&sthkw=&fnl=search&srcId=1-3478922254 18 eConsultancy; “Balancing the Personalisation and Privacy Equation - The Consumer View”: https:// econsultancy.com/press-releases/7935-57-of-consumers-are-happy-to-share-personal-information-withbrands-they-trust/ 19 20 GHA; https://www.gha.com/About-DISCOVERY Accenture; Technology Vision 2015: http://techtrends.accenture.com/us-en/business-technology-trendsreport.html 21 McKinsey; Making loyalty pay: Lessons from the innovators; McKinsey 2013 22 Accenture; Technology Vision 2015: http://techtrends.accenture.com/us-en/business-technology-trendsreport.html 23 eConsultancy; “Balancing the Personalisation and Privacy Equation - The Consumer View”: https:// econsultancy.com/press-releases/7935-57-of-consumers-are-happy-to-share-personal-information-withbrands-they-trust/ 24 New York Times, 2015; Using Smartphones and Apps to Enhance Loyalty Programs: http://www.nytimes. com/2015/01/29/business/smallbusiness/using-smartphones-and-apps-to-enhance-small-business-loyaltyprograms.html?_r=1 25 Harvard Business Review, 2015; Customer Data: Designing for Transparency and Trust: https://hbr. org/2015/05/customer-data-designing-for-transparency-and-trust 26 www.snipp.com 13