Beta estimation and the cost of equity for listed shipping companies

advertisement

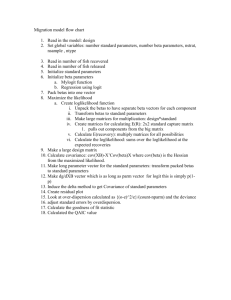

Beta estimation and the cost of equity for listed shipping companies Wolfgang Drobetz, Christina Menzel, and Henning Schröder Baltic Exchange Shipping Risk Management Symposium| Hamburg | October 2014 Beta estimation and the cost of equity for listed shipping companies |1 Discount rates Discount rates are a critical ingredient in discounted cash flow valuation (the NPV formula). Errors in estimating the discount rate (i.e., the opportunity cost of capital for investors) or mismatching cash flows and discount rates can lead to serious errors in valuation. The discount rate used must be consistent with both the riskiness and the type of cash flows being discounted. Equity vs. firm: If the cash flows being discounted are cash flows to equity, the appropriate discount rate is the cost of equity. The cost of equity is the rate of return that investors require to make an equity investment in a firm. If the cash flows are the cash flows to the firm, the appropriate discount rate is the cost of capital. Currency: The currency in which the cash flows are estimated should also be the currency in which the discount rate is estimated. Nominal vs. real: If the cash flows being discounted are nominal cash flows (i.e., reflect expected inflation), the discount rate should also be nominal. October 2014 Baltic Exchange Symposium Hamburg Beta estimation and the cost of equity for listed shipping companies |2 Cost of equity The cost of equity is higher for riskier investments and lower for safer investments Assumption: Investors like overall portfolio reward (expected return) and dislike overall portfolio risk (variance or standard deviation of return). Most risk and return models in finance assume that investors are well diversified, thus the only risk an investor perceives in an investment is the risk that cannot be diversified away (i.e., market or non-diversifiable risk). The risk that should be rewarded (and built into the equity discount rate) in valuation should be the risk perceived by the marginal investor in the investment. The contribution to overall portfolio risk is the market beta of a project – a measure of the project’s “toxicity”. A project that decreases in value when the market decreases in value, and increases when the market increases, has a positive beta – it is toxic, and investors do not like it. A project with a low beta helps an investor who holds the market portfolio to reduce the overall investment risk. October 2014 Baltic Exchange Symposium Hamburg Beta estimation and the cost of equity for listed shipping companies |3 Cost of equity: The Capital Asset Pricing Model (CAPM) The CAPM is a model that provides an appropriate expected rate of return (or cost of equity) for each project. An investment’s cost of equity is lower when it offers diversification benefits for an investor who holds the market portfolio, i.e., less required reward for less risk contribution. The market beta is the model’s measure of risk contribution. The CAPM posits that investors care only about project market betas, because these measure the risk components which investors holding the (perfectly diversified) market portfolio cannot diversify away. Projects contributing more risk (higher market beta) require a higher expected rate of return for investors to want them; projects contributing less risk (lower market beta) require a lower expected rate of return. Cost of equity ≡ Expected return = Risk-free rate + [Beta×Market risk premium] 𝐸 𝑅 = 𝑅𝑓 + 𝛽 × 𝐸 𝑅𝑚 − 𝑅𝑓 October 2014 Baltic Exchange Symposium Hamburg Beta estimation and the cost of equity for listed shipping companies |4 Estimating the CAPM inputs (1) Cost of equity ≡ Expected return = Risk-free rate + [Beta×Market risk premium] 𝐸 𝑅 = 𝑅𝑓 + 𝛽 × 𝐸 𝑅𝑚 − 𝑅𝑓 For an investment to be risk-free, it has to have… No default risk No reinvestment risk Therefore, the risk-free rate in valuation depends on when the cash flows are expected to occur (term structure) and will vary across time. For valuation puroses, the time horizon is generally long, thus a long-term (or duration matched) risk-free rate is preferable to a short-term rate (if the investor has to pick one). The market risk premium is not revealed in market prices, thus most investors use historical premiums (i.e., the premium that stocks have historically earned over riskless securities). October 2014 Baltic Exchange Symposium Hamburg Beta estimation and the cost of equity for listed shipping companies |5 Estimating the CAPM inputs (2) Source: Credit Suisse Global Investment Returns Yearbook 2013 October 2014 Baltic Exchange Symposium Hamburg Beta estimation and the cost of equity for listed shipping companies |6 Estimating the CAPM inputs (3) Note: Geometric averages Source: Credit Suisse Global Investment Returns Yearbook 2013 October 2014 Baltic Exchange Symposium Hamburg Beta estimation and the cost of equity for listed shipping companies |7 Estimating the CAPM inputs (4) Historical averages: a few caveats… Length of sample period? Long-term vs. short-term bonds? Geometric vs. arithmetic rates of return? Statistical significance? (margin of error) Peso problems? (tiny probability of desasters that just happened not to happen; survivorship bias and “good luck”) High historical returns may indicate low future expected rates of return (mean reversion) Beta estimation: Regress excess stock returns against excess return: with The slope of the market model regression corresponds to the beta of the stock, and measures the riskiness of the stock. October 2014 Baltic Exchange Symposium Hamburg Beta estimation and the cost of equity for listed shipping companies |8 Estimating the CAPM inputs (5) Beta estimation: a few caveats… Length of the estimation period Return interval and market index Accuracy of estimate (margin of error may require beta shrinking towards 1) 0.6 Market model regression: An example Daiichi Chuo Kisen Kaisha: y = (‒0,0025) + 1,0259•x Monthly company excess return 0.4 0.2 0 -0.3 -0.2 -0.1 ≡ slope of line 0 -0.2 0.1 0.2 Monthly MSCI World excess return -0.4 October 2014 Baltic Exchange Symposium Hamburg Beta estimation and the cost of equity for listed shipping companies |9 Determinants of betas Beta of equity Beta of firm (asset beta) Nature of product or service offered: Operating Leverage: Other things equal, the more discretionary the product or service, the higher the beta. Other things equal, the greater the ratio of fixed costs to total costs, the higher the beta of the company. Implications: Implications: Cyclical firms have higher betas Luxury and high priced goods/service firms have higher betas Growth firms have higher betas October 2014 Financial Leverage: Other things equal, the greater the proportion of capital that a firm raises from debt, the higher the equity beta. Implication: Highly levered firms should have higher betas Firms with high infrastructure needs and rigid cost structures have higher betas Smaller and younger firms have higher betas Source: Damodaran, 2012 Baltic Exchange Symposium Hamburg Beta estimation and the cost of equity for listed shipping companies | 10 Different approaches to estimate betas of shipping companies Shipping companies are prone to have high betas… …highly cyclical, high operating leverage, and high financial leverage Earlier empirical studies report low betas using the market model regression Prior studies use small and old samples, but market betas may have increased over time Market betas may be time-varying depending on the economic conditions We use static and dynamic beta estimation methods… Standard market model regression Fama-French three-factor model (controlling for size and value premia) Scholes-Williams method and Dimson’s AC method (controlling for infrequent trading) Rolling window regression approach (rolling window of 60 months) Kalman filter approach (conditional coefficient estimates by recursively estimating dynamic betas from the market model) Bivariate M-GARCH approach (conditional variances and covariances) October 2014 Baltic Exchange Symposium Hamburg Beta estimation and the cost of equity for listed shipping companies | 11 Data description (1) October 2014 Baltic Exchange Symposium Hamburg Beta estimation and the cost of equity for listed shipping companies | 12 Data description (2) Benchmark for market model regression: MSCI World Market (TR) October 2014 Baltic Exchange Symposium Hamburg Beta estimation and the cost of equity for listed shipping companies | 13 Static beta estimates October 2014 Baltic Exchange Symposium Hamburg Beta estimation and the cost of equity for listed shipping companies | 14 Dynamic beta estimates October 2014 Baltic Exchange Symposium Hamburg Beta estimation and the cost of equity for listed shipping companies | 15 Beta estimates over sample period: Daiichi Chuo Kisen Kaisha 3 2.5 2 1.5 1 0.5 0 1996 1998 Kalman Filter October 2014 2000 Rolling Window 2002 2004 M-GARCH 2006 Fama-French Baltic Exchange Symposium 2008 CAPM 2010 Dimson 2012 Scholes-Williams Hamburg Beta estimation and the cost of equity for listed shipping companies | 16 Dynamic beta estimates over sample period October 2014 Baltic Exchange Symposium Hamburg Beta estimation and the cost of equity for listed shipping companies | 17 Determinants of beta October 2014 Baltic Exchange Symposium Hamburg Beta estimation and the cost of equity for listed shipping companies Estimated cost of capital October 2014 | 18 Assumptions: • Risk-free rate: 2.5% (based on U.S. T-bond yield) • World USD equity risk premium: 4.1% • Beta estimation based on Kalman filter Baltic Exchange Symposium Hamburg