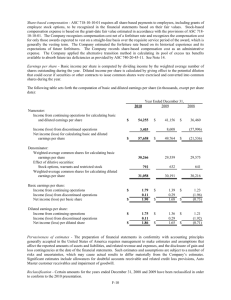

FRS 14 - Financial Reporting Council

advertisement