Novated lease guide - Toyota Fleet Management

advertisement

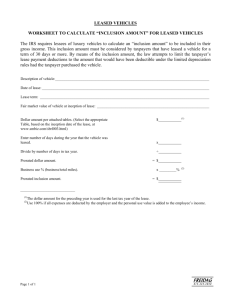

Novated lease guide Contents 1.0 Introduction 1.0Introduction 1 2 3 4 6 1.1 What is novated leasing? 1.2 How does novated leasing work? 1.3 Benefits of a novated lease 1.4 Novated lease vehicle packaging comparison 2.0 Understanding the costs 8 8 9 2.1 Novated lease finance costs 2.2 Vehicle running costs 3.0 Understanding the tax benefits 12 12 14 15 16 3.1 Fringe Benefits Tax (FBT) 3.2 Employee Contribution Method (ECM) 3.3 Days not available 3.4 Example calculations 4.0Helping you keep track of your novated lease 18 5.0 Getting started 19 6.0 Additional lease information 20 20 20 20 21 21 22 22 22 22 6.1 Lease terms 6.2 Eligible vehicles 6.3 Residual values 6.4 Luxury Car Tax (LCT) 6.5 Luxury Vehicle Income Tax (LVIT) adjustment 6.6 Lease reconciliation 6.7 Lease end 6.8 Employment cessation 6.9 Early termination 7.0 Common novated lease terms Introducing novated leasing with Toyota Fleet Management (TFM) At TFM, we specialise in novated leasing. With over 30 years’ experience in financial services, we work with you closely as a trusted partner, offering the highest quality service and products to suit your needs, as well as taking care of the details from start to finish. A TFM novated lease can provide you with significant cost savings, tax benefits and convenient ways to keep track of your vehicle expenses. For all the benefits of a TFM novated lease, please review this guide and contact our TFM team any time on 1300 888 870. This guide will be updated from time to time, so please contact us regularly to ensure you have the latest information. Novated lease team 1300 888 870 novated@toyota.com.au 23 1 1.1 What is novated leasing? —— pricing when you buy a car, saving you even more money. A novated lease may mean you can drive the vehicle of your choice, without compromising your lifestyle, and you could save thousands A novated lease may allow you access to corporate fleet discount —— At the end of your novated lease, unlike conventional company on the purchase price and running costs of a new or used car, or even vehicle arrangements, you may be able to take advantage of any the car you currently drive. surplus between the market value of the vehicle and its residual value (plus GST).* A novated lease also allows you to enjoy the convenience of cashless motoring and gives you access to TFM’s discount programs, so you’ll receive great deals on finance, fuel, maintenance and repairs. 1.2 How does novated leasing work? Novated leasing simply means that your employer pays for your Novated leasing is a form of salary sacrifice or salary packaging. It is a vehicle lease out of your salary package through a combination of pre-tax and post-tax salary deductions. The many potential benefits for you include: —— —— * Conditions apply. financial arrangement between the Financier (TFM), you (lessee) and your Employer. ‘Novated’ refers to the transfer of the lease to your employer, who takes responsibility for the lease on your behalf during Novated leasing is recognised by the Australian Tax Office (ATO) the term of your employment. You generally have responsibility for as a tax-effective way to salary package. the vehicle itself. Novated leasing allows you to choose the vehicle you want. All three parties agree to individual obligations through a TFM You can even sacrifice additional salary to package more novated lease agreement. than one vehicle. —— Novated leasing enables you to take advantage of GST credits (input tax credits) on vehicle purchase and vehicle running costs, meaning you can save even more. —— You No cash, no worries – all fuel and other vehicle expenses can be covered in the monthly lease payment. We take care of Vehicle lease Novation everything, including registration renewal, scheduled servicing, warranty repairs, tyre replacement and fuel payments. —— Our buying power means that you can access discounts normally only available to corporate fleets on all products and services. For Your Employer Toyota Fleet Management example, by using a TFM Fuel Card you’ll get a discount every time you fill up your tank. Vehicle lease/ Operating costs 2 3 1.3 Benefits of a novated lease Convenient and cashless motoring: With a novated lease from TFM, everyone wins. From tax and cost —— provides discounts through a number of major fuel providers. savings through to flexibility and convenience, both employers and employees can benefit. Tax savings: A vehicle financed through a novated lease is considered a company vehicle for tax purposes. This means you can take advantage of these —— —— No more keeping receipts or completing logbooks. —— Novated leasing is a handy budgeting tool, as all vehicle running costs can be packaged into a single monthly payment, —— GST credits on vehicle running costs including maintenance, tyres and fuel. —— Fringe Benefits Tax (FBT) can provide a lower form of taxation when you package all or a significant amount of the vehicle lease and running costs through your pre-tax (gross) salary. Save on the purchase price and running costs: —— automatically deducted from your salary. GST credits (input tax credit), on the initial vehicle purchase (capped in accordance with the Luxury Car Limit). You may be able to benefit from corporate fleet discount All your vehicle servicing and repairs can be paid for through our Repair Authorisation Service. extra benefits: —— Our TFM Fuel Card is a convenient way to pay for fuel and also Control and flexibility: —— You choose the vehicle you want and where and how you want to drive it. —— Lease any make and model, including new, used or demonstrator vehicles. —— If you choose to leave your current employer, the vehicle remains with you and you may continue the lease yourself or ‘novate’ the lease to your new employer. programs, which can significantly reduce the recommended retail price of a car. —— Vehicle running costs can be managed by TFM, so you enjoy access to our discount servicing and maintenance costs. 4 5 1.4 Novated lease vehicle packaging comparison Assumptions made in the example demonstrated in the table Compare the potential savings when you finance your vehicle through on the left hand page include: a TFM novated lease. —— Analysis assumes that employer is eligible for an input tax credit and will pass the benefit to the employee’s novated lease. Toyota Kluger KX-R AWD 3.5L Automatic 7-Seat Wagon RRP $45,990 Private purchase Total vehicle on-road cost $47,921.50 —— With novated lease $42,435.95 Fleet discounts reduce the vehicle purchase price. has been made to provide an accurate representation at time of preparation, costs provided are indicative at time of quoting and subject to change. —— $47,921.50 $39,084.04 48 months 48 months $15,498.47 $15,498.47 20,000km 20,000km $888.94 $699.46 Maintenance $58.89 $53.54 Tyres $26.50 $24.09 $308.00 $280.00 Comprehensive insurance $83.33 $83.33 Registration $78.99 $78.99 $0.00 $25.00 $1,444.65 $1,244.41 Savings per month $200.24 Lease term Residual value (inc GST) Km per annum —— Novated lease finance is further reduced by GST credits. Fuel Management fee Total monthly cost 6 Finance is a novated lease with a residual value calculated monthly in advance and in accordance with TFM policy and ATO guidelines. —— All costs are based on the vehicle being leased in the state of NSW. Lease costs (monthly) Finance Vehicle discounts are based on Toyota Fleet discount scheme and subject to eligibility. Factors Amount financed Quotes prepared as at 01 November 2012. Whilst every effort —— Running costs are budgeted and dependent on actual cost with a reconciliation adjustment during and/or at end of lease. Enjoy the benefit of GST credits for vehicle running costs. —— All lease costs quoted are per month unless otherwise stated. —— Comprehensive insurance cost is an estimate; actual cost depends on the individual application. 7 2.0 Understanding the costs 2.1 Novated lease finance costs 2.2 Vehicle running costs All the running costs for your vehicle can be covered in your monthly lease payments. These may include fuel, servicing and maintenance, tyre replacements, registration and insurance renewals. Your vehicle The total amount financed through your novated lease is calculated running costs are based on your lease term and the nominated by taking into account the cost of the vehicle and its accessories, the number of kilometres you are likely to travel. lease term, current interest rates and market value of the vehicle at lease end. Fuel Card Vehicle purchases attract GST. However, TFM can claim a GST credit Buying fuel is easy with our TFM Fuel Card. You’ll enjoy significant (input tax credit) when we finance a vehicle under a novated lease. discounts on the pump price (via a rebate) at all BP outlets, as You benefit because this effectively reduces the vehicle price. well as over 80% of service stations operating through the We then pass the benefit of any GST credit to you and reduce the national Motorpass network. The TFM Fuel Card can also be used amount being financed (capped by the Luxury Car Limit). in conjunction with supermarket docket fuel discount offers for The total amount financed is calculated over an agreed term and broken down into monthly payments. At a glance, your TFM novated lease covers: —— Vehicle price and accessories. —— Dealer delivery charges. —— Initial registration and Compulsory Third Party (CTP) insurance. —— Purchase stamp duty. —— Luxury Car Tax (where applicable). —— Novated lease establishment fee. —— Personal Property Security (PPS) registration fee. even greater savings. Service, maintenance and tyres TFM’s Repair Authorisation Service uses an extensive network of maintenance facilities to make sure you receive great service and allows us to: —— Negotiate substantial discounts on labour rates and spare parts. —— Enforce and extend warranty claims. —— Accurately forecast service and maintenance costs, which means lower monthly charges. —— Offer a broad repair and service network to minimise any inconvenience to you when your vehicle needs to be serviced. —— Ensure that like-for-like, manufacturer-specified parts are used. Our approved repairers also prevent over-servicing while maintaining your vehicle to the highest standard, keeping you on the road and increasing the market value of your vehicle. 8 9 Registration and CTP insurance Roadside assistance A novated lease covers the full registration and CTP insurance If you want the reassurance of roadside assistance or motor amounts in your monthly payment. In states where CTP can club membership, you can include these additional costs in your be purchased separately, our buying power achieves very monthly payments. competitive rates. Reimbursement Comprehensive insurance All personal vehicle-related costs like re-registration can be Whether you choose Toyota Insurance or your own insurer, we include reimbursed simply by completing a personal expense form budgets and can arrange payment on your behalf. located at novatedonline.com.au Renewal management Fees and charges Another great advantage of a TFM novated lease is that we remind These include an establishment fee and ongoing monthly you of any registration, CTP and comprehensive insurance renewals management fees. Variation fees and reimbursement fees may well in advance of due dates and also arrange renewal. Please note apply if there are excess requests for reimbursement or if you that it is your responsibility to ensure that the vehicle is registered at want to change your agreement. All TFM fees will be fully explained all times. in your employer’s vehicle policy and also in your novated lease terms and conditions. Novated lease protection TFM offers payment and gap insurance through Toyota Insurance* Please note: which will continue to pay your lease for up to six months and —— within that time. TFM novated lease protection gives you extra peace of mind. * Terms and conditions apply. Before making a decision about any of the insurance products, please refer to the current Product Disclosure Statement (PDS) for the relevant product available, via the Toyota Insurance website at toyotainsurance.com.au or by calling 137 200. Toyota Insurance is a division of Aioi Nissay Dowa Insurance Co., Ltd. ABN 39 096 302 466. AFSL Number 254489 (Andia). 10 Tolls and parking cannot be incorporated into your novated lease payment. provides a vehicle hand-back option if you don’t gain employment —— Deposits or trade-ins cannot be used to reduce the amount to be financed. With novated leasing, the full amount of the vehicle purchase price must be financed. —— Your employer may stipulate other exclusions and these should be noted in the employer’s policy. 11 3.0 Understanding the tax benefits Fringe Benefits Tax – Transitional Arrangements The Federal Government Budget on 10 May 2011 introduced transitional rules towards the calculation of car FBT using a standard statutory flat rate of 20%. 3.1 Fringe Benefits Tax (FBT) Although application of the FBT regime can lower the amount of tax you pay, you must be careful not to incur extra costs. Your FBT Statutory % is based on the number of kilometres you are likely to travel during Until 10 May 2011 the FBT year, from 01 April to 31 March, not on the anniversary of 0 to 14,999km 26% 15,000 to 24,999km 20% By novating a vehicle, your lease costs are salary packaged through 25,000 to 40,000km 11% a combination of pre-tax and post-tax deductions, meaning you 40,001km plus 7% your lease signing or the Australian financial year. have less taxable income. However, because you benefit from this arrangement, it is deemed a ‘fringe benefit’ under taxation law. As a Transitional FBT result, two types of tax apply: Income Tax for your cash salary and FBT From 01 April 2012 – 31 March 2013 for your vehicle. You still come out on top if you make sure you meet 0 to 24,999km 20% 25,000 to 40,000km 17% 40,001km plus 13% your kilometre target, which reduces the FBT to be paid. Projected FBT costs are calculated into your novated lease package costs and adjusted accordingly at FBT year end. Your kilometre target for the FBT year covers your vehicle for both From 01 April 2013 – 31 March 2014 0 to 40,000km 20% readings each time you fill up, which means we can help you track 40,001km plus 17% and calculate your FBT obligations in accordance with ATO guidelines. From 01 April 2014 An example of the FBT ATO Statutory Rates is demonstrated on the 0km plus business and personal use. Your TFM Fuel Card captures odometer right hand page. 12 Annual kilometres travelled 20% Novated lease commitments commenced prior to 7.30pm on 10 May 2011 will be grandfathered and will not be subject to transitional FBT unless the contract is modified. Novated lease commitments commenced after 7.30pm on 10 May 2011 will be subject to Transitional FBT. Vehicles travelling 25,000km or more will be subject to increasing Statutory % to 20% on 01 April 2014. 13 3.2 Employee Contribution Method (ECM) FBT calculation using the ECM The most popular way to package your vehicle is Employee Contribution Method (ECM), which includes both pre-tax and post-tax deductions from your salary. FBT cost base x Statutory rate % FBT taxable value x FBT gross-up / Days in FBT year (365) x Days available (days in FBT year less days unavailable) x FBT tax rate = FBT liability ECM has greater tax benefits than a purely pre-tax sacrifice approach - Employee post-tax contributions = FBT taxable value if your salary is below $180,000. By contributing from your post–tax salary you substitute the FBT rate of 46.5% with your own lower income tax rate. As an added benefit, we calculate the correct portion of pre-tax and post-tax dollars for you so that the right amount of post-tax dollars is contributed to eliminate FBT, while maximising your tax savings. The good news is there are no FBT penalties if you exceed your 3.3 Days not available nominated kilometre target under the ECM method. However, if you Sometimes your vehicle may not be available for travel. In these do not achieve your kilometre target, you will be liable to pay a higher instances you are entitled to a reduction in FBT. ‘Days not available’ is FBT amount. applicable when: If you earn $180,000 or more per year, Statutory Method without ECM —— one whole business day or more. and Statutory Method with ECM salary packaging options deliver the same benefits. Your vehicle is off the road for accident or mechanical repairs for —— You leave your vehicle on company premises and surrender the keys to an authorised person for one whole business day or more. It’s important to note that although your vehicle may not be available, Australian taxation laws stipulate that your FBT kilometre targets remain unchanged and must be met. 14 15 3.4 Example calculations Comparison calculation for non-packaged, statutory packaged and ECM packaged FBT calculation using the Statutory Method Without salary packaging Simple annual FBT liability calculation (A) FBT cost base^ (B) Distance travelled (C) FBT statutory percentage (D) FBT taxable value (A x C) Salary package x $8,001.19 FBT gross-up (E) x FBT tax rate (F) = FBT Liability Gross-up 2.0647 (F) FBT tax rate 46.50% x 2.0647 (E) x 46.50% (F) FBT Salary packaged – statutory with ECM $80,000 Salary package $14,933 Vehicle package $7,682 Pre-tax ECM GST $80,000 $6,932 $727 Taxable salary $80,000 $57,385 $72,341 Less tax payable $18,747 Less tax payable $11,058 Less tax payable $16,143 Less vehicle cost $17,336 Less vehicle cost $0 Post-tax vehicle $8,001 Total after-tax salary $43,917 $46,327 $48,197 Calculations based on tax rates effective 01 July 2012. (E) $8,001.19 (D) Vehicle package 20,000km ^ W here the FBT cost base is the total GST inclusive On-Road Cost of the vehicle excluding Registration CTP and Purchase Stamp Duty. FBT taxable value (D) $80,000 Salary package $40,005.95 20% Salary packaged – statutory without ECM = FBT Liability $7,681.83 Please note: The FBT calculation may change due to other considerations such as days not available and employee contributions (explained on the previous page), which are calculated from information provided in an FBT declaration form at the end of each FBT year. 16 17 4.0 Helping you keep track of your novated lease TFM makes sure you stay in touch with the latest news about your novated lease through quarterly reports, via our website and regular email updates. Importantly, we’ll help you with your FBT by letting you know your target odometer reading for 31 March each year and provide a kilometre analysis to keep you on target. Account information online You can easily track the activity and details of your novated lease 5.0 Getting started It’s easy. All you need to do is call our novated leasing Fleet Management team. Our consultants will guide you through the process and answer any questions you might have. Assuming that your car is ready for you to pick up from the dealer, a consultant can have you up and running within one to two weeks. Just follow these eight easy steps: 1. Call us on 1300 888 870 to request a quote (select option 1). 2. Choose the best option for you and submit a credit application. 3. We will assess your application and confirm credit approval. account any time via our online portal, novatedonline.com.au 4. You’ll receive the lease documentation to complete. You can see the number of kilometres already travelled and how many 5. Simply sign the lease documents with your employer and return you still need to satisfy your FBT requirements. It also includes your insurance and personal details and itemised expenditure related to your account. them to TFM. 6. We will order your vehicle and confirm a delivery date. 7. Legal documentation Your novated lease agreement clearly shows details of your legal obligations to TFM, your employer and yourself in regard to your We will arrange delivery of your vehicle. 8. We will notify your employer, arrange payroll deductions and mail your TFM Driver’s Kit. novated lease. FBT declaration At the end of each FBT year (31 March) you must sign an FBT declaration, detailing the number of kilometres you travelled during the FBT year. This form allows the ATO and TFM to determine your FBT obligations. 18 19 6.0 Additional lease information ATO residual value table Lease term (months) Residual value % 12 65.63% 24 56.25% 36 46.88% 48 37.50% 60 28.13% A TFM novated lease gives you a choice of terms, vehicles and ways to manage your lease, according to your needs. 6.1 Lease terms TFM offers a choice of lease terms ranging from 12 to 60 months. 6.2 Eligible vehicles 6.4 Luxury Car Tax (LCT) Vehicles with a GST-inclusive value above the applicable LCT limit You can choose a vehicle of any make or model to suit your personal will be subject to LCT. The current rate of LCT is 33% and is payable and business lifestyle, whether it’s a new or used passenger sedan on the GST-exclusive value of the vehicle above the applicable limit. or hatch, SUV or 4WD. Under ATO law, boats, caravans, trucks and motorbikes cannot be novated. 6.5 Luxury Vehicle Income Tax (LVIT) adjustment Use of the statutory method requires that the vehicle be a ‘car’ for Special tax accounting rules apply if you lease luxury vehicles valued FBT purposes, being a vehicle which is designed to carry less than above the LVIT limit ($57,466 at date of publication). These rules one tonne and fewer than nine passengers. A vehicle that is not a re-characterise the lease as a sale and loan transaction. Your car may be subject to additional FBT liabilities. employer needs to account for your luxury vehicle novated lease as a ‘loan transaction’ which can result in increased costs for both 6.3 Residual values Determining the residual value of your vehicle is simple – it is based on the amount being financed as a percentage of the lease term (see table opposite). Please note: If you decide to offer to purchase your vehicle, any payment will attract GST. This applies at lease end or upon early termination. 20 of you. Rather than claiming the lease payments (finance rent element) as a deductible expense, your employer claims interest and depreciation as a taxation deduction. The depreciation charge is capped at the LVIT limit of $57,466, which is where the increased costs lie. The good news is, we manage the intricacies of LVIT adjustments for you and incorporate additional costs into your lease as itemised payments. 21 6.6 Lease reconciliation We reconcile each novated lease at the end of its term, when you cease employment with your employer or upon early termination. 7.0 Common novated lease terms This may take up to 30 days. Both you and your employer will be formally advised in writing of the amount outstanding or owed by TFM. 6.7 Lease end Prior to lease expiry you may be offered the opportunity to purchase your vehicle, extend the contract or return the vehicle to us. 6.8 Employment cessation If you leave your employer, the novated lease and vehicle payment obligations transfer immediately from your employer to you. All of our services, including TFM Fuel Card and vehicle running costs, will cease. Unless you decide to re-novate your vehicle with a new employer, you will be required to continue lease payments from your after-tax income. Alternatively, you may pay out the lease or refinance your vehicle with a consumer loan. 6.9 Early termination If you wish to end your novated lease prior to the completion of the agreed lease term, please contact us on 1300 888 870 to receive a lease payout quote. A payout figure will be calculated and the reconciliation process will begin. 22 Australian Taxation Office (ATO) The ATO is the government’s principal revenue collection agency. The role of the ATO is to manage tax, excise and superannuation systems that fund services for Australians. Cashless motoring As a TFM novated lease customer you do not need to use cash for the day-to-day running of your vehicle. You pay for your fuel on our TFM Fuel Card and all vehicle registrations and insurance payments can be made through TFM. Employee Contribution Method (ECM) This form of salary packaging includes both pre-tax and post-tax deductions from your salary and increases your tax benefits. The FBT rate of 46.5% is effectively substituted by your income tax rate for post-tax contributions. Fringe Benefits Tax (FBT) FBT is applied to the portion of your salary that is not paid in cash. In the case of a novated lease, your vehicle attracts FBT charges. The FBT paid can be reduced by ensuring you meet the projected target for kilometres travelled within the FBT year (01 April – 31 March). 23 Goods and Services Tax (GST) About this guide The standard GST rate of 10% is applied to vehicle purchases and This guide has been developed by TFM to provide you with running costs. As a novated lease customer, you benefit from GST information about the selection, establishment and ongoing credits (input tax credits) on your vehicle’s purchase price, finance, management of a novated lease. maintenance, tyres, running costs and fuel. Financial advice Lease In Australia, there are certain taxation benefits to acquiring a vehicle This is a legally binding agreement between two or more parties, through a novated lease. It is recommended that before making any where one party supplies a product or service, and another party decision, parties should seek appropriate advice from their taxation pays to use the product or service for a period of time. consultant or financial adviser regarding the benefits of this financing option, including its treatment under income tax, FBT, GST law or Luxury Car Tax (LCT) relevant state and territory laws where applicable. LCT is applied to vehicles with values exceeding the Luxury Car Limit, GST-inclusive value of $59,133 (01 July 2012) and $75,375 for fuel efficient vehicles (7.0L/100km or less). Novate To transfer the contractual rights and obligations of a legal agreement to another party i.e. the employee transfers the rights and obligations of the vehicle lease to their employer. Residual value The value of the vehicle at the end of the contracted term, which was agreed at the beginning of the lease. This value is used to calculate the monthly lease payments. Statutory Method A car FBT calculation based on a legislatively prescribed schedule. The calculation may include the use of ECM to provide the best How to contact TFM Phone: 1300 888 870 Fax: 02 9430 0918 Email: novated@toyota.com.au tax benefit. 24 25 Move forward with us 1300 888 870 novated@toyota.com.au toyotafleetmanagement.com.au Toyota Fleet Management is a division of Toyota Finance Australia Limited ABN 48 002 435 181. Australian Credit Licence 392536. A member of the Toyota Group of Companies. TFM002 (1/13)