Personal Systems – Positioned for Growth

advertisement

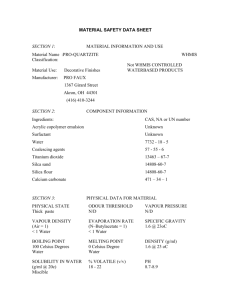

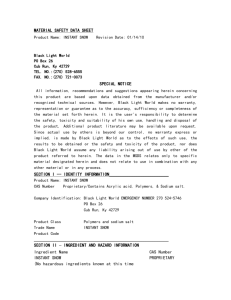

Personal Systems – Positioned for Growth Ron Coughlin September 15,2015 1 © Copyright 2015 HP Development Company, L.P. The information contained herein is subject to change without notice. Sizeable TAM market, operational leadership and disruptive innovation Sizable TAM and opportunity to grow $340B+ market, with growth segments 2 Strong Share Momentum Driven by breakthrough innovation, world class cost structure, & leading go-to-market © Copyright 2015 HP Development Company, L.P. The information contained herein is subject to change without notice. Clear Strategy to Expand Leverage scale to drive share growth, expand into profitable adjacencies, and create new categories Leading Operational Execution Over $1B of cost savings in last year and a negative cash conversion cycle $340B+ Personal Systems TAM growing at 4% +4% 358 53 49 51 4% 80 88 97 9% 5 5 5 6 9% 176 171 170 168 -2% 2015 2016 2017 2018 345 THIN CLIENT & RPOS COMMERCIAL MOBILITY DEVICES 9 24 44 COMMERCIAL PC & MOBILITY SERVICES 45 9 36 45 47 DISPLAYS & ACCESSORIES 66 CONSUMER DETACHABLES 4 74 200 2014 387 10% 14% 347 PC CLIENTS 372 ‘15-’18 CAGR 10 11 49 12 New PC form factors, mobility, and adjacencies are key growth drivers PC CLIENT SOURCE: IDC WORLDWIDE QUARTERLY PC FORECAST (AUGUST 2015) NON-PC CLIENT SOURCE: HP INTERNAL MARKET ANALYSIS & PLANNING (3Q15) MOBILITY SERVICES TAM BASED ON HP PRIMARY RESEARCH (2H15) RPOS = RETAIL POINT OF SALE 3 © Copyright 2015 HP Development Company, L.P. The information contained herein is subject to change without notice. A best seller available at Best Buy HP 25vx 25” LED HD Monitor HP 25vx 4 © Copyright 2015 HP Development Company, L.P. The information contained herein is subject to change without notice. Oscar winning HP DreamColor Displays HP DreamColor LP2480zx Professional Display HP DreamColor LP2480ZX $340B+ Personal Systems TAM growing at 4% +4% 358 53 49 51 4% 80 88 97 9% 5 5 5 6 9% 176 171 170 168 -2% 2015 2016 2017 2018 345 THIN CLIENT & RPOS COMMERCIAL MOBILITY DEVICES 9 24 44 COMMERCIAL PC & MOBILITY SERVICES 45 9 36 45 47 DISPLAYS & ACCESSORIES 66 CONSUMER DETACHABLES 4 74 200 2014 387 10% 14% 347 PC CLIENTS 372 ‘15-’18 CAGR 10 11 49 12 New PC form factors, mobility, and adjacencies are key growth drivers PC CLIENT SOURCE: IDC WORLDWIDE QUARTERLY PC FORECAST (AUGUST 2015) NON-PC CLIENT SOURCE: HP INTERNAL MARKET ANALYSIS & PLANNING (3Q15) MOBILITY SERVICES TAM BASED ON HP PRIMARY RESEARCH (2H15) RPOS = RETAIL POINT OF SALE 5 © Copyright 2015 HP Development Company, L.P. The information contained herein is subject to change without notice. PC market declines expected to moderate in second half 2016 PC market Y/Y trends Factors shaping market trajectory 5% Windows XP migration 0% 2015 2016 NA Currency driven pricing NA -5% Windows 8 -10% Windows 10 launch -15% Core Processor Architecture Transition FORECAST CY14 CY15 SOURCE: IDC WORLDWIDE QUARTERLY PC FORECAST (AUGUST 2015) 6 2014 © Copyright 2015 HP Development Company, L.P. The information contained herein is subject to change without notice. CY16 New Form Factors Clear opportunities for growth Aged installed base drives replacement opportunity INSTALLED BASE OLDER THAN 4 YRS (UNITS) 589M Windows 10, Skylake, and new form factors to catalyze growth SOURCE: INTEL, 2015 • 7 © Copyright 2015 HP Development Company, L.P. The information contained herein is subject to change without notice. Clear opportunities for growth Further market concentration AGGREGATE PC CLIENT VENDOR MIX (UNITS, %) OTHERS ACER, ASUS, TOSHIBA, FUJITSU 13.6M 21% 11.5M 18% 40.2M 61% HP, LENOVO, DELL, APPLE 2011 2012 2013 2014 2015 2Q15 UNITS/ SHR Average Y/Y share gain +1.9% pts Y/Y last 3 quarters SOURCE: INTEL, 2015 • 8 SOURCE: IDC WORLDWIDE QUARTERLY PC TRACKER, 2Q15 © Copyright 2015 HP Development Company, L.P. The information contained herein is subject to change without notice. Clear opportunities for growth Adjacencies & new categories PERSONAL SYSTEM GROWTH CATEGORIES (TAM, $B) 11% CAGR $92 HP, LENOVO, DELL, APPLE $14 $9 $24 $138 NEW CATEGORIES $23 $10 WORKSTATION, THIN CLIENT $53 COMMERCIAL MOBILITY $45 $51 2014 2018 PC & MOBILITY SERVICES HP Inc. Comm. Services & Mobility YTD Revenue growth +21% Y/Y SOURCE: INTEL, 2015 SOURCE: IDC WORLDWIDE QUARTERLY PC TRACKER, 2Q15 SOURCE: HP INTERNAL, MAP ( (2Q15) NEW CATEGORIES = HOME AUTOMATION, DAAS, WEARABLES, IMMERSIVE COMPUTING • 9 © Copyright 2015 HP Development Company, L.P. The information contained herein is subject to change without notice. Clear opportunities for growth Under penetrated segments 11% CAGR $92 HP, LENOVO, DELL, APPLE $14 $9 $24 $138 NEW CATEGORIES $23 $10 WORKSTATION, THIN CLIENT $53 COMMERCIAL MOBILITY $45 $51 2014 2018 PC & MOBILITY SERVICES GEOGRAPHIES Target markets with below average share PRODUCT SEGMENTS Focus on Premium and Detachables ATTACH Accelerate Accessories & Displays Targeted share growth plans underway SOURCE: INTEL, 2015 SOURCE: IDC WORLDWIDE QUARTERLY PC TRACKER, 2Q15 SOURCE: HP INTERNAL, MAP ( (2Q15) NEW CATEGORIES = HOME AUTOMATION, DAAS, WEARABLES, IMMERSIVE COMPUTING • 10 © Copyright 2015 HP Development Company, L.P. The information contained herein is subject to change without notice. SOURCE: HP INTERNAL Solid execution in the face of significant headwinds Relentless focus on taking cost out, quality and customer satisfaction Growing share in a tough market FY15 COMMERCIAL PC SHARE CHANGE +2.1 pts SOURCE: IDC WORLDWIDE QUARTERLY PC TRACKER, Q2 2015 TIMEFRAME COVERS CQ4’14 THROUGH CQ2’15 11 © Copyright 2015 HP Development Company, L.P. The information contained herein is subject to change without notice. Solid execution in the face of significant headwinds Relentless focus on taking cost out, quality and customer satisfaction Reducing costs • • • SOURCE: IDC WORLDWIDE QUARTERLY PC TRACKER, Q2 2015 TIMEFRAME COVERS CQ4’14 THROUGH CQ2’15 Warranty, logistics, overhead cost reductions Relentless focus on Price-Feature-Value Complexity reduction FY15 Y/Y PLATFORM REDUCTION FY15 Y/Y COMPONENT REDUCTION -23% -18% SOURCE: HP INTERNAL COMPONENT REDUCTION = NOTEBOOK ONLY CONSUMER AND COMMERCIAL INCLUDED © Copyright 2015 HP Development Company, L.P. The information contained herein is subject to change without notice. Solid execution in the face of significant headwinds Relentless focus on taking cost out, quality and customer satisfaction Relatively consistent profitability PS OPERATING PROFIT % 4.0% 4.0% 3.3% 14Q1 SOURCE: IDC WORLDWIDE QUARTERLY PC TRACKER, Q2 2015 TIMEFRAME COVERS CQ4’14 THROUGH CQ2’15 13 SOURCE: HP INTERNAL COMPONENT REDUCTION = NOTEBOOK ONLY CONSUMER AND COMMERCIAL INCLUDED © Copyright 2015 HP Development Company, L.P. The information contained herein is subject to change without notice. 3.5% 3.7% 3.0% 3.0% 15Q1 SOURCE:HP INTERNAL (HP FINANCIAL PLANNING & ANALYSIS) 15Q3 Solid execution in the face of significant headwinds Relentless focus on taking cost out, quality and customer satisfaction Improving customer satisfaction NET PROMOTER SCORE % CHANGE (3Q15 VS FY14) +23% Consumer SOURCE: IDC WORLDWIDE QUARTERLY PC TRACKER, Q2 2015 TIMEFRAME COVERS CQ4’14 THROUGH CQ2’15 14 SOURCE: HP INTERNAL COMPONENT REDUCTION = NOTEBOOK ONLY CONSUMER AND COMMERCIAL INCLUDED © Copyright 2015 HP Development Company, L.P. The information contained herein is subject to change without notice. SOURCE:HP INTERNAL (HP FINANCIAL PLANNING & ANALYSIS) +12% Commercial * We ask customers to rate how likely they would be to recommend HP based on their recent purchase experience on an 11-point scale, from (0) not at all likely to (10) extremely likely. We take the percentage of customers that gave a rating of 9 or 10 and subtract the percentage that gave a rating of 0-6 to obtain the net promoter score (NPS). Personal Systems PC client leadership & scale Global share leadership in major personal computing categories CQ215 Category Share Commercial Desktop Commercial Notebook Workstation 20.7% 25.0% 42.0% Thin Client Consumer PC Client #1 #1 #1 #1 #2 27.9% 14.5% HP ships 1.7 PCs every second SOURCE: HP INTERNAL FINANCIAL UNITS FISCAL 4Q14-3Q15, PC CLIENTS, EXCLUDES WORKSTATIONS AND THIN CLIENTS HP Inc.’s Commercial PCs rank #1 or #2 in 44 of the top 50 countries CQ215 HP Inc.’s Commercial PC client share by top 10 markets (%) 34% 33% 31% 28% 28% 27% 24% 23% 21% 19% 7% ITA FRA AUS IND UK USA CAN WW DEU JPN CHN SOURCE: : IDC WORLDWIDE QUARTERLY PC, ENTERPRISE CLIENT DEVICE AND WORKSTATION TRACKERS (CQ215). BUSINESS DESKTOP AND NOTEBOOK SHARE INCLUDES WORKSTATIONS, EXCLUDES ENTERPRISE CLIENT DEVICE 15 © Copyright 2015 HP Development Company, L.P. The information contained herein is subject to change without notice. #1| #2 3+ HP Inc.’s Commercial PC Client Rank – CQ215 Leading edge products launched 1H15 – driving share gains Spectre x360 “The HP Spectre x360 is the best HP laptop ever and a top pick for any business user” - Inc. Mag Elitebook 1020 “World’s thinnest lightest business-class notebook” Zbook Workstation Ultrabooks™ “HP’s ZBook 14 G2 and 15u G2 pack power for productivity” – Digital Trends Curved display FIRST 34” CURVED DISPLAY ElitePad Healthcare Tablet “HP's New Displays Push Curves, VR And A 5K Priced So Low You MUST Read This Story” PCWorld “The magic is the silver ions in the white frame, which can kill germs on contact.” – betanews ELITEBOOK THIN AND LIGHT CLAIM IS BASED ON BUSINESS CLASS NOTEBOOKS AS OF JANUARY 9, 2015 WITH >1 MILLION UNIT ANNUAL SALES HAVING PRE-INSTALLED ENCRYPTION, AUTHENTICATION, MALWARE PROTECTION AND BIOS-LEVEL PROTECTION, PASSING MIL STD 810G TESTS, WITH OPTIONAL DOCKING INCORPORATING POWER DELIVERY. 16 © Copyright 2015 HP Development Company, L.P. The information contained herein is subject to change without notice. Breakthrough innovation across the portfolio Core HP ELITEBOOK 1020 18 Growth HP SPECTRE X360 © Copyright 2015 HP Development Company, L.P. The information contained herein is subject to change without notice. The Future SPROUT BY HP Personal systems strategy to drive profitable growth We will empower and transform how customers work and play Our foundation 19 World Class Supply Chain, Go-to-Market & Marketing © Copyright 2015 HP Development Company, L.P. The information contained herein is subject to change without notice. Personal systems strategy to drive profitable growth We will empower and transform how customers work and play Our market spaces Core Growth The Future Best Price-Feature Value Most Innovative Disruptive Innovation Our strategic priorities Leverage scale advantages to drive share World class E2E cost & quality Leading innovation Targeted country & segment growth Our foundation 20 2 in 1s & Premium Commercial Mobility PC & Mobility Services Immersive Computing Office, School and Home of the future World Class Supply Chain, Go-to-Market & Marketing © Copyright 2015 HP Development Company, L.P. The information contained herein is subject to change without notice. Winning in Core Play to win in Commercial, and play where attractive in Consumer Growth actions • • • • Industry leading Price-Feature-Value Maniacal focus on end-to-end cost reduction Leverage ecosystem partnerships Innovation focused on sprinkles of magic 23.0% 22.8% Commercial 22.7% PC Client Share (%) 22.0% 21.6% HP ELITEBOOK 1020 20.9% Y/Y SHR CHG CQ114 +1.3% CQ215 +1.2% +1.3% +2.9% +2.2% SOURCE: IDC WORLDWIDE QUARTERLY PC TRACKER (Q2 2015) 21 © Copyright 2015 HP Development Company, L.P. The information contained herein is subject to change without notice. +1.0% HP ELITEBOOK 840 #1 HP COMMERCIAL NOTEBOOK HP ZBOOK WORKSTATION ULTRABOOKS HP ELITEDESK 700 MINI HP CHROMEBOOK 11 22 © Copyright 2015 HP Development Company, L.P. The information contained herein is subject to change without notice. HP STREAM Growth – new form factors & premium Growth actions • Leading product & marketing innovation in 2-in-1s • Security and serviceability in Commercial hybrids • Premium growth through design & curated experience HP US Convertible Quarterly share trend (%) +16 HP US Premium Notebook >$999 27.7% +3 11.9% CQ114 Quarterly share trend (%) 9.8% CQ215 CQ114 SOURCE: THE NPD GROUP / RETAIL TRACKING SERVICE, NOTEBOOK COMPUTERS, JAN 2014-JUNE 2015 23 © Copyright 2015 HP Development Company, L.P. The information contained herein is subject to change without notice. 13.2% CQ215 Growth and The Future to drive long term growth Growth Expanding the Commercial Mobility Solutions portfolio Healthcare Retail Field Service Education Driving expansion in Commercial Services Commercial Mobility Revenue Growth 3Q15 Y/Y 2X SOURCE: HP INTERNAL (HP FINANCIAL PLANNING & ANALYSIS) *COMMERCIAL MOBILITY INCLUDES TABLET AND DETACHABLE ** HP SERVICEONE 2.0 PROGRAM LAUNCHED NOV 11, 2014 24 The Future © Copyright 2015 HP Development Company, L.P. The information contained herein is subject to change without notice. Immersive Computing – the on-ramp for Blended Reality 20%+ growth in Commercial Services since 2013 • Consumer launched in ‘15 40% • Commercial launching in ‘16 growth in number of Service One partners since launch HP positioned to win and capture growth opportunities Leading global brand Powerful innovation Inspired marketing Over 45M views Sprout by HP Presents “Jane” Unparalleled go-tomarket coverage World class execution 19K+ • Product Life Cycle management • Portfolio simplification • End to End cost structure • Account planning discipline RETAIL PARTNERS 200K+ #BendTheRules 26 © Copyright 2015 HP Development Company, L.P. The information contained herein is subject to change without notice. COMMERCIAL PARTNERS