2016_2 - Merchants Bank

advertisement

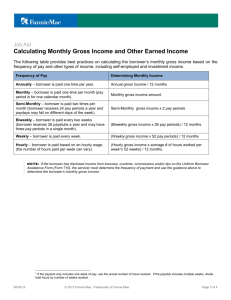

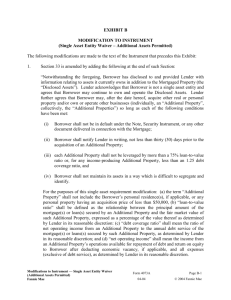

Residential Lending • Correspondent Network Page 1 Correspondent Network January 28th, 2016| Bulletin #2016-2 Inside This Issue: • • • • Self-Employed Income Updates MI Update on Files Using Employment Contracts What’s the Key to Faster Underwriting Turn Times? Underwriting Help Desk Changes – Update Effective February 1, 2016 Self-Employed Income Updates This guidance is effective with applications taken on or after February 1st, 2016 and pertains to Partnership and S-Corporation business structures and applies to both Fannie and Freddie loans. Fannie Mae has updated the self-employment income policies that were originally published in December 2014 regarding how to calculate and document self-employment income, including the parameters under which business income without a history of distribution may be included to qualify self-employed borrowers. This policy update provides an alternative approach that lenders may follow for borrowers who do not show a history of receiving distributions of business income provided certain conditions are met. The lender must confirm the borrower has access to the business income and the business must have adequate liquidity to support the withdrawal of earnings. Key Changes • • We need to document the borrower can access the income, and Document that the business has adequate liquidity to support the withdrawal of earnings. Prior to this update, we were utilizing the cash flow analysis worksheets for self-employed borrowers (various sources show the income calculation very similar whether it be MGIC’s worksheet, Fannie’s Form 1084 Cash Flow Analysis, or Freddie’s Form 91 and Form 1088) and following the worksheets line by line using the amounts shown on the K1 as income. The taxable income shown on the K1 does not represent money that goes into the borrower’s pocket. The worksheets should still be followed; however, additional analysis may be required when utilizing this income. Page 2 Residential Lending • Correspondent Network Scenarios: 1. If the Schedule K1 reflects a stable history of receiving cash distributions of income from the business consistent with the level of business income being used to qualify, no further documentation of access to the income or adequate business liquidity is required. The K1 income may be included in the borrower’s income. The distributions are shown in Box 19A on the 1065 K1, or in Box 16D on the 1120S K1. In the K1 sample shown, Box 1 shows income of $360,845 and the distribution amount shows $199,963. In this example, we would be able to use $199,963 as income without additional documentation as the borrower received $199,963 as an actual distribution and the income shown in Box 1 supports that. No additional documentation would be required. Page 3 Residential Lending • Correspondent Network 2. If the Schedule K1 does not reflect a stable history of receiving cash distributions of income from the business consistent with the level of business income being used to qualify, the lender must confirm the following to include the income: a. Document that the borrower has access to the income (provide a partnership agreement or corporate resolution) – unless the borrower(s) own 100% of the business, in which case confirmation of access to the income is not required; AND b. The business has adequate liquidity to support the withdrawal of earnings. In the K1 sample shown above, if we needed to use more income than $199,963 distribution amount, (for example, if we wanted to use the full $360,845 as we have done in the past) we would need to provide additional documentation showing the borrower has access to the funds and that the business has the liquidity to support the withdrawal of earnings. Page 4 Residential Lending • Correspondent Network How do we document that the borrower has access to the income? • Provide a Partnership Agreement or Corporate Resolution. (This is not required when the borrower(s) own 100% of the business). How do we document that the business has the liquidity to support the withdrawal of earnings? You can measure liquidity using generally accepted accounting principles as shown in the formulas below: • Current Liquidity = Current Assets / Current Liabilities If the business model includes inventory, then the following formula may be used: • Quick Ratio for Liquidity = (Current Assets – Inventory) / Current Liabilities The information for both of these formulas can be located on the Schedule L of the business tax returns (which is the “Balance Sheet per Books” section of IRS Form 1065 or 1120S). Generally lines 1-6 would be considered current assets and lines 16-18 would be considered current liabilities. See the applicable sample Schedule L sections shown below: In the example shown above, the liquidity ratio would be calculated as follows: Current assets / current liabilities = current liquidity 6,283 / $5,500 = 1.14 This company has $1.14 in assets for every $1.00 of liabilities and they are liquid and able to meet their short term debts. Therefore, a ratio greater than one would indicate that the business is liquid as the liquid assets are greater that the debt. A ratio of less than one would indicate that the business is not liquid as the debt would exceed the assets. Please note that Mortgages, notes, bonds payable in less than one year can be excluded from the calculation if documentation is provided showing they are renewable. Do I have to do the liquidity test for both years if two years tax returns are required? • No, you are only required to do the liquidity test for the most recent year. Rural Development Loans This is a reminder that files utilizing RD funds cannot be eligible for conventional financing. The GUS feedback has a finding that references this. Please see RD 3555 guide section 9-4 which pertains to assets that must be considered and section 8-3B which is excerpted below. The guide states that if the borrower meets the cumulative criteria shown below the loan is not eligible for RD: • • • The applicant has available personal non-retirement liquid asset funds of at least 20% of the purchase price that can be used as a down payment; The applicant can, in addition to the 20% down payment, pay all closing costs associated with the loan; The applicant can meet qualifying ratios of no more than 28% PITI and 36% TD when applying the 20% down payment; Page 5 • Residential Lending • Correspondent Network The applicant demonstrates qualifying credit for such a loan. Qualifying credit consists of at least two credit bureau trade lines open and paid as agreed for at least a 24- month period to include that: The applicant was not currently 30 days or more past due on any trade line; and The applicant had not been 60 days or more past due on any trade line over the past 24 month period; and The applicant did not have a foreclosure or bankruptcy in their credit history over the past 36- month period. The conventional mortgage loan term is for a 30- year fixed rate loan term without a condition to obtain private mortgage insurance (PMI). -Please contact the Underwriting Help Desk with questions regarding this article. MI Update on Files Using Employment Contracts We previously published employment contract guidelines in Merchants Bank Bulletin 2015-18 on November 23, 2015. At that time, we had two mortgage insurance companies that allowed us to use our Freddie Mac contract additional provisions as they relate to employment contracts/letters or income received from a salary increase. We now have received approval from United Guaranty to utilize this program as well. Please see the United Guaranty overlays shown below as well as the previously published guidelines. Freddie Mac We have an additional provision through our contract with Freddie Mac (the loan must be locked Freddie and submitted through LP) that allows us to use income in connection with income received from a salary increase or income from future employment as long as the following guidelines are met: Future Employment (Employment Contract/Employment Letter) • The Borrower’s employment offer must be non-contingent and the non-contingent offer letter must be retained in the Mortgage file; • The Borrower’s written acceptance of the employment offer must be retained in the Mortgage file; • The time frame between the Mortgage Note Date and the commencement of employment (employment gap) must not exceed 90 days; • Must be a purchase transaction secured by a 1-unit primary residence; • The Borrower must have adequate cash reserves after the Note Date to pay the monthly principal, interest, taxes, insurance and association dues during the employment gap, plus one additional month; • A verbal VOE is not required for the Borrower’s future employment. Income Received from a Salary Increase • The Borrower’s employer must verify in writing the amount and effective date of the salary increase and the documentation must be retained in the mortgage file; • The effective date of the salary increase must be no more than 90 days after the Note Date; and • A verbal VOE is required to be done no more than 10 business days prior to the note date. Fannie Mae Merchants Bank will require the following items be included when utilizing an employment contract on a Fannie Mae loan: • • • • Copy of the fully executed employment contract Pay stub or full VOE that contains YTD earnings Verbal VOE done prior to closing dated within 10 business days of note date. The information provided must be sufficient to calculate income accurately MI MGIC – Merchants Bank has received a waiver that allows us to follow the MGIC Go guidelines. Genworth – Use of the Simply Underwrite guidelines is allowed. United Guaranty – Overlays to the information shown above: the borrower must be employed in the same field for a minimum of two years or have an educational equivalent, a verbal VOE is required, and the borrower must be a salaried or W2 borrower that is not employed by a family owned business or an interested party to the transaction. Additional requirement for future salary increases: increase must be consistent and reasonable based on the time on the job past increases. -Please contact the Underwriting Help Desk with questions regarding this article. Residential Lending • Correspondent Network Page 6 What’s the Key to Faster Underwriting Turn Times? Underwriting needs your help to ensure delivery of complete applications when loans are submitted to underwriting. This will ensure prompt underwriting of your files, and quicker approvals. If you import the Fannie 3.2 file from your loan origination system (LOS) or import the 3.2 file directly from DU, it should pull over your liabilities. One thing that does not come over from Fannie Mae is the closing costs and prepaid expenses from the Details of Transaction. For instructions on how to enter the closing costs and prepaid expenses into Path, see the Calyx Path User Guide under Manuals on the Landing Page. Page 40 will show you how. For refinance loans, please complete the Refinance Information under the property tab. LP will not return findings if this information is not complete. We need the year acquired, original costs, and amount of existing liens. Other things which are very important, especially if your file is chosen for a pre-closing audit: *Complete 2 year residence/address history *2 year work history with employer name, addresses, phone numbers, and start/end dates *Asset section complete with bank/institution name, address, account numbers *Complete Real Estate Owned (REO) Section including value of property, taxes and insurance on each property, correctly entering retained/rental/sold/pending sale under property status, the property type, if it’s their current residence, if it’s the subject property, and linking the mortgages to the property from the liabilities page. *Originator information and your Bank information on page 4 of the application. If this information is missing, contact MRG or Tech Help and we can correct it for you. Help us approve your loans quicker by providing complete applications. -Please contact the Tech Help Desk with questions regarding this article. Underwriting Help Desk Changes – Update Effective February 1, 2016 The Underwriting Help Desk will be updated and you will notice some changes. The subject line in the Underwriting Help Desk response email will look a little different as there will be additional information. Please see the example below and continue to respond to the emails as normal. -Please contact the Underwriting Help Desk with questions regarding this article.