28 April 2009

Americas

Equity Research

Product Marketing

Swine Flu Outbreak

Research Analysts

Credit Suisse Global Product Marketing

212 538 4442

global.productmarketing@credit-suisse.com

Credit Suisse US Eq. Res

877 291 2683

equity.research@credit-suisse.com

THEME

Assessing the Potential Impact on Sectors &

Stocks

Swine flu has become a growing global concern in recent days, with 75 cases

confirmed by the World Health Organization as of Monday, and hundreds more

suspected. Mexico and the United States are of particular concern, though

cases have also been verified in Europe and others are under surveillance in

Israel, Australia, New Zealand, and Brazil. As a precautionary measure, the

United States has declared a health emergency.

The swine flu outbreak occurs at a critical time for the US economy, which is

just beginning to show faint signs of life from recent data releases. With the

outbreak potentially impacting companies from the Consumer, Health Care,

Industrial arenas and beyond, we thought it was important to check with our

analysts to get their initial impressions on the potential impact to their stocks.

Of note:

■ In Health Care, Gilead should see a benefit from the stockpiling of Tamiflu.

Managed care companies could be negatively impacted as medical costs

increase, while the drug distributors and hospitals could see incremental

revenues.

■ In the Transportation space, a swine flu pandemic would most likely lead to

a slowdown in global trade across the containership and dry bulk shipping

sectors.

■ In the Consumer space, Processed Food companies are in focus as foreign

markets take precautionary measures on inspections of US pork exports. In

Retail, Wal-Mart and Costco have 5% and 3% of total sales in Mexico,

respectively.

■ In Technology, Citrix Systems could benefit as more people work from home

and need remote access capabilities. And semiconductor companies could

be impacted to the extent that a pandemic disrupts normal supply logistics.

Pages 2-5 include a list of our Equity Research analysts' comments on the

impact to their industries and stocks. Beginning on page 6, Global Equity

Strategist Andrew Garthwaite highlights the SARS crisis as the most recent

precedent. During that period, Hong Kong underperformed global markets by

15% and the market’s relative performance did not trough until 2 ½ weeks after

the number of new SARS cases peaked. The worst performing Hong Kong

sectors were travel, hotels, and general retailing.

DISCLOSURE APPENDIX CONTAINS IMPORTANT DISCLOSURES, ANALYST CERTIFICATIONS, INFORMATION ON

TRADE ALERTS, ANALYST MODEL PORTFOLIOS AND THE STATUS OF NON-U.S ANALYSTS. FOR OTHER

IMPORTANT DISCLOSURES, visit www.credit-suisse.com/ researchdisclosures or call +1 (877) 291-2683. U.S.

Disclosure: Credit Suisse does and seeks to do business with companies covered in its research reports. As a result,

investors should be aware that the Firm may have a conflict of interest that could affect the objectivity of this report. Investors

should consider this report as only a single factor in making their investment decision. Customers of Credit Suisse in the

United States can receive independent, third party research on the company or companies covered in this report, at no cost

to them, where such research is available. Customers can access this independent research at www.credit-suisse.com/ir or

call 1 877 291 2683 or email equity.research@credit-suisse.com to request a copy of this research.

28 April 2009

Industry and Stock Commentary

US IMPLICATIONS OF THE SWINE FLU

SUMMARY - SELECT INDUSTRY IMPACT

Potential Upside

Neutral / No Impact

Biotech (GILD)

Software (CTXS)

Specialty Chemicals (MMM)

Drugstores

Hospitals & Labs

Property/Casualty Insurers

Major Pharma

Potential Negative Impact

Managed Care

Commercial Aerospace

Marine Transportation

Credit Cards

Integrated Oils

INDUSTRY & STOCK COMMENTARY

Stocks with

Potential

Positive Impact

Coverage

Universe

Industry Impact

Michael Aberman

Biotechnology

GILD (2.2%);

Swine flu should benefit biotech on a very stock specific basis. GILD will record more

ROG.VX (3.5%);

royalty revenue from Roche with increased stockpiling of Tamiflu. Other companies

GSK.L (3.3%);

with vaccine technologies (BCRX, DVAX, NVAX) stand to benefit as well, although the

BCRX; DVAX;

impact is more weighted to the near term and may be more sentiment driven than

NVAX (% taken

anything else.

from latest Q)

Ralph Giacobbe

Hospitals and labs could see some volume benefit in 2Q. Regardless of whether they

see an impact or not, the perception will be that they will and we expect the stocks to

reflect that. Also of note, the first areas hit were Texas and California where many of

Hospitals and Labs

the public hospitals have exposure. We would highlight Community Health Systems

(CYH), Tenet Healthcare (THC), and Universal Health Services (UHS) as most

exposed to those regions.

Scott Hirsch

Specialty

Pharmaceutical

We expect the swine flu to have minimal impact on the majority of companies in our

space. However if the incidence of swine flu increases significantly, Perrigo could

stand to modestly benefit as it supplies a number of large retailers with private label

cough and cold products.

PRGO

Glen Santangelo

Drug Distributors

Distribution of the vaccine as well as the drugs used to treat the flu would provide a

slight uptick in sales. Do not believe it would have a material impact, but do believe it

would generate some incremental sales.

<1% revs: CAH,

MCK, ABC, HSIC

Gregory Nersessian

Managed Care

Negative. To the extent the swine flu were to result in a broad based increase in

hospital admissions and/or flu vaccine administration, medical costs would increase

and margins would decline. Typically, the flu tends to impact children and the elderly

to a greater degree however the WHO has indicated that the swine flu cases have

appeared almost exclusively in young adults. This would suggest that companies with

commercial exposure could be more at risk than those with Medicare or Medicaid

exposure, though it is probably too early at this time to know that for certain.

Catherine Arnold

Major

Pharmaceuticals

We do not think the swine flu outbreak should have any impact on US Major Pharma

or any of the individual names under our coverage.

Analyst

Stocks with

Potential

Negative Impact

HEALTHCARE

Swine Flu Outbreak

CYH (1.2%

exposure

CA/14.4%

exposure TX),

THC (17.0%

CA/19.3% TX),

and UHS (10.5%

CA/33.9% TX)

UNH, WLP, AET,

HUM

2

28 April 2009

Stocks with

Potential

Positive Impact

Stocks with

Potential

Negative Impact

Coverage

Universe

Industry Impact

Semiconductors

The semiconductor industry has a highly disaggregated and complex supply chain including die production, packaging, test, and foundry services located on a global

basis. To the extent that any pandemic disrupts normal supply logistics all companies

have exposure. 16% of semiconductor production is done in the US, 11% in Europe,

and 73% in Asia. We would note that given current low utilization levels, localized

disruption could be compensated for elsewhere. Of the US semi companies, MU has

significant packaging assets in Puerto Rico (~35%), Intel in Costa Rica (~25%). In

general we find supply disruptions (especially temporary) as weak reasons to sell

stocks. End demand disruptions could be more significant - but we suspect that

demand disruptions in tech would be no different than other areas of the economy with

respect to a swine flu pandemic. In fact, a deepening of the nesting theme we have

already seen occur relative to economic weakness could continue to support

consumer electronic demand like FPDs, Netbooks/Notebooks, and Entertainment.

MU (~35%

exposure to

Puerto Rico),

INTC (~25%

exposure to Costa

Rica)

IT Hardware

All vendors would

likely see some

boost in the

We see three effects from a significant spread of the swine flu, including the disruption percentage of

of supply chains, a temporary increase in the mix of direct (online) purchasing, and a

revenues from

negative impact on high labor content businesses such as consulting. Virtually all of IT direct distribution,

Hardware companies have outsourced manufacturing, so restricted travel and transparticularly DELL.

border shipping would have an impact on goods delivery. Companies that rely on

Again, this could

services revenues would be negatively impacted if swine flu spread in a significant

clearly be

manner. Lastly, if people domiciled, direct and electronic distribution of content and

outweighed by

goods could come into favor. Please note, however, that these impacts would likely

supply chain and

result from a near pandemic scenario and not from merely transitory concerns.

end demand

compression from

a pandemic

scenario.

Virtually all stocks

in our coverage

universe could be

affected by supply

chain issues. IBM

and HP have a

relatively high

portion of revenue

coming from

people-driven

services

businesses.

Paul Silverstein

Communications

Infrastructure

PLCM and

Tandberg

(Telepresence and

To the extent more people work from home outside of the office, it could lead to

high-end

increased network utilization rates, which, if sufficiently prolonged, could drive

videoconference

incremental demand for networking infrastructure. Telepresence and other high-end

systems market).

(i.e., high-def) videoconferencing systems could particularly benefit. We believe,

CSCO

however, that it would take a severe and prolonged epidemic to trump the macro(Telepresence and

economic backdrop to fuel a meaningful uptick in comm infrastructure spending by

indirect impact on

either enterprises or carriers. Please see the Appendix for geographic rev mix (North

its switch and

America v. RoW) for over 50 suppliers of comm infrastructure.

router business JNPR would see

this indirect

benefit as well).

Phil Winslow

Software

Citrix Systems is a software company that could benefit as more people would work

from home and would need remote access. Citrix is a leading provider of

infrastructure software that enables secure access to enterprise applications and

information regardless of location using any device over any connection.

Will Stein

Electronic

Manufacturing

Svcs & Electronic

Components

Many electronics and industrial OEMs have a significant portion (if not all) of their

manufacturing capacity outsourced to global Electronics Manufacturing Services

(EMS) providers. Our analysis of these companies' manufacturing footprint indicates

that approximately 8% of global EMS capacity exists within Mexico (albeit none of it in

Mexico City). We believe much of this capacity is aligned to serve the U.S. consumer

electronics industry. We believe the specific products manufactured in these factories

are skewed to inkjet printer cartridges, handsets, and set top boxes. A shut-down of

these factories, or limitation of these factories to ship product into / out of Mexico,

would meaningfully reduce output of the EMS companies and their consumer

electronics OEM customers.

Bryan Keane

Swine flu may negatively affect the remittance industry by restricting migration and

Computer Services

travel. Lowering of global GDP will affect remittance volumes. Outsourcing/offshoring

& IT Consulting

would be negatively affected by restrictions on travel.

Kulbinder Garcha

Telecom

Equipment

Analyst

TECHNOLOGY

John Pitzer

Bill Shope

Swine Flu Outbreak

Less global travel could bode well for handset manufacturers and suppliers as more

people work from remote locations (beneficiaries: NOK, RIMM, QCOM)

CTXS

WU, GPN (10%),

ACN

NOK, RIMM,

QCOM,

3

28 April 2009

Coverage

Universe

Industry Impact

John McNulty

Specialty

Chemicals

Moderate--for most names in the space there is virtually no impact and for others it

will depend on the severity of the outbreak. The most direct beneficiary is MMM--they

have a respiratory mask business that benefited in 2003 with the SARS outbreak, so

they could see a benefit in one of their divisions. For SEE there may be some

negative impact as they do food packaging (including pork) so if pork sales dip on this,

SEE would be temporarily impacted. ECL--if swine flu results in limited travel this

summer, it could hurt them, otherwise no impact on the name.

David Gagliano

Metals & Mining

If Swine flu crimps global demand, it will hurt the metal equities. Metal prices usually

move in the same direction as global IP growth rates. If Global IP growth rates are

materially impacted by a drastic slowdown in economic activity, it will likely translate

into a more extended period of weak pricing for the metals in general.

Analyst

Stocks with

Potential

Positive Impact

Stocks with

Potential

Negative Impact

MMM

SEE, ECL

MATERIALS

CONSUMER DISCRETIONARY

We believe swine flu would only impact companies with operations in Mexico. Under

our coverage group, this includes Costco and Wal-Mart. Sales trends this past

weekend were almost at the level of a regular weekend for Sam's Club and Wal-Mart

Supercenters. WMT de Mexico still expects to see SSS grow 5% y/y in April. Other

retailers such as Grupo Famsa saw no change in trend and Soriana saw minor impact

in traffic this past weekend. This leads us to believe the swine flu impact has had a

minor impact if any on our companies' sales thus far. But there is a chance that the

negative impact could become more pronounced in the next few days.

WMT (~5% of

total sales in

Mexico)

COST (~3% of

total sales in

Mexico)

Michael Exstein

Broadlines

Omar Saad

Net negative for the industry. We believe the swine flu pandemic creates risks to

sales and to supply chain efficiency for the entire apparel and footwear industry. From

a demand perspective, the disease could potentially discourage consumers from

shopping due to the concentration of crowds in shopping centers. This pandemic could Potential market

Branded Apparel & also cause a shift in traffic patterns toward open air outlet malls (over the more

share gains for

confined traditional indoor malls), which would produce an offsetting sales benefit for

Footwear

RL, VFC, CRI,

companies with large factory outlet operations (RL, VFC, CRI, and PVH). Finally, the

and PVH

spread of the disease in Asia, Mexico, and other parts of Latin America could disrupt

the supply chain and profitability of the entire industry, and this risk seems especially

acute for GIL, HBI, and VFC, which self-operate factories in these regions.

Paul Lejuez

Specialty Softlines

Minimal impact overall. Slightly greater impact on denim focused retailers, as high

quality denim is often sourced in Mexico.

AEO, ANF

Rob Moskow

Processed Food

It is too early to tell whether there will be a negative impact on consumer demand for

pork, but the situation looks OK for now. So far, the international markets are rationally

keeping their channels open to our exports, but taking more precautionary measures

on inspections. Mexico accounts for 14% of U.S. exports and was off to a great start

in 2009. It is hard to see how that pace can continue with the Mexican government

essentially declaring a state of emergency and consumers staying away from

restaurants and public places.

TSN, SFD

Edward Kelly

Modest positive for Drugstores at best. While the market's initial reaction seems to be

that an increase in swine flu incidents should be positive (would drive increased sales

Supermarkets and of antiviral drugs in pharmacy, cold cough and flu medication in OTC, and other

WAG, CVS, RAD

products like surgical masks, antibacterial soap, and disinfectant wipes), we estimate

Drugstores

that the issue would have to escalate to a crisis to provide a meaningful earnings

benefit.

Risks to supply

chain efficiency

most acute for

GIL, HBI, and

VFC

CONSUMER STAPLES

ENERGY

Independent

Refiners

Assuming a moderate scenario in regards to the swine flu outbreak, there would be a

limited impact on the Refiners as jet fuel makes up on average ~9.6% of production.

[Jet Fuel is where the impact will be felt for this outbreak]. However, if the outbreak is

such that air travel comes to a halt, then there would be a much larger (negative)

impact on the refiners as this would lead to higher distillate inventory levels, hence

pressuring distillate cracks. [Distillate makes up ~28% of production].

All Refiners if air

travel comes to a

halt: DK, FTO,

HOC, SUN, TSO,

VLO, WNR

Mark Flannery

Integrated Oils

Assuming a moderate scenario in regards to the swine flu outbreak, there would be a

relatively moderate hit on global economic oil demand, which would probably move in

line with the overall global economy. It may be slightly worse than the market and

underperformance could be expected. The refining segment would be affected as

described in the Independent Refining entry.

All Integrateds

would be affected

Brad Handler

In general, the swine flu will have an impact to the extent that it affects oil

Oilfield Services &

consumption (airline travel). For Services, the swine flu could play a role to the extent

Equipment

that it affects development activity in Mexico.

SLB, HAL, WFT,

BJS, SII

Mark Flannery

Swine Flu Outbreak

4

28 April 2009

Stocks with

Potential

Positive Impact

Stocks with

Potential

Negative Impact

Coverage

Universe

Industry Impact

Moshe Orenbuch

Specialty Finance

We could see (1) Reduced travel sales and commissions for AXP, (2) fewer crossborder transactions and related fees for the credit card networks (V, MA, AXP)

AXP (~20% rev);

MA (~30% rev); V

(~30% rev)

Tom Gallagher

Life Insurance

A pandemic that led to material losses of lives would cause a spike in life insurance

claims and have an adverse impact on life insurers.

All

Vinay Misquith

Minimal impact. Accident and health insurers could have some claims, though we

US Property

Casualty Insurance don't believe it will be material

Analyst

FINANCIALS

INDUSTRIALS

Rob Spingarn

Commercial

Aerospace

Negative impact to the extent that airline capacity is reduced to reflect lower traffic

demand.

Greg Lewis

Marine

Transportation

Negative impact to the whole sector. Would most likely lead to a slowdown in global

trade across the containership and dry bulk shipping sectors. We would expect the oil

trade to remain insulated after adjusting for potential slowdown in GDP.

BA, PCP, COL,

SPR, BEAV, TDG

MEDIA

Spencer Wang, Peter

Stabler, John

Blackledge, Topher

Solmssen

Entertainment,

Little impact expected on media and telecom industries, other than potentially more

Internet,

Cable/Satellite TV, time spent consuming media, especially watching/listening/reading news.

Advertising

GLOBAL IMPLICATIONS OF THE SWINE FLU

Roche/Chugai/Gilead are the most likely to benefit (through increased Tamiflu sales)

although GSK may also gain (through increased Relenza sales). In the longer-term,

companies with pandemic flu vaccine expertise may be able to develop a pandemic

vaccine, and we may also see an increase in overall influenza vaccines. The main

pandemic and seasonal manufacturers are GSK, Sanofi- Aventis and Novartis.

Luisa Hector

Europe Major

Pharmaceuticals

Steve East

We expect to see weakness in stocks exposed to commercial aerospace following the

outbreak of a new swine flu virus in Mexico, US and Canada. The sector was hit hard

by the SARS crisis in 2003 and if this crisis escalates we would be very wary of

sentiment since this could further weaken global air traffic and hit a fragile customer

Europe Aerospace base. Traffic is already tracking at 5-6% down year on year, which if sustained (as we

expect) will make 2009 the worst year for growth in history by a considerable margin

(previous margin was -2.7%). Since we believe there is already over-capacity in

aircraft and a major financing challenge for remaining buyers of new aircraft, further

demand weakness could present additional challenges for the aircraft manufacturers.

Marcel Moraes

Sam Lee

Foong Wai Loke

Sean Quek

Swine Flu Outbreak

Brazil Food

Producers

Slightly negative for Brazilian protein export players. Up to now, there is no way of

knowing if the swine flu will become pandemic. Assuming that it will not contaminate

other animals (poultry and cattle) and considering that pork exports represent roughly

6% to 8% of Perdigao and Sadia's total sales, it should have a marginally negative

impact on results.

Asia Airlines

Since the operating environment is much worse now versus 2003 (SARS breakout), if

we see an outbreak as bad as SARS, the stocks could trade below their historical low

P/Bs. On the other hand, if swine flu does less damage to this region, and the aviation

market bottoms out in 2Q/3Q09 on recovering global GDP, buying opportunities will reemerge.

Asia Resorts

Resorts were relatively unscathed during SARS as Malaysia was relatively unaffected

by the outbreak. Leisure revenues fell 1% YoY, while Leisure EBIT fell 3% YoY.

Resorts' revenues were relatively resilient at the start of the Asian financial crisis,

revenues grew 12.9% in 1997 and 1.8% in 1998 but tumbled 11% in 1999. Should

history repeat itself, the impact of the global economic crisis could again have a lag

effect on Resorts and may cause earnings disappointment later on.

Singapore Market

Strategy

With the SARS outbreak lasting less than four months, the impact on the market was

not very significant. In 2Q03, Singapore GDP contracted 1.6% YoY, versus 1Q's

+3.7% and 3Q's +4.5%. The STI fell 8% during the SARS outbreak from 1,299 to

1,196. This was also because, by the time SARS started, the market has already

collapsed 54% from the peak in January 2000. Currently, the market had lost 52%

from the peak in October 2007.

Roche

(ROGN.VX);

GlaxoSmithKline

(GSK)

EAD.PA, RR.L,

SAF. PA

5

28 April 2009

Global Equity Strategy

Dr. John McCauley, virologist at the National Institute for Medical Research, believes that

the estimate of 120m fatalities from the crisis is "not unreasonable". We have no estimate.

For the record, the Spanish flu pandemic lasted from 1918 to 1920 and killed 50m people,

2.5% of the total population. In the US, 28% of the population was infected and 500k to

675k people died (0.6% of the population). Admittedly, many exceptional factors

contributed to the deadliness of that pandemic, such as mass troops movements,

weakened population post- WWI and limited medical facilities (no nationalised healthcare)

or limited medical know-how (penicillin invented in 1928).

Andrew Garthwaite

44 20 7883 6477

andrew.garthwaite@

credit-suisse.com

The most recent precedent is the SARS crisis. That crisis probably was more of a shock

than the current crisis, as: a) initially nobody knew much about the disease (was it

bacterial or a virus?), b) its mortality rate was extremely high (10% overall, but higher

initially until it was discovered to be a virus; apparently, the mortality rate in the current

swine flu is thought to be 2% - and if caught in the early stages it can be treated.); and c) it

was spreading extremely quickly (moreover, it was the first pandemic scare for a long

time). In total 8,437 people were infected and 813 died from SARS.

According to an October 2008 World Bank study, the economic consequences of a flu

pandemic can be huge. A “mild” pandemic such as the Hong Kong flu of 1968-9, would

reduce global GDP by 2% (4% in a more severe pandemic, such as the 1918-20 Spanish

flu episode). Of the total economic impact, about 12% would result from higher mortality,

28% from illness and 60% from efforts to avoid infection (mainly reduced air travel and

nonessential retail shopping). (We note, however, that the World bank study might be

overestimating the economic impact of a pandemic, given that US GDP was flat between

1918 and 1920, while consumption actually grew by 9.4% in real terms over the same

period). During the SARS crisis, Hong Kong underperformed global markets by 15%

(despite high beta markets outperforming in the aftermath of the Iraqi invasion). More

interestingly, the Hong Kong market’s relative performance did not trough until 2 ½ weeks

AFTER the number of new SARS cases peaked and around 2 MONTHS before the WHO

th

declared that the SARS crisis was contained (which was July 5 although by mid-May the

number of new SARS cases in Hong China had fallen very dramatically as shown

overleaf).

Swine Flu Outbreak

6

28 April 2009

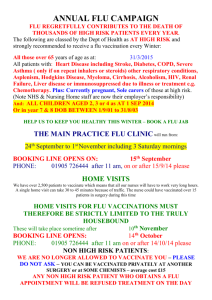

Exhibit 1: Hong Kong relative price performance versus new incidences of SARS in

China

1.95

90

New cases of SARS in China

80

1.9

Hong Kong price relative to world, rhs

70

1.85

60

50

1.8

40

1.75

30

20

1.7

10

0

3/12/2003

3/26/2003

4/9/2003

4/23/2003

1.65

5/21/2003

5/7/2003

Source: © Datastream International Limited ALL RIGHTS RESERVED, WHO, Credit Suisse research

We believe if concerns rose to SARS type levels, which we believe is very unlikely, then

markets could fall 10% to 15%.

th

Sectors: during the first part of the SARS crisis (which we take as the 12 March 2003

th

when the WHO issued a global warning until April 24 ), the worst performing Hong Kong

sectors were travel (which underperformed their global peers by 27%) and hotels (which

underperformed their global peers by 25%) and general retailing (underperformed peers

by 22%).

Exhibit 2: Hong Kong travel & leisure underperformed by 16% during the SARS crisis (it

continued to underperform until the number of new cases had fallen to a quarter of the

peak level). It then outperformed by 12% in the following 2 weeks.

90

0.165

New cases of SARS in China

80

Hong Kong travel & leisure relative to the Hong Kong market, rhs

70

0.16

0.155

60

0.15

50

0.145

40

0.14

30

0.135

20

0.13

10

0

3/12/2003

3/26/2003

4/9/2003

4/23/2003

5/7/2003

0.125

5/21/2003

Source: © Datastream International Limited ALL RIGHTS RESERVED, Credit Suisse research, WHO

Swine Flu Outbreak

7

28 April 2009

Additionally, food producers performed very badly (underperformed by 20%) in spite of

being 'defensive' as investors worried about food and contamination (initially SARS was

believed to be spread by bacteria).

Even real estate stocks underperformed both the market (by 5%) and global peers (by

12%) as end buyers were refusing to visit properties. (Retailing, food producers and travel

and leisure all outperformed by 15%-20% in the two months following the crisis- again

implying that SARS accounted for about 20% off these sectors).

We show in Exhibit 4 the sector performance of Hong Kong sectors relative to their global

peers over the SARS crisis.

Exhibit 3: Hong Kong sector performance (relative to global sectors) during the peak of

the SARS crisis (12 March 2003 to 24 April 2003)

0%

-5%

-10%

-15%

-20%

Hong Kong sectors relative to global sectors, during peak of SARS crisis

-25%

-30%

Forestry & Pap

Electricity

Fxd Line T/Cm

Con & Mat

Chemicals

Oil & Gas Prod

Real Est Inv,Svs

Personal Goods

Gs/Wt/Mul Util

Banks

Inds Transpt

Support Svs

Media

Auto & Parts

General Inds

Financial Svs

Eltro/Elec Eq

Nonlife Insur

Mobile T/Cm

Fd Producers

Tch H/W & Eq

S/W & Comp Svs

Gen Retailers

Hotels

Airlines

Source: © Datastream International Limited ALL RIGHTS RESERVED, Credit Suisse research

The second chart shows sector performance relative to the Hang Seng- basically showing

what was high beta to SARS on the way down was equally the case on the way up.

Exhibit 4: Hong Kong sector performance relative to the Hong Kong market in the two

phases of the SARS crisis

Performance post SARS crisis (24/04 to 5/07)

20

S/W & Comp Svs

Travel & Leis

15

Eltro/Elec Eq

Tch H/W & Eq

10

Auto & Parts

Gen Retailers

Mobile T/Cm

5

Fd Producers

Personal Goods

Financial Svs

Media

Inds Transpt

Oil & Gas Prod

General Inds

Real Est Inv,Svs

0

-5

Nonlife Insur

Performance of Hong Kong

sectors relative to the market

-10

Chemicals

Banks Con & Mat

Gs/Wt/Mul Util

-15

Electricity

Fxd Line T/Cm

Forestry & Pap

Support Svs

-20

-25

-18

-15

-12

-9

-6

-3

0

3

6

9

Performance during SARS crisis (12/03 to 24/04)

Source: © Datastream International Limited ALL RIGHTS RESERVED, Credit Suisse research

Swine Flu Outbreak

8

28 April 2009

The winners were clearly the more defensive sectors: utilities, drugs and telecoms.

The winners would be: drug companies (each $200m of flu related sales is estimated to

add 0.5% to EPS for Roche and GSK by our European drugs team). Recall, European

drugs stocks have a FCF yield of 12.4% (before dividends) and as we highlighted last

week cyclicals since the market low have outperformed by 30%- this is in line with the

normal cyclical outperformance.

Maybe we should also be looking at those companies who would benefit as more people

would work from home.

Certainly over the SARS crisis, many people in Hong Kong were told to work from home

for a few weeks. The beneficiaries of this would be the device manufacturers (PCs,

netbooks- Acer, Dell), smartphone manufacturers (RIM, Nokia, HTC), webcams (Logitech)

and then if the crisis persists the manufactures of the internet/broadband infrastructure

(CISCO, Alcatel, Siemens).

Swine Flu Outbreak

9

28 April 2009

Appendix

Exhibit 5: Communications Infrastructure Geographic Exposure

Data as of the most recent fiscal year

Company

ADC Telecommunications

Adtran

ADVA Optical

Airspan

Alcatel/Lucent

Allot

ARRIS

Aruba

AudioCodes

Aware

BigBand

BlueCoat

Brocade

Ceragon

Ciena

Cisco

Commscope

Ditech

Echelon

Ericsson

Extreme

F5

Harmonic

Infinera

Juniper Networks

Motorola

Netgear

Nokia-Siemens

Polycom

Riverbed

Sandvine

Shoretel

Sonus

Starent

Sycamore

Tekelec

Tellabs

UTStarcom

Veraz

Average

Ticker

ADCT

ADTN

ADV-DE

AIRN

ALU

ALLT

ARRS

ARUN

AUDC

AWRE

BBND

BCSI

BRCD

CRNT

CIEN

CSCO

CTV

DITC

ELON

ERICY

EXTR

FFIV

HLIT

INFN

JNPR

MOT

NTGR

NOK

PLCM

RVBD

SAND.L

SHOR

SONS

STAR

SCMR

TKLC

TLAB

UTSI

VRAZ

Total

Revenues

(million USD)

$ 1,381,600

$

500,676

$

319,787

$

70,351

$ 24,856,860

$

37,101

$ 1,144,565

$

191,012

$

174,744

$

30,516

$

185,293

$

419,353

$ 1,550,680

$

217,278

$

842,432

$ 39,575,000

$ 4,016,561

$

21,299

$

134,047

$ 31,620,435

$

357,417

$

661,558

$

364,963

$

353,426

$ 3,572,376

$ 30,146,000

$

743,344

$ 23,511,135

$ 1,069,320

$

333,349

$

48,327

$

137,388

$

313,642

$

254,075

$

63,188

$

460,564

$ 1,729,000

$ 1,640,449

$

93,433

$173,472,101

North

America /

U.S.

59.0%

94.0%

29.7%

18.0%

28.4%

29.2%

70.8%

48.6%

52.3%

78.9%

91.4%

41.5%

63.8%

9.0%

61.7%

52.7%

47.5%

60.8%

25.0%

8.7%

40.9%

56.8%

56.2%

80.5%

43.1%

49.0%

40.1%

4.6%

53.0%

58.0%

61.4%

94.1%

70.0%

90.7%

65.3%

39.4%

67.6%

61.1%

13.1%

34.2%

Non-North

America /

U.S

41.0%

6.0%

70.3%

82.0%

71.6%

70.8%

29.2%

51.4%

47.7%

21.1%

8.6%

58.5%

36.2%

91.0%

38.3%

47.3%

52.5%

39.2%

75.0%

91.3%

59.1%

43.2%

43.8%

19.5%

56.9%

51.0%

59.9%

95.4%

47.0%

42.0%

38.6%

5.9%

30.0%

9.3%

34.7%

60.6%

32.4%

38.9%

86.9%

65.8%

Source: Company data, Credit Suisse estimates

Swine Flu Outbreak

10

28 April 2009

Companies Mentioned (Price as of 24 Apr 09)

3M (MMM, $57.00, NEUTRAL, TP $61.00)

Abercrombie & Fitch Co. (ANF, $25.36, OUTPERFORM, TP $30.00)

Accenture Ltd. (ACN, $29.27, OUTPERFORM, TP $42.00)

Aetna, Inc. (AET, $23.96, NEUTRAL, TP $35.00)

American Eagle Outfitters, Inc. (AEO, $15.60, NEUTRAL [V], TP $8.00)

American Express Co. (AXP, $25.30, UNDERPERFORM [V], TP $17.00)

AmerisourceBergen Corp. (ABC, $34.58, OUTPERFORM, TP $48.00)

BE Aerospace Inc. (BEAV, $10.79, OUTPERFORM [V], TP $13.00)

BJ Services Co. (BJS, $14.14, UNDERPERFORM [V], TP $10.00)

Boeing (BA, $38.72, NEUTRAL, TP $40.00)

CA Inc. (CA, $18.13, NEUTRAL, TP $20.50)

Carter's Inc (CRI, $22.46, NEUTRAL [V], TP $19.00)

Cisco Systems Inc. (CSCO, $18.42, NEUTRAL [V], TP $14.00)

Citrix Systems Inc. (CTXS, $25.84, NEUTRAL [V], TP $24.50)

Community Health Systems, Inc. (CYH, $20.04, OUTPERFORM [V], TP $31.00)

Costco Wholesale Corporation (COST, $48.17, NEUTRAL, TP $39.00)

CVS Caremark Corporation (CVS, $29.73, OUTPERFORM [V], TP $32.00)

Delek US Holdings, Inc. (DK, $9.94, NEUTRAL [V], TP $8.00)

Dell Inc. (DELL, $11.05, OUTPERFORM [V], TP $11.00)

Ecolab (ECL, $37.91, OUTPERFORM, TP $50.00)

Frontier Oil Corporation (FTO, $13.47, OUTPERFORM [V], TP $16.00)

Gildan Activewear Inc. (GIL, $12.66, NEUTRAL [V], TP $8.00)

Gilead Sciences (GILD, $45.80, OUTPERFORM [V], TP $54.00)

Global Payments, Inc. (GPN, $30.97, NEUTRAL, TP $32.00)

Halliburton (HAL, $20.01, OUTPERFORM [V], TP $22.00)

Hanesbrands, Inc. (HBI, $14.16, OUTPERFORM [V], TP $15.00)

Henry Schein, Inc. (HSIC, $39.85, OUTPERFORM, TP $46.00)

Hewlett-Packard (HPQ, $35.80, NEUTRAL, TP $30.00)

Holly Corp. (HOC, $21.73, NEUTRAL [V], TP $24.00)

Humana Inc. (HUM, $29.25, OUTPERFORM [V], TP $35.00)

Intel Corp. (INTC, $15.62, OUTPERFORM [V], TP $18.00)

International Business Machines (IBM, $100.08, NEUTRAL, TP $90.00)

MasterCard, Inc. (MA, $173.09, NEUTRAL [V], TP $175.00)

McKesson Corporation (MCK, $35.85, OUTPERFORM, TP $52.00)

Micron Technology Inc. (MU, $4.86, OUTPERFORM [V], TP $7.00)

Nokia Corporation (NOK, $14.00, OUTPERFORM [V], TP $15.60, MARKET WEIGHT)

Perrigo Co. (PRGO, $25.41, OUTPERFORM, TP $26.00)

Phillips-Van Heusen (PVH, $29.19, NEUTRAL [V], TP $20.00)

Polo Ralph Lauren (RL, $53.68, OUTPERFORM [V], TP $50.00)

Precision Castparts (PCP, $73.10, NEUTRAL [V], TP $68.00)

QUALCOMM Inc. (QCOM, $41.36, OUTPERFORM [V], TP $45.00, MARKET WEIGHT)

Research In Motion Limited (RIMM, $68.76, NEUTRAL [V], TP $61.00, MARKET WEIGHT)

Rite Aid Corporation (RAD, $.88, NEUTRAL [V], TP $1.00)

Rockwell Collins, Inc. (COL, $36.54, NEUTRAL, TP $40.00)

Schlumberger (SLB, $48.38, NEUTRAL [V], TP $46.00)

Sealed Air Corp. (SEE, $17.93, NEUTRAL [V], TP $19.00)

Smith International, Inc. (SII, $25.46, OUTPERFORM [V], TP $26.00)

Smithfield Foods (SFD, $10.32, NEUTRAL [V], TP $11.00)

Spirit AeroSystems (SPR, $12.96, NEUTRAL [V], TP $15.00)

Sunoco, Inc. (SUN, $26.79, UNDERPERFORM [V], TP $28.00)

Tenet Healthcare Corporation (THC, $2.11, OUTPERFORM [V], TP $3.00)

Tesoro Corp. (TSO, $15.05, NEUTRAL [V], TP $12.00)

TransDigm (TDG, $36.06, NEUTRAL, TP $33.00)

Tyson Foods (TSN, $10.93, NEUTRAL [V], TP $8.00)

UnitedHealth Group (UNH, $23.06, NEUTRAL [V], TP $25.00)

Universal Health Service (UHS, $43.28, OUTPERFORM, TP $48.00)

Valero Energy Corporation (VLO, $20.74, NEUTRAL [V], TP $22.00)

VF Corporation (VFC, $68.92, OUTPERFORM, TP $60.00)

Visa Inc. (V, $60.38, NEUTRAL, TP $57.00)

Walgreen Co. (WAG, $29.59, OUTPERFORM, TP $32.00)

Wal-Mart Stores, Inc. (WMT, $47.87, NEUTRAL, TP $53.00)

Weatherford International, Inc. (WFT, $17.41, OUTPERFORM [V], TP $16.00)

WellPoint, Inc. (WLP, $40.94, RESTRICTED)

Western Refining Inc. (WNR, $12.97, NEUTRAL [V], TP $10.00)

Swine Flu Outbreak

11

28 April 2009

Western Union (WU, $17.47, NEUTRAL [V], TP $19.00)

Disclosure Appendix

Important Global Disclosures

The analysts identified in this report each certify, with respect to the companies or securities that the individual analyzes, that (1) the views

expressed in this report accurately reflect his or her personal views about all of the subject companies and securities and (2) no part of his or her

compensation was, is or will be directly or indirectly related to the specific recommendations or views expressed in this report.

The analyst(s) responsible for preparing this research report received compensation that is based upon various factors including Credit Suisse's total

revenues, a portion of which are generated by Credit Suisse's investment banking activities.

Analysts’ stock ratings are defined as follows***:

Outperform (O): The stock’s total return is expected to exceed the industry average* by at least 10-15% (or more, depending on perceived risk)

over the next 12 months.

Neutral (N): The stock’s total return is expected to be in line with the industry average* (range of ±10%) over the next 12 months.

Underperform (U)**: The stock’s total return is expected to underperform the industry average* by 10-15% or more over the next 12 months.

*The industry average refers to the average total return of the relevant country or regional index (except with respect to Europe, where stock

ratings are relative to the analyst’s industry coverage universe).

**In an effort to achieve a more balanced distribution of stock ratings, the Firm has requested that analysts maintain at least 15% of their rated

coverage universe as Underperform. This guideline is subject to change depending on several factors, including general market conditions.

***For Australian and New Zealand stocks a 7.5% threshold replaces the 10% level in all three rating definitions, with a required equity return

overlay applied.

Restricted (R): In certain circumstances, Credit Suisse policy and/or applicable law and regulations preclude certain types of communications,

including an investment recommendation, during the course of Credit Suisse's engagement in an investment banking transaction and in certain other

circumstances.

Volatility Indicator [V]: A stock is defined as volatile if the stock price has moved up or down by 20% or more in a month in at least 8 of the past 24

months or the analyst expects significant volatility going forward.

Analysts’ coverage universe weightings are distinct from analysts’ stock ratings and are based on the expected

performance of an analyst’s coverage universe* versus the relevant broad market benchmark**:

Overweight: Industry expected to outperform the relevant broad market benchmark over the next 12 months.

Market Weight: Industry expected to perform in-line with the relevant broad market benchmark over the next 12 months.

Underweight: Industry expected to underperform the relevant broad market benchmark over the next 12 months.

*An analyst’s coverage universe consists of all companies covered by the analyst within the relevant sector.

**The broad market benchmark is based on the expected return of the local market index (e.g., the S&P 500 in the U.S.) over the next 12 months.

Credit Suisse’s distribution of stock ratings (and banking clients) is:

Global Ratings Distribution

Outperform/Buy*

36%

(57% banking clients)

Neutral/Hold*

44%

(57% banking clients)

Underperform/Sell*

18%

(48% banking clients)

Restricted

2%

*For purposes of the NYSE and NASD ratings distribution disclosure requirements, our stock ratings of Outperform, Neutral, and Underperform most closely correspond to Buy,

Hold, and Sell, respectively; however, the meanings are not the same, as our stock ratings are determined on a relative basis. (Please refer to definitions above.) An investor's

decision to buy or sell a security should be based on investment objectives, current holdings, and other individual factors.

Credit Suisse’s policy is to update research reports as it deems appropriate, based on developments with the subject company, the sector or the

market that may have a material impact on the research views or opinions stated herein.

Credit Suisse's policy is only to publish investment research that is impartial, independent, clear, fair and not misleading. For more detail please refer to Credit

Suisse's

Policies

for

Managing

Conflicts

of

Interest

in

connection

with

Investment

Research:

http://www.csfb.com/research-and-analytics/disclaimer/managing_conflicts_disclaimer.html

Credit Suisse does not provide any tax advice. Any statement herein regarding any US federal tax is not intended or written to be used, and cannot

be used, by any taxpayer for the purposes of avoiding any penalties.

Important Regional Disclosures

Restrictions on certain Canadian securities are indicated by the following abbreviations: NVS--Non-Voting shares; RVS--Restricted Voting Shares;

SVS--Subordinate Voting Shares.

Individuals receiving this report from a Canadian investment dealer that is not affiliated with Credit Suisse should be advised that this report may not

contain regulatory disclosures the non-affiliated Canadian investment dealer would be required to make if this were its own report.

For Credit Suisse Securities (Canada), Inc.'s policies and procedures regarding the dissemination of equity research, please visit

http://www.csfb.com/legal_terms/canada_research_policy.shtml.

Swine Flu Outbreak

12

28 April 2009

The following disclosed European company/ies have estimates that comply with IFRS: MMM, THC.

As of the date of this report, Credit Suisse acts as a market maker or liquidity provider in the equities securities that are the subject of this report.

Principal is not guaranteed in the case of equities because equity prices are variable.

Commission is the commission rate or the amount agreed with a customer when setting up an account or at anytime after that.

CS may have issued a Trade Alert regarding this security. Trade Alerts are short term trading opportunities identified by an analyst on the basis of

market events and catalysts, while stock ratings reflect an analyst's investment recommendations based on expected total return over a 12-month

period relative to the relevant coverage universe. Because Trade Alerts and stock ratings reflect different assumptions and analytical methods, Trade

Alerts may differ directionally from the analyst's stock rating.

The author(s) of this report maintains a CS Model Portfolio that he/she regularly adjusts. The security or securities discussed in this report may be a

component of the CS Model Portfolio and subject to such adjustments (which, given the composition of the CS Model Portfolio as a whole, may differ

from the recommendation in this report, as well as opportunities or strategies identified in Trading Alerts concerning the same security). The CS

Model Portfolio and important disclosures about it are available at www.credit-suisse.com/ti.

To the extent this is a report authored in whole or in part by a non-U.S. analyst and is made available in the U.S., the following are important

disclosures regarding any non-U.S. analyst contributors:

The non-U.S. research analysts listed below (if any) are not registered/qualified as research analysts with FINRA. The non-U.S. research analysts

listed below may not be associated persons of CSSU and therefore may not be subject to the NASD Rule 2711 and NYSE Rule 472 restrictions on

communications with a subject company, public appearances and trading securities held by a research analyst account.

For Credit Suisse disclosure information on other companies mentioned in this report, please visit the website at www.creditsuisse.com/researchdisclosures or call +1 (877) 291-2683.

Disclaimers continue on next page.

Swine Flu Outbreak

13

28 April 2009

Americas

Equity Research

This report is not directed to, or intended for distribution to or use by, any person or entity who is a citizen or resident of or located in any locality, state, country or other jurisdiction

where such distribution, publication, availability or use would be contrary to law or regulation or which would subject Credit Suisse, the Swiss bank, or its subsidiaries or its affiliates

(“CS”) to any registration or licensing requirement within such jurisdiction. All material presented in this report, unless specifically indicated otherwise, is under copyright to CS. None of

the material, nor its content, nor any copy of it, may be altered in any way, transmitted to, copied or distributed to any other party, without the prior express written permission of CS. All

trademarks, service marks and logos used in this report are trademarks or service marks or registered trademarks or service marks of CS or its affiliates.

The information, tools and material presented in this report are provided to you for information purposes only and are not to be used or considered as an offer or the solicitation of an

offer to sell or to buy or subscribe for securities or other financial instruments. CS may not have taken any steps to ensure that the securities referred to in this report are suitable for

any particular investor. CS will not treat recipients as its customers by virtue of their receiving the report. The investments or services contained or referred to in this report may not be

suitable for you and it is recommended that you consult an independent investment advisor if you are in doubt about such investments or investment services. Nothing in this report

constitutes investment, legal, accounting or tax advice or a representation that any investment or strategy is suitable or appropriate to your individual circumstances or otherwise

constitutes a personal recommendation to you. CS does not offer advice on the tax consequences of investment and you are advised to contact an independent tax adviser. Please

note in particular that the bases and levels of taxation may change.

CS believes the information and opinions in the Disclosure Appendix of this report are accurate and complete. Information and opinions presented in the other sections of the report

were obtained or derived from sources CS believes are reliable, but CS makes no representations as to their accuracy or completeness. Additional information is available upon

request. CS accepts no liability for loss arising from the use of the material presented in this report, except that this exclusion of liability does not apply to the extent that liability arises

under specific statutes or regulations applicable to CS. This report is not to be relied upon in substitution for the exercise of independent judgment. CS may have issued, and may in

the future issue, a trading call regarding this security. Trading calls are short term trading opportunities based on market events and catalysts, while stock ratings reflect investment

recommendations based on expected total return over a 12-month period as defined in the disclosure section. Because trading calls and stock ratings reflect different assumptions and

analytical methods, trading calls may differ directionally from the stock rating. In addition, CS may have issued, and may in the future issue, other reports that are inconsistent with, and

reach different conclusions from, the information presented in this report. Those reports reflect the different assumptions, views and analytical methods of the analysts who prepared

them and CS is under no obligation to ensure that such other reports are brought to the attention of any recipient of this report. CS is involved in many businesses that relate to

companies mentioned in this report. These businesses include specialized trading, risk arbitrage, market making, and other proprietary trading.

Past performance should not be taken as an indication or guarantee of future performance, and no representation or warranty, express or implied, is made regarding future

performance. Information, opinions and estimates contained in this report reflect a judgement at its original date of publication by CS and are subject to change without notice. The

price, value of and income from any of the securities or financial instruments mentioned in this report can fall as well as rise. The value of securities and financial instruments is subject

to exchange rate fluctuation that may have a positive or adverse effect on the price or income of such securities or financial instruments. Investors in securities such as ADR’s, the

values of which are influenced by currency volatility, effectively assume this risk.

Structured securities are complex instruments, typically involve a high degree of risk and are intended for sale only to sophisticated investors who are capable of understanding and

assuming the risks involved. The market value of any structured security may be affected by changes in economic, financial and political factors (including, but not limited to, spot and

forward interest and exchange rates), time to maturity, market conditions and volatility, and the credit quality of any issuer or reference issuer. Any investor interested in purchasing a

structured product should conduct their own investigation and analysis of the product and consult with their own professional advisers as to the risks involved in making such a purchase.

Some investments discussed in this report have a high level of volatility. High volatility investments may experience sudden and large falls in their value causing losses when that

investment is realised. Those losses may equal your original investment. Indeed, in the case of some investments the potential losses may exceed the amount of initial investment, in

such circumstances you may be required to pay more money to support those losses. Income yields from investments may fluctuate and, in consequence, initial capital paid to make

the investment may be used as part of that income yield. Some investments may not be readily realisable and it may be difficult to sell or realise those investments, similarly it may

prove difficult for you to obtain reliable information about the value, or risks, to which such an investment is exposed.

This report may provide the addresses of, or contain hyperlinks to, websites. Except to the extent to which the report refers to website material of CS, CS has not reviewed the linked

site and takes no responsibility for the content contained therein. Such address or hyperlink (including addresses or hyperlinks to CS’s own website material) is provided solely for your

convenience and information and the content of the linked site does not in any way form part of this document. Accessing such website or following such link through this report or

CS’s website shall be at your own risk.

This report is issued and distributed in Europe (except Switzerland) by Credit Suisse Securities (Europe) Limited, One Cabot Square, London E14 4QJ, England, which is regulated in

the United Kingdom by The Financial Services Authority (“FSA”). This report is being distributed in Germany by Credit Suisse Securities (Europe) Limited Niederlassung Frankfurt am

Main regulated by the Bundesanstalt fuer Finanzdienstleistungsaufsicht ("BaFin"). This report is being distributed in the United States by Credit Suisse Securities (USA) LLC ; in

Switzerland by Credit Suisse; in Canada by Credit Suisse Securities (Canada), Inc..; in Brazil by Banco de Investimentos Credit Suisse (Brasil) S.A.; in Japan by Credit Suisse

Securities (Japan) Limited, Financial Instrument Firm, Director-General of Kanto Local Finance Bureau (Kinsho) No. 66, a member of Japan Securities Dealers Association, The

Financial Futures Association of Japan; elsewhere in Asia/Pacific by whichever of the following is the appropriately authorised entity in the relevant jurisdiction: Credit Suisse (Hong

Kong) Limited, Credit Suisse Equities (Australia) Limited , Credit Suisse Securities (Thailand) Limited, Credit Suisse Securities (Malaysia) Sdn Bhd, Credit Suisse Singapore Branch,

Credit Suisse Securities (India) Private Limited, Credit Suisse Securities (Europe) Limited, Seoul Branch, Credit Suisse Taipei Branch, PT Credit Suisse Securities Indonesia, and

elsewhere in the world by the relevant authorised affiliate of the above. Research on Taiwanese securities produced by Credit Suisse Taipei Branch has been prepared by a registered

Senior Business Person. Research provided to residents of Malaysia is authorised by the Head of Research for Credit Suisse Securities (Malaysia) Sdn. Bhd., to whom they should

direct any queries on +603 2723 2020.

In jurisdictions where CS is not already registered or licensed to trade in securities, transactions will only be effected in accordance with applicable securities legislation, which will vary

from jurisdiction to jurisdiction and may require that the trade be made in accordance with applicable exemptions from registration or licensing requirements. Non-U.S. customers

wishing to effect a transaction should contact a CS entity in their local jurisdiction unless governing law permits otherwise. U.S. customers wishing to effect a transaction should do so

only by contacting a representative at Credit Suisse Securities (USA) LLC in the U.S.

Please note that this report was originally prepared and issued by CS for distribution to their market professional and institutional investor customers. Recipients who are not market

professional or institutional investor customers of CS should seek the advice of their independent financial advisor prior to taking any investment decision based on this report or for

any necessary explanation of its contents. This research may relate to investments or services of a person outside of the UK or to other matters which are not regulated by the FSA or

in respect of which the protections of the FSA for private customers and/or the UK compensation scheme may not be available, and further details as to where this may be the case

are available upon request in respect of this report.

Any Nielsen Media Research material contained in this report represents Nielsen Media Research's estimates and does not represent facts. NMR has neither reviewed nor approved

this report and/or any of the statements made herein.

If this report is being distributed by a financial institution other than Credit Suisse, or its affiliates, that financial institution is solely responsible for distribution. Clients of that institution

should contact that institution to effect a transaction in the securities mentioned in this report or require further information. This report does not constitute investment advice by Credit

Suisse to the clients of the distributing financial institution, and neither Credit Suisse, its affiliates, and their respective officers, directors and employees accept any liability whatsoever

for any direct or consequential loss arising from their use of this report or its content.

Copyright 2009 CREDIT SUISSE and/or its affiliates. All rights reserved.

CREDIT SUISSE SECURITIES (USA) LLC

United States of America: +1 (212) 325-2000

Swine Flu Final.doc