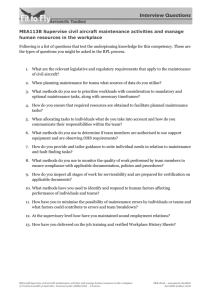

pdf - Cebu Pacific Air

advertisement