Greyhound Seeks Salvation in a Strategic Reservation System

advertisement

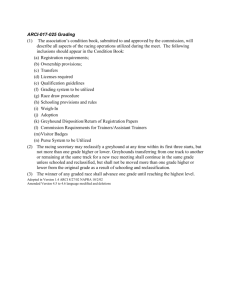

Greyhound Seeks Salvation in a Strategic Reservation System Greyhound Lines Inc., headquartered in Dallas, Texas, has long been the leading transcontinental bus company in the United States. However, the company share of interstate travel dropped from 30 percent in 1960 to 6 percent in the late 1980s, because of the rise in ownership of automobiles and discount airline service. The following chronology lists events that appear to be relevant to the problems Greyhound underwent. JULY 1991 • Frank Schmieder becomes Greyhound chief executive. Schmieder gained a reputation as an intelligent though volatile boss. Union negotiators found him to be affable and were pleased that he occasionally rode the bus. • Michael Doyle, a former financial officer at Phillips Petroleum Co., becomes chief financial officer and works closely with Schmieder to run Greyhound. AUGUST 1991 Schmieder begins to cut costs, upgrade buses and facilities, and settle labour disputes. Schmieder's and Doyle's policies include cutting the bus fleet from 3700 to 2400 and replacing current regional executives. They also replace most terminal workers with part-time workers who are paid about $6 an hour, whether they sweep floors or serve customers. These part-time workers are offered little opportunity to get a raise. Over the next three years, annual staff turnover of 30 percent becomes common, with some terminals reaching 100 percent annual turnover. OCTOBER 1991 The Greyhound business plan includes a commitment to a computerized reservation system that financial market analysts focus on as the key to remaining competitive in the national market. The plan includes system sup-port for more efficient use of buses and drivers. Bus customers traditionally do not reserve seats in advance but rather arrive at the terminal, buy a ticket, and take the next bus. Few buses ever reserve seats. The primary use of bus-customer telephone lines has been to disseminate schedule information, not for reserving seats as is the case in the airline industry. Traditionally, clerks plotted journeys manually from thick bus schedule log books (Greyhound buses stop in several thousand towns in the United States). The process was very slow. Computerizing all the routes and stops would theoretically greatly reduce the time needed to plot journeys and issue tickets. The goals of an automated system were not only to speed the issuing of tickets, thereby reducing company service counter costs, but also simultaneously to improve customer service and customer relations. The company had to manage several thousand buses and their drivers nationwide, making certain they were in the right locations at the right time. Greyhound assigned buses and bus drivers by hand, using data that were usually months old. The company kept buses and drivers in reserve to meet peak period demand, thereby enabling the company to remain the premier continent-wide bus company. The new system, called Trips, was to handle both reservations and bus and driver allocations together because they were seen as tightly linked. The traditional bus strategy of no reservations, only walk-in riders, meant that many times buses departed nearly empty. Management hoped that adopting a reservation approach would allow them to reduce the number of near-empty buses. They also expected that the reservation portion of the system would provide Greyhound with reliable customer data so schedules could be more efficiently organized and so planners could determine where and when to reduce prices to fill seats. The plan for Trips was received very positively in the financial markets, giving Greyhound the ability to borrow funds and to offer new shares to raise capital. EARLY SPRING 1992 The Trips project begins with a staff of 40 or so and a $6 million budget; Thomas Thompson, Greyhound senior vice president for network planning and operations, is placed in charge of Trips development. A bus reservation system, by the nature of the operation of buses, is far more complex than airline reservation systems. A passenger might make one or two stops on an airline flight and cross the United States with one to two stops only, whereas bus passengers may make 10 or more stops on a trip, and a cross-country trip might involve scores of stops. Greyhound technicians estimated that a bus management system would need to manage 10 times the number of vehicle stops per day of an airline vehicle management system. The average bus passenger is much less affluent than the average airline passenger. Several Greyhound executives later claimed to have raised the questions of how many bus passengers would have credit cards to enable them to purchase tickets in advance by telephone, and even how many have telephones available. American Airlines' SABRE reservation system had taken three years to develop and had cost several hundred million dollars, and the project had included a staff many times the size of the Trips staff. NOVEMBER-DECEMBER 1992 • Greyhound stock price reaches $13.50. • Greyhound management actively promotes Trips to investors, lenders, and security analysts as a key to the future success of Greyhound. Management publicly promises to launch the system in time for the 1993 summer busy season. Trips had been developed by a consulting firm. Planned users of the system such as ticket clerks required 40 hours of training to learn to use it. Clerks had to deal with many screens to plot a trip between any two points. The system data bank was incomplete, with the result that clerks often had to pull out the logbooks and revert to plotting a ticket purchaser's planned trip manually. Clerk time to issue tickets doubled when they used the system. The system also crashed repeatedly. Thompson decided to redesign the system and to introduce it in the Northeast corridor in the spring of 1993. After that initial introduction, no new sites would be added until the autumn of 1993, when the busiest travel season would be behind Greyhound. This approach would also give the team time to work out the bugs before the system was introduced nationally. However, he was overruled by Doyle, who had promised the new system to the financial community. • Greyhound reports a profit of $11 million, its first profit since 1989. MAY 1993 • Rollout of Trips begins, using the failed version because Thompson did not have enough time to develop the new version. When Trips reaches 50 locations, the computer terminals begin to freeze unpredictably. • Greyhound stock hits a post-Chapter 11 high of $22.75. Securities analysts had been praising Greyhound management for reengineering the company and for cutting costs. JUNE 1993 • The rollout of Trips continues. Doyle exercises an option to purchase 15,000 shares of Greyhound stock at $9.81. • Greyhound stock holds above $20 as formal introduction of Trips nears. • Doyle exercises options on 22,642 shares at $9.81 and immediately sells them at a prof it of $179,000. JULY 1993 • The new toll-free number telephone system begins serving the 220 terminals already hooked up to Trips to be used for making reservations. The system could not handle all the calls, with many customers receiving busy signals. Customers often had to call as many as a dozen times to get through. The busy signals were caused by the switching mechanism and by the slow response time of Trips. The computer in Dallas sometimes took as long as 45 seconds to respond to just a single keystroke and could take up to five minutes to print a ticket. The system also crashed numerous times, causing many tickets to be written manually. At some bus terminals, the passengers who arrived with manual tickets were told to wait in line so that they could be reissued a ticket by the computer. Long lines, delays, and confusion resulted. Many passengers missed their connections; others lost their luggage. • On the same day as the initiation of the telephone system, Greyhound announces an increase in earnings per share and ridership and the introduction of a new discount-fare program; Greyhound stock rises 4.5 percent. AUGUST 1993 • Doyle sells 15,000 shares of stock at $21.75 on August 4. Two other Greyhound vice presidents sell a total of 21,300 shares of stock. SEPTEMBER 1993 • Trips is closed down west of the Mississippi River because of its continuing problems and delays, • On September 23, Greyhound announces ridership down by 12 percent in August and earnings also down; the press release does not mention Trips and blames the fall in ridership on the national economic environment. • Greyhound stock, which was down 12 percent in August, falls to $11.75, or 24 percent in one day. • Thompson is relieved of his duties on Trips; another vice president takes over responsibility. MAY 1994 The company offers a $68 ticket for a trip anywhere in the United States with a three-day advance purchase. The crush of potential customers brings Trips to a halt. Buses and drivers are not available in some cities, resulting in large numbers of frustrated passengers stranded in terminals. JULY 1994 • On-time bus performance falls to 59 percent, versus 81 percent at its peak. • First-half operating revenues fall 12.6 percent, accompanied by a large dropoff in ridership; the nine largest regional carriers in the United States show an average rise in operating revenue of 2.6 percent. AUGUST 1994 • Schmieder and Doyle both resign. • Thomas G. Plaskett, a 50-year-old Greyhound director, is appointed interim CEO; Plaskett was the chairman and CEO of Pan Am Corporation and a former managing director of Fox Run Capital Associates investments. NOVEMBER 1994 • Greyhound creditors file suit to attempt to force Greyhound back into protection under Chapter 11 of the Federal Bankruptcy Act. • Greyhound stock falls to $1.875 per share. • Greyhound announces its fourth consecutive quarterly loss. • A financial restructuring agreement is reached that gives creditors 45 percent ownership of Greyhound. The agreement allows the company to avoid Chapter 11 bankruptcy. • Craig Lentzcsh is appointed Greyhound's new permanent CEO. JANUARY 1995 Greyhound announces that the Securities and Exchange Commission is investigating the company and former directors, officers, and employees for possible securities law violations. The investigation is examining possible insider trading, the adequacy of the firm's internal accounting procedures, and the adequacy of public disclosures related to the Trips system and the company's disappointing earnings in 1993. Greyhound says that it does not believe it has violated any securities laws and is cooperating fully. In addition to the SEC investigation, Greyhound is facing a raft of investors' lawsuits involving similar allegations and a Justice Department antitrust investigation into its terminal agreements with smaller carriers. Lentzsch's first step in bringing the company back was to dismantle the "airline" model which relied on reservations. Greyhound today does not take reservations. If people want to travel by bus, they show up at the terminal and will get a seat on the bus at a reasonable price. If a bus fills up, Greyhound will roll out another until everyone has a seat. Lentzsch then changed the company's pricing structure. Schmieder had raised the walk-up prices as high as possible while lowering prices of advanced purchased tickets to compete with the airlines. Lentzsch realized that Greyhound's core customers had incomes of less than $15,000 per year and wanted low-cost no-frills travel above all. Today Greyhound's maximum one-way walk-up fare averages half of airline discount prices. Other steps toward profitability include adding more people to answer telephones, adding buses to popular routes, such as New York to Boston, and restoring long-haul routes to rural areas that Schmieder nearly abandoned. Lentzsch is also trying to rebuild the company's package express business, which at one time had generated 15 percent of Greyhound's total revenue. Greyhound can use its buses carrying passengers to deliver packages from urban to rural areas at a low cost. Since Lentzsch took over, revenues and sales have grown and the company expects to be in the black again. But some Wall Street analysts question how much more the company can grow. Bus travel today only accounts for 1.5 percent of intercity travel, down from 5 percent in 1950. • Sources; Wendy Zellner, "Leave the Driving to Lentzsch," Business Week, March 18, 1996; Bill Deener, "The Greyhound Turnaround," Dallas .Mowing News, January 14, 1996; Robert Tomsho, ".Greyhound Says SEC Is Investigating Possible Violations of Securities Law," The Wall Street Journal, January 26, 1995; "How Greyhound Lines Re-Engineered Itself Right into a Deep Hole," The Wall Street Journal, October 20, 1994. Case Study Questions 1. What was Greyhound's business strategy? How were its business processes related to that strategy? 2. How compatible was Trips with Greyhound's business processes and other organizational features? 3. What management, organization, and technology factors contributed to Greyhound's problems? 4. If you were a Greyhound manager, what solutions would you recommend? Would you suggest new business processes or information systems applications? If so, what would they do? 5. Does this case raise any ethical issues? .