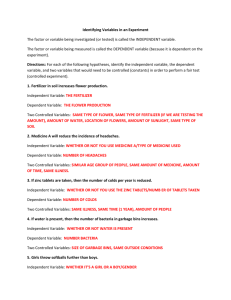

2010 - CSL Stockbrokers

advertisement

Notore: Champion of the Nigerian Green Revolution by Ikponmwosa Izedonmwen Head, Corporate Finance September 2011 Outline Introduction to Notore Fertilizer Market Addendum 1 Domestic Investors Jite Okoloko TITA-KURU PETROCHEMICALS LTD (TY HOLDINGS) Group CEO, Notore 28% ownership in NCI Founding Partner of Ocean & Oil Group Fmr MD/CEO of Oando Energy Services Non-Executive Director at Oando Plc; Director at Union Bank Bachelors Degree from University of Benin Alumnus of the Harvard Business School OMP Programme Mike Osime 3% ownership in NCI Worked with NNPC Fmr MD/CEO of O-Secul Nigeria Limited Corporate member of the Nigerian Society of Engineers and COREN certified Bachelor’s degree in Engineering from Teeside University in the UK Michael Orugbo 22% ownership in NCI Manufacturer & exporter of hyrdo-carbon based products Installation, laying & maintenance of pipelines for lifting crude oil and natural gas 5% ownership in NCI Private sector-led investment bank and development finance institution created to help mobilize and channel required capital towards driving Africa’s economic development Has a US$1 billion capital base to support early and intermediate stage projects across Africa Richard Herb 2% ownership in NCI MD/CEO of ICMG Securities Limited and Chairman of Broadband Technologies Limited Degree in Actuarial Science, obtained from the University of Lagos in 1981 MBA from the Strathclyde Business School in Glasgow Fellow of the Chartered Institute of Stockbrokers 2% ownership in NCI Entrepreneur with 35 years experience in the fertilizer industry Director of the Nigerian Business Council Chairman of Eko Hotel and Suites in Lagos. Degree in Chemistry from the University of London Foreign Investors BLAKENEY MANAGEMENT 12% ownership in NCI Africa’s leading private equity group $1.6 billion under management, across six funds focused on Africa Over 50 investments, across 40 countries, in all major regions of the African continent provides corporate finance support and guidance on best-in class corporate governance 5% ownership in NCI UK bases hedge fund £5billion fund under management Focused on emerging markets 14% ownership in NCI An emerging market leader in the construction and fertilizer industries Currently with a market capitalization of over $6 Billion USD Ownership in three Urea factories across North Africa Provides technical oversight via a technical service agreement 2 Our footprints in time 1981: NAFCON incorporated as joint venture between FGN (70%) and Kellogg Brown and Root (30%) 2005: Notore acquired the asset of the abandoned 500,000 MT Urea Plant for US$152m 1987: Plant commenced production of fertilizer and subsequently officially commissioned with a design capacity of 1,500 MT/d of urea 2006: Notore signed 20 year gas supply contract with Nigerian Gas Company 2000: FGN decided to privatize NAFCON 2003/2004: 2 attempts by the FGN t o sell NAFCON as going concern failed 2010: Commenced commercial production & dispatch of ammonia & urea in January & March respectively 2010: Additional $55m equity infusion through two leading institutional investors in July 1990-92: Plant recognised as one of KBR’s most efficient plants running at over 110% capacity 1999: NAFCON is shut down following key equipment failure 2009: Additional $20 m equity injected from existing shareholder 2007:Raised record US$222m facility from syndicate of Nigerian Banks 2007:Overcame significant operating challenges and begins extensive rehabilitation of plant 2011: Average daily urea production (Jan – Jul) = 1,100MT /day. ca. 75% of name-plate capacity 5/11: Commenced implementation of Technical Services Agreement with TATA Chemicals India 8/11: Concluded scheduled maintenance program to improve plant reliability and efficiency 9/11: Successfully restructured our balance sheet by extending the amortization profile our loans 3 Competitive Advantage Notore Industrial Complex strategically located at Onne, Rivers State, Nigeria – Abundant supply of natural gas – Land available for expansion opportunities – Own jetty (by the Atlantic ocean) for easy import of raw materials and export of products 50 Megawatts of power generating capacity Signed 20 year gas contract at a competitive price in June 2006 for supply of sufficient gas to feed current plant and planned expansion i.e. Trains I & II Own the only urea fertilizer plant in the whole of Sub Saharan and Southern Africa; annual production capacity is 500,000 metric tonnes of Urea and 600,000 metric tonnes of blended NPK Asset located in Nigeria, a large and growing market for fertilizer; domestic consumption in Nigeria is currently estimated to be between 900,000 – 1,100,000 metric tones per year Own Nigeria’s Largest Fertilizer Marketing, Sales and Agric Services Team as well as an effective fertilizer supply chain 4 Overview of Businesses Notore Fertilizer • Completed rehabilitation of ammonia plant in January 2010 • Completed rehabilitation of Train I for urea capacity of 500,000 MT per annum in March 2010 • Completed scheduled maintenance to increase daily ammonia and urea production capacity to 90% of production capacity Notore Seeds • • • • • Notore Power • 25MW of the 50MW installed capacity is currently generated and supplied to fertilizer plant. Excess power is available to trade • Executed PPA with a neighboring customer to supply Power on a “Take or Pay” basis • Working with the Government on a pilot project to generate 250MW into the National Grid Secured license to operate as a seeds business Working with partners to commercialize best available seed varieties Plans to invest in R&D to develop next generation Miracle Seeds Identifying sales opportunities for crop protection products There are strong synergies with the Fertilizer business (Supply Chain) 5 Financial Highlights - Fertilizer Business 2012 Urea production at 90% of capacity, i.e. 400,270 metric ton • Average urea selling price: $520 per ton In 2012, EBITDA is expected to be circa. $ 102 million and $ 115 million in 2013 Concluded the restructuring of 70% of our current project loans to longer term loans to align our cash flows/cash generation capacity with out debt service obligations Further expansion planned with the construction of a new 1,500, 000 Metric ton plant (Train II) at our Onne Facility. CAPEX ca. US$900 million. Construction is expected to start in 2013. Plans to complete the listing and public offering of Notore Fertilizer Co. shares via an Initial Public Offering (IPO) on the floors of the Nigerian Stock Exchange and an international actively traded stock exchange/bourse in 2012 6 Outline Introduction to Notore Fertilizer Market Addendum 7 Market Size Global Fertilizer Market The global fertilizer industry is one of the largest agribusiness sectors estimated at 150million tons per year, with China and India accounting for over 40%, and the US,12% Fertilizers are a significant factor in improving crop yields. The primary fertilizer products include nitrogen, phosphate, and potash. • Collectively, these nutrients represent 90% of the world’s fertilizer consumption with nitrogen alone representing approximately 65% of global fertilizer consumption. Urea prices are cyclical and driven by global supply and demand and energy prices Since the large increase in natural gas prices in the U.S. in 2000, the cost of urea production in the U.S. has provided a floor to international urea prices 8 Source: IFA, IFDC Gas Contributes 80% - 90% to the Raw Material Costs of Producing Urea Notore Gas Pricing in Lowest Quartile Globally Russia $0.93 Toronto $4.60 New York $4.01 Louisiana Puerto Rico $3.85 $4.45 Notore Gas Discount vs: UK $4.67 Spain $4.50 Belgium $4.57 Qatar Egypt $1.50 Notore $1.19 $1.06 India $2.32 Korea $6.00 China $7.20 Japan $6.10 China: (85%) UK: (77%) US: (75%) Argentina $4.10 Argentina: (74%) India: (54%) Egypt: (11%) Sources: ONGC prices (India); EIA estimates (New York, Russia); Credit Suisse research (China); US FERC (other countries/regions: landed LNG prices); World Bank reports (Egypt) ; ICIS (Qatar). Data in $US/mmbtu 9 Significant Growth Potential in Africa Africa was recently classified as one of the world’s most rapidly growing economic regions It is expected that by 2015: 200 million Africans will enter into the consumer goods market GDP per capita will grow at 4.5% CAGR , implying over 35% increase in spending power The continent also owns over 25% of the world’s total arable land but generates only 10% of global agricultural output Africa currently has only 20 companies each generating a minimum annual revenue of $3billion Nigeria was recently classified by the World Bank as a Category 2 conducive environment to do business in (same league as Morocco, Egypt and Ethiopia) 10 Fertilizer Market Outlook Current consumption rate in Africa is still far below the FAO recommended 200kg/ha Current average fertilizer consumption in West and Central African is about 10kg/ha Africa’s estimated CAGR for fertilizer consumption (MT) is roughly 3.5% up to 2015 Product supply is largely dependent on importation as only one fertilizer producing company (i.e. Notore) exists in West and Central Africa The International Fertilizer Association (IFA) Africa forum has written a position paper on fertilizer policy proposing the following: Forecast on Fertilizer Consumption (kg/ha) in West and Central Africa 60 50 2006 Abuja Declaration CAGR = 40% Today's assumptions from research CAGR = 27% 40 Fertilizer related taxes and custom duties be abolished to include eliminating tax breaks for local fertilizer manufacturing and/or blending companies 30 20 10 0 Regional blocs should grant tax exempt status for agricultural inputs including Source: FAO Statistics, Abuja Declaration of Fertilizers fertilizers 2010 2011 2012 2013 2014 2015 11 Nigeria’s Agricultural Challenge Whereas Use of inputs (fertilisers and Seeds) has been targeted as the key path to higher yields Majority of Government agricultural budget goes into inputs subsidy (> $700M in 2010) Natural gas is abundant in the country There is enough arable land to produce seeds for the Sub Region Potential fertilizer market size over 3.5million MT What gets to the farmer are: Only 10% - 20% of subsidies Little inputs at Very high costs (Fertiliser >$700/MT– a 37% increase over average international FOB price) Isolation and desolation A vicious cycle of subsistence 12 The Nigerian Fertilizer Market Place Product Products Used Utilization (kg/Ha) •No formal distribution system •Competition* sells primarily to government •Three Types of Markets *Competitors: o Tak Continental and o Golden Fertiliser Promotion •No investment in Marketing •Major Challenges in the Market o Distortion of Market Price o Poor Quality Bulk Blends o Short Weight Bags o Availability in Season Price • Significant price premium in local market • Customer willing to pay premium price for quality 13 brand Notore in the Nigerian Market Space Notore currently controls 60% of the non-government urea market Produce Inputs (Fertilisers and Seeds) Notore non-government fertilizer sales activities in 23 states Educate farmers on inputs and best farming practices Give farmers access to inputs (lead with fertiliser) Provide inputs that are appropriate and affordable Crop Specific blends Pack size: 50kg, 10kg and 1 kg bags Pricing 14 Our Commercial Focus is to take Education and Good Quality & Affordable Inputs to the Poor Farmer across Nigeria 2009: 2010: With Government Extension With Private Extension (Village Promoters) Recruited 60 Dealer Partners, 1500 Agro Dealers, 6 Transport Partners Trained 210 ADP Staff of16 states Implemented 420 demonstration plots Trained over 40,000 farmers Introduced private sector extension Trained 180 VPs in 15 states Implemented 917 demonstration plots Trained over 58,000 farmers Introduced 1kg fertilizer pack size Impact: 175 private extension jobs each making N150,000 Resulted in 70-120% higher yields for trained farmers Increased grain outputs of 196,000MT Notore generated N9.8 Billion GDP 15 Our Achievements as at September 2011 Work Done 143, 348 MT of Urea Produced Expected Impact (against 71, 411 MT produced in (already achieved) 2010) - 83, 587 MT of Ammonia (30 VPs per state) Introduced 10kg fertilizer pack size to the market in August Average 100% higher yields Increased grain outputs of 2Million MT 930 Village Promoters working with our Agricultural Services team To reach 1,300,000 farmers by December 2011 Produced 750 additional village promoters added in 25 states 36, 622 MT of Urea Exported (26%) 930 private extension jobs Generation of N80 Billion GDP 16 Notore 5-Year Fertilizer Strategy Our fertilizer business strategy is to secure the West and Central African markets via 2.3 million MT production capacity and a world class supply chain Train I Refurbishment/restart of NH3 plant Train I Refurbishment/restart of Urea plant Train II Secure additional plant to Increase capacity Completed Completed ~ Additional urea and blended NPK production capacity 20 year Gas Contract Ensure Market Visibility in West and Central Africa 17 Outline Introduction to Notore Fertilizer Market Addendum 18 Notore Seeds Market Entry Assessment Potential Market Market Entry Cost •Rice and Maize Seed Market $1 Billion Rice: $800 Million Maize: $200 Million •R&D: about $8 Million Crop Land cultivated Seeds planted per Ha Cost per Kg of seed Rice 5 Million 60Kg $2.50 Maize 5 Million 15Kg $2.50 • Develop improved seeds with required quality for Nigerian farmer and customers •Infrastructure: about $10 Million • Seeds processing mill with 100,000 MT / annum capacity • Processing involves applying herbicides and removing impurities Time to Market and Margins Strategic Fit •One-year time horizon •Estimated Operating Margins of 30% •Increase Sales From Fertilizer Business •Diversify Revenue Streams •Leverage on our distribution network •Feed directly into our Foods Business •Catalyst to Green Revolution 19 3-Year Seeds Business Strategy 2011 2012 Launch Seeds & Crop Protection Business Acquire Seeds License (Done) Grow Business Commence trading of seeds 2013 Commence Seeds Production Continue to grow Business Implement technical sales training for the crop protection business Phase I: Engage farmers to produce 1,000 MT of maize seeds and 500 MT of rice Phase II: Increase production capacity of maize seeds to 2,000 MT 20