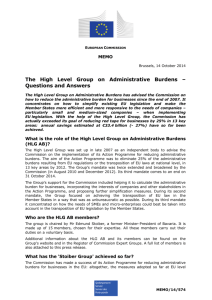

Regulatory Burden: Reduction and Measurement Initiatives

advertisement