Limited to Distribute Islamic Fund, Public Ittikal Fund

advertisement

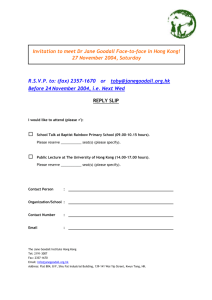

(馬來西亞大眾銀行附屬公司 A subsidiary of Public Bank Berhad, Malaysia) 19th May, 2014 1 / 3… ***PRESS RELEASE*** Public Bank (Hong Kong) Limited to Distribute Islamic Fund, Public Ittikal Fund The Fund is an Islamic Fund. This Fund is therefore subject to the Islamic investment principles. The Fund invests in a diversified portfolio of primarily Shariah-compliant Malaysian equities and sukuk. It may also invest in Shariah-compliant equities and sukuk outside Malaysia to diversify its portfolio. The Fund may only utilise foreign currency futures contracts (approved as Shariahcompliant by the Shariah Adviser of the Fund) for hedging purposes only. The Fund will not participate/invest in financial derivatives (except for futures contracts for hedging purposes only and warrants), options, repo, reverse repo or similar over-thecounter transactions, stock lending and nil-paid/partly paid securities. The Fund is therefore exposed to a range of investment related risks which includes market risk, specific security risk, liquidity risk, unlisted security risk, risks associated with investments in warrants, currency risk, emerging markets risk, concentration risk, credit risk, interest rate risk, derivatives risk, risk of noncompliance with Shariah requirements, early termination risk and risk of distribution out of capital. There are fees and charges involved. The prices of units and distribution payable, if any, may go up as well as down and may become valueless. Past performance of the Fund is not an indication of its future performance. Public Mutual Berhad announced that it is launching its inaugural Islamic unit trust fund, Public Ittikal Fund (P ITTIKAL) in Hong Kong on 19 May 2014. Public Mutual Berhad, a wholly-owned subsidiary of Public Bank Berhad (Malaysia) is the fund manager of P ITTIKAL. P ITTIKAL was launched in April 1997 in Malaysia, and was among the first Shariahcompliant funds launched in the country1. The Fund is mainly invested in the Malaysian equity market. The equity exposure of P ITTIKAL generally ranges from 70% to 98% of its net asset value (NAV). The balance of the Fund’s NAV will be invested in sukuk (Islamic bond) and Islamic liquid assets which include Islamic money market instruments and Islamic investment accounts. To diversify its portfolio, the Fund may invest in markets outside Malaysia which include selected North Asia and Southeast Asia markets. Public Bank (Hong Kong) Limited’s Chief Executive, Mr. Tan Yoke Kong said, “Public Bank (Hong Kong) Limited is proud to be the appointed representative and distributor of P ITTIKAL, which is one of Public Mutual Berhad’s award-winning funds2. The Fund is now offered to investors in the Hong Kong market to complement and diversify their investment portfolio with Shariah-compliant capital market instruments.” …2 / 3 Meanwhile, Chief Executive Officer of Public Mutual Berhad, Ms. Yeoh Kim Hong said, “P ITTIKAL provides investors the opportunity to participate in long-term growth potential of a diversified portfolio of primarily Shariah-compliant Malaysian equities and sukuk (Islamic bond). “Looking ahead, the outlook for Malaysia’s equity market is supported by fair valuations, reasonably healthy earnings growth and sustainable economic growth. On the economic front, Malaysia’s Gross Domestic Product (GDP) growth is projected to sustain at about 5% in 2014 compared to 4.7% registered in 20133,” said Yeoh. P ITTIKAL is suitable for medium- to long-term investors who are able to withstand ups and downs of the stock market in pursuit of capital growth. Interested investors can contact Public Bank (Hong Kong) Limited Customer Hotline at (852) 8107 0818 for more details of the Fund. Photo caption: Public Bank (Hong Kong) Limited’s Chief Executive, Mr Tan Yoke Kong and Public Mutual Berhad’s CEO, Ms Yeoh Kim Hong officiating the launch of P ITTIKAL. 1 Source: Lipper, 31 March 2014. 2 Key recent awards won by P ITTIKAL are Equity Malaysia Islamic (10 years) in The EdgeLipper Malaysia Fund Awards 2011 and Equity Malaysia Islamic (10 years) in The Edge - Lipper Malaysia Fund Awards 2010. 3 Source: Bloomberg, May 2014. …3 / 3 The Fund Manager The fund manager - Public Mutual Berhad is a private unit trust company in Malaysia with the total fund size surpassing MYR62 billiona (HKD 147.27 billion*). The Company has a wealth of more than 30 years of experience in managing funds. A recent survey has shown that Public Mutual Berhad is ranked No. 2 within the top 50 biggest managers of Islamic funds globally (in terms of asset under management as at end December 2013) for both public equity and sukuk categoriesb. Public Mutual Berhad is also recognised internationally as an outstanding Islamic fund manager. The Company has won The Asset Triple A Islamic Finance Awards - Best Islamic Retail Asset Management House, Malaysia for three consecutive years, from 2011 to 2013. a Source: Lipper, 31 March 2014. Source: AsianInvestor, March 2014. * Based on the exchange rate of MYR1 = HKD2.3754. Source: Lipper, 31 March 2014. b This document is issued by Public Bank (Hong Kong) Limited and has not been reviewed by SFC or any regulatory authorities in Hong Kong. The information stated here is for reference only and does not constitute any recommendation, offer or solicitation for purchase or sale of any investment products. Distribution of this document may be restricted in certain jurisdiction. This document does not constitute the distribution of any information or the making of any offer or solicitation by anyone in any jurisdiction in which such distribution or offer is not authorised or to any person to whom it is unlawful to distribute such information or make such an offer or solicitation. Investors are advised to read and understand the contents of the Offering Document and Product Key Facts of the Fund (including the investment related risks) before investing. If investors are in any doubt about the contents of the Offering Document, they should seek independent professional financial advice. Investors should not solely rely on this document to make any investment decision and are responsible for their investment decisions.