The coordination of investment in systems of complementary assets

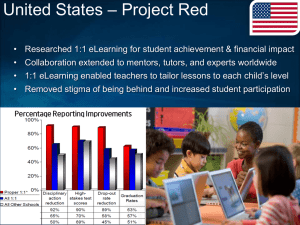

advertisement