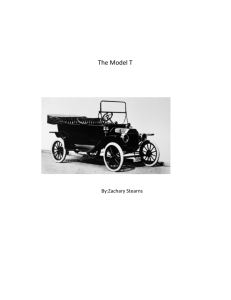

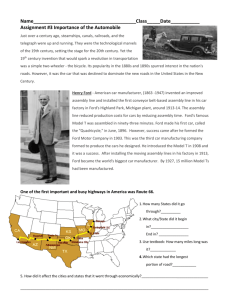

Ford.com

advertisement