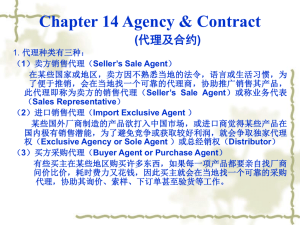

Exclusive Contracts Foster Relationship

advertisement