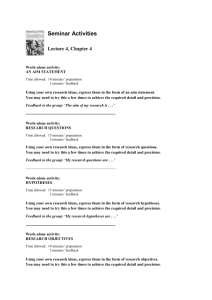

abstract of thesis a feasibility study

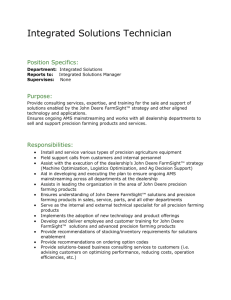

advertisement