Medicare levy surcharge

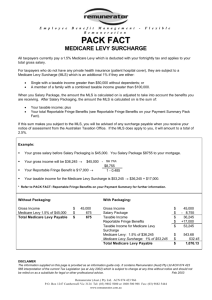

advertisement

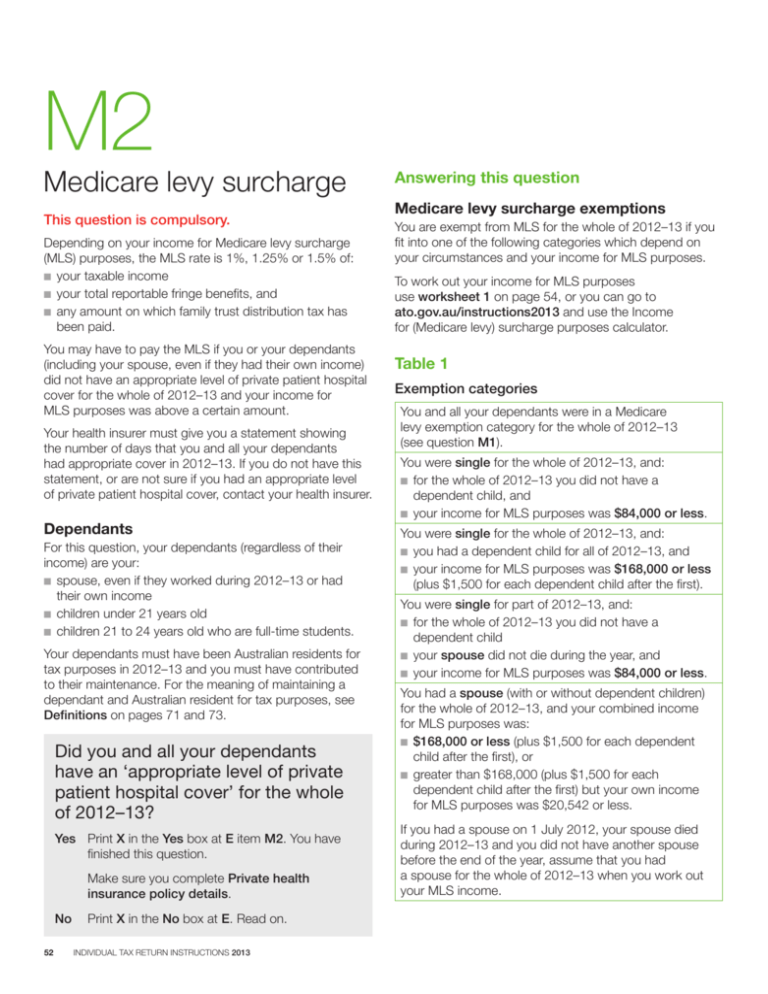

M2 Medicare levy surcharge This question is compulsory. Depending on your income for Medicare levy surcharge (MLS) purposes, the MLS rate is 1%, 1.25% or 1.5% of: n your taxable income n your total reportable fringe benefits, and n any amount on which family trust distribution tax has been paid. You may have to pay the MLS if you or your dependants (including your spouse, even if they had their own income) did not have an appropriate level of private patient hospital cover for the whole of 2012–13 and your income for MLS purposes was above a certain amount. Your health insurer must give you a statement showing the number of days that you and all your dependants had appropriate cover in 2012–13. If you do not have this statement, or are not sure if you had an appropriate level of private patient hospital cover, contact your health insurer. Dependants For this question, your dependants (regardless of their income) are your: nspouse, even if they worked during 2012–13 or had their own income n children under 21 years old nchildren 21 to 24 years old who are full-time students. Your dependants must have been Australian residents for tax purposes in 2012–13 and you must have contributed to their maintenance. For the meaning of maintaining a dependant and Australian resident for tax purposes, see Definitions on pages 71 and 73. Did you and all your dependants have an ‘appropriate level of private patient hospital cover’ for the whole of 2012–13? Yes Print X in the Yes box at E item M2. You have finished this question. Make sure you complete Private health insurance policy details. No 52 Print X in the No box at E. Read on. INDIVIDUAL TAX RETURN INSTRUCTIONS 2013 Answering this question Medicare levy surcharge exemptions You are exempt from MLS for the whole of 2012–13 if you fit into one of the following categories which depend on your circumstances and your income for MLS purposes. To work out your income for MLS purposes use worksheet 1 on page 54, or you can go to ato.gov.au/instructions2013 and use the Income for (Medicare levy) surcharge purposes calculator. Table 1 Exemption categories You and all your dependants were in a Medicare levy exemption category for the whole of 2012–13 (see question M1). You were single for the whole of 2012–13, and: n for the whole of 2012–13 you did not have a dependent child, and n your income for MLS purposes was $84,000 or less. You were single for the whole of 2012–13, and: n you had a dependent child for all of 2012–13, and n your income for MLS purposes was $168,000 or less (plus $1,500 for each dependent child after the first). You were single for part of 2012–13, and: n for the whole of 2012–13 you did not have a dependent child n your spouse did not die during the year, and n your income for MLS purposes was $84,000 or less. You had a spouse (with or without dependent children) for the whole of 2012–13, and your combined income for MLS purposes was: n $168,000 or less (plus $1,500 for each dependent child after the first), or n greater than $168,000 (plus $1,500 for each dependent child after the first) but your own income for MLS purposes was $20,542 or less. If you had a spouse on 1 July 2012, your spouse died during 2012–13 and you did not have another spouse before the end of the year, assume that you had a spouse for the whole of 2012–13 when you work out your MLS income. M2 Medicare levy surcharge You must go to ato.gov.au/instructions2013 and read question M2 if you did not fit into any of the categories in table 1 on page 52 and: n you were single for part of the year n you were widowed during the year n you became or ceased to be a sole parent n you or any of your dependants were covered for only part of the year, or n you are an overseas visitor with health cover. at A item M2 the number of days for which you 3 Write do not have to pay MLS. If you do not have to pay MLS for any days during the period 1 July 2012 to 30 June 2013, write 365 at A item M2. Completing your tax return If you have to pay MLS for: n the whole period 1 July 2012 to 30 June 2013, write 0 at A item M2 n part of the period 1 July 2012 to 30 June 2013, write the number of days for which you do not have to pay MLS at A item M2. 1 Write the number of dependent children you had during 2012–13 at D item M2. If you had private patient hospital cover for any part of the year, you must complete Private health insurance policy details on pages 47–8 and then read on. If you and all your dependants had an appropriate level of private patient hospital cover for the whole of 2012–13, print X in the Yes box at E item M2. You have now finished this question. If you or any of your dependants did not have private patient hospital cover or only had cover for part of the year, print X in the No box at the right of E item M2. Go to step 2. category (see table 1 2 Ifonyoupagewere52)inforantheexemption whole of 2012–13, print X in the Yes box to the left of ‘You do not have to pay the surcharge’ and write 365 at A item M2. You have now finished this question. Go to A1. Make sure you complete: n Income tests on page 8 of your tax return, and n Spouse details if you had a spouse during the year, on pages 8–9 of your tax return. Working out income for MLS purposes Complete worksheet 1 on page 54 to work out your income and your spouse’s income (if you had one during the year) for MLS purposes. You can also go to ato.gov.au/instructions2013 and use the Income for (Medicare levy) surcharge purposes calculator. If you or your spouse received exempt foreign employment income, add it to taxable income at (a). If you were not in an exemption category, print X in the No box to the left of ‘You may have to pay the surcharge’ and read on. INDIVIDUAL TAX RETURN INSTRUCTIONS 2013 53 M2 Medicare levy surcharge Worksheet 1 You Taxable income (from TAXABLE INCOME OR LOSS) Total reportable fringe benefits amount (from W item IT1) Amount on which family trust distribution tax has been paid (from X item A4 supplementary section) Net financial investment loss (from X item IT5) Net rental property loss (from Y item IT6) Reportable employer superannuation contributions (from T item IT2) Deductible personal superannuation contributions (from H item D12 supplementary section ) Spouse $ (a) $ (a) $ (b) $ (b) $ (c) $ (c) $ (d) $ (d) $ (e) $ (e) $ (f) $ (f) $ (g) $ (g) $ (h) Your spouse’s share of the net income of a trust on which the trustee must pay tax and which has not been included at (a) (from T Spouse details) Add the amounts from (a) to (h) in each column. If you or your spouse were 55 to 59 years old, write here the taxed element amount of superannuation lump sums (other than a death benefit) received during 2012–13 that do not exceed your or your spouse’s low rate cap. To work out the taxed element, you must go to ato.gov.au/instructions2013 and read question M2. Take (k) away from (j). This is each individual’s income for MLS purposes. $ (j) $ (j) $ (k) $ (k) $ (l) $ (l) $ (n) Add the amount from (l) in your column to the amount from (l) in your spouse’s column. Your income for MLS purposes when you are single is the amount at (l) in your column. Your combined income for MLS purposes is the amount at (n). If your spouse received a lump sum payment in arrears which is either foreign income (shown at item 20) or other income (shown at item 24), you must complete a schedule of additional information. You must go to ato.gov.au/instructions2013 and read question M2 to find out how to complete the schedule. 54 INDIVIDUAL TAX RETURN INSTRUCTIONS 2013