Merchant Bankers - ICAI Knowledge Gateway

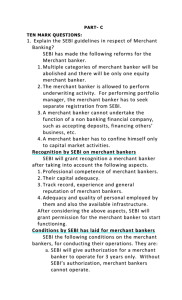

advertisement

CA Final Course Paper 1 Financial Reporting Chapter 8 Unit 3 CA. Ajay Lunawat Meaning of Merchant Banker Commercial Vs Merchant Banking Categories of Merchant Bankers Registration with SEBI Services Offered Guidelines Intermediary Channel between the issuers and the ultimate purchasers of securities in the primary security market Providing advisory, managerial and non banking services To help existing units for expansion or set up new ventures “Merchant banks are the financial institutions providing specialist services which generally include the acceptance of bills of exchange, corporate finance, portfolio management and other banking services”. •Cox. D “any person who is engaged in the business of issue management either by making arrangements regarding selling, buying or subscribing to securities as manager, consultant, advisor or rendering corporate advisory service in relation to such issue management”. • The Notification of the Ministry of Finance The Term originated from London where Foreign Trade was financed through acceptance of bills Later on helped the government of under developed countries to raise long term funds Thereafter the merchant bankers formed association which is now called “Merchant Banking and Securities House Association” Commercial Banking Merchant Banking Financial Services with Saving Accounts, Loans, Credit Cards, Brokerage Financial Consultancy and Advisory Services Earns on Loans, Mortagates etc. Earnings as Profits from Fees it charges for its services Involved in Debt Related Finances Involved in Equity Related Finances Primarily Risk Averters Are Risk Takers Category I Category II Category III Category IV •Issue Management •Advisor •Consultant •Manager •Underwriter •Portfolio Manager •Advisor, •Consultant •Comanager, •Underwriter, •Portfolio Manager; •Advisor •Consultant •Underwriter •Advisor •Consultant Application for Grant of Certificate Information Furnishing, Clarification & Personal Representation Application Consideration Granting the Certificate Payment of Fees Project Counseling Issue Management Loan Syndication •Preparing project report •Deciding on Finance Pattern •Project Appraisal •Marketing of Corporate Securities •Pre Issue and Post Issue Activities •Assistance in Loan Raising Underwriting Managers/Consultants. Advisors Portfolio Management Offshore Finance •Provides underwriting services to the companies •The underwriting helps in easy raising of external resources •Managing and Providing advisory services for listing the companies in stock exchanges •Advisory services during Mergers and Acquisitions •Assists the investors in selecting and maintaining proper portfolio •Help in Long Term Foreign Currency Loan •Joint Ventures Abroad Specified under SEBI under the SEBI (Merchant Bankers) Regulations, 1992. Net worth’ means the sum of paid-up capital and free reserves of the applicant at the time of making application under sub-regulation (1) of regulation 3. Net worth Category wise should be Category I Rs 5,00,00,000 Category II Rs 50,00,000 Category III Rs 20,00,000 Category IV NIL Every merchant banker shall keep and maintain the following books of account, records and documents as per regulation 14 a copy of balance sheet as at the end of the each accounting period a copy of profit and loss account for that period; a copy of the auditor's report on the accounts for that period; a statement of financial position Records and documents pertaining to due diligence exercised in pre-issue and post issue activities of issue management and in case of takeover, buy-back and delisting of securities The responsibilities with regard to the management of the issue Any change in the information or particulars previously furnished, which have a bearing on the certificate granted to it. The names of the body corporate whose issue he has managed or has been associated with; The particulars relating to the breach of the capital adequacy requirements as specified in regulation 7; Under Regulation 29, the merchant banker shall submit a half yearly report for the period ending up to 31st March and 30th September of every year in the format specified in Schedule IV, within three months from the close of the period to which it corresponds.∗ SEBI (Issue of Capital and Disclosure Requirements) Regulations, 2009 has specified a format for half yearly report to be submitted by merchant bankers. To ensure that the books of account are being maintained in the required manner That the provisions of the Act, rules, regulations are complied with; To investigate into the complaints received from investors, other merchant bankers or any other person on any matter having a bearing on the activities of the merchant banker To investigate suo motu in the interest of securities business or investors' interest into the affairs of the merchant banker. SEBI has the right to appoint one or more persons as inspecting authority to undertake inspection of the books of account As per Regulation 31, it shall be the duty of the merchant banker to allow the inspecting authority to have reasonable access to the premises occupied by such merchant banker or by any other person on his behalf extend reasonable facility for examining any books, records, documents and computer data in the possession of the merchant banker or any such other person and also provide copies of documents or other materials which, in the opinion of the inspecting authority, are relevant for the purposes of the inspection. The SEBI may also appoint a qualified auditor to investigate into the books of account or the affairs of the merchant bankers. • five per cent of the total underwriting commitment or rupees twenty-five lacs, whichever is less. Underwriting Oblligation • the merchant banker shall, itself or jointly with other merchant bankers associated with the issue, Further Issue underwrite at least fifteen per cent of the issue size Should make all efforts to protect investors interests Maintain high standards of Integrity, dignity and Fairness Fulfill all obligations in ethical and professional manner No Discrimination among the clients Render best possible advice to the clients To inform the clients of penal action by SBI, if any To abide by Rules and Regulations of the concerned Acts Not Create False Market It is responsible for the act of its employees and agents Ability to Analyse Abundant Knowledge Innovative Approach Integrity Capital Market Familiarity High Capital Non Cooperation of Issuing Companies Vast Scope •SBI stipulates high capital adequacy norms which restricts the young professionals •Non Cooperation of Issuing Companies •Non Cooperation of Issuing Companies •Non Cooperation in Timely Securities Allotment •Non Cooperation during refunding of application money etc •Wider in scope of services requires development of adequate expertise For What Purpose inspection of records and documents of Merchant Bankers is ordered by SEBI? SEBI has the right to appoint one or more persons as inspecting authority to undertake inspection of the books of account, records and documents of the merchant banker for any of the following purposes: To see that books of account are being maintained in the required manner To ensure that provisions of SEBI Act, rules and regulations are complied with To investigate into complaints received from investors, other merchant bankers, or any other person on any matter having a bearing on the activities of merchant banker; To investigate suo moto in the interest of securities business or investors’ interest into the affairs of merchant bankers. Write short note on Capital adequacy requirements of merchant bankers Capital adequacy requirements have been specified by SEBI under the SEBI (Merchant Bankers) Regulations, 1992. Regulation 7 specifies that the requirement of capital adequacy shall be a net worth of not less than five crore rupeesAs amended by SEBI (Merchant Banker) (Third Amendment) Regulations, 2006 For the purpose of this regulation, ‘ Net worth’ means the sum of paid-up capital and free reserves of the applicant at the time of making application under sub-regulation (1) of regulation 3 Merchant bankers are the specialised agency which manages the capital issues. They are also called the managers to the issue. A merchant banker acts as an intermediary between the issuers and the ultimate purchasers of securities in the primary security market. The services offered includes underwriting and providing advice on complex financings arrangements, mergers and acquisitions, direct equity investments in corporations.