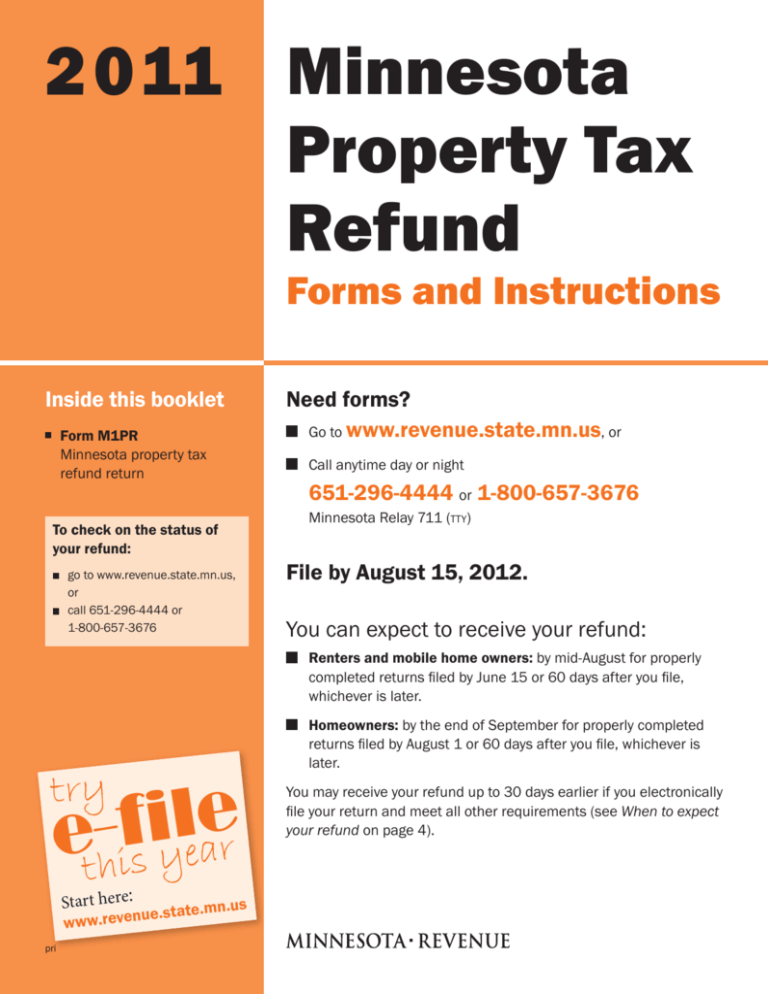

2011 Property Tax Refund Return - Minnesota Department of Revenue

advertisement