Tax Filing Instructions

advertisement

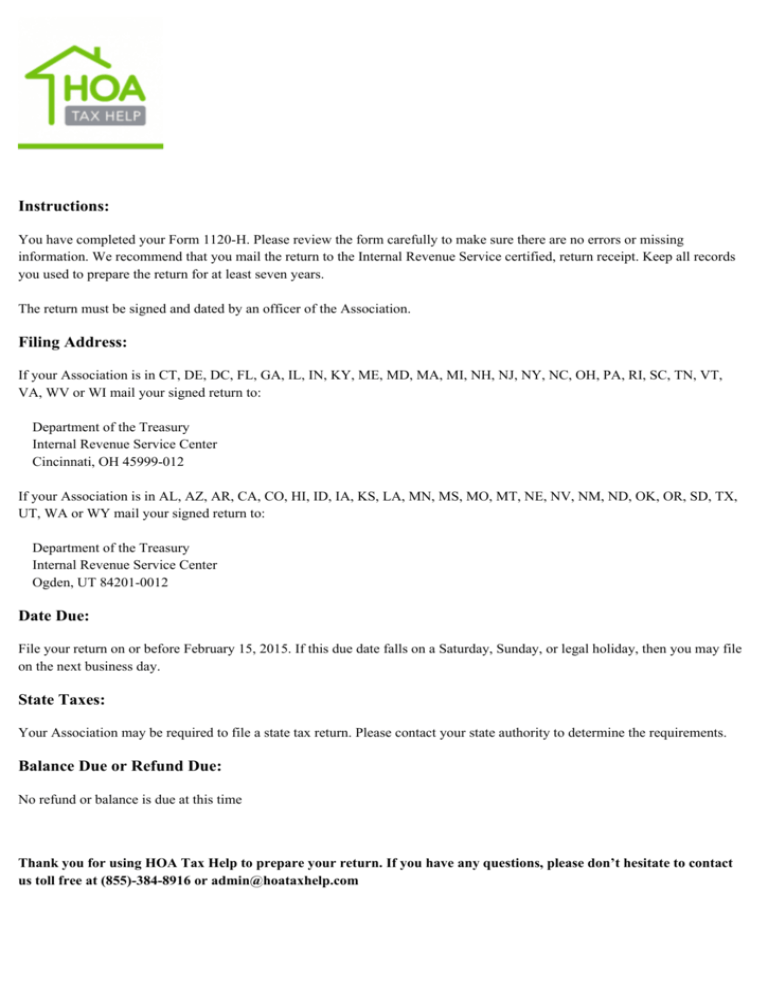

Instructions: You have completed your Form 1120-H. Please review the form carefully to make sure there are no errors or missing information. We recommend that you mail the return to the Internal Revenue Service certified, return receipt. Keep all records you used to prepare the return for at least seven years. The return must be signed and dated by an officer of the Association. Filing Address: If your Association is in CT, DE, DC, FL, GA, IL, IN, KY, ME, MD, MA, MI, NH, NJ, NY, NC, OH, PA, RI, SC, TN, VT, VA, WV or WI mail your signed return to: Department of the Treasury Internal Revenue Service Center Cincinnati, OH 45999-012 If your Association is in AL, AZ, AR, CA, CO, HI, ID, IA, KS, LA, MN, MS, MO, MT, NE, NV, NM, ND, OK, OR, SD, TX, UT, WA or WY mail your signed return to: Department of the Treasury Internal Revenue Service Center Ogden, UT 84201-0012 Date Due: File your return on or before February 15, 2015. If this due date falls on a Saturday, Sunday, or legal holiday, then you may file on the next business day. State Taxes: Your Association may be required to file a state tax return. Please contact your state authority to determine the requirements. Balance Due or Refund Due: No refund or balance is due at this time Thank you for using HOA Tax Help to prepare your return. If you have any questions, please don’t hesitate to contact us toll free at (855)-384-8916 or admin@hoataxhelp.com

![Form C-VI [See Rules 43 & 44] Book Number Refund Payment Order under](http://s2.studylib.net/store/data/016946525_1-83576a195ca935e7793487aef29d9241-300x300.png)

![Form C-V [See Rules 43 & 44] Book Number](http://s2.studylib.net/store/data/016946524_1-73cd57a6a60067877776844053460e75-300x300.png)