AFMAdata 'BBSW' Reference Rates

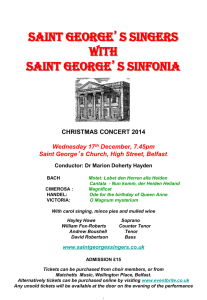

advertisement

AFMAdata ‘BAB/NCD’ Reference Rates Bank Accepted Bills / Negotiable Certificates of Deposit (‘BAB/NCD’) end-of-day Reference Rates provide independent & transparent reference rates for the pricing and revaluation of an organisation’s Australian Dollar denominated short-term securities portfolios & short-term interest rate risk positions. The definition for ‘BAB/NCD’ EOD Reference Rates (BABSEOD) for a reset date will be the average mid rate at approximately 4.30 p.m. Sydney time, for Australian Dollar ‘prime bank’ bills of exchange, accepted by an approved ‘prime bank’, having a tenor of designated maturitities out to 1 year. Reference Rates input are provided on a business day in Sydney. The AFMA NTI Committee has agreed that, from 4 March 2008: The basis for the contributed of ‘BAB/NCD’ EOD mid rates from 1 to 6 months tenors will be the mid of the bid/offer rates for each tenor; The basis for the contributed of ‘BAB/NCD’ EOD mid rates for 9 and 12 month tenors will be a ‘zero coupon’ curve based on a strip of relevant SFE 90 day bill futures contract prices for each tenor. PRIME BANK PAPER The following definition of ‘prime bank’, has been approved by the AFMA Market Governance Committee on the recommendation of the AFMA NTI Committee. To be considered a prime name, a bank must: be an APRA Authorised Deposit-Taking Institution and classified by APRA as; an “Australian-owned Bank”; a “Foreign Subsidiary Bank”; or a “Branch of a Foreign Bank ” authorised to carry on banking business pursuant to the Banking Act 1959 (as amended) or “comparable legislation in its country of origin”; and meet the rating criteria of being rated by Standard & Poor’s as having a short term rating of A1+ and a long term rating of at least AA-. It is also expected that its acceptances and certificates of deposit will trade at the lowest benchmark yield, as determined by the market. BAB/NCD EOD RATE INPUTS BAB/NCD reference rates for each tenor (quoted to 2 decimal places) are input into the AFMAdata system by those organisations contributing to the BABSEOD reference rate process on a business day in Sydney and will be displayed on various Information Vendor systems (eg. Thomson Reuters, Bloomberg, SunGard and QUICK Corp). Rate contributions are provided for each tenor as at 4.30 p.m. Sydney time to reflect each panellist’s view of EOD mid rates for BAB/NCD reference ‘bank bills of exchange’ as defined above. Yields must be updated between 4.20 p.m. & 4.40 p.m. for inclusion in the AFMAdata BAB/NCD EOD process. Yields will be collected at approx. 4.40 p.m. TENOR / MATURITY Each BBSW panel member will contribute ‘mid rates’ on the basis of “early month (1 st to 15th)” & “late month (16th to EOM)” for maturities of one, two, three, four, five, six months and straight ‘mid rates’ rates for nine and twelve months maturities. The maturity date is determined on a modified following basis (ie. if the straight date for a specific tenor falls on a weekend or public holiday in Sydney, the date will be the next business day, unless that day crosses the mid-month (15th ) or end of a month then it will be the preceding business day). CALCULATION: Elimination & Averaging Procedure The calculation mechanism calculates the ‘mid rate’ for each tenor from all relevant input rates, rounding to the nearest three decimal places, if necessary. From these mid-rates an elimination process will eliminate, the highest and lowest rates for each individual tenor until a maximum of eight mid-rates remain. If between five and eight eligible input rates are available for any tenor only those contributions will be displayed on BABSEOD for that tenor. If less than five eligible input rates are available for any tenor, no contributions will be displayed and no average rates will be displayed for that tenor. Rates displayed on page BABSEOD on a row-by-row basis across all tenors will not necessarily belong to the same contributor. AVAILABILITY: Calculated AFMAdata BAB/NCD reference rates will be available to all participating vendors, no later than 5.00 p.m. on a Sydney Business Day. A “Business Day” is defined in the AFMA Conventions for Negotiable / Transferable Instruments (NTI) (http://www.afma.com.au/) as any day that on which the payment system is open for business in Sydney. CONTRIBUTING FINANCIAL INSTITUTIONS: ANZ Banking Group Limited BNP Paribas Commonwealth Bank of Australia Limited Lloyds TSB Australia Macquarie Bank Limited National Australia Bank Limited Royal Bank of Canada Suncorp Metway Ltd Westpac Banking Corporation 2