PT HCL Technologies Indonesia

PT HCL Technologies Indonesia

Financial statements as of June 30, 2015 and for the year then ended with independent auditor’s report

PT HCL TECHNOLOGIES INDONESIA

FINANCIAL STATEMENTS AS OF JUNE 30, 2015

AND FOR THE YEAR THEN ENDED WITH

INDEPENDENT AUDITOR’S REPORT

Contents

Independent Auditor’s Report

Financial Statements

Statement of Financial Position ..…………………………………………………………………

Statement of Comprehensive Income ..………………………………………………………….

Statement of Changes in Equity .…………………………………………………………………

Statement of Cash Flows ..………………………………………………………………………..

Page

1

2

3

4

Notes to the Financial Statements ..…………………………………………………………….. 5-24

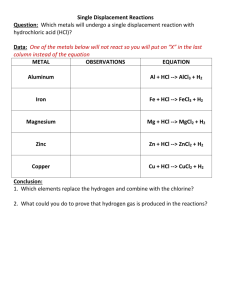

PT HCL TECHNOLOGIES INDONESIA

STATEMENT OF FINANCIAL POSITION

As of June 30, 2015

(Expressed in Rupiah)

ASSETS

CURRENT ASSETS

Cash and cash equivalents

Trade receivables

Unbilled receivables

Other receivables

Inventories

Prepaid expenses

Prepaid taxes

Advance payments

Security deposits

Total current assets

NON-CURRENT ASSETS

Deferred cost

Fixed assets

Deferred tax assets

Total non-current assets

TOTAL ASSETS

Notes 2015

2c,k,3 4,661,560,075

2d,j,k,4 12,873,126,871

2d,j,k,5 10,182,116,784

2k,6

2e,7

33,836,124

463,014,987

48,381,802

2i,15a

2k

481,675,712

15,709,361

87,520,888

28,846,942,604

2h

2f,8

2i,15d

-

3,907,352

1,281,095,443

1,285,002,795

30,131,945,399

LIABILITIES AND EQUITY

CURRENT LIABILITIES

Trade payables

Other payables

Accrued expenses

Short term loans

Taxes payable

2j,k,9

2k,10

2j,k,11

4,158,758,322

265,118,095

3,211,393,114

2g,j,k,12 13,339,000,000

2i,15b 2,308,616,385

Total current liabilities

NON-CURRENT LIABILITIES

Deferred income

Post employment benefits obligations

Total non-current liabilities

EQUITY

Share capital - Rp 9,074 par value per share

2h,13

2l,14

23,282,885,916

277,808,920

94,559,112

372,368,032

Authorized, issued and fully paid-up capital

1,000,000 and 500,000 shares on June 30, 2015 and 2014

Paid in capital from exchange rate differences

Accumulated deficit

Total equity

16

17

26

TOTAL LIABILITIES AND EQUITY

9,074,000,000

1,326,165,000

(3,923,473,549)

6,476,691,451

30,131,945,399

2014

327,854,021

9,187,215,834

1,989,843,808

278,354,425

-

54,558,071

228,847,353

-

78,163,000

12,144,836,512

78,371,438

7,814,705

872,804,756

958,990,899

13,103,827,411

940,543,708

354,685,621

1,783,041,321

8,312,500,000

182,014,047

11,572,784,697

123,851,613

12,219,103

136,070,716

4,537,000,000

-

(3,142,028,002)

1,394,971,998

13,103,827,411

The accompanying notes are an integral part of these financial statements

1

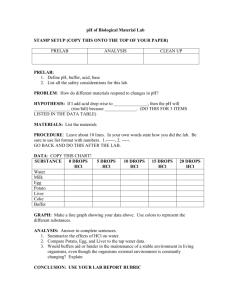

PT HCL TECHNOLOGIES INDONESIA

STATEMENT OF COMPREHENSIVE INCOME

For the year ended June 30, 2015

(Expressed in Rupiah)

Revenue

Cost of sales

Notes 2015

2h,19 27,687,909,797

2014

17,662,545,814

2h,20 (18,537,263,466) (12,574,225,305)

Gross profit

Operating expenses

Selling and marketing expenses

General and administrative expenses

2h,21

2h,22

9,150,646,331

(13,598,784)

(7,748,014,282)

5,088,320,509

(780,000)

(5,064,101,078)

(7,761,613,066)

1,389,033,265

(5,064,881,078)

23,439,431

Total operating expenses

Profit from operations

Other income (expenses)

Profit (loss) on foreign exchange, net

Others

2b

Total other income (expenses), net

Profit before income tax

Corporate income tax

Current tax - expense

Prior year tax - expense

Deferred tax - expense

Total corporate income tax

Profit (loss) for the year

Other comprehensive income

Total comprehensive income (loss) for the year

2i,15c

2i,n,15e

2i,15d

(438,823,096)

(58,331,673)

(497,154,769)

891,878,496

(1,117,606,577)

(964,008,153)

408,290,687

(1,673,324,043)

(781,445,547)

-

(781,445,547)

230,385,092

(38,888,861)

191,496,231

214,935,662

(112,571,937)

-

872,804,756

760,232,819

975,168,481

-

975,168,481

The accompanying notes are an integral part of these financial statements

2

PT HCL TECHNOLOGIES INDONESIA

STATEMENT OF CHANGES IN EQUITY

For the year ended June 30, 2015

(Expressed in Rupiah)

Paid in

capital from

exchange rate Accumulated

Capital stock differences deficit

Balance as of June 30, 2013

Total comprehensive income for the year

4,537,000,000

-

4,537,000,000

- (4,117,196,483)

- 975,168,481

Total

419,803,517

975,168,481

- (3,142,028,002) 1,394,971,998 Balance as of June 30, 2014

Addition of capital stock

Total comprehensive income for the year

4,537,000,000 1,326,165,000

- -

- 5,863,165,000

(781,445,547) (781,445,547)

Balance as of June 30, 2015 9,074,000,000 1,326,165,000 (3,923,473,549) 6,476,691,451

The accompanying notes are an integral part of these financial statements

3

PT HCL TECHNOLOGIES INDONESIA

STATEMENT OF CASH FLOWS

For the year ended June 30, 2015

(Expressed in Rupiah)

Cash flows from operating activities

Profit before income tax

Adjustments to reconcile profit before income

tax to net cash used in operating activities:

Post employement benefit obligations

Depreciation expenses of fixed assets

Allowance for doubtfull account

Operating profit before working capital changes

Changes in working capital:

Increase in trade receivables

Increase in unbilled receivables

Decrease (increase) in prepaid expenses

Decrease (increase) in other receivables

Decrease (increase) in prepaid taxes

Decrease (increase) in advance payments

Decrease (increase) in inventories

Increase in security deposits

Decrease (increase) in deferred charges

Increase (decrease) in trade payables

Increase (decrease) in other payables

Increase in accrued expenses

Increase in taxes payable

Increase (decrease) in deferred income

Payment of tax

Net cash used in operating activities

Cash flows from financing activities

Proceed from issuance of capital stock

Additional paid in capital from exchange rate differences

Increase short term loans

Net cash used in financing activities

Net increase (decrease) in cash and cash equivalents

Cash and cash equivalents at beginning of the year

Cash and cash equivalents at end of the year

2015

891,878,496

2014

214,935,662

82,340,009

3,907,353

1,320,768,094

2,298,893,952

(8,623,501)

7,814,706

2,593,031,905

2,807,158,772

(5,006,679,130)

(8,192,272,976)

6,176,269

244,518,301

(252,828,359)

(15,709,361)

(463,014,987)

(9,357,888)

78,371,438

3,218,214,613

(89,567,526)

1,428,351,793

2,126,602,338

153,957,307

(2,081,614,730)

(9,238,133,109)

(1,534,519,039)

(51,768,734)

(88,733,528)

175,469,689

10,313,578

240,376,094

(36,510,792)

(78,371,438)

(2,759,933,017)

57,830,536

912,728,223

181,037,592

(123,581,825)

(112,571,937)

(6,555,958,946) (9,639,208,935)

4,537,000,000 -

10,889,665,000

1,326,165,000

5,026,500,000

4,333,706,054

327,854,021

4,661,560,075

-

8,312,500,000

8,312,500,000

(1,326,708,935)

1,654,562,956

327,854,021

The accompanying notes are an integral part of these financial statements

4

PT HCL TECHNOLOGIES INDONESIA

NOTES TO THE FINANCIAL STATEMENTS

As of June 30, 2015 and for the year then ended

(Expressed in Rupiah, unless otherwise stated)

1. GENERAL

PT HCL Technologies Indonesia (the “Company”) established based on the Notarial Deed of Humberg

Lie S.H., S.E., Mkn. No 205 dated July 28, 2010. The Company's articles of incorporation were approved by the Minister of Justice and Human Rights of the Republic of Indonesia in his Decision

Letter No. AHU-10.AH.02.02-Tahun 2010 dated February 9, 2010.

The Company’s articles of incorporation amendment was made based upon Notarial Deed No. 10 dated November 22, 2011 of Etty Roswitha Moelia S.H., Notary in Jakarta, concerning the increase in authorized capital and changes of the Company’s financial year from January 1 up to December 31 into July 1 up to June 30, which has been approved by the Minister of Justice and Human Rights of the

Republic of Indonesia in his Decision Letter No. AHU-00993.AH.01.02.Tahun 2012 dated January 6,

2012.

The Company has obtained approval from the Office of Tax Service to changes its financial year/fiscal year from January 1 up to December 31, into July 1 up to June 30, in its decision letter No. KEP-

00003/THBK/WPJ.04/KP.0403/2012 dated December 5, 2012. The change is effective starting from financial year/fiscal year 2012.

The Company is domiciled at One Pacific Place Building 15 th

floor SCBD, Jl. Jend. Sudirman

Kav. 52-53, South Jakarta. The Company commenced its commercial operation in June 2011.

In accordance with Article 3 of the articles of incorporation, the Company is engaged in software and business process outsourcing services. Total employees as of June 30, 2015 and 2014 are 9 and

6 people, respectively.

Based on the Extraordinary General Shareholders’ Meeting notarized by Notary Public Ny. Etty

Roswitha Moelia, SH under the deed No.6 dated February 26, 2014, the Company’s shareholders approved the change of the Company’s commissioners and Directors. The change has been approved by the Minister of Justice and Human Rights of the Republic of Indonesia in his Decision Letter

No. AHU-AH.01.10-11400 dated March 17, 2014.

The members of the Company's Board of Commissioner and Board of Directors as of June 30, 2015 and 2014 are as follows:

Commissioner : Mr. Sundharam Sridharan

President Director

Directors

: Mr. Prahlad Rai Bansal

: Mr. Manish Anand

: Mr. Nalin Mittal

2. SUMMARY OF SIGNIFICANT ACCOUNTING POLICIES

A summary of significant accounting policies adopted by the Company, which affects the determination of its financial position and results of its operations, is presented below. a. Presentation of Financial Statements

The Company’s financial statements have been prepared in accordance with Indonesian Financial

Accounting Standards. The financial statements have been prepared under the historical cost concept and using the accrual basis, unless otherwise stated.

The statement of cash flows is prepared based on the indirect method by classifying cash flows on the basis of operating, investing and financing activities. For the purpose of the cash flow statement, cash and cash equivalents include cash in banks and time deposits with a maturity period of 3 months or less, as long as these time deposits are not pledged as collateral for borrowings nor restricted.

5

PT HCL TECHNOLOGIES INDONESIA

NOTES TO THE FINANCIAL STATEMENTS

As of June 30, 2015 and for the year then ended

(Expressed in Rupiah, unless otherwise stated)

2. SUMMARY OF SIGNIFICANT ACCOUNTING POLICIES (continued) a. Presentation of Financial Statements (continued)

Except as described below, the accounting policies applied are consistent with those of annual financial statements as of June 30, 2014, which conform to the Indonesian Financial Accounting

Standards.

In order to provide further understanding of the financial performance of the Company, due to the significance of their nature or amount, several items of income or expense have been shown separately.

The preparation of financial statements in conformity with Indonesian Financial Accounting

Standards requires the use of certain critical accounting estimate. It also requires management to exercises its judgment in the process of applying the Company’s accounting policies. The areas involving a higher degree of judgment or complexity, or areas where assumptions and estimates are significant to the financial statements are disclosed in Note 2n.

New accounting standards

The adoption of the following revised interpretation of the accounting standards, which are effective from January 1, 2014, did not result in substantial changes to the Company’s accounting policies and had no material effects on the amounts reported for the current period financial statements:

- ISAK 27 “Transfers of assets from customers”

- ISAK 28 “Extinguishing financial liabilities with equity instruments”

- ISAK 29, “Stripping Costs in the Production Phase of a Surface Mining”

New standards, amendments and interpretations issued but not yet effective for the financial year beginning January 1, 2015 are as follows:

- PSAK 1 (revised 2013) “Presentation of financial statements”

- PSAK 4 (revised 2013) “Separate financial statements”

- PSAK 15 (revised 2013) “Investment in associates and joint ventures”

- PSAK 24 (revised 2013) “Employee benefits”

- PSAK 46 (revised 2013) “Income taxes”

- PSAK 48 (revised 2013) “Impairment of assets”

- PSAK 50 (revised 2013) “Financial Instrument: Presentation”

- PSAK 55 (revised 2013) “Financial Instrument: Recognition and Measurement”

- PSAK 60 (revised 2013) “Financial Instrument: Disclosure”

- PSAK 65 “Consolidated financial statements”

- PSAK 66 “Joint arrangements”

- PSAK 67 “Disclosure of interests in other entities”

- PSAK 68 “Fair value measurement”

- ISAK 26 (revised 2013) “Reassessment of embedded derivatives”

- Withdrawal of PSAK 12 (revised 200 9) “Interest in joint venture”

- Withdrawal of ISAK 7 “Consolidation - special purpose entities”

- Withdrawal of ISAK 12 “Jointly controlled entities: Non monetary contribution by venturers”

Early adoption of these new and revised standards prior to January 1, 2015 is not permitted. As at the authorisation date of this financial statements, the company is still evaluating the potential impact of these new and revised PSAK.

6

PT HCL TECHNOLOGIES INDONESIA

NOTES TO THE FINANCIAL STATEMENTS

As of June 30, 2015 and for the year then ended

(Expressed in Rupiah, unless otherwise stated)

2. SUMMARY OF SIGNIFICANT ACCOUNTING POLICIES (continued) b. Foreign Currency Transactions and Balances

1. Functional and presentation currency

Items included in the Company’s financial statements are measured using the currency of the primary economic environment in which the entity operates (the “functional currencies”).

The financial statements are presented in Rupiah, which is the functional and presentation currency of the Company.

2. Transaction and balances

Foreign currency transactions are translated into Rupiah using the exchange rates prevailing at the dates of the transactions. At each reporting date, monetary assets and liabilities denominated in foreign currency are translated into Rupiah using the management closing exchange rate. Exchange rate used as benchmark is the rate which is issued by the group of the Company. Foreign exchange gain and losses resulting from the settlement of such transactions and from the translation at period-end exchange rates of monetary assets and liabilities denominated in foreign currencies are recognized in profit or loss.

c. Cash and Cash Equivalents

Cash and cash equivalents include cash in hand, deposit held on call with banks and other shortterm highly liquid investments with original maturities of three months or less. d. Trade Receivables

Trade receivables are amounts due from customers for services performed in the ordinary course of business. If collection is expected in one year or less (or in the normal operating cycle of the business if longer), they are classified as current asets. If not, they are presented as non-current assets.

Trade receivables are recognized initially at fair value and subsequently measured at amortized cost using the effective interest method, less provision for impairment. A provision for impairment of trade receivables are established when there is objective evidence that the Company will not be able to collect all amounts due according to the original term of the receivables. Significant financial difficulties of the debtor, the probability that the debtor will enter bankcrupty of financial reorganization, and default or delinquency is impaired.

The amount of the provision is the differences between the asset’s carrying amount and the present value of estimated future cash flows, discounted at the original effective interest rate. The carrying amount and the present value of estimated future cash flows, discounted at the original effective interest rate. The carrying amount of the asset is reduced through the use of an income.

When trade receivables are uncollectible, it is written off against the allowance account for trade receivables. Subsequent recoveries of amounts previously written off are credited against the statement of comprehensive income. e.

Inventories

Inventories are valued at the lower of the cost or net realizable value. Net realizable value is the estimated selling price in the ordinary course of business, less estimated costs of completion and estimated costs necessary to make the sale.

Cost procured for specific projects is assigned by specific identification of individual costs of each item. Cost is determined using the weighted average cost formula.

Provision for obsolete and slow moving inventory is determined on the basis of estimated future usage or sale of individual inventory items.

7

PT HCL TECHNOLOGIES INDONESIA

NOTES TO THE FINANCIAL STATEMENTS

As of June 30, 2015 and for the year then ended

(Expressed in Rupiah, unless otherwise stated)

2. SUMMARY OF SIGNIFICANT ACCOUNTING POLICIES (continued) f. Fixed assets

Fixed assets are stated at cost less accumulated depreciation and any impairment in value.

The cost of an asset comprises its purchase price and any cost directly attributable to bringing the assets to the location and condition necessary for it to be capable of operating in the manner intended by management.

Subsequent expenditures such as replacement and major inspection are added to the carrying amount of the asset when it is probable that future economic benefits will flow to the Company and the cost of the item can be measured reliably. The carrying amount of those parts that are replaced or any remaining carrying amounts of the cost of the previous inspection is derecognized.

The costs of day-to-day servicing of an asset are recognized as an expense in the period in which they are incurred.

Depreciation is recognized on a straight-line basis to write down the depreciable amount of fixed asset to reduce value of depreciated fixed assets.

As of June 30, 2015 the Company changes the estimated useful lives of the fixed assets that applied prospectively. The estimated useful life of the fixed assets is as follows:

Year Year

Computer

2015

4

2014

3

The residual values, useful lives and depreciation method are reviewed at each financial position date to ensure that such residual values, useful lives and depreciation method are consistent with the expected pattern of economic benefits from those assets.

An asset’s carrying amount is written down immediately to its recoverable amount if the asset’s carrying amount is greater than its estimated recoverable amount.

When an asset is disposed of or when no future economic benefits are expected from its use or disposal, the cost and accumulated depreciation and accumulated impairment losses, if any, are removed from the accounts. Any resulting gain or loss from the recognition of an item of fixed asset is included in the statement of comprehensive income.

The Company chose to adopt the cost model; accordingly, the Company’s fixed asset, are carried at cost less accumulated depreciation and accumulated impairment losses, if any. g. Borrowings

Borrowings are recognized initially at fair value, net of transaction costs incurred. Borrowings are subsequently stated at amortized cost.

Any difference between the proceeds (net of transaction cost) and the redemption value is recognized in the statement of comprehensive income over the period of the borrowings using the effective interest rate method.

Borrowings are classified as current liabilities unless the Company has unconditional right to defer settlement of the liability for at least 12 months after the statement of financial position date.

8

PT HCL TECHNOLOGIES INDONESIA

NOTES TO THE FINANCIAL STATEMENTS

As of June 30, 2015 and for the year then ended

(Expressed in Rupiah, unless otherwise stated)

2. SUMMARY OF SIGNIFICANT ACCOUNTING POLICIES (continued) h. Revenue and Expense Recognition

The Company adopted PSAK No. 23 (Revised 2010), “Revenue”. This revised PSAK identifies the circumstances in which the criteria on revenue recognition will be met and, therefore revenue may be recognized, and prescribes the accounting treatment of revenue arising from certain types of transactions and events, and also provides practical guidance on the application of the criteria on revenue recognition.

Revenue from material contracts is recognized as related services are performed.

Revenue from fixed price and fixed time frame contracts is recognized in accordance with the percentage of completion method under which the sales value of performance.

Revenue from sale of licenses for the use of software applications is recognized when title in the user license are transfer.

Revenue from annual technical service contracts is recognized on a pro rata basis over the period in which such services are rendered. Income from revenue sharing agreements is recognized when the right to receive is established.

Expenses are recognized when they are incurred (accrual method). i. Income Tax

The tax expense comprises current and deferred tax. Tax is recognized in the profit or loss, except to the extent that it relates to items recognized in other comprehensive income or directly in equity.

The current income tax charge is calculated on the basis of the tax laws enacted or substantively enacted at the reporting date. Management periodically evaluates positions taken in tax returns with respect to situations in which applicable tax regulation is subject to interpretation. It establishes provision where appropriate on the basis of amounts expected to be paid to the tax authorities.

Deferred income tax is recognized, using the balance sheet approach method, on temporary differences arising between the tax bases of assets and liabilities and their carrying amounts in the financial statements. Deferred income tax is determined using tax rates that have been enacted or substantially enacted as at reporting period and is expected to apply when the related deferred income tax asset is realised or the deferred income tax liability is settled.

Deferred income tax assets are recognized only to the extent that is probable that future taxable profit will be available against which the temporary differences can be utilised.

Amendments to tax obligations are recorded when an assessment is received or, if appealed against by the Company, when the result of the appeal is determined. j. Transactions with Related Parties

The Company enter into transactions with related parties. In the financial statements, the term related parties are used as defined in the Statement of Financial Accounting Standards (“PSAK”)

No. 7 (Revised 2010) regarding with “Related Party Disclosures”.

The nature of transactions and balances of accounts with related parties, whether or not transacted on normal terms and conditions similar to those with non-related parties, are disclosed in the notes to the financial statements.

9

PT HCL TECHNOLOGIES INDONESIA

NOTES TO THE FINANCIAL STATEMENTS

As of June 30, 2015 and for the year then ended

(Expressed in Rupiah, unless otherwise stated)

2. SUMMARY OF SIGNIFICANT ACCOUNTING POLICIES (continued) k. Financial Assets and Liabilities

Financial Assets

Financial assets are classified as financial assets at fair value through profit or loss, loans and receivables, held-to-maturity investments, and available-for-sale financial assets. The Company determines the classification of its financial assets at initial recognition.

The Company’s financial assets consist of cash and cash equivalents, trade, unbilled, and other receivables, security deposit classified as loans and receivables.

Loans and receivables are non-derivative financial assets with fixed or determinable payments that are not quoted in an active market. Loans and receivables are initially recognized at fair value plus transaction costs and subsequently measured at amortized cost using the effective interest rate method.

Financial Liabilities

The Company classifies its financial liabilities into the following category (i) financial liabilities at fair value through profit or loss and (ii) financial liabilities measured at amortised cost.

The Company’s financial liabilities consist of trade and other payables, accrued expenses and short term loans. Financial liabilities that are not classified as fair value through profit or loss fall into this category and are measured at amortized cost. l. Post-Employment Benefit Obligation

Employee’s entitlements to service and compensation payments relating to the employee’s separation, gratuity and compensation are recognized. A provision is made for the estimated liability as a result of past services rendered by employees up to the reporting date and is calculated based on the Manpower Law No.13/2003.

The Company provides provision for employee’s severance by using current salary for permanent employees multiplied by number of years of service. No funding has been made to this defined benefit plan. m. Identification and Measurement of Impairment

Non-financial assets

Under PSAK No. 48 (Revised 2009), "Impairment of Assets", the value of assets are reviewed for possible impairment of assets to the recoverable amount is caused by events or changes in circumstances which identifies its carrying value may not be recoverable.

The Company assesses at each reporting date whether there is an indication that an asset may be impaired. If any such indication exists, or when annual impairment testing for an asset is required, the Company makes an estimate of the asset’s recoverable amount. Recoverable amount is immediately recognized in profit or loss, but not in excess of any accumulated impairment loss previously recognized.

Financial assets

At each reporting date, the Company assesses whether there is objective evidence that the

Company’s financial assets are impaired. Financial assets are impaired when objective evidence demonstrates that a loss event has occurred after the initial recognition of the financial assets, and that the loss event has an impact on the future cash flows on the financial assets that can be estimated reliably.

10

PT HCL TECHNOLOGIES INDONESIA

NOTES TO THE FINANCIAL STATEMENTS

As of June 30, 2015 and for the year then ended

(Expressed in Rupiah, unless otherwise stated)

2. SUMMARY OF SIGNIFICANT ACCOUNTING POLICIES (continued) n. Use of Estimates

The preparation of financial statements in conformity with the Indonesian Financial Accounting

Standards requires the management to use estimates and assumptions that affect the reported amounts of assets and liabilities, the disclosure of contingent assets and liabilities as at the date of the financial statements, and the reported amounts of revenues and expenses during the reporting period. Actual results could differ from those estimates.

3. CASH AND CASH EQUIVALENTS

2015 2014

Cash in bank:

Citibank Indonesia

Rupiah

US Dollar

PT Bank Mandiri (Persero) Tbk.

Total

3,029,483,011

1,622,541,020

9,536,044

4,661,560,075

280,429,602

37,424,419

10,000,000

327,854,021

Cash in bank generally earn interest at rates based on daily bank deposit rates.

4. TRADE RECEIVABLES

2015

Related parties:

HCL America Inc.

HCL Technologies Limited

HCL Technologies Holland

Third parties:

Genting Plantations Berhad

Allianz SE

PT Digita Media Utama

PT Bank Mandiri (Persero) Tbk

PT Agro Indomas

PT Kronicles IT Consulting

Misys International Banking Systems

PT Globalindo Agung Lestari

Prudential Indonesia

AXA Technology Service SEA Ltd.

Allianze Insurance

PT Bekaert Indonesia

Others

Less: allowance for impairment

Trade receivables - net

1,980,108

-

-

7,239,501,481

2,118,760,090

1,553,993,500

1,280,905,982

909,719,800

858,399,331

853,322,508

851,028,200

761,057,324

304,833,237

199,968,150

198,847,141

154,339,814

(4,413,529,795)

12,873,126,871

2014

222,994

23,750,000

434,999

-

4,624,427,128

1,383,437,500

1,316,755,608

613,937,500

764,187,125

760,237,500

-

2,064,636,740

-

336,503,063

198,847,141

192,600,237

(3,092,761,701)

9,187,215,834

11

PT HCL TECHNOLOGIES INDONESIA

NOTES TO THE FINANCIAL STATEMENTS

As of June 30, 2015 and for the year then ended

(Expressed in Rupiah, unless otherwise stated)

4. TRADE RECEIVABLES (continued)

A reconciliation of the allowance for impairment at the beginning and end of 2015 and 2014 is shown below:

2015 2014

Balance at beginning of year

Impairment during the year (Note 22)

Foreign exchange

Balance at end of year

3,092,761,701

1,127,658,346

193,109,748

4,413,529,795

499,729,796

2,337,482,246

255,549,659

3,092,761,701

The management believes that the allowance for impairment losses is adequate to cover possible losses from uncollectible accounts.

5. UNBILLED RECEIVABLES

2015 2014

Related party:

HCL America Inc.

Third parties:

PT Bank Mandiri (Persero) Tbk

Misys International Banking Systems

Allianz SE

Genting Plantations Berhad

PT Globalindo Agung Lestari

Astra Zeneca

PT Digita Media Utama

Prudential Indonesia

PT Agro Indomas

Total

652,279

4,871,296,100

2,062,209,400

1,370,558,714

971,892,900

880,374,000

25,133,391

-

-

-

10,182,116,784

222,994

-

-

1,513,480,720

-

-

25,348,000

199,595,000

191,822,094

59,375,000

1,989,843,808

6. OTHER RECEIVABLES

Employees

2015

33,836,124

2014

278,354,425

Based on a review of collectibility of outstanding amounts, management believes that other receivables are fully collectible. Therefore, the Company does not provided provision for impairment losses for other receivables.

7. INVENTORIES

2015 2014

Hardware 463,014,987 -

Inventories are hardware as component requirement that used to support the installation of the

Company’s service to customers. These are mainly laptops, servers, networking equipment’s and other accessories which are purchased from vendor and will be bill to the customer as and when project requirement will be received.

12

PT HCL TECHNOLOGIES INDONESIA

NOTES TO THE FINANCIAL STATEMENTS

As of June 30, 2015 and for the year then ended

(Expressed in Rupiah, unless otherwise stated)

8. FIXED ASSETS

As of June 30, 2015 and 2014 the details of fixed assets are as follows:

2015

Beginning Disposal/ Ending

Balance Additions Reclassification Balance

Acquisition cost:

Computer

Accumulated depreciation:

Computer

Book value

Acquisition cost:

Computer

Accumulated depreciation:

Computer

Book value

23,444,117

23,444,117

15,629,412

15,629,412

7,814,705

-

-

3,907,353

3,907,353

-

-

-

-

23,444,117

23,444,117

19,536,765

19,536,765

3,907,352

2014

Beginning Disposal/ Ending

Balance Additions Reclassification Balance

23,444,117

23,444,117

7,814,706

7,814,706

15,629,411

-

-

7,814,706

7,814,706

-

-

-

-

23,444,117

23,444,117

15,629,412

15,629,412

7,814,705

The amount of depreciation is allocated as follows:

Depreciation expenses are allocated to:

General and administrative expenses

2015

3,907,353

2014

7,814,705

As of June 30, 2015 and 2014, fixed assets were not covered with insurance against fire and other possible losses.

9. TRADE PAYABLES

2015 2014

Related parties:

HCL Axon Malaysia Sdn. Bhd

HCL Axon Malaysia Sdn

HCL Technologies Limited.

HCL Technologies (Shanghai) Limited

HCL Mexico

HCL Japan Limited

3,059,568,242

174,011,431

160,861,768

103,487,270

91,505,540

71,999,378

60,466,061

-

267,117,618

92,098,426

-

-

13

PT HCL TECHNOLOGIES INDONESIA

NOTES TO THE FINANCIAL STATEMENTS

As of June 30, 2015 and for the year then ended

(Expressed in Rupiah, unless otherwise stated)

9. TRADE PAYABLES (continued)

Related parties (continued):

HCL Axon Solutions Kunshan

HCL (Brazil) Tecnologia

HCL Singapore Pte. Ltd

HCL Technologies (Swiss) Limited

HCL Finland

HCL America Inc.

Third parties:

PT Infotech Solutions

PT Clarus Innovace Teknologi

Others

Total

10. OTHER PAYABLES

Third parties:

PT Bank Commonwealth

Others

Total

11. ACCRUED EXPENSES

Related parties:

Consulting cost

Interest

Third parties:

Professional fees

Others

Total

2015

54,829,388

50,629,909

40,367,426

40,255,909

13,926,556

-

114,669,950

53,776,179

128,869,376

4,158,758,322

2015

186,237,442

78,880,653

265,118,095

2015

2,517,678,768

81,366,430

2014

-

-

-

-

-

265,756,563

255,105,040

-

-

940,543,708

2014

281,004,948

73,680,673

354,685,621

2014

1,432,508,468

15,371,404

595,968,660

16,379,256

3,211,393,114

334,161,449

1,000,000

1,783,041,321

12. SHORT TERM LOAN

HCL Singapore Pte. Ltd

2015

13,339,000,000

2014

8,312,500,000

On January 22, 2014, the Company entered into unsecured short-term loan facility agreement with

HCL Singapore Pte. Ltd. in amount of USD 500,000. This loan intended for the Company working capital and will be payable on demand with interest of LIBOR rate + 200 bps per annum.

On March 12, 2014, the Company amended the unsecured short-term loan facility agreement with

HCL Singapore Pte. Ltd. with amount not exceed USD 1,000,000.

14

PT HCL TECHNOLOGIES INDONESIA

NOTES TO THE FINANCIAL STATEMENTS

As of June 30, 2015 and for the year then ended

(Expressed in Rupiah, unless otherwise stated)

12. SHORT TERM LOAN (continued)

The outstanding loan as of June 30, 2015 and 2014 amounted Rp 13,339,000,000 (equivalent to

USD 1,000,000) and Rp 8,312,500,000 (equivalent to USD 700,000), respectively.

13. DEFERRED INCOME

2015 2014

Third parties:

Genting Plantations Berhad

PT Bekaert Indonesia

Misys International Banking Systems

259,016,842

18,792,078

-

277,808,920

-

36,772,271

87,079,342

123,851,613 Total

14. POST-EMPLOYMENT BENEFITS OBLIGATION

In April 2003 the Government of Republic of Indonesia issued Manpower Law No. 13/2003, regarding the settlement of work Dismissal and Determination of Separation, Appreciation and Compensation payments in companies. This law requires companies to pay their employees termination, appreciation and compensation benefits in case of employment dismissal based on the employees’ number of years of services provided the conditions set forth in the Manpower Law are met. Relative to this, as of

June 30, 2015 and 2014 the Company has recorded provision for employees’ entitlements amounting to Rp 94,559,112 and Rp 12,219,103, respectively. Management is in the opinion that such provisions can cover certain requirements of the said Manpower Law.

2015 2014

Beginning balance

Provision (reversal) during the year

Ending balance

12,219,103

82,340,009

94,559,112

20,842,604

(8,623,501)

12,219,103

15. TAXATION a. Prepaid taxes

Prepaid income tax art 23

Overpayment corporate income taxes

2012

2013

Total b. Taxes payable

Income tax article 23

Income tax article 4(2)

Value added tax

Corporate Income tax (Note 15c)

Tax provision

Total

2015

421,921,305

-

59,754,407

481,675,712

2015

3,209,762

-

558,177,421

1,117,606,577

629,622,625

2,308,616,385

2014

67,718,346

101,374,600

59,754,407

228,847,353

2014

3,085,708

5,350,571

149,714,131

23,863,637

-

182,014,047

15

PT HCL TECHNOLOGIES INDONESIA

NOTES TO THE FINANCIAL STATEMENTS

As of June 30, 2015 and for the year then ended

(Expressed in Rupiah, unless otherwise stated)

15. TAXATION (continued) c. Corporate income tax

A reconciliation between profit before income tax, as shown in the statements of comprehensive income with the estimated taxable income which were calculated by the Company for the years ended June 30, 2015 and 2014 is as follows:

2015 2014

Profit before income tax 891,878,496 214,935,662

Fiscal adjustments consisted of:

Permanent differences:

Non-deductible expenses

Timing differences:

Employee benefits

Other payable

Depreciation

Professional charges

Provision for bad debt

Total fiscal correction

Estimated taxable income for the year

Estimated taxable income for the year - rounded

Fiscal loss carried forward

Correction from prior year

Fiscal loss carried forward after correction

Total accumulated taxable income

Calculation of income tax expense and payable is as follow:

12.5% x Rp 849,153,386

25% x Rp 4,045,849,614

Prepaid taxes:

Income tax article 23

Estimated corporate income tax payables

2,369,961,907

82,340,009

(44,064,581)

(1,953,676)

276,072,896

1,320,768,094

4,003,124,659

4,895,003,155

4,895,003,000

4,895,003,000

2015

-

-

-

106,144,173

1,011,462,404

1,117,606,577

-

1,117,606,577

209,790,103

(8,623,501)

2,373,711

1,953,677

(136,579,183)

2,593,031,905

2,661,946,712

2,876,882,374

2,876,882,000

229,856,076

(2,766,417,448)

110,464,552

3,752,502

20,111,135

23,863,637

-

23,863,637

(2,996,273,524)

2014

The corporate income tax calculation for the years ended 2015 and 2014 is a preliminary estimate made for accounting purposes and is subject to revision when the Company lodges its annual corporate tax return.

16

PT HCL TECHNOLOGIES INDONESIA

NOTES TO THE FINANCIAL STATEMENTS

As of June 30, 2015 and for the year then ended

(Expressed in Rupiah, unless otherwise stated)

15. TAXATION (continued) d. Estimated deferred tax

The balances of deferred tax assets as of June 30, 2015 and 2014 are as follows:

2015

As of

June 30,

2014

Credited

(charged to)

the statement of

comprehensive

income for the year

Deferred tax assets

Employee benefits

Bonus

Provision for doubtful debts

Depreciation expense

Professional charges

Total

3,054,776

11,792,355

773,190,425

976,838

83,790,362

872,804,756

20,585,003

(11,016,145)

330,192,024

(488,419)

69,018,224

408,290,687

Deferred tax assets

Employee benefits

Bonus

Provision for doubtful debts

Depreciation expense

Professional charges

Fiscal loss

Total deferred tax assets

Valuation allowance

Total

As of

June 30,

2013

5,210,650

9,144,978

-

488,419

109,460,158

749,068,382

873,372,587

(873,372,587)

-

23,639,779

776,210

1,103,382,449

488,419

152,808,586

1,281,095,443

2014

Credited

(charged to)

the statement of

comprehensive income for the year Correction

As of

June 30,

2014

(2,155,875)

593,428

648,257,976

488,419

(34,144,796)

(691,604,362)

(78,565,210)

-

-

2,053,950

124,932,449

-

8,475,000

(57,464,020)

77,997,379

873,372,587

As of

June 30,

2015

3,054,775

11,792,356

773,190,425

976,838

83,790,362

-

872,804,756

-

872,804,756 e.

Tax assessment letter

Based on the tax assessment letter of underpayment of corporate income tax No. 00003/206/

12/012/13 dated December 17, 2013 and letter of decree No. KEP-474/WPJ.04/2015 issued by the Directorate General of Taxes Office Services, it was stated that for fiscal year 2012, the

Company’s underpayment of income tax was Rp 716,498,328. On June 9, 2015 the Company has paid of the above underpayment which was charged as tax expenses in year 2015. It also stated that the fiscal loss compensation for fiscal year 2011 and 2012 were nil. The Company recalculate the corporate income tax for fiscal year 2013 and will have impact to the underpayment of corporate income tax for fiscal year 2013 amounted Rp 247,509,825.

17

PT HCL TECHNOLOGIES INDONESIA

NOTES TO THE FINANCIAL STATEMENTS

As of June 30, 2015 and for the year then ended

(Expressed in Rupiah, unless otherwise stated)

16. CAPITAL STOCK

The composition of stockholders as of June 30, 2015 and 2014 as follows:

2015

Stockholders

Number of Percentage of

Shares ownership (%)

HCL Bermuda Limited

HCL Singapore Pte. Ltd.

990,000

10,000

1,000,000

99

1

100

Par value

8,983,260,000

90,740,000

9,074,000,000

Stockholders

HCL Bermuda Limited

HCL Singapore Pte. Ltd.

2014

Number of Percentage of

Shares ownership (%)

495,000

5,000

500,000

99

1

100

Par value

4,491,630,000

45,370,000

4,537,000,000

Based on notarial deed No.7 dated August 27, 2014 of Etty Roswitha Moelia, S.H, the Company was approved the increase of share capital issued and fully paid from Rp 4,537,000,000 (equivalent to

US$ 500,000) to Rp 9,074,000,000 (equivalent with US$ 1,000,000) consist of 1,000,000 shares with par value of Rp 9,074 per share.

17. PAID-IN CAPITAL FROM EXCHANGE RATE DIFFERENCES

The capital of the Company is stated in the articles of incorporation in both Indonesia Rupiah and

US Dollar currencies. The differences between the rate of exchange in the article of incorporation and the actual paid-in capital made by the shareholders were recorded in the paid-in capital from exchange rate differences account, as follows:

2015

US$ 500,000 of (Rp 5,863,165,000 - Rp 4,537,000,000)

Rp

Balance as of June 30, 2015

1,326,165,000

1,326,165,000

18. GENERAL RESERVE

The Limited Liability Company Law of the Republic of Indonesia No. 1/1995 introduced in March 1995 requires the establishment of a general reserve from net profits amounting to at least 20% of a company's issued and paid up capital. This regulation has been amended by Indonesian Limited

Company Law No. 40 year 2007 which also requires companies to set up a general reserve amounting to at least 20% of the issued and paid-up share capital. There is no set period of time over which this amount should be provided.

As of June 30, 2015 and 2014 the Company has not yet established a general reserve.

18

PT HCL TECHNOLOGIES INDONESIA

NOTES TO THE FINANCIAL STATEMENTS

As of June 30, 2015 and for the year then ended

(Expressed in Rupiah, unless otherwise stated)

19. REVENUE

Support and maintenance service

20. COST OF SALES

Salaries and wages

Consultancy (Note 23d)

Recruitment and training

Pension scheme contributions

Project expenses

Others

Total

21. SELLING AND MARKETING EXPENSES

Client entertainment

Marketing expenses

Total

22. GENERAL AND ADMINISTRATIVE EXPENSES

2015

27,687,909,797

2015

9,256,958,868

8,913,775,011

263,606,960

85,603,002

17,319,625

-

18,537,263,466

2015

13,598,784

-

13,598,784

2014

17,662,545,814

2014

5,256,744,147

6,941,161,016

-

28,927,966

35,326,716

312,065,460

12,574,225,305

2014

-

780,000

780,000

Rates and taxes

Profesional charges

Impairment losses (Note 4)

Travel and conveyance

Rent office premises

Communications

Others

Total

2015

2,355,833,775

1,707,436,739

1,127,658,346

1,626,670,563

532,234,930

2,056,263

396,123,666

7,748,014,282

2014

900

1,112,914,099

2,337,482,246

1.020,835,847

406,161,431

43,967,740

142,738,815

5,064,101,078

23. RELATED PARTIES TRANSACTIONS AND BALANCES

In conducting its business, the Company entered into certain business and financial transactions with its related parties.

The nature of related parties is as follows:

Related parties Nature of related parties Transactions

HCL Technologies Limited

HCL Singapore Pte. Ltd.

HCL America Inc.

HCL Axon Malaysia Sdn.

Ultimate Holding Company Consultancy fee, deferred charges,

Holding Company trade payables

Short term loans,

Affiliate

Affiliate deferred charges

Trade payables,

Trade receivables

Trade payables, consultancy fee

19

PT HCL TECHNOLOGIES INDONESIA

NOTES TO THE FINANCIAL STATEMENTS

As of June 30, 2015 and for the year then ended

(Expressed in Rupiah, unless otherwise stated)

23. RELATED PARTIES TRANSACTIONS AND BALANCES (continued)

Related parties Nature of related parties Transactions

HCL Technologies (Shanghai) Limited

HCL Technologies Holland

HCL Axon Malaysia Sdn. Bhd.

HCL Technologies Ltd. Swiss

HCL Finland

Affiliate

Affiliate

Affiliate

Affiliate

Affiliate

Trade payables, consultancy fee

Trade receivables

Trade payables, consultancy fee

Trade payables, consultancy fee

Trade payables, consultancy fee

HCL Japan Limited

HCL Axon Solutions Kunshan

HCL (Brazil) Tecnologia

HCL Mexico

HCL Comnet Limited

HCL Holland

These transactions and balances are as follows:

Affiliate

Affiliate

Affiliate

Affiliate

Affiliate

Affiliate

Trade payables, consultancy fee

Trade payables, consultancy fee

Trade payables, consultancy fee

Trade payables, consultancy fee

Trade payables, consultancy fee

Trade payables, consultancy fee a. Trade receivables to related parties as of June 30, 2015 and 2014 consist of (Note 4):

2015 2014

HCL America Inc.

HCL Technologies Limited

HCL Technologies Holland

1,980,108

-

-

1,980,108

222,994

23,750,000

434,999

24,407,993 b. Unbilled receivable to related parties as of June 30, 2015 and 2014 consist of (Note 5):

2015 2014

HCL America Inc. 652,279 222,994 c. Trade payables to related parties as of June 30, 2015 and 2014 consist of (Note 9):

2015

HCL Axon Malaysia Sdn. Bhd.

HCL Axon Malaysia Sdn.

HCL Technologies Limited

HCL Technologies (Shanghai) Limited

HCL Mexico

HCL Japan Limited

HCL Axon Solutions Kunshan

HCL (Brazil) Tecnologia

HCL Singapore Pte. Ltd.

3,059,568,242

174,011,431

160,861,768

103,487,270

91,505,540

71,999,378

54,829,388

50,629,909

40,367,426

2014

60,466,061

-

267,117,618

92,098,426

-

-

-

-

-

20

PT HCL TECHNOLOGIES INDONESIA

NOTES TO THE FINANCIAL STATEMENTS

As of June 30, 2015 and for the year then ended

(Expressed in Rupiah, unless otherwise stated)

23. RELATED PARTIES TRANSACTIONS AND BALANCES (continued) c. Trade payables to related parties as of June 30, 2015 and 2014 consist of (Note 9) (continued):

2015 2014

HCL Technologies Ltd. Swiss

HCL Finland

HCL America Inc.

Total

40,255,909

13,926,556

-

3,861,442,817

-

-

265,756,563

685,438,668 d. Consultancy fees to related party for the year ended June 30, 2015 and 2014 consist of (Note 19):

2015 2014

HCL Technologies Limited

HCL Axon Malaysia Sdn. Bhd.

HCL Axon Malaysia Sdn.

HCL Mexico

HCL Japan Limited

HCL Axon Solutions Kunshan

HCL (Brazil) Tecnologia

HCL Singapore Pte. Ltd.

HCL Technologies (Shanghai) Limited

HCL Comnet Limited

4,088,661,725

3,907,751,494

645,567,124

84,981,680

71,702,921

54,829,388

46,261,138

14,019,541

-

-

6,697,543,651

93,332,663

-

-

-

-

-

-

92,098,426

58,186,276

Total 8,913,775,011 6,941,161,016

Consultancy fee to HCL Technologies Limited is management fee paid by the Company based on

Master Service Agreement dated July 1, 2011. On the agreement, HCL Technologies Limited and the Company agreed to perform all services and to undertake obligations. This agreement shall deemed to have taken effect from the effective date of July 1, 2011 and shall continue thereafter until terminate at any time by both parties. e. Accrued expense to related party as of June 30, 2015 and 2014 consist of (Note 11):

2015 2014

HCL Technologies Limited

HCL Axon Malaysia Sdn. Bhd.

Total

2,386,584,801

131,093,967

2,517,678,768

1,432,508,468

15,371,404

1,447,879,872 f. Short term loan to related party as of June 30, 2015 and 2014 consist of (Note 12):

2015

HCL Singapore Pte. Ltd. 13,339,000,000

2014

8,312,500,000

21

PT HCL TECHNOLOGIES INDONESIA

NOTES TO THE FINANCIAL STATEMENTS

As of June 30, 2015 and for the year then ended

(Expressed in Rupiah, unless otherwise stated)

24. RISK MANAGEMENT OBJECTIVES AND POLICIES

Financial Risk Management Objectives and Policies

Risk management is integral to the whole business of the Company. The Company has a system of controls in place to create an acceptable balance between the cost of risks occurring and the cost of managing the risks. The management continually monitors the Company's risk management process to ensure that an appropriate balance between risk and control is achieved. Risk management policies and systems are reviewed regularly to reflect changes in market conditions and the Company's activities.

The Company has exposure to the followong risks from its use of financial instruments:

Liquidity Risk

The Company monitors its liquidity risk and maintains a level of cash deemed adequate by management to finance the Company's operations and to mitigate the effects of fluctuations in cashflows.

The Company's trade and other payables and accrued expenses are due within one year from the statement of financial position date.

Credit Risk

Credit risk is the risk that one party to a financial instrument will fail to discharge an obligation and cause the other party to incur a financial loss.

The Company has a credit policy in place and the exposure to credit risk is monitored on an ongoing basis. Cash is placed with reputable banks. The maximum exposure to credit risk is represented by the carrying amount of each financial asset as indicated in the statement of financial position.

The maximum exposure to credit risk as of June 30, 2015 and 2014 are as follows:

2015 2014

Cash and cash equivalents

Trade receivables

Unbilled receivables

Other receivables

Security deposits - short term

Total

4,661,560,075

12,873,126,871

10,182,116,784

33,836,124

87,520,888

27,838,160,742

327,854,021

9,187,215,834

1,989,843,808

278,354,425

78,163,000

11,861,431,088

The Company continuously monitors defaults of customers and other counterparties, identified either individually or by group, and incorporate this information into its credit risk controls. Where available at reasonable cost, external credit ratings and/or reports on customers and other counterparties are obtained and used. The Company's policy is to deal only with creditworthy counterparties.

Market Risk

Market risk is the risk that changes in market prices, such as interest rates and foreign exchange rates, will affect the Company's income or the value of its holdings of financial instruments. The objective of market risk management is to manage and control market risk exposures within acceptable parameters, while optimizing the return.

22

PT HCL TECHNOLOGIES INDONESIA

NOTES TO THE FINANCIAL STATEMENTS

As of June 30, 2015 and for the year then ended

(Expressed in Rupiah, unless otherwise stated)

24. RISK MANAGEMENT OBJECTIVES AND POLICIES (continued)

Financial Risk Management Objectives and Policies (continued)

Foreign Exchange Risk

Risk of exchange rate against foreign currencies is a risk of fair value or future cash flows of financial instruments fluctuate due to changes in foreign currency exchange rates. Severity of risk is the risk tolerance value which is quite dominant.

At this risk, the Company does not manage the impact of risk. The Company is optimistic that domestic economic conditions will continue to improve to incline with appreciated Rupiah.

Major monetary assets and monetary liabilities in foreign currencies, as of June 30, 2015 and 2014 are as follows:

June 30, 2015

AUD CHF CNY EUR INR JPY MYR SGD USD Total

Major monetary

assets in foreign

currencies

Trade receivables

Other receivables

-

30

30

-

-

-

-

-

-

-

-

-

-

5,789

5,789

-

-

-

-

7,365

7,365

-

-

815,354

200,031

- 1,015,385

815,354

213,215

1,028,569

Major monetary

liabilities in foreign

currencies

Trade payables

Other payables

Short term loan

-

-

-

-

2,811

-

-

2,811

73,598

-

-

73,598

937

12,741

-

13,678

5,789

-

-

5,789

658,792

-

-

658,792

50,679

37,083

-

87,762

1,414

-

16,687

225,637

- 1,000,000

1,414 1,242,324

810,707

275,461

1,000,000

2,086,168

Excess of assets

(liabilities)

denominated in

foreign currencies 30

Major monetary assets in foreign currencies

Trade receivables

Other receivables

Major monetary liabilities in foreign currencies

Trade payables

Other payables

Excess of assets (liabilities) denominated in foreign currencies

Fair value risk

(2,811)

AUD

40

-

40

28,131

10

28,141

(28,101)

(73,598)

CNY

(13,678)

-

-

-

50,609

-

50,609

(50,609 )

EUR

- (658,792)

June 30, 2014

27

-

27

-

27

27

-

MYR

(80,397)

-

-

-

25,401

-

25,401

(25,401)

(1,414)

USD

(226,939) (1,057,599)

185,936

3,152

189,088

176,550

710,126

886,676

(697,588)

Total

186,003

3,152

189,155

280,691

710,163

990,854

(801,699)

The fair value of the financial assets and liabilities are included at the amount at which instrument could be exchanged in a current transaction between willing parties, other than in a forced liquidation or sale. The carrying amounts of trade, unbilled and other receivables, cash and cash equivalents, trade and other payables, accrued expenses and short term loans approximate their fair values due to their short-term nature.

23

PT HCL TECHNOLOGIES INDONESIA

NOTES TO THE FINANCIAL STATEMENTS

As of June 30, 2015 and for the year then ended

(Expressed in Rupiah, unless otherwise stated)

24. RISK MANAGEMENT OBJECTIVES AND POLICIES (continued)

Financial Risk Management Objectives and Policies (continued)

Capital management

The primary objective of the Company's capital management is to ensure that it maintains healthy capital ratios in order to support its business and maximize shareholders' value. The Company manages its capital structure and makes alignment to it, in light of changes in economic conditions.

25. ACCUMULATED DEFICIT

The accumulated deficit amounted to Rp 3,923,473,549 and Rp 3,142,028,002 as at June 30, 2015 and 2014, respectively, was due to the operating losses incurred by the Company.

HCL Bermuda Limited., the Company’s majority shareholder shall continue to provide financial support to the Company to enable the Company to continue to operate as a going concern entity.

26. SUPPLEMENTARY INFORMATION FOR STATEMENT OF CASH FLOWS

2015 2014

Reclassification of fixed assets to prepaid taxes

27. PREPARATION AND COMPLETION OF THE FINANCIAL STATEMENTS

- 269,857

The Company's managements are responsible for the content and preparation of these financial statements that were completed and authorized to be issued by the Board of Director on

September 23, 2015.

24