1999 Annual Report - Barrick Gold Corporation

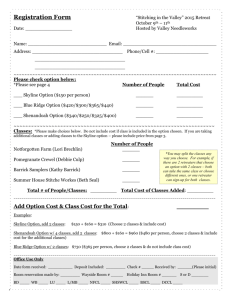

advertisement