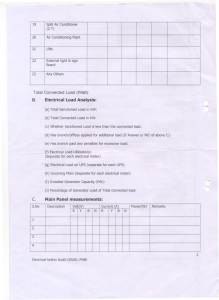

philippine national bank sec form 20-is information

advertisement