The People's Republic of China:

Merger Control under the

Anti-Monopoly Law

Further information

If you would like further information on any aspect of

our competition law practice in China please contact

a person mentioned below or the person with whom

you usually deal.

Contact

Shanghai

Andrew McGinty

T +86 21 6138 1688

andrew.mcginty@lovells.com

Kirstie Nicholson

T +86 21 6138 1688

kirstie.nicholson@lovells.com

June 2009

This note is written as a general guide only. It

should not be relied upon as a substitute for specific

legal advice.

Contents

1

OVERVIEW

1

2

NOTIFIABLE CONCENTRATIONS

2

3

PROCEDURE

4

4

PENALTIES

5

5

OVERVIEW OF FURTHER GUIDANCE AVAILABLE

5

6

MERGER CASES

5

7

COMMENTS

7

8

AML-RELATED DOCUMENTS

8

Lovells

Lovells Competition

1

The People's Republic of China: Merger Control Under the AML

1.

OVERVIEW

•

The People’s Republic of China AntiMonopoly Law (the "AML"), which came

into effect on 1 August 2008, requires

that transactions which qualify as

“concentrations” and which reach

certain defined thresholds must be

notified to the Anti-Monopoly Law

Enforcement Agency (the "AMEA").

The AML itself does not define the

relevant thresholds, which are

contained in the Implementing

Regulations on the Notification of

Concentrations of Business Operators

(the "Implementing Regulations on

Concentrations") adopted by the State

Council of the People's Republic of

China on 3 August 2008. Whilst the

Implementing Regulations on

Concentrations provide very little further

guidance on the interpretation of these

thresholds, MOFCOM has recently

published some further guidance

relating to the AML merger control

regime. The full list of further guidance

is set out in Annex 1.

On 18 November 2008, the Ministry of

Commerce ("MOFCOM") (the AMEA

body responsible for merger control

clearances under the AML) published

its first conditional approval decision

under the AML relating to the proposed

acquisition by InBev of Anheuser Busch

(the "InBev Case"). On 18 March

2009, MOFCOM published its first

prohibition decision under the AML,

which related to the proposed

acquisition by Coca-Cola Corporation of

Huiyuan Juice (the "Coca-Cola Case").

On 23 April 2009, MOFCOM published

its second conditional approval

decision, which related to the

acquisition of Lucite International Group

Limited by Mitsubishi Rayon Co., Ltd.

(the "Mitsubishi Case").

Practical implications of the notification

requirements under the AML include:

Mandatory notification and

suspension: notifiable transactions

must be notified to the AMEA and

cannot be implemented prior to

MOFCOM clearance, which may

be express or tacit once the

statutory deadlines for clearance

have passed.

•

Pre-notification: where the

concentration must be notified, the

Business Operators concerned are

recommended to file an advance

draft notification with the AMEA for

discussion (in practice, this is likely

always to be required).

•

Derogation from the obligation

to notify: there is no express

provision for any general

derogation from the obligation to

notify a concentration falling within

the thresholds. However, the AML

provides for certain specific

circumstances which will not be

considered a notifiable

concentration (see Notifiable

Concentrations below).

•

Waiting periods: the AMEA has

30 days from the date on which the

notification is declared complete to

conduct a preliminary examination

of the concentration, make a

decision on whether to conduct a

further examination and notify such

decision to the relevant Business

Operators. If the AMEA decides to

conduct a further examination, it

has an additional 90 days in which

to take a final decision, although in

certain circumstances the AMEA

may extend this period by up to a

total of a further 60 days. Whilst

this is not clear in the AML,

MOFCOM has informally indicated

that the periods refer to “working

days”; although in its published

decisions so far, MOFCOM has

appeared to apply calendar days. If

the AMEA fails to make a decision

before the expiry of the relevant

time limit, the transaction is

deemed cleared and the Business

Operators are permitted to

implement the concentration.

•

Notification documents: Business

Operators need to start assembling

the required documents and

information at an early stage.

Failure to provide complete

information may delay the start of

the formal merger clearance

process while MOFCOM requests

further information.

•

Substantive appraisal: a

concentration’s compatibility with

the AML is appraised according to

whether or not it will, or may have,

the effect of eliminating or

restricting competition.

•

Conditions: the AMEA may

impose conditions on a nonprohibited concentration of

Business Operators in order to

reduce the harmful impact of such

concentration on competition in the

relevant market(s). As set out in

further detail below, MOFCOM has

already adopted two conditional

approval decisions (namely, in the

InBev and Mitsubishi Cases).

•

Sanctions: where prior clearance

is not obtained for a transaction,

the AMEA may order the

termination of implementation of

the concentration, the disposal of

the shares or assets involved in the

concentration, the transfer of the

business and/or impose fines of up

to RMB 500,000.

•

Allocation of resources: Business

Operators involved in a transaction

need to ensure that adequate time

Lovells Competition

and resources are allocated to

consideration of the applicability of

the notification requirements of the

AML, the collection of documents

and other required information, and

also to dealing with any follow-up

action required under the relevant

procedures. Our experience tells

us that the amount of time and

effort needed is frequently

underestimated by the Business

Operators in question.

•

2.

Joint-ventures: whether the

establishment of a joint venture

may constitute a notifiable

concentration is not addressed by

either the AML or the Implementing

Regulations on Concentrations.

However, in March 2009, in the

Revised Draft Provisional

Measures Relating to the

Notification of Concentrations of

Business Operators ("Revised

Draft Notification of

Concentrations Guidance")

issued by MOFCOM for the second

round of public consultation, it is

indicated that the establishment of

a full-function joint venture by two

or more Business Operators which

reaches the notification thresholds

does constitute a notifiable

concentration.

NOTIFIABLE CONCENTRATIONS

2.1 Concentration

The AML and the Implementing

Regulations on Concentrations indicate

that the following will be considered a

“concentration”:

•

a merger between Business

Operators;

•

the acquisition of control over

another Business Operator by

means of equity or asset purchase;

2

•

the acquisition of controlling rights

or decisive influence over another

Business Operator by means of

contract or any other means.

The Revised Draft Notification of

Concentrations Guidance provides

further guidance on the concept of

"obtaining control over other Business

Operators", as follows:

(i)

"acquiring 50% or more of the

shares carrying voting rights or

assets of another business

operator; and

(ii) despite not acquiring 50% or more

of the shares carrying voting rights

or assets of another business

operator, obtaining the ability to

decide on the appointment of one

or more members of the board of

directors and the appointment of

the core management personnel,

the financial budget, sales and

operations, pricing, major

investments and other important

management and operational

decisions and so forth in relation to

such other business operator by

means of acquiring shares or

assets, as well as by contractual or

other such means. All of the aforementioned factors must be taken

into account when determining

whether or not a party obtains

control over other business

operators. However, the veto rights

granted to medium and small

shareholders for the purpose of

protecting the interests and rights of

such shareholders with regard to

matters including amending the

Articles of Association, capital

increase and decrease and

liquidation shall not be deemed to

confer control".

Paragraph (ii) above is of particular

application to the situation of a minority

shareholder. It appears that, in such

circumstances, in determining the

existence of control, MOFCOM will take

account of all the above-mentioned

factors, none of which is decisive. It is

not, however, clear whether the

existence of any single one of the listed

factors will be sufficient to confer joint

control on a minority shareholder.

The AML also provides for certain

circumstances in respect of which a

concentration will not be notifiable,

namely:

•

where one of the Business

Operators owns 50% or more of

the voting shares/assets of each of

the other Business Operators

involved in the concentration; and

•

where 50% of more of the voting

shares/assets of each Business

Operator involved in the

concentration are owned by

another Business Operator not

involved in the concentration.

In summary, therefore, the AML merger

control provisions will not apply to intragroup re-organisations.

Significantly, the Revised Draft

Notification of Concentrations Guidance

also introduces into Chinese merger

control, for the first time, the concept of

"full-function" joint ventures and

confirms that these will be considered a

"concentration". It provides that "where

two or more business operators

("Parent Companies") jointly establish

a new independent entity which

operates on a continuous basis, the

newly established enterprise will be

regarded as a concentration of business

operators as referred to in Article 20 of

the AML, except for any special

purpose entity which merely serves

certain functions such as research and

development, sales or manufacturing

certain products for the Parent

Lovells Competition

Companies". The proposed definition

of a "full function" joint venture is,

therefore, similar to that used by the EC

Commission pursuant to the EC Merger

Regulation. It is not clear whether all

full function joint ventures that meet the

thresholds will be notifiable, or whether

there is also a requirement of "joint

control" by the parents. Although the

Revised Draft Notification of

Concentrations Guidance is not yet final

and has not yet became effective, its

provisions do send a clear signal that

the merger control provisions of the

AML are intended to cover the

establishment of a full function joint

venture (indeed, the application of the

AML merger control provisions to joint

ventures has been confirmed informally

on a number of occasions in comments

made by various MOFCOM officials). It

is unclear at the time of writing when

the final version of the Revised Draft

Notification of Concentrations Guidance

will become available.

2.2 Notification Thresholds

A concentration will only be notifiable

where the relevant thresholds are

satisfied.

3

financial year is in excess of RMB 2

billion, and there are at least two

Business Operators each of whom

have turnover in China for the

preceding financial year in excess

of RMB 400 million.

In cases falling outside these

thresholds, the AMEA may still

investigate where the facts and

evidence show that the concentration

has, or may have, the effect of

eliminating or restricting competition.

This wide residual power has raised

some concerns, in particular about

giving MOFCOM the right to selectively

pursue investigations into transactions

based on non-competition law

concerns. However, earlier this year,

MOFCOM published for public

consultation further draft guidance on

the procedures for the investigation of

concentrations of business operators

which do not reach the notification

thresholds, but which are suspected of

having, or of being likely to have, the

effect of excluding or restricting

competition. We are not aware of any

cases where MOFCOM has exercised

this power to date.

2.3 Calculation of turnover

The jurisdictional thresholds for the

notification of concentrations are set out

in the Implementing Regulations on

Concentrations, as follows:

•

•

the aggregate global turnover of all

Business Operators to the

concentration for the preceding

financial year is in excess of RMB

10 billion, and there are at least

two Business Operators each of

whom have turnover in China for

the preceding financial year in

excess of RMB 400 million;

the aggregate turnover in China of

all Business Operators to the

concentration for the preceding

The Implementing Regulations on

Concentrations contain virtually no

guidance on the calculation of turnover

for the purpose of the thresholds.

However, the Revised Draft Notification

of Concentrations Guidance does

contain further guidance on the

calculation of turnover for the purposes

of the application of the jurisdictional

thresholds. In summary, "turnover"

includes the income of the relevant

Business Operators derived from the

sales of products and the provision of

services for the preceding financial

year, after deducting all kinds of taxes

and penalties; enterprise income tax

and value added tax cannot be

deducted from such income.

Significantly, it has now also been

confirmed that, where the concentration

of Business Operators includes the

acquisition of part of one or more

Business Operators, as far as the seller

is concerned, only the turnover relating

to the part involved in the concentration

will be relevant.

Generally, with the exception of the

seller, as described above, it will be the

turnover of the whole group to which the

parties belong that will be relevant for

determining whether the merger control

thresholds have been reached. In

particular, the turnover of any individual

Business Operator involved in the

concentration shall include the

aggregate of the turnover of each of the

following:

(a) the individual Business Operator in

question;

(b) other Business Operators directly

or indirectly controlled by the

Business Operator referred to in

item (a) above;

(c) other Business Operators directly

or indirectly controlling the

Business Operator referred to in

item (a) above;

(d) other Business Operators directly

or indirectly controlled by the

Business Operators referred to in

item (c) above;

(e) other Business Operators jointly

controlled by two or more of the

Business Operators referred to in

items (a) to (d) above.

The turnover of any individual Business

Operator involved in the concentration

does not include any turnover derived

from activities between the Business

Lovells Competition

Operators referred to in items (a) to (e)

above.

4

3.

PROCEDURE

3.1 Notification

Accordingly, based on the above, in

respect of a joint venture company, the

turnover of all controlling shareholders

will also be relevant.

When notifying a concentration to the

AMEA, a Business Operator must

submit the following documents:

Further, where there are other Business

Operators jointly controlled by any of

the individual Business Operators

involved in the concentration, special

provisions apply in order to prevent

"double-counting" of turnover, namely:

•

(i)

•

The aggregate turnover of all

Business Operators involved in the

concentration shall not include any

turnover derived from activities

between any jointly controlled

Business Operator and any other

Business Operator involved in the

concentration which controls such

jointly controlled Business

Operator, or any turnover derived

from activities between Business

Operators which control any such

jointly controlled Business

Operator;

(ii) The aggregate turnover of all

Business Operators involved in the

concentration shall include turnover

that is derived from activities

between any jointly controlled

Business Operator and third

parties, and shall be equally divided

between the Business Operators

involved in the concentration which

control any jointly controlled

Business Operator.

the notification form, containing the

names of the Business Operators

involved in the concentration, their

addresses, business scopes and

the date on which the concentration

is to be implemented;

an explanation of the effects of the

concentration on the relevant

market(s);

•

the underlying agreements relating

to the concentration;

•

the audited financial and

accounting reports for the previous

fiscal year of the Business

Operators involved in the

concentration; and

•

other documents and materials

required by the AMEA.

The applicant should prepare the

notification materials in accordance with

the Guidance Opinion on the

Documents and Materials required for

Concentration Notifications, together

with the Notification Form (the

"Documentary Guidance Opinion")

which contains further information about

the documents and materials that must

be submitted, and also the Notification

Form which may be completed for the

notification.

3.2 AMEA examination

Once the set of notification documents

has been declared complete by the

AMEA, the AMEA has 30 days in which

to conduct its preliminary examination

of the concentration and an additional

90 days within which to carry out further

investigations. If the AMEA decides to

conduct a further examination, it may

extend the timetable by up to a further

60 days.

If the AMEA fails to make a decision

within the above time limits, the

concentration is deemed cleared and

the Business Operators may implement

the concentration.

When examining the concentration, the

AMEA will take into account the

following factors:

the relevant market share(s) of the

Business Operators in, and any ability

to exercise power over, the relevant

market(s);

•

the degree of concentration within

the relevant market(s);

•

the impact of the concentration on

market access and technological

advancement;

•

the impact of the concentration on

consumers and other relevant

Business Operators;

•

the impact of the concentration on

national economic development;

•

any other factors that may affect

competition on the relevant

market(s).

If a foreign investor participates in a

concentration that involves

considerations of national security (e.g.

involves a strategic or sensitive sector

or products with a military application),

the AMEA may conduct a further,

separate, examination on the basis of

such national security. The process for

this examination is opaque.

Lovells Competition

3.3 Decisions of the AMEA

The AMEA may decide to approve the

notified concentration. It can also

authorise the concentration but impose

restrictive conditions on it in order to

reduce any harmful impact on

competition. Where the notified

concentration is likely to have the effect

of excluding or restricting competition,

the AMEA must issue a ruling to prohibit

such concentration. However, the

AMEA is entitled to rule against

prohibiting a concentration which is

potentially harmful to competition if the

Business Operator is able to prove

either that:

•

•

the beneficial impacts on

competition resulting from the

concentration clearly outweigh the

harmful impacts; or

the concentration complies with the

public interest requirements.

Accordingly, if the Business Operator

can prove one of the above mentioned

conditions (no details are available

about the type or standard of proof that

must be submitted), the AMEA may, in

its discretion, decide not to prohibit the

concentration.

4.

PENALTIES

If a concentration is implemented

contrary to the AML or prior to the

AMEA’s decision, the AMEA may:

•

order the termination of the

implementation of the

concentration;

•

order the disposal of relevant

shares/assets;

•

order the transfer of the relevant

business;

5

•

order any other measures

necessary to restore the status quo

prior to the concentration;

•

impose a fine of up to RMB

500,000.

5.

OVERVIEW OF FURTHER

GUIDANCE AVAILABLE

On 7 January 2009, MOFCOM

published various documents containing

further practical guidance on the

notification of concentrations, namely:

•

Guidelines for Anti-Monopoly

Investigations into Concentrations

of Business Operators

•

Flow chart for Anti-Monopoly

Investigations into Concentrations

of Business Operators

•

Guidance Opinion on

Concentration Notifications

•

Guidance Opinion on the

Documents and Materials required

for Concentration Notifications,

together with the Notification Form

MOFCOM followed the above guidance

with the publication of a number of

additional draft documents for public

consultation. This included guidance on

some of the key outstanding issues

relating to the AML merger control

process, such as market definition, the

review of transactions not meeting the

turnover thresholds, the calculation of

turnover, application of the merger filing

provisions to joint ventures and the

rights of the parties to defend

themselves.

6.

MERGER CASES

MOFCOM has so far published only

three decisions relating to AML merger

control. Details of these are set out

below, as they provide some further

guidance on the practical application of

the AML merger control regime by

MOFCOM.

It should be noted that MOFCOM is

only obliged to publish its prohibition

and conditional clearance decisions (i.e.

not its unconditional clearance

decisions).

6.1 InBev case

This case relates to the proposed global

acquisition of Anheuser Busch by

InBev. This was MOFCOM's first

published decision under the AML

merger filing provisions. It was also the

first case in which MOFCOM imposed

conditions on a transaction. After

carrying out its examination, MOFCOM

found that the InBev Case would not

have the effect of excluding or

restricting competition on the market for

beer in China and, therefore, issued a

clearance decision. This is the only

indication that we have about

MOFCOM's findings in relation to the

relevant market in this case;

interestingly, MOFCOM seems to have

accepted both a wide product market

(including all beer) and a wide

geographic market (including the whole

of China).

However, despite finding that the

proposed transaction would not

adversely affect competition in the

relevant market, MOFCOM somewhat

surprisingly nonetheless imposed

restrictive conditions on the parties

relating to future acquisitions of

additional shares in certain Chinese

beer companies by the merged

Lovells Competition

company, in order to reduce any future

negative impact on competition.

The decision is very short and contains

no details about MOFCOM’s

investigation, analysis or reasoning.

Generally, it is somewhat disappointing

that MOFCOM did not take the

opportunity to publish more details

about its review process and the factors

that led it to impose conditions on the

parties to the transaction, and how it

arrived at the choice of conditions it

finally imposed.

6.2 Coca-Cola/Huiyuan case

The second, and certainly the most

controversial case so far, relates to

Coca-Cola's proposed acquisition of

Huiyuan Juice.

Coca-Cola had announced its intention

to acquire Huiyuan, a Hong Kong listed,

China-based producer of fruit juices in

September 2008. The proposed

transaction was controversial from the

start, sparking criticism in China about

the sale of one of the country’s bestknown brands to “foreigners” and

numerous reports of intense lobbying of

MOFCOM by third party Chinese juice

manufacturers opposed to the bid.

The proposed transaction was subject

to merger review under the AML and

was duly notified to MOFCOM. After an

in-depth investigation, MOFCOM finally

adopted and published its decision

prohibiting the proposed transaction.

In common with its InBev decision,

MOFCOM’s Coca-Cola decision is

relatively short and lacking in detail

about MOFCOM's investigation and

analytical processes, as well as the

underlying reasoning for its decision;

much of the text simply describes the

procedural process. (By way of

comparison, the last prohibition decision

6

adopted by the EC Commission was in

2007 relating to the Ryanair/Aer Lingus

case (Case No COMP/M.4439), and

was over 500 pages long!) The

decision does include a brief summary

of MOFCOM’s key concerns, including

the risk that, following the transaction,

Coca-Cola might abuse its dominant

position in the carbonated drinks

industry by imposing bundled sales of

juice drinks on retailers/distributors, or

by imposing other restrictive trading

conditions on third parties, which would

restrict competition in the market for

juice drinks. Interestingly, the decision

also confirms that MOFCOM entered

into negotiations with Coca-Cola in

respect of possible remedies to deal

with the competition concerns raised;

ultimately the conditions offered were

considered insufficient to satisfy

MOFCOM’s concerns (no details of the

proposed conditions have been made

public).

Although the decision indicates that

competition-based reasons led to the

prohibition decision, the lack of detail

and reasoning have led to suspicions

that non-competition-related, political

and policy-based reasons also played a

role. There are also question marks

about the logic behind such reasoning

as is provided: for example, any future

abuse of a dominant position by CocaCola could have been dealt with under

the existing law by the initiation of an

investigation by the AMEA under

Chapter 3 of the AML (i.e. the

prohibition on the abuse of a dominant

position), and the imposition of

appropriate penalties.

In response to criticism about the lack

of detail in its decision, on 24 March

2009, a MOFCOM spokesperson

provided further details about the

decision in the Coca-Cola case in an

official interview with the media (the

"Interview") (a report of the Interview

was published by MOFCOM the

following day). The Interview provided

some interesting further information, in

particular, MOFCOM clarified that the

relevant product markets involved in the

Coca-Cola Case included two separate,

but related, markets within the market

for non-alcoholic beverages, namely:

fruit juice drinks and carbonated drinks.

This is the first time that MOFCOM has

provided details of its analysis of the

definition of the relevant market in an

AML merger review case.

Both Coca-Cola and Huiyuan have

subsequently announced that they

respect MOFCOM's decision, and so

any appeal now seems unlikely.

6.3 Mitsubishi Case

On 23 April 2009, MOFCOM issued a

decision clearing the Mitsubishi Case

subject to a number of substantive

conditions intended to remedy

competition concerns MOFCOM had

identified in relation to certain relevant

chemicals markets in China.

After examining the proposed

transaction, MOFCOM concluded that it

would result in an adverse impact on

competition on the market for MMA. In

particular, the market share of the

merged company would be 64% in

China, which would enable it to exclude

and/or restrict competition in the

Chinese MMA market. Furthermore,

since Mitsubishi is active in both the

MMA market and two downstream

markets, MOFCOM concluded that after

completion of the proposed transaction

the merged company would also be

capable of vertically foreclosing

competition on downstream markets

through its dominant market position in

the upstream market for MMA.

In order to lessen the potential adverse

impact of the proposed transaction,

Lovells Competition

MOFCOM entered into negotiations

with the parties to determine whether

steps could be taken to address the

competition concerns identified.

The conditions imposed on the parties

in this case are more sophisticated than

those imposed in the InBev Case and

are as follows:

(a) Capacity divestment: Lucite must

divest upfront 50% of its annual

MMA production capacity to one or

more unaffiliated third party

purchasers for a period of five

years. If the divestment is not

completed within the time limit,

MOFCOM will appoint an

independent trustee to sell off

Lucite China's entire stake to an

independent third party. The

divestment must be completed

within six months from the date of

closing of the Proposed

Transaction, a period which may be

extended by MOFCOM for another

six months at the request of Lucite

China.

(b) Independent operation of Lucite

China until completion of

capacity divestment: Lucite China

and the MMA business of

Mitsubishi in China must be

operated separately, with an

independent management team

and board membership during the

period from the closing of the

Proposed Transaction to the

completion of the capacity

divestment. During the independent

operation period, both parties shall

continue to sell MMA in competition

with each other in China. All

exchanges of pricing, customer or

other commercially sensitive

information during this period will

be prohibited and will be punishable

by the imposition of fines.

7

(c) No further acquisitions or new

plants in China within next five

years: Without the prior approval of

MOFCOM, for a period of five years

from the closing of the proposed

transaction, the merged company

must not acquire or build any

manufacturer of MMA monomer,

PMMA polymer or cast sheet in

China.

This is the first MOFCOM decision

requiring parties to divest any

production capacity as a condition of

approval under the AML. The structure

of the conditions is, however, somewhat

ambiguous; in particular, how is it

possible to divest capacity for only 5

years? Does this mean that what is

envisaged is actually closer to a

licensing, or leasing, or outsourcing

arrangement? No reasons as to why a

temporary divestment was chosen are

provided in the decision.

The willingness by MOFCOM in this

case to adopt relatively complex and

flexible undertakings to remedy

competition concerns can be

considered an indication that MOFCOM

is already becoming more sophisticated

in its decisions. In particular, the

imposition of a temporary (five year)

divestment is interesting in that it falls

short of an outright divestment of assets

whilst, at the same time, the structure of

the conditions also provides MOFCOM

with the fall-back solution of an outright

divestment should the temporary

divestment not be completed as agreed.

However, the publication of the relevant

deadlines is somewhat unfortunate for

the parties to the transaction: it clearly

puts the parties at a commercial

disadvantage in the negotiation of the

divestment of part of the capacity to a

potential third party purchaser, because

as the deadline comes closer, it may

become something of a "fire sale".

In terms of procedure, MOFCOM

officially accepted the notification

approximately only one month after the

initial submission: this is a relatively

short pre-notification period, particularly

in a case that raised competition

concerns. Further, the decision

indicates that MOFCOM initiated its indepth review on 20 February 2009,

following the expiry of the preliminary

review period. This timing is interesting

as, in common with its other published

AML decisions, it appears that

MOFCOM used calendar (rather than

working) days for the calculation of the

relevant deadline. MOFCOM also

completed its in-depth review on 20

May 2009, well within the statutory

deadline, thus confirming that

MOFCOM can, and will, issue an early

decision where appropriate. This

relatively speedy procedure by

MOFCOM may be considered good

news for parties to a transaction subject

to a tight commercial timetable.

7.

COMMENTS

The AML has only been in force since

August 2008, and it would be unrealistic

to expect all aspects of its application to

be clear in such a relatively short space

of time; this period represents only the

first few steps of what is likely to be a

long march in the development of a

comprehensive competition law in

China. It is therefore, not surprising that

many questions remain about the

practical implementation of AML merger

control. What is clear is that the merger

control regime in China cannot be

ignored by multinationals.

The further guidance recently published

by MOFCOM is very much welcomed,

as this provides business operators with

greater certainty. The publication of

some of the guidance in draft for public

consultation is also a positive

development, as it gives investors an

Lovells Competition

opportunity to comment on and

(hopefully) change the trajectory of

potentially onerous or problematic

provisions.

As for MOFCOM's recent merger

control decisions, these send a

somewhat mixed message to potential

foreign investors in China, particularly at

a time when foreign investment in China

is actually declining. What is clear is

that international companies looking to

acquire Chinese companies, or

international companies with sales into

or a presence in, the Chinese market

will need to consider the potential

application of the AML merger control

provisions at an early stage of their

transaction and, where necessary, enter

into a dialogue with MOFCOM as soon

as practical to ensure that the merger

notification process progresses as

rapidly and efficiently as possible. It will

also be important to gauge the political

and policy waters in relation to any

potential acquisition, as it now appears

that despite spirited denials by

MOFCOM, this is an issue (as it is

overtly also in other international

jurisdictions) that foreign investors

ignore at their peril, particularly when a

foreign investor is seeking to make an

acquisition of a famous brand or in a

sensitive industry in China.

8.

AML-RELATED DOCUMENTS

We have prepared an English

translation of all the AML-related

documents mentioned in this Note,

which can be provided on request.

The original Chinese version of the

documents published by MOFCOM can

be found on MOFCOM's website at

http://fldj.mofcom.gov.cn/zcfb/zcfb.html.

The original Chinese version of the AML

and the Implementing Regulations of

Concentrations can be found on

8

MOFCOM's website at

http://fldj.mofcom.gov.cn/c/c.html.

Lovells Competition

9

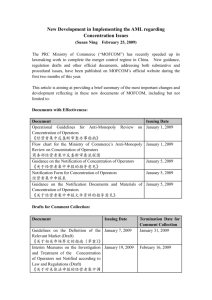

ANNEX 1

List of further guidance published by MOFCOM

Further guidance

Guidelines for anti-monopoly investigations into concentrations of Business Operators (7 January 2009)

Contains further practical details relating to the notification process for concentrations that meet any of the relevant

jurisdictional thresholds and which must therefore be notified to MOFCOM.

Flow chart for anti-monopoly investigations of concentrations of Business Operators (7 January 2009)

Summarises in diagram form the procedures as set out in the above Guidelines for Anti-Monopoly Investigations into

Concentrations of Business Operators.

Guidelines for the notification of concentrations of Business Operators (7 January 2009)

Contains further guidance on the filing process, including confirmation of the filing party(ies). Namely, for mergers, all parties

involved in the merger must be named as filing parties, and for other types of concentration, only the business operator

obtaining control over another business operator (including through the ability to exercise decisive influence) will be the filing

party (although other parties must cooperate in relating to the filing).

Guidance opinion on the documents and materials required to be submitted with the notification form for the

notification of a concentration of business operators (7 January 2009)

Contains further information about the documents and materials that must be submitted when notifying a concentration to

MOFCOM. The provisions of this guidance are, in general, similar to those of the Anti-Monopoly Notification Guidelines for

Mergers and Acquisitions of Enterprises in China by Foreign Investors published by MOFCOM in 2007 (the "2007 Notification

Guidelines"). Whilst there are no express provisions in the AML dealing with the relationship between the previous and new

merger filing obligations, the filing obligations under the AML will take precedence on the basis of the Chinese principle of

interpretation that "the old replaces the new" for normative guidance issued at the same hierarchical level (notably, the previous

filing obligations applied only to foreign companies, whilst the AML merger requirements apply both to foreign and domestic

companies). This AML guidance does, however, contain some additional provisions not mentioned in the 2007 Notification

Guidelines, for example:

(i)

details of some of the factors that the applicant may use when determining the relevant market;

(ii)

confirmation that the applicant may incorporate into its notification relevant third party views;

(iii)

importantly, for the first time, MOFCOM has published a designated form for concentration notifications. Notifications

pursuant to the AML may be prepared in accordance with the requirements set out in the Notification Form, which covers

most of the required documents and other information, and is similar to the Form CO that must be submitted in respect of

merger filings pursuant to the EC Merger Regulation.

Draft guidance on the definition of the relevant market (7 January 2009)

Contains further guidance on the definition of the relevant market. The approach taken in the draft is broadly in line with the

approach adopted by the EC Commission. In particular, it proposes the use of the "hypothetical monopolistic test"; similar to

the EC "SSNIP" test.

Lovells Competition

10

Further guidance

Draft provisional measures relating to the investigation of concentrations that have not been notified in accordance

with law (19 January 2009)

Sets out the procedures that MOFCOM will follow in respect of concentrations that meet the thresholds for notification, but

which have not been notified to MOFCOM by the parties. In particular, it confirms the sources of information available to

MOFCOM and the penalties that may be imposed. The proposed process also includes an opportunity for the parties to submit

their comments on the notifiability of the concentration.

Revised draft provisional measures relating to the investigation of concentrations that have not been notified in

accordance with law (13 March 2009)

Makes extensive language changes to the previous draft. In particular, this draft adds several provisions specifying the

procedural rules by which AMEA officials must abide by during the investigation, and it clarifies how MOFCOM will dispose of

the concerned transactions, a point on which the previous draft was unclear.

Draft provisional measures on the collection of evidence relating to suspected concentrations that do not meet the

notification thresholds (19 January 2009)

Relates to the residual power of MOFCOM to review any concentrations that have, or may have, the effect of excluding or

restricting competition, even if the turnover thresholds are not met.

Revised draft provisional measures on the collection of evidence relating to suspected concentrations that do not

meet the notification thresholds (13 March 2009)

Largely adopts the language in the previous draft. In particular, this draft sets out that, besides MOFCOM, the business

operators being investigated, and other entities and individuals must also keep in confidence trade secrets and other

confidential information they learn during the investigation, unless the disclosure of the information is required by law, or prior

consent of the right-holders of the trade secrets has been obtained.

Draft provisional measures on the investigation and treatment of suspected concentrations that do not meet the

notification thresholds (6 February 2009)

Sets out further guidance on the procedures that MOFCOM will follow in the investigation and treatment of any concentration

that does not meet the notification thresholds, but which has, or may have, the effect of excluding or restricting competition (in

circumstances where the turnover thresholds are not met). Importantly, this guidance also clarifies the rights of the Business

Operators to the concentration to defend themselves where MOFCOM decides to exercise its residual power to investigate.

Lovells Competition

11

Further guidance

Draft provisional measures on the notification of concentrations of Business Operators (20 January 2009)

This document is significant as not only does it represent the first time that MOFCOM has specified the circumstances in which

"control" will be deemed to arise, but it also confirms that the establishment of a "green field" joint venture by two or more

Business Operators which reaches the notification thresholds constitutes a concentration subject to merger control review. The

document also contains helpful further guidance in respect of the calculation of turnover, which was one of the key outstanding

issues in relation to the application of the turnover thresholds.

Revised draft provisional measures on the notification of concentrations of Business Operators ("Draft Notification of

Concentrations Measures") (13 March 2009)

Article 3 contains further details about the circumstances in which a minority shareholder may be considered to have "control".

Namely, "despite not acquiring 50% or more of the shares carrying voting rights or assets of another business operator,

obtaining the ability to decide on the appointment of one or more members of the board of directors and the appointment of the

core management personnel, the financial budget, sales and operations, pricing, major investments and other important

management and operational decisions and so forth in relation to such other business operator by means of acquiring shares

or assets, as well as by contractual or other such means. All of the afore-mentioned factors must be taken into account when

determining whether or not a party obtains control over other business operators. However, the veto rights granted to medium

and small shareholders for the purpose of protecting the interests and rights of such shareholders with regard to matters

including amending the Articles of Association, capital increase and decrease and liquidation shall not be deemed as obtaining

control". It is currently unclear whether the minority shareholder must be able to decide on all of the above-mentioned issues

in order to be considered to have control, or whether any one of them will be sufficient.

Article 3 also contains further details about the situations in which a joint venture will be considered a concentration and

therefore potentially notifiable. In summary, MOFCOM has adopted the EC Commission's full functionality test. Namely,

"where two or more business operators ("Parent Companies") jointly establish a new independent entity performing on a lasting

basis, the newly established enterprise will be regarded as a concentration of business operators as referred to in Article 20 of

the AML, except for any special purpose entity which merely serves certain functions such as research and development, sales

or manufacturing certain products for the Parent Companies".

Draft provisional measures on the investigation of concentrations of Business Operators (20 January 2009)

Sets out the procedures that MOFCOM will follow in respect of the investigation of concentrations. It includes a provision that

MOFCOM may, as required, organise a hearing and seek opinions from experts, government authorities, industry associations,

customers, and so forth. Importantly, further details are also provided about the restrictive conditions that the parties may

propose and/or MOFCOM can impose, to eliminate the anti-competitive effects of a concentration.

Revised draft provisional measures on the investigation of concentrations of business operators (13 March 2009)

Articles 12 and 13 contain further guidance on the procedures relating to the proposal by the parties of remedies to eliminate

competition concerns arising out of the proposed concentration. In particular, it confirms that both MOFCOM and the business

operators involved in the concentration are entitled to give opinions and suggestions on modifying the restrictive conditions in

order to eliminate or reduce the effects of excluding or restricting competition that the concentration of business operators has,

or is likely to have.

www.lovells.com

Lovells LLP and its affiliated businesses have offices in:

Alicante

Madrid

Amsterdam

Milan

Beijing

Moscow

Brussels

Munich

Budapest*

New York

Chicago

Paris

Dubai

Prague

Dusseldorf

Rome

Frankfurt

Shanghai

Hamburg

Singapore

Hanoi

Tokyo

Ho Chi Minh City

Warsaw

Hong Kong

Zagreb*

London

Lovells is an international legal practice comprising Lovells LLP and its affiliated businesses. Registered with the Ministry of Justice of the People's Republic of China as

a Foreign Law Firm Representative Office. Certificate No. 2-0002 (2003). Not licensed to practise Chinese law. Lovells LLP is a limited liability partnership registered in

England and Wales with registered number OC323639. Registered office and principal place of business: Atlantic House, Holborn Viaduct, London EC1A 2FG.

The word "partner" is used to refer to a member of Lovells LLP, or an employee or consultant with equivalent standing and qualifications. New York State Notice:

Attorney Advertising

Member of the Sino Global Legal Alliance with member offices in: Beijing Chengdu Chongqing Guangzhou Hangzhou Hong Kong Qingdao Shanghai Shenyang

Shenzhen Tianjin Wuhan and of the Pacific Rim Advisory Council with member offices in: Argentina Australia Brazil Canada Chile China Colombia France India

Indonesia Japan Korea Malaysia Mexico Netherlands New Zealand Peru Philippines Singapore Taiwan Thailand USA Venezuela

© Copyright Lovells LLP 2009. All rights reserved. HKGLIB#805288

*Associated offices