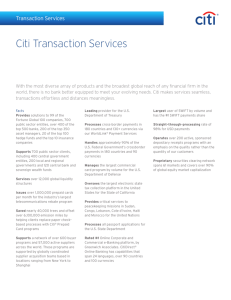

International retail banking: The Citibank Group

advertisement