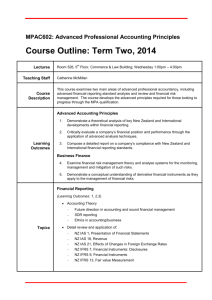

IFRS Bridging Manual

advertisement