Cash Flow Management Basics

advertisement

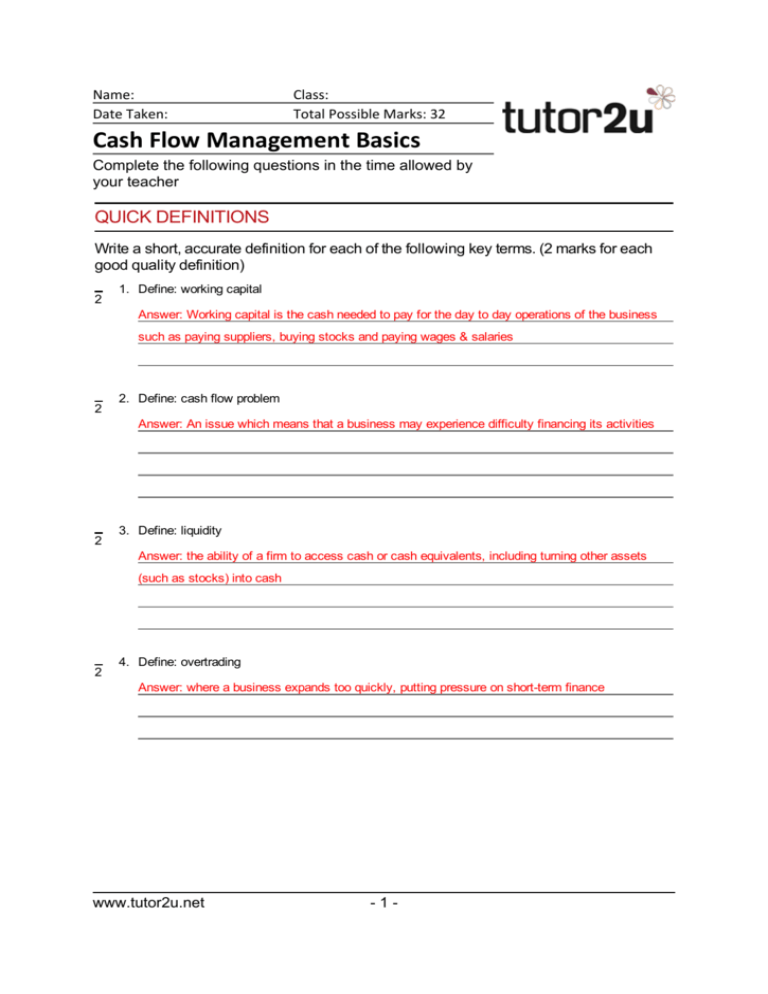

Ω Name: Date Taken: Class: Total Possible Marks: 32 Cash Flow Management Basics Complete the following questions in the time allowed by your teacher QUICK DEFINITIONS Write a short, accurate definition for each of the following key terms. (2 marks for each good quality definition) 2 1. Define: working capital Answer: Working capital is the cash needed to pay for the day to day operations of the business such as paying suppliers, buying stocks and paying wages & salaries 2 2. Define: cash flow problem Answer: An issue which means that a business may experience difficulty financing its activities 2 3. Define: liquidity Answer: the ability of a firm to access cash or cash equivalents, including turning other assets (such as stocks) into cash 2 4. Define: overtrading Answer: where a business expands too quickly, putting pressure on short-term finance www.tutor2u.net -1- Ω -2- QUICK LISTS In this section, provide an outline or list points which answer the question 4 5. List four ways in which a business could reduce a net cash outflow in the short-term A. Delay payments to suppliers B. Sell excess or surplus stocks at a discount, for cash C. Chase customers for payment of outstanding amounts D. Delay or cancel capital spending projects E. Cut discretionary expenditure on items such as marketing and administration F. Reduce overtime hours and payments 4 6. List five potential causes of significant cash flow problems in a manufacturing business A. Falling and profits or (worse) losses B. Over-investment in capacity (e.g. rising or high excess capacity) C. Allowing customers too much credit D. Buying too much stock or investing too much into work-in-progress E. Seasonal changes in demand 4 7. List three ways in which a business could improve the cash flows arising from sales to credit customers A. Offer incentives (e.g. 1% off) for early payment of invoices B. Only offer and extend credit terms once a customer has developed a track record for prompt payment C. Implement systematic processes for highlighting and chasing slow-paying customers D. Use invoice discounting or invoice factoring to release cash from amounts owed E. Tighten procedures for checking the credit-worthiness of potential new customers www.tutor2u.net -2- Ω -3- Short Answers In this section, write a short answer (one or two sentences) for each question. 4 8. Explain two benefits for a business that actively manages its cash flow: Valid points include that the business... Knows where its cash is tied up, spotting potential bottlenecks and acting to reduce their impact Can plan ahead with more confidence. Management are in better control of the business and can make informed decisions for future development and expansion Can reduce its dependence on the bank and save interest charges Can identify surpluses which can be invested to earn interest 4 9. Explain why a loss-making business will often also experience cash-flow problems Valid points include: The profit a business makes from trading is often the most important source of finance. There is a direct link between low profits or losses and cash flow problems A cash flow problem may occur because of high cash outflows (e.g. high costs being paid) or lower than expected sales revenue (lower profits) Loss-making businesses often have high fixed costs and excess capacity - both of which are linked to high cash outflows www.tutor2u.net -3- Ω -44 10. Explain why a business that invests too much in fixed assets and stocks may experience cash flow problems Valid points include: Investment in fixed assets suggests spending on production capacity. If capacity is increased too far, then the business is left with excess capacity (capacity it doesn't need, but which it has paid for). Excess stocks (or inventories) arises when the business has paid for more raw materials, finished goods etc than it needs to meet normal demand. Stocks have to be paid for - so high stocks imply that too much cash is tied up in them. www.tutor2u.net -4-