THE HISTORY AND EVOLUTION OF FRANCHISING1

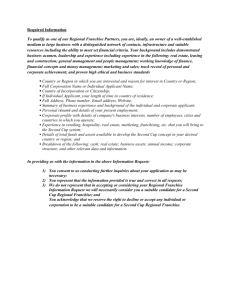

advertisement

THE HISTORY AND EVOLUTION OF FRANCHISING1 The word "franchise" is derived from the Anglo-French word meaning “liberty.” In Middle French, it is “franchir”– to free. In Old French, it is “franc,” signifying free. The French term “francis” means granting rights or power to a peasant or serf. The English term “enfranchise” is defined as empowering those who have no rights. The term “Royal Tithes” is the predecessor of royalties, and originated as the practice of certain English men (referred to as “freemen”) receiving a percentage of the land fees paid by serfs to nobility.2 Throughout history, franchising has promoted economic liberation, synergy, and opportunity, and has been true to its etymological roots – “freeing” commerce from many of the traditional chains that had bound it. Naisbitt’s famous comment in Megatrends is no exaggeration – “Franchising is the single most successful marketing concept ever.”3 This article provides a brief timeline on the seminal developments in franchising since the Middle Ages, followed by a more detailed description of the flourishing history of McDonald’s and KFC, the historical intersection between franchising and antitrust law, and finally, a brief overview of the regulatory framework that has emerged over the past thirty-five years. I. THE HISTORY OF FRANCHISING A. -- Kings, Courts and Lord – Franchising Pre-18004 During the Middle Ages, local governments granted high church officials and other personages a license to maintain civil order and to assess taxes. Medieval courts or lords granted others the right to operate ferries, hold markets, and perform professional business activities. The licensee paid a royalty to the powers that be in exchange for, among other things, “protection.” This was equivalent to a monopoly on commercial ventures. The practice was perpetuated throughout the Middle Ages, and eventually became part of European common law.5 -- During the Colonial Period, European monarchs bestowed franchises on daring entrepreneurs who agreed to establish colonies and gain the protection of the “Crown” in exchange for taxes or royalties.6 B. -- Drinks, Cars and Sewing Machines -- Franchising From 1800 to 1900 In 19th Century England and Germany, pub proprietors with financial difficulties became exclusive distributors of beer purchased from specific brewers. The breweries did not exercise any day-to-day control over the pubs.7 -- The first franchise in Australia under "royal privilege" was granted by Governor Macquarie in 1809. The franchisee was granted the right to import 45,000 gallons of rum over three years in exchange for building the Sydney Hospital (the so-called "rum hospital").8 -- In the United States during the mid-1800's, trademark/product franchising developed when the Singer sewing machine company formed a franchise in 1851. Due to the lack of necessary capital and the incipient stage of the sewing industry, Singer had difficulty in marketing sewing machines, and turned to franchising. Singer commissioned agents to sell and repair its line of machines. However, once the machines were accepted by the public, Singer changed its marketing strategy and commenced selling the machines through its company-owned outlets in the 1860's.9 -- In the 1880's, U.S. cities granted monopoly “franchises” to utility companies for water, sewage, gas, and later electricity.10 -- In 1898, William E. Metzger of Detroit, Michigan became the first official dealer/franchisee of General Motors Corporation (GM). Under GM’s system, dealers purchased the land and built the buildings for the dealership. In return, the dealers were allowed to buy GM’s vehicles at a discount.11 -- In 1899, Coca Cola sold its first franchise.12 C. -- A Period of Steady Growth – Franchising From 1901 to 1950 In the early 1900's, Henry Ford franchised dealers for his Model T. The oil companies followed suit, franchising gas stations.13 -- In 1902, Rexall Drugstores began franchising.14 -- In 1909, Western Auto established dealership programs.15 -- In 1920, the “Ben Franklin” store systems appeared with general merchandise stores.16 -- In 1925, A&W established “walk up” root beer stands, and Howard Johnson offered his three flavors of "superior" ice cream from his Wollaston, Massachusetts drugstore. Howard Johnson’s franchised ice cream business expanded to a group of East Coast restaurants, and in 1940, appeared on a state turnpike.17 -- Between 1938 and 1955, the following companies commenced franchise activities: Arthur Murray Dance Studios, Baskin-Robbins ice cream stores, Duraclean carpet cleaning services, McDonald’s, Howard Johnson Motor Lodge, and Harlan Sanders’s Kentucky Fried Chicken.18 -- In 1948, Dairy Queen established its 2500th unit.19 3 D. -- Build Along the Highway – Growth In Franchising from 1951-1969 Franchising in the U.S. exploded in the 1950s. In 1950, less than 100 companies had employed franchising in their marketing operations. By 1960, more than 900 companies had franchise operations involving an estimated 200,000 franchised outlets.20 -- In 1955, Tastee Freeze established its 1500th unit.21 -- In the 1950's and 1960's, the development of business format franchising escalated, due in large part to the expansion of the service economy and President Eisenhower’s decision to build the Interstate Highway System (with its concomitant increase in automobile travel). Holiday Inn, Roto-Rooter, Dunkin Donuts, McDonald’s, Burger King, H&R Block, Lee Myles, Midas, 7-Eleven, Dunhill Personnel, Wendy's, Pearle Vision Center, Dairy Queen, Orange Julius, Tastee Freeze, and Sheraton all began to franchise.22 -- By the late 1960's, McDonald’s, Holiday Inn, and KFC were all approaching or had surpassed the one-thousand unit mark. -- Between 1964 and 1969, fueled by an ever expanding economy, an estimated 100,000 new franchise businesses commenced.23 E. New Regulation and an Oil Embargo – Franchising 1970 to 1985 -- In 1970, annual retail sales for franchises were estimated at over $95 billion.24 -- In 1970, the U.S.’s 181,000 franchised gasoline stations accounted for 82% of product/trade name franchises and nearly 55% of all franchises.25 -- Also in 1970, California became the first state to regulate the sale of franchises when it enacted the California Franchise Investment Law (CFIL).26 4 -- In 1971, annual retail sales of franchised businesses were estimated at over $114 billion.27 -- Between 1969 and 1973, an additional 50,000 franchised units took form, and by 1973, franchised businesses exceeded 374,000 units.28 -- Between 1973 and 1976, due to the Arab oil embargo, national shortages of gasoline precipitated the closure of nearly 32,000 franchised gasoline service stations.29 -- In 1975, retail sales of franchises exceeded $161 billion.30 -- By 1976, gasoline’s share of total franchising fell to 41%, and, by 1980, to 36%.31 -- Between 1976 and 1980, more than 19,000 new franchises were established; however, the increase did not offset the loss of gasoline franchises during the decade.32 -- In 1978, the Federal Trade Commission (FTC) adopted the FTC Rule involving pre-sale disclosures, which became effective in 1979.33 -- In 1979, retail sales of franchises exceeded $274 billion, an increase of 140% from 1971.34 -- By 1980, there were more than 356,000 franchised businesses, 18,000 less than the peak level achieved in 1973. Product/trade name franchise sales reached $231 billion, an increase of 129% from 1971. Sales by business format franchises tripled from $16 billion in 1971 to $48 billion in 1979.35 -- In 1985, retail sales of franchises exceeded $474 billion.36 F. -- Big Overall Growth Returns – 1986 to 1995 In 1986, the U.S. Department of Commerce estimated that retail sales by 5 franchised establishments represented 34% of all retail sales. Sales of products and services by all franchises grew by $198 billion during the period of 1980-1986.37 -- During 1987 and 1988, an additional 50,000 new business format franchises were established, nearly double the number added during 1985-1986.38 -- In 1988, there were more than 416,000 franchise businesses, employing approximately 7 million workers, with estimated sales of $543 billion. The mix was approximately 70% business format, and 30% product franchise. The estimated 27,273 new franchise units that opened in 1988 represented the addition of one new franchise unit every twenty minutes throughout the year.39 -- Between 1987 and 1989, franchises added over 400,000 new jobs to the United States economy, while the Fortune 500 companies added only 10,000 (i.e., franchising accounted for 40 times as many new jobs).40 -- In 1990, retail sales of franchises exceeded $607 billion, with more than 460,000 units in existence.41 -- In 1993, NASAA unanimously adopted the UFOC Guidelines as the recommended format for franchise disclosure documents at the state level. The FTC approved the use of the UFOC as an alternative to the FTC’s disclosure requirements later that year.42 -- By 1995, the new UFOC Guidelines were adopted by each of the state franchise regulatory authorities that require registration of franchise offerings.43 F. The Current Status and Reasons for New Growth – 1996 to the Present Advances in technology, orientation towards a service economy, a relative decrease in the 6 importance of product franchising, an expansive interstate road system, active baby boom retirees looking to “be their own boss,” and women in the work force, have all contributed to the burgeoning rise in business format franchising. According to a survey conducted for the International Franchise Association’s Educational Foundation, as of 2001, there were more than 767,483 franchise-related businesses (including franchisor owned), generating 9,797,117 jobs (equivalent employment of all manufacturers of durable goods, such as computers, cars, trucks, planes, communications equipment, primary metals, wood products, and instruments), meeting a $229.1 billion payroll, and producing $624.6 billion of output. The same survey found that franchised businesses in 2001 accounted for 7.4 percent of all private-sector jobs, 5.0 percent of all private sector payrolls, and 3.9 percent of all private sector output. Business format franchising accounted for 4.3 times as many business establishments as product franchising, and four times as many jobs, and operated more establishments, met a greater payroll, and generated more output in business services than in any other single line of business. The quick service restaurants hired more people than any other business format segment, and automotive and truck dealers employed more workers and had the greatest payroll of any other product distribution franchise. Jobs and payrolls in franchised businesses were greatest in California, Texas, Florida, and Illinois in 2001. Relative to the size of the statewide economy, franchising had the greatest impact on jobs and payrolls in Nevada, Arizona, New Mexico, Florida, and Mississippi.44 Studies indicate that a new franchise business opens approximately every five to eight minutes of each business day, and that franchises are, on average, more profitable than company owned locations. This holds especially true for franchisors in the fast food industry. 50% of all 7 franchise companies in existence started in the last 25 years, 70% of them in the last 45 years, and 97% of them in the last 55 years.45 II. Two Short Case Studies – the Beginnings of McDonald’s and KFC A. McDonald’s Raymond Albert Kroc (“Kroc”), born in Chicago, Illinois, became a volunteer ambulance driver in World War I, a dance-band musician, a salesman, a representative for Lily-Tulip paper cups and plates, and, later in his career, a promoter of a milk shake mixing machine. Never completing high school, Kroc espoused a conservative, anti-regulatory philosophy, and fought for a modification of the minimum wage law to allow entrepreneurs to employ teenage and student workers.46 In 1954, Kroc visited the McDonald brothers' small San Bernardino, California, hamburger stand, because he was curious why the brothers needed so many of Kroc’s milk shake mixers. What Kroc found was a specialized labor system that produced quality sandwiches at an affordable price. Kroc obtained the exclusive license to market the McDonald name and methods, and founded McDonald's Corporation. Kroc also opened a drive-in location in Des Plaines, Illinois, to demonstrate the business format's profitability.47 Along with his associate, Harry Sonnenborn, Kroc purchased the land to build franchise locations, and then rented the real estate to franchisees on long-term leases. This action increased access to capital funds. In 1957, there were 37 McDonald’s locations, by 1959 there were 100 locations, and by 1961, there were 228 locations. McDonald’s meteoric rise continued. In 1977, Kroc assumed the title of Senior Chairman. By 1980, there were 5,000 McDonald’s locations, and by 1987, there were 10,000. At that point, McDonald's estimated that it had sold 65 billion 8 hamburgers to the eagerly consuming public. It has been estimated that McDonald’s purchases 7.5% of the total potato crop production in the United States.48 B. KFC The story of Harlan Sanders is equally intriguing. In the Great Depression era of the 1930's, Sanders operated a gas station in Corbin, Kentucky, feeding weary travelers a unique fried chicken that earned Sanders accolades from the governor of Kentucky. From gas station owner to restaurateur, Sanders’ business flourished until 1955, when the new interstate road system left him impecunious, as his chicken restaurant was not sufficiently close to the interstate. In 1956, Sanders took to the road and convinced restaurateurs in Kentucky, Ohio, and Indiana to pay him a five cent royalty for using his proprietary recipe.49 By 1960, there were 200 KFC franchised outlets, by 1963, 600 outlets, and by the end of the decade, approximately 1,000. Sanders managed the burgeoning company from his home in Shelbyville, Kentucky, with a relatively modest staff. KFC continued to grow, reaching the 6,000 mark in the 1980's, and eventually 10,000 outlets.50 III. Franchising’s Collision With Antitrust Law – 1949 to 1980 Following the Supreme Court ruling in 1949 in Standard Oil v. United States,51 franchisors operated in a legal quicksand, unsure of whether their actions constituted violations of the federal antitrust laws. Standard Oil involved the issue of whether a required purchase agreement between a franchisor and franchisee could constitute a Clayton Act prohibition against tying or exclusive dealing. Two years later, the Court in United States v. Richfield Oil Corp,52 further complicated the issue by stating that Richfield’s relationship with its franchisees both: (1) 9 constituted an unreasonable restraint of trade in violation of the Section One of the Sherman Act, and (2) resulted in a substantial lessening of competition in violation of Section Three of the Clayton Act. This led to decades of legal and academic debate on the antitrust implications of franchising. Leading the charge in the 1960's were the Antitrust Division of the Department of Justice (which also took an aggressive stand on mergers and acquisitions during this period), as well as the FTC. Both held the view that economic imbalances in the franchisor/franchisee relationship needed to be rectified through taking a hard line on tying arrangements. The conundrum was resolved in the Carvel cases in the mid-1960's, and led to a resurgence in franchise activity. The Federal Court of Appeals and the FTC separately ruled that the Carvel trademark licenses set a critical element in the franchise arrangement, and were not anti-competitive illegal ties, but rather, a necessary component in preserving the franchisor’s goodwill.53 However, the pendulum swung back against franchising in Siegel v. Chicken Delight during 1970-1973.54 The Federal Court held that the trademark could not shield an illegal tying arrangement. The FTC followed suit in 1973, ruling that the franchisor could not force feed a franchisee product as part and parcel of the franchise arrangement.55 This resulted in numerous class action lawsuits against franchisors. This heavy-handed federal regulatory approach lasted until 1977, when the Supreme Court decided the landmark GTE Sylvania56 case. In GTE Sylvania, the Supreme Court distinguished vertical restraints intended to hinder competition from those that may have “redeeming virtues” in promoting inter-brand competition, by permitting a manufacturer to compete more efficiently, or by assuring the safety and quality of products to consumers. Since franchise agreements 10 generally have such “redeeming virtues,” the decision was considered a victory by franchise proponents and entrepreneurs. Gone were the Standard/Richfield days of excessive scrutiny and overbearing antitrust regulation over independent businessman who benefited industry and commerce. Instead of being judged illegal tying arrangements per se, the rule of reason (competitive analysis of the relevant market) carried the day and judged the franchise bundle of goods and services as an integrated format for doing business. GTE Sylvania also had the practical effect of dramatically increasing franchise activity post-1980, and of refocusing the FTC’s concerns away from anti-competitive ties, and towards earnings claims and pre-purchase disclosure. The FTC’s disclosure investigation culminated in the Franchise Rule of 1979. IV. The History of Franchising’s Regulatory Environment Concomitant with the enormous growth of the franchise industry came the growth of franchise abuse, and with the abuse, industry regulation. The notion of “fairness” began to pervade the regulatory scene by the 1950's, and franchise fairness provisions began to appear in federal legislation in the Automobile Dealer Franchise Act of 1956, the various franchise bills introduced in Congress in the 1960s, and the Federal Petroleum Marketing Practice Act of 1968.57 In the mid-1970's, due in part to the failure of Congress to enact any franchise fairness legislation, as well as the perceived bargaining inequality between franchisors and franchises, many states adopted franchise relationship laws to prevent abuses involving encroachment, renewal, performance standards, assignment, free association, discrimination, and wrongful termination.58 Although there were brief attempts to regulate franchises by treating them as a 11 type of security (an “investment contract”) to provide federal statutory protection for consumers, the notion that a franchise was akin to a security never gained solid legal footing, in part due to the fact that a security is a passive investment while a franchise requires active involvement by a franchisee.59 In 1985 and 1986, legislation was introduced in twenty-two states impacting franchise sales or relationships, including amendments to existing franchise disclosure statutes, fairness statutes, dealer relationship, and business opportunities laws.60 During 1987, the number of franchise or dealer-related legislative proposals increased substantially, with a record forty-nine new statutes or amendments enacted into law. The pace persisted. In 1989, forty-three franchise or dealer-related statutes were enacted by twenty-five state legislatures, including regulatory changes to the franchise statutes in Michigan, Minnesota, New York, and North Dakota.61 Many states have enacted some form of a “little FTC Act,” prohibiting unfair methods and deceptive acts in trade or commerce, as well as industry relationship laws regulating automobile dealerships, gasoline franchises, farm equipment dealers or alcoholic beverage distributorships. Nearly 75% of the states have business opportunity statutes prohibiting fraud and misrepresentation in the sale of certain types of franchises and business opportunities. Business opportunity scams have been a major focus of FTC enforcement over the years. Since 1995, the FTC has organized at least six coordinated sweeps with various state agencies focused on fraudulent business opportunities, with a recent sweep dubbed “Project Busted Opportunity.” The FTC has brought over two hundred law enforcement actions against 640 respondents under Section 5 of the FTC Act and the Franchise Rule.62 There are fifteen states which have enacted statutes specifically regulating franchise 12 solicitations and sales (California, Hawaii, Illinois, Indiana, Maryland, Michigan, Minnesota, New York, North Dakota, Oregon, Rhode Island, South Dakota, Virginia, Washington, and Wisconsin). These states account for one-third of the nation’s population, more than a third of all the franchises, and the overwhelming majority of all franchise enforcement actions. Although there were great similarities, there were many differences as well among the statutory enactments. For example, disclosure requirements in Illinois, North Dakota, South Dakota, New York, and Washington required specific language referencing franchise renewal, arbitration, and termination. Virginia required estimating annual costs of operation, while Wisconsin prohibited substantive changes to renewal agreements. Minnesota required acknowledging a franchisee’s right to use the franchisor’s trademarks, while California required reference to the policy prohibiting non-competition covenants.63 Following the United States’ model, Australia, Canada, China, France, Indonesia, Korea, Malaysia, Mexico, Romania, and Spain, among other countries, have enacted disclosure laws, many of which have Rule 436's requirement of disclosure to prospective franchisees ten days prior to the execution of the franchise agreement. As regulation became more pervasive, it also grew more complex. In response, in August 1987, the National Conference of Commissioners on Uniform State Laws (NCCUSL) recommended a Uniform Franchise Act for greater uniformity and coordination by state legislatures. An alternative Model Franchise Investment Act was circulated in draft form in mid1989 by the North American Securities Administrators Association (NASAA), which embodied a more stringent regulatory approach, including a strongly-worded good faith standard, and rigorous restrictions relating to franchise termination, renewal, and transfer.64 13 To counter the claims of abuse in franchising, the International Franchise Association (IFA) instituted self-policing mechanisms including a Code of Ethics, and organizations such as the American Association for Franchisees and Dealers (AAFD), and the American Franchise Association (AFA) began to flourish. The stated goal of these entities was to educate regulators, franchisors, and franchisees on a “win-win” approach, and “level the playing field” for all concerned.65 Although federal legislation has never been adopted, over the last decade the Congress repeatedly introduced a version of the Federal Fair Franchising Practices Act ("FFFPA"), initially introduced by Congressman John LaFalce (D-NY) in the early 1990’s. The bill would allow a private right of actions for damages, recovery of attorneys' fees, as well as actions by state attorneys general. The bill would regulate both disclosure and the franchise relationship, and addresses fraud, discrimination in the sale of franchises, termination and cancellation, purchasing requirements, non-competition clauses, fiduciary, good faith, and due care duties, encroachment, and mandatory arbitration. After Chairman LaFalce lost the Chair of the Small Business Committee in 1995, the prospects for successful passage of the bill became remote, although efforts are ongoing. V. Conclusion Given that franchising over the last century has been true to its roots in “freeing” commerce, the goal is to encourage the indomitable entrepreneurial spirit that has led to so many success stories, while simultaneously restraining the cupidity that has led to abuse in the past. It is the right balance of legislation, regulation, enforcement, oversight, self-policing, and education 14 that will pave the way for franchising in this new millennium. Mario L. Herman mherman@franchise-law.com 301-607-4111 Endnotes 1 The author wishes to thank Mary Klein for her valuable contribution to this article. 2 3 Robert L. Purvin, Jr., The Franchise Fraud (1994), at p. 40 (hereinafter “Purvin”). Purvin, at p. 49. 4 A great deal of this historical timeline is discussed in Purvin. It is also discussed in Franchising in the U.S. Economy: Prospects and Problems, Committee on Small Business, House of Representatives, 101st Congress, Second Session, August 1990 (hereinafter “Committee”). 5 History of Franchising, Franchise Classroom www.bus.lsu.edu/academics (2004). 6 Purvin, p.43. 7 History of Franchising, Franchise Classroom www.bus.lsu.edu/academics (2004); History of Franchising, www.fasa.co.za (2004). 8 http://www.hawkesburyhistory.org.au/articles/rum_hospital.html (2004). 9 Purvin, at p. 37. 10 11 12 13 14 www.fasa.co.za (2004). Committee at p. 4. Boroian, How to Buy and Manage a Franchise (1993) at pp.32-33 (“Boroain”) Purvin, at p. 45. Id. . 15 Id. 15 16 Committee, at p.6. 17 Purvin, at p. 45. 18 Committee, at p.6. 19 Purvin, at p. 45. 20 Committee, at pp. 6-7. 21 Purvin, at p. 45. 22 Committee, at pp. 6-7. 23 Committee, at p. 6. 24 Committee, at Appendix B. 25 Committee, at pp. 7-8. 26 California Corporations Code, section 31000, et seq. 27 Committee, at pp. 7-8. 28 Committee, at pp. 7-8. 29 Committee, at pp. 7-8. 30 Committee, at Appendix B. 31 Committee, at pp. 7-8. 32 Committee, at pp. 7-8. 33 16 C.F.R. 436 34 Committee, at pp. 7-8. 35 Committee, at pp. 11-14. 36 Committee, at Appendix B. 37 Committee, at pp. 11-14. 38 Committee, at pp. 11-14. 39 Committee, at pp. 11-14. 40 Committee, at pp. 11-14. 41 Committee, at Appendix B. 16 42 Business Franchise Guide (CCH), ¶ 5700, et seq., at p. 8401, et seq. 43 FTC Matter No. R511003 44 The Economic Impact of Franchised Businesses, Executive Summary In the United States, Price WaterhouseCoopers, IFA Educational Foundation (2004). 45 Kevin Murphy, Historic & Economic Principles of Franchising, 1985-2004. 46 Bororian, at pp. 35-40. 47 Bororian, at pp. 35-40. 48 Purvin, at p. 49. 49 Kevin Murphy, Historic & Economic Principles of Franchising, 1985-2004. 50 Kevin Murphy, Historic & Economic Principles of Franchising, 1985-2004. 51 337 U.S. 293 , 69 S.Ct. 1051, 93 L.Ed. 1371 (1949.) 52 99 F.Supp. 280, (C.D. Cal. 1951) . 53 Susser v. Carvel Corp., 206 F.Supp 636, 640 (S.D.N.Y 1962); F.2d 505, 517 (2nd Cir. 1964); FTC Proceeding, In re Carvel Corp., Trade Reg. Rep. 16440 (June 12, 1963). 54 Siegel v. Chicken Delight, 331 F.Supp. 847, 849 (N.D. Cal. 1970), 448 F.2d 43, 48-49 (9th Cir. 1971.) 55 Chock Full O’ Nuts Corp., Inc., 83 F.T.C. 575, 594 (1973) (FTC initial decision); 83 F.T.C. 575, 642 (1973). 56 Continental T.V., Inc. v. GTE Sylvania, Inc., 433 U.S. 36, 97 S.Ct. 2549, 53 L.Ed.2d 568 (1977). 57 The Automobile Dealer’s Franchise Act defined for the first time in a federal statute the concept of “good faith and fair dealing.” The definition stated each party must “act in a fair and equitable manner toward each other so as to guarantee the one party freedom from coercion, intimidation, or threats of coercion or intimidation from the other party: Provided, that recommendation, endorsement, exposition, persuasion, urging or argument shall not be deemed to constitute a lack of good faith.” Automobile Dealers Franchise Act of 1956 (also called the Federal Automobile Dealer Day-in-Court-Act), 15 U.S.C. 1221(e). Some time later, a number of state statutes identified a “community of interest” between franchisor and franchisee as a definitional element of a franchise relationship, including the Hawaii Franchise Investment Law, the Washington Franchise Protections Act, the Wisconsin Fair Dealership Law, the Minnesota Franchise Act, and the New Jersey Franchise Protection Act. 58 A total of seventeen states adopted such legislation, seven states enacted only franchise relationship statutes, and ten “regulating” states adopting relationship provisions either in conjunction with, or in addition to, broader franchise disclosure and registration statutes. Arkansas, Connecticut, Delaware, Mississippi Missouri, Nebraska, and New Jersey enacted fairness statutes only. California, Hawaii, Illinois, Indiana, Michigan, Minnesota, Virginia, South Dakota, Washington, and Wisconsin enacted both fairness statutes and franchise disclosure/registration statutes. 59 FTC-Rule, Business Franchise Guide, Para. 6302, Chapter II. Background of Franchising (2004), p.3. See also, Statement of Philip A. Loomis, Jr., General Counsel, Securities and Exchange Commission, Williams Hearings, at 707 and statement of Neal S. McCoy, Chief Counsel, Division of Corporation Finance, Securities and Exchange 17 Commission before the House Select Committee on Small Business, June 27, 1973. Contra, Goodwin, “Franchising in the Economy: The Franchise Agreement as a Security Under Securities Acts, Including 10b-5 Considerations” 24 Bus.Law. 1311, 1319 (1969), arguing that the real functions of franchisees “comprise mostly ministerial rather than discretionary activities” and that a franchise should be held to be a security. 60 Eventually, 17 other states (plus Alberta, Canada, and Mexico) enacted generally applicable statutes regulating franchise sales in some manner. These range from those with extensive and complex registration and disclosure requirements to those merely prohibiting fraud in franchise sales. State disclosure/registration laws appear in Business Franchise Guide, starting at ¶3000. In addition, state relationship laws, including those applicable to franchises and dealerships in special industries, appear in the Business Franchise Guide (CCH) starting at ¶4000. 61 Committee, pp. 27-32. 62 “The Franchise Rule”, Prepared Statement of the FTC before the Subcommittee on Commerce, Trade, and Consumer Protection of the Committee on Energy and Commerce, United States Representatives, June 25, 2002. 63 Franchising in the U.S. Economy: Prospects and Problems, Committee on Small Business, House of Representatives, 101st Congress, Second Session, August 1990. 64 Committee, pp. 30-31. 65 http://www.aafd.org/Mission_Statement.cfm 18