Passive Activity Losses In general, California law conforms to the

advertisement

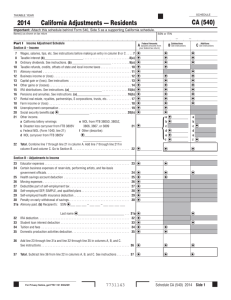

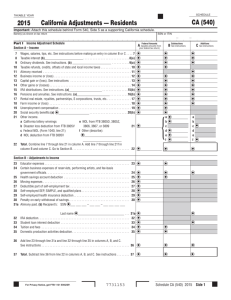

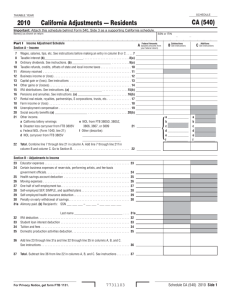

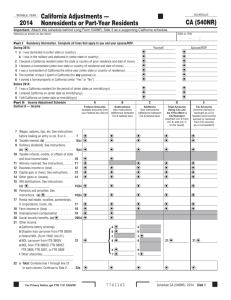

Passive Activity Losses In general, California law conforms to the Internal Revenue Code (IRC) as of January 2005. However, there are continuing differences between California and federal law. When California conforms to federal tax law changes, they do not always adopt all of the changes made at the federal level. Passive activity losses are reported on FTB 3801. The following passive-loss rules in IRC section 469(c)(7) may affect the computation of the corporation’s passive activity loss and credit limitation: Beginning in 1994, and for federal purpose only, rental real estate activities of taxpayers engaged in a real property business are not automatically treated as passive activity. California did not conform to this provision. For California purposes, all rental activities are passive activities regardless of the level of participation as per IRC section 197 on the amortization of certain intangibles: Property classified as IRC section 197 property under federal law is also IRC section 197 property for California purposes; there is no separate California election required or allowed. For California purposes, in the case of IRC section 197 properties acquired before January 1, 1994, the California adjusted basis as of January 1, 1994, must be amortized over the remaining federal amortization period. Material Participation in Real Property Business IRC Section 469(c)(7) Beginning in 1994, and for federal purposes only, rental real estate activities of taxpayers engaged in real property business are not automatically treated as passive activity. California did not conform to this provision. For California purposes, all rental activities are passive activities. Summary California has conformed to the Internal Revenue Code concerning passive activity loss since January 1, 2010. California generally conforms to the federal law concerning passive activity loss limitations. Differences may arise when taxpayers are real estate professionals. Their California passive activity loss may be different than the federal. 64 Chapter 8: Adjustments to Income Objectives At the end of this lesson, the student will have an understanding of how to treat: California adjustments to income Subtractions of federal income Additions of federal income Resources 540 Schedule CA FTB Publication 1001 Instructions 540 Schedule CA California Adjustments to Income California has several adjustments to income. To arrive at the state’s adjusted gross income, California starts with the federal AGI, then subtracts income not taxable by California, and finally adds income taxable by California that was not taxable by federal law. The most common subtractions from federal AGI are allowed on page 1 of Form 540. If the taxpayer has subtractions not listed on Form 540 or any addition to income, it must be listed on California 540 Schedule CA, California Adjustments—Residents, which is an attachment to Form 540. Part-year or nonresidents must use the specific Schedule CA (540NR). California adjustments consist of certain income that is taxed on the federal return but is not taxable on the California return. Taxable Refunds, Credits, or Offsets of Local Income Taxes Federal law includes the state income tax refund in income. California excludes the state income tax refund from income. Enter the amount of state income tax refund included in federal income on 540 Schedule CA, line 10, column B. Unemployment Compensation California does not tax unemployment compensation. Unemployment is taxable on the federal return. An adjustment must be made 540 Schedule CA, line 19, column B. Social Security Benefits and Railroad Retirement Tier 1 California does not tax social security benefits and equivalent tier 1 railroad retirement benefits. If there are any taxable social security benefits or railroad tier 1 benefits on the federal return, an adjustment must be made on 540 Schedule CA, line 20, column B. California Nontaxable Interest or Dividends Income Municipal or state bond interest from states other than California is taxed. Form 540 must be used. California does not tax interest earned from U.S. savings bonds; U.S. Treasury bills, notes, and bonds; or bonds and obligations of U.S. territories and government agencies specifically exempted by federal law. 65 California Lottery Winnings Only California lottery winnings are not taxable. All other gambling winnings, including lottery winnings from other states, are fully taxable, and no adjustment would be made. An adjustment needs to be made for California lottery winnings. Educator Expense California does not conform to federal law. Enter the amount taken on the federal line 23 to 540 Schedule CA column B, line 23 of 540 Schedule CA. Certain Business Expense of Reservists, Performing Artists, and Fee-Basis Government Officials California conforms to federal law in the tax treatment of expenses for reservists, performing artists, and fee-basis government officials. If the taxpayer is claiming a depreciation deduction on Form 2106 or Form 2106-EZ, an adjustment may need to be made in column B or column C. If the federal depreciation is more than the state depreciation, enter the difference in column B. If the federal depreciation is less, enter the difference in column C of Schedule CA. Health Savings Account California does not allow a deduction for the contribution to an HSA account. Transfer the amount from column A to column B, line 25 of 540 Schedule CA. Alimony Paid Alimony payments that are made to a recipient are deductible if all of the following conditions are met: The payments were made in cash, checks, or money orders The divorce or separation instrument does not explicitly state that the payment is not to be considered alimony The taxpayer and former spouse are not members of the same household There is not liability to make any payment after the death of the spouse or former spouse The payment is not treated as child support Alimony payments paid by a nonresident alien that were not taken on the federal return are a deduction on the California return. Enter the amount in column B, line 23 of 540 Schedule CA. IRA Deduction If the taxpayer is an active military service member domiciled in California and his or her IRA deduction was limited due to the taxpayer’s federal AGI limitation, recalculate the deduction without using the military wages and enter the difference in column C, line 36 of 540 Schedule CA. For more information, see FTB Publication 1001. Student Loan Interest Federal law allows a deduction for student loan interest and has eliminated the 60-month limitation. California will allow a deduction only on the interest required to be paid on student loans for the first 60 months. California also has a different phaseout of the deduction. Use the worksheet included in 540 Schedule CA to calculate the California adjustment. Enter on 540 Schedule CA, line 26, column B, the 66 amount of the federal deduction not allowed for California. For more information, see FTB Publication 1032. Tuition and Fees Deduction Federal law allows a deduction from income up to $4,000 for qualified higher education expenses paid. California has not conformed. Enter the amount on 540 Schedule CA, column B. Should the taxpayer encounter other adjustments not covered in this chapter, more research would be required. For additional information, see Instructions 540 Schedule CA in the Personal Income Tax Booklet. Summary California does not always conform to the federal laws. When the state does not conform, the adjustments are made on 540 Schedule CA. When the California law conforms, no adjustment is necessary on 540 Schedule CA. If the taxpayer has depreciation on the tax return, a thorough tax professional will doublecheck the differences between the federal and state depreciation deduction amount. 67 Chapter 9: Itemized Deductions Objectives At the end of this lesson, the student will have an understanding of: The difference between federal and California itemized deductions How to calculate California lottery losses The mortgage interest credit How voluntary contributions affect the taxpayer’s refund or balance due Resources Form 540 Schedule CA (540) FTB 3526 FTB 1001 Instructions Form 540 Instructions Schedule CA (540) Itemized Deductions To calculate California itemized deductions, first start with federal itemized deductions. California adjusts the federal by adding and subtracting the deductions that differ by California law. If the taxpayer did not itemize on the federal return, a Schedule A would need to be completed to calculate the California itemized deductions. State, Local, and Foreign Income Taxes California does not allow the deduction of any state, local, federal, or foreign income tax. Nor does it allow for the deduction of State Disability Insurance (SDI) or Voluntary Plan Disability Insurance (VPDI). These would have been listed on federal Schedule A, line 5. Also included on line 5 is limited partnership tax and income or franchise tax paid by S corporations. Always include amounts paid to California as a result of a balance due for the prior tax year. An adjustment is made on Form 540 Schedule CA, Part II, line 39, to remove these amounts from the California return. California law does not allow a deduction for sales or state taxes. The Cal Fire fee that is imposed upon California residents has been determined not to be a tax. The IRS, according to IRC section 164, states that this fire-protection fee is not a tax under federal or state law but rather a regulatory fee. It is not based on property valuation. Medical and Dental Expense Deduction California does not conform to the federal change for taxpayers under the age of 65 that medical and dental expenses be more than 10 percent of the federal AGI. A California medical and dental expense is still at 7.5 percent. The difference would be entered as a positive number on line 41 of Schedule CA (540). Mortgage Interest Credit If the taxpayer reduced federal mortgage interest by the amount of the mortgage interest credit (from federal Form 8396, Mortgage Interest Credit), he or she will need to increase the California itemized deductions by the same amount. Enter the amount of federal mortgage interest credit as a positive number on Schedule CA (540), Part II, line 41. 68 Employee Business Expenses There are only a few differences between federal and California law regarding employee business expenses. Federal employee business expenses would be listed on Form 2106 and be carried forward to Schedule A. If there are differences and the federal amount is larger, the difference would be entered as a negative number on Schedule CA (540). If the California portion is larger, the difference is entered as a positive number. California laws have conformed to federal laws concerning employee business expenses and reimbursements. The current law states: Under the safe harbor rules, all meals furnished to employees at the employer’s place of business meet the convenience test under IRS section 119, if more than one-half of the furnished meals on the premises are for the convenience of the employer. If these conditions are satisfied, the value of all such meals is excludable from the employee’s income and fully deductible to the employer. California does not allow a business expense deduction for expenses incurred at a club that restricts membership or use of its services or facilities that discriminate based on age, sex, race, religion, color, ancestry, national origin, sexual orientation, and other forms of discrimination covered generally by antidiscrimination laws. Example: Bud joined the Traveling Boomers Club. The club restricts membership for those over the age of 65. Bud paid $1,500 in dues and $2,500 in business entertainment expenses. Bud may not deduct the $1,000 for dues for either federal or California purposes. For federal purposes, he may deduct $1,250 ($2,500 × 50 percent). For California, Bud is unable to deduct the entertainment because the club discriminates. California law generally conforms to federal law and no adjustments are needed. However, adjustments are needed when the following occur: Assets requiring depreciation were placed in service before January 1, 1987. Federal employees are on a temporary duty status. California does not conform to the federal provision that expanded temporary duties to include prosecution duties, in addition to investigative duties. Therefore, travel expenses paid or incurred in connection with temporary duty status (exceeding one year) involving the prosecution (or support of the prosecution) of a federal crime should not be included in the California amount Compare federal Form 2106, line 10, or Form 2106-EZ, line 6, and the form completed using California amounts. If the federal amount is larger, enter the difference as a negative number on line 41. If the California amount is larger, enter the difference as a positive number on line 41. Investment Interest Adjustment The California deduction for investment interest expense may be different from the federal deduction. Form FTB 3526, Investment Interest Expense Deduction, should be used to figure the amount to enter on Schedule CA (540). 69 California Lottery Losses California lottery losses included with gambling losses are not deductible under California law. All other gambling losses are deductible as they comply with federal law. Any California lottery losses included on line 27 of the federal Schedule A must be adjusted on Schedule CA (540) as a negative number in Part II, line 41. Charitable Contribution Carryover Deduction If the taxpayer is deducting a prior year’s charitable contribution carryover and the California carryover is larger than the federal carryover, increase the California itemized deductions by entering the additional amount as a positive number on Schedule CA (540), Part II, line 41. Casualty and Theft Losses for Income-Producing Property California law does not conform to the federal provision that allows taking the full deduction if a casualty or theft loss occurs for income-producing property. For California purposes, the deduction is considered to be a miscellaneous itemized deduction and is subject to the 2 percent of AGI floor. Voluntary Contributions California allows taxpayers to make voluntary contributions to various charitable causes. These contributions can be designated on page 3 of Form 540 or page 2 of Form 540A. Unlike the federal Presidential Election Fund on the federal return, these voluntary contributions will increase the taxpayers’ balance due or decrease their refund by the amount contributed on their California return. For 2014, contributions can be made to: Alzheimer’s Disease/Related Disorders Fund American Red Cross, California Chapters Fund California Breast Cancer Research Fund California Cancer Research Fund California Firefighters’ Memorial Fund California Sexual Violence Victim Services Fund California Peace Officer Memorial Foundation Fund California Senior Legislature Fund California Sea Otter Fund California Seniors Special Fund Child Victims of Human Trafficking Fund Emergency Food for Families Fund Habitat for Humanity Fund Keep Arts in Schools Fund Protect Our Coast and Oceans Fund Rare and Endangered Species Preservation Program State Parks Protection Fund/Parks Pass Purchase School Supplies for Homeless Children Fund If the taxpayer wants to contribute to one of these funds, additional research will be necessary to determine contribution minimums, maximums, and eligibility. 70 Community Development Financial Institutions Investment Credit The Community Development Financial Institutions Investment Credit has been extended for taxable years beginning on or after January 1, 2012, and before January 1, 2017. Reduction in Itemized Deductions California itemized deductions are reduced from the federal by the lesser of 6 percent or the excess of the taxpayer’s federal AGI over the threshold amount of 80 percent of the amount allowed for the current taxable year. The AGI threshold is: Single or married/RDP filing separately $176,413 Head of household $264,623 Married/RDP filing jointly or qualifying widow(er) $352,830 Delinquent Parking and Traffic Violations DMV will not process a family transfer of a vehicle until all outstanding parking and toll-evasion citations are paid in full. Sales Suppression Device A sales suppression device is software that is used by a business to hide or alter sales transactions in order to avoid paying tax. California Assembly Bill 781 provides new penalties for a person who knowingly sells, purchases, installs, transfers, possesses, or uses any automated sales suppression device. An individual found guilty of purchasing, installing, or using the sales suppression device, also known as zappers or phantom-ware, in order to evade tax is guilty of a misdemeanor, liable for fines and/or imprisonment, and liable for applicable taxes, interest, and penalties. The fines depend on the number of devices sold, installed, transferred, or possessed: For three or fewer sales suppression devices, the fine is up to $5,000 For more than three sales suppression devices, the fine is up to $10,000 Summary Tax deductions are allowed to taxpayers if they are specifically authorized. Taxpayers must be able to substantiate the deductions that are claimed on their tax return, if requested either by the IRS or FTB. Taxpayers can normally substantiate tax deductions by providing documentation such as receipts, invoices, and canceled checks. Knowing when California conforms to federal law is very important when filing the state return. A good tax professional will always do research and not rely on software for the answers. Remember, when taxpayers live in a community property state, both income and expenses are added together and then divided between the two tax returns. The taxpayer does not take his income and expenses, and the spouse does not take her income and expenses. 71 Chapter 10: Tax and Additional Taxes Objectives At the end of this lesson, the student will have an understanding of: Who can claim the child’s investment income When exemption credits begin to phaseout When to use the tax rate schedule When to use the tax table Resources Form 540 FTB 3800 FTB 3803 FTB 5870A Schedule 540 (CA) Schedule G-1 FTB Publication 1001 Instructions Form 540 Instructions FTB 3800 Instructions FTB 3803 Instructions FTB 5870A Instructions Schedule 540 (CA) Instructions Schedule G-1 This chapter covers Form 540, lines 31- 35. Line 31 To figure the taxpayer’s tax, one of the following methods needs to be used: 1. If the taxpayer’s taxable income is less than $100,000 on line 19, use the tax tables. 2. If the taxpayer’s taxable income is more than $100,000 on line 19, tax rate schedules would be used. 3. FTB 3800 is used when the taxpayer has a child with investment income. 4. FTB 3803 is used if the parent elects to claim his or her child’s interest, and dividend income is less than $10,000. Form 3800 Certain children under the age of 18, or 24 if the child is a full-time student, would report their investment income over $2,000 on FTB 3800. The investment income could be taxed at the parent’s rate if any of the following apply: 72 The child is 18 or younger or a student under the age of 24. A child born on January 1, 1997, is considered to be 18 at the end of 2014. A child born on January 1, 1991, is considered to be 24 at the end of 2014. The child had investment income taxable in California of more than $2,000. At least one parent was alive at the end of 2014. The child was age 18 at the end of 2014 and did not have earned income that was more than half of the child’s support. Parents may elect to claim their child’s income. To make this election, the child can only have income from interest and dividends. If the election was made on the federal return and not the state return, be sure to make an adjustment on Schedule CA (540), line 21f. Form 3803 Parents (including RDP’s) can claim their child’s income on their California return even if they did not report it on the federal return. If this election is made, the child would not file a tax return. Parents who qualify to make the election to claim their child’s income must file Form 540 or 540NR if any of the following applies: Was under age 19 or a student under age 24 at the end of 2014. A child born on January 1, 1996, is considered to be age 19 at the end of 2014. A child born on January 1, 1991, is considered to be age 24 at the end of 2014. Is required to file a 2014 income tax return. Does not file a joint return for 2014. Had income only from interest and dividends, including capital gain distributions. Had gross income for 2014 that was less than $10,000. Made no estimated tax payments for 2014. Did not have any overpayment of tax shown on his or her 2013 return applied to the 2014 estimated taxes. Had no state income tax withheld from his or her income (backup withholding). For more information about interest, dividends, and capital gain distributions taxable in California, see instructions for Schedule CA (540). Line 32 Exemption credits reduce the taxpayer’s tax liability. Depending on the filing status, the exemption credits could be limited. Filing Status Single or married/RDP filing separately Married/RDP filing jointly or qualifying widow(er) Head of household Amount on line 13 is more than: $176,413 $352,830 $264,623 The worksheet to calculate the AGI limitation is found in the instructions for Form 540. 73 Line 34 If the taxpayer received a qualified lump-sum distribution and was born before January 2, 1936, use Schedule G-1 to calculate the additional tax. If the distributions are from foreign trusts or from certain domestic trusts, use Form 5870A to figure the additional tax. Schedule G-1 If the taxpayer was born before January 2, 1936, and received a qualified lump-sum distribution in 2014, the taxpayer should use Schedule G-1 to calculate the tax by special method, which could lower the tax. The tax is paid only once, in the year the distribution is received. Summary There are some major differences between California and federal law and regulations regarding taxes and additional taxes. Understanding when California conforms to additional taxes is critical. When the state does not conform, the tax preparer must make sure that Schedule CA (540) is adjusted properly. 74