Chapter 5-Judicial Interpretations THE FEDERAL COURT SYSTEM

advertisement

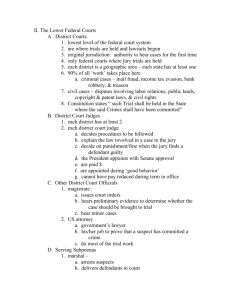

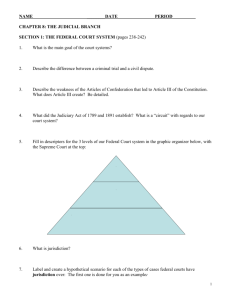

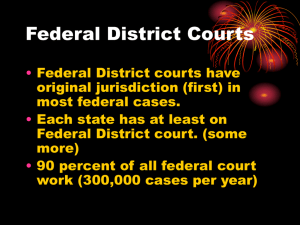

Federal Tax Research, Ninth Edition Page 5-1 Chapter 5-Judicial Interpretations THE FEDERAL COURT SYSTEM 1. The federal court system consists of three trial courts and two levels of appellate courts. Judicial decisions are the third primary source of tax law. 2. Legal Conventions 3. 4. a. The burden of proof is on the taxpayer. b. The attorney-client privilege of confidentiality also applies in tax matters to nonattorneys authorized to practice before the IRS. c. Tax researchers must understand some legal terminology. The Tax Court is a specialized trial court that hears only federal tax cases. a. Nineteen Tax Court judges hear cases in Washington, D.C. and other cities. b. No jury trials; one judge to a case unless the case is unusual. c. The trial judge's opinion may be reviewed by other members of the Court before its release. • “Regular” decisions are issued for new or unusual points of law and are published by the Government Printing Office in Tax Court of the United States Reports. • “Memorandum” decisions concern application of existing law or interpretation of facts and are published by commercial publishers in special-decision reporters. • Decisions of the Small Cases Division are not published. • Regular and memorandum decisions have both temporary and permanent citations. • Under Rule 155, the Tax Court does not compute the amount of tax due. • The Tax Court may examine an entire tax return for a taxpayer whose case it is hearing. The U.S. District Courts have judges who are generalists, not tax specialists, and hear cases involving legal issues based upon the entire U.S. Code. a. A case is heard before one judge and may be heard by a jury upon request by the taxpayer. b. Decisions may vary significantly between Districts and over time. c. Taxpayers who disagree with the IRS may take their case to the District Court only after paying the disputed tax liability. d. All decisions are published as part of the Federal Supplement Series and RIA and CCH publish tax case reporters for tax decisions. Each source uses a different form of citation. Page 5-2 5. 6. 7. INSTRUCTOR’S MANUAL The Court of Federal Claims. a. Sixteen judges hear cases concerning all monetary claims against the federal government, not just tax claims. b. Judges are generalists; there are no jury trials. c. The Court of Federal Claims is located in Washington D.C, but judges travel periodically to major cities in a manner similar to that of the Tax Court. d. Decisions are published by West, RIA and CCH. U.S. Courts of Appeals are the first level of appellate federal courts. a. Generally these courts hear only cases involving a question of law, including both tax and non-tax issues. b. Three-judge panels hear cases; there are no jury trials. c. Decisions constitute precedent, but not in other Circuits if there are conflicting decisions there. d. Decisions are published in several general and specialized tax publications. e. Congress has created thirteen Courts of Appeals: 11 are geographical, one assigned to Washington D.C. and the other is a Court of Appeals for the Federal Circuit. U. S. Supreme Court is the final level of appeal and the sovereign legal authority. a. The few tax cases heard generally involve an issue at conflict among the federal Circuits or a tax issue of major importance. b. Permission to present a case before the Court must be requested by a writ of certiorari. c. Refusal to hear a case is not to be interpreted to mean that the lower court decision is correct. d. Decisions are published in general and specialized reporters. CASE BRIEFS AND HEADNOTES Case briefs are concise summaries of court cases, useful in deciding whether to review the full case covered by the brief or other cases mentioned in the brief. SUMMARY The tax practitioner must understand the federal court system and the courts' decisions to be able to advise clients and select proper trial-level courts in which to pursue litigation.