BF3203

Equity Securities

_________________________________________________________________________

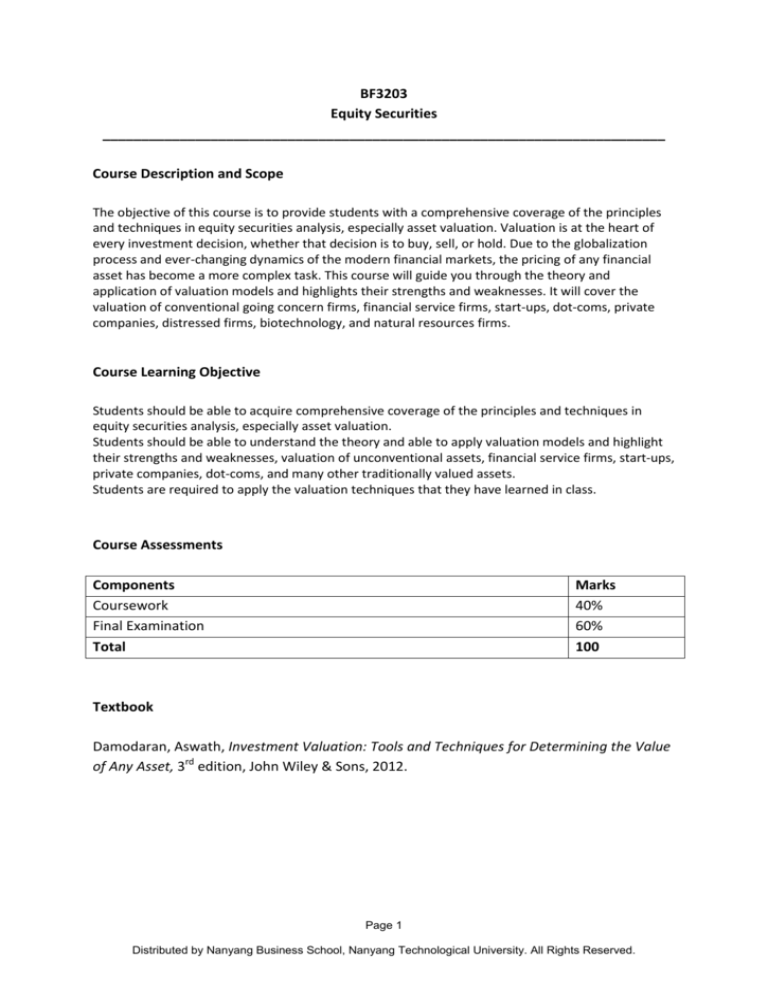

Course Description and Scope

The objective of this course is to provide students with a comprehensive coverage of the principles

and techniques in equity securities analysis, especially asset valuation. Valuation is at the heart of

every investment decision, whether that decision is to buy, sell, or hold. Due to the globalization

process and ever-changing dynamics of the modern financial markets, the pricing of any financial

asset has become a more complex task. This course will guide you through the theory and

application of valuation models and highlights their strengths and weaknesses. It will cover the

valuation of conventional going concern firms, financial service firms, start-ups, dot-coms, private

companies, distressed firms, biotechnology, and natural resources firms.

Course Learning Objective

Students should be able to acquire comprehensive coverage of the principles and techniques in

equity securities analysis, especially asset valuation.

Students should be able to understand the theory and able to apply valuation models and highlight

their strengths and weaknesses, valuation of unconventional assets, financial service firms, start-ups,

private companies, dot-coms, and many other traditionally valued assets.

Students are required to apply the valuation techniques that they have learned in class.

Course Assessments

Components

Coursework

Final Examination

Total

Marks

40%

60%

100

Textbook

Damodaran, Aswath, Investment Valuation: Tools and Techniques for Determining the Value

of Any Asset, 3rd edition, John Wiley & Sons, 2012.

Page 1

Distributed by Nanyang Business School, Nanyang Technological University. All Rights Reserved.

Proposed Weekly Schedule

Week

1.

2.

3.

4.

5.

6.

7.

8.

9.

10.

11.

12.

13.

Topic

Introduction to Equity Analysis and Valuation Approaches

Estimating Discount Rates

Measuring Earnings From Earnings to Cash Flows

Estimating Growth and Terminal Value

Cash & Non-operating assets, Cross-holdings, and ESOS

Equity Valuation: Dividend Discount Models, FCFE Discount Models

Firm Valuation: Cost of Capital and Adjusted Present Value Approaches

Recess Week

Fundamental Principles of Relative Valuation Earnings Multiples

Book Value Multiples, Revenue Multiples and Sector-Specific Multiples

Valuing Financial Service Firms

Valuing Firms with Negative Earnings

Valuing Young or Start-Up Firms

Valuing Private Firms

OGM Valuation: Valuing Equity in Distressed Firms, Biotechnology and Natural

Resources Firms

Acquisitions and Takeovers

Final Examination

Page 2

Distributed by Nanyang Business School, Nanyang Technological University. All Rights Reserved.