Westwood Community Church Consolidated Financial Statements

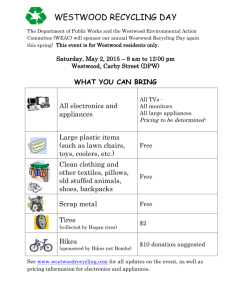

advertisement

WESTWOOD COMMUNITY CHURCH CONSOLIDATED FINANCIAL STATEMENTS YEARS ENDED JULY 31, 2013 AND 2012 WESTWOOD COMMUNITY CHURCH TABLE OF CONTENTS YEARS ENDED JULY 31, 2013 AND 2012 INDEPENDENT AUDITORS’ REPORT 1 CONSOLIDATED FINANCIAL STATEMENTS CONSOLIDATED STATEMENTS OF FINANCIAL POSITION 3 CONSOLIDATED STATEMENTS OF ACTIVITY 4 CONSOLIDATED STATEMENTS OF CASH FLOWS 5 NOTES TO CONSOLIDATED FINANCIAL STATEMENTS 6 INDEPENDENT AUDITORS’ REPORT Leadership Board Westwood Community Church Chanhassen, Minnesota We have audited the accompanying consolidated financial statements of Westwood Community Church (the Church), which comprise the consolidated statements of financial position as of July 31, 2013 and 2012, and the related consolidated statements of activity and cash flows for the years then ended, and the related notes to the consolidated financial statements. Management’s Responsibility for the Consolidated Financial Statements Management is responsible for the preparation and fair presentation of these consolidated financial statements in accordance with accounting principles generally accepted in the United States of America; this includes the design, implementation, and maintenance of internal control relevant to the preparation and fair presentation of consolidated financial statements that are free from material misstatement, whether due to fraud or error. Auditors’ Responsibility Our responsibility is to express an opinion on these consolidated financial statements based on our audits. We conducted our audits in accordance with auditing standards generally accepted in the United States of America. Those standards require that we plan and perform the audit to obtain reasonable assurance about whether the consolidated financial statements are free from material misstatement. An audit involves performing procedures to obtain audit evidence about the amounts and disclosures in the consolidated financial statements. The procedures selected depend on the auditors’ judgment, including the assessment of the risks of material misstatement of the consolidated financial statements, whether due to fraud or error. In making those risk assessments, the auditor considers internal control relevant to the entity’s preparation and fair presentation of the consolidated financial statements in order to design audit procedures that are appropriate in the circumstances, but not for the purpose of expressing an opinion on the effectiveness of the entity’s internal control. Accordingly, we express no such opinion. An audit also includes evaluating the appropriateness of accounting policies used and the reasonableness of significant accounting estimates made by management, as well as evaluating the overall presentation of the consolidated financial statements. We believe that the audit evidence we have obtained is sufficient and appropriate to provide a basis for our audit opinion. An independent member of Nexia International (1) Leadership Board Westwood Community Church Opinion In our opinion, the consolidated financial statements referred to above present fairly, in all material respects, the consolidated financial position of Westwood Community Church as of July 31, 2013 and 2012, and the changes in its net assets and its cash flows for the years then ended in accordance with accounting principles generally accepted in the United States of America. CliftonLarsonAllen LLP Minneapolis, Minnesota November 21, 2013 (2) WESTWOOD COMMUNITY CHURCH CONSOLIDATED STATEMENTS OF FINANCIAL POSITION JULY 31, 2013 AND 2012 2013 2012 ASSETS CURRENT ASSETS Cash and Cash Equivalents Cash and Cash Equivalents - Open Hands Foundation Total Cash and Cash Equivalents Accounts Receivable Prepaid Expenses Total Current Assets $ $ 1,808,630 25,260 1,833,890 103,941 1,937,831 22,198,606 22,808,938 33,155 57,193 $ 24,699,061 $ 24,803,962 $ $ PROPERTY AND EQUIPMENT, NET OTHER ASSETS Loan Closing Costs - Net of Accumulated Amortization of $1,005 and $183,163 in 2013 and 2012, Respectively Total Assets 2,146,049 21,317 2,167,366 174 299,760 2,467,300 LIABILITIES AND NET ASSETS CURRENT LIABILITIES Current Portion of Long-Term Debt Current Portion of Capital Lease Accounts Payable Accrued Payroll and Benefits Deferred Revenue Total Current Liabilities LONG-TERM LIABILITIES Long-Term Debt Long-Term Capital Lease Total Long-Term Liabilities Total Liabilities NET ASSETS Unrestricted Net Assets Temporarily Restricted Net Assets Total Net Assets Total Liabilities and Net Assets See accompanying Notes to Consolidated Financial Statements. (3) 647,338 63,569 116,565 275,444 30,919 1,133,835 543,053 32,320 140,662 230,988 41,337 988,360 10,143,323 132,383 10,275,706 10,811,163 10,811,163 11,409,541 11,799,523 12,493,276 796,244 13,289,520 12,486,315 518,124 13,004,439 $ 24,699,061 $ 24,803,962 WESTWOOD COMMUNITY CHURCH CONSOLIDATED STATEMENTS OF ACTIVITY YEARS ENDED JULY 31, 2013 AND 2012 Unrestricted SUPPORT AND REVENUE Contributions: General Land and Building Donated Materials and Services Open Hands Foundation Events and Program Revenue Interest Income Gain on Sale of Investments Loss on Disposal of Fixed Assets Other Income Net Assets Released from Restrictions Total Support and Revenue EXPENSE Program General and Administrative Fundraising Total Expense CHANGE IN NET ASSETS Net Assets - Beginning NET ASSETS - ENDING $ 4,398,318 2,725 720,914 6,532 (81) 652 31 1,481,536 6,610,627 2013 Temporarily Restricted $ 173,863 1,585,793 (1,481,536) 278,120 Total Unrestricted $ 4,572,181 1,585,793 2,725 720,914 6,532 (81) 652 31 6,888,747 $ 3,879,835 2,559 25,000 650,529 5,985 (28,501) 812 1,881,660 6,417,879 5,166,104 1,395,203 42,359 6,603,666 - 5,166,104 1,395,203 42,359 6,603,666 6,961 278,120 285,081 12,486,315 518,124 13,004,439 12,822,510 796,244 $ 13,289,520 $ 12,486,315 $ 12,493,276 $ See accompanying Notes to Consolidated Financial Statements. (4) 2012 Temporarily Restricted $ 5,233,268 1,420,744 100,062 6,754,074 (336,195) $ 419,129 1,979,021 1,634 (1,881,660) 518,124 Total $ 4,298,964 1,979,021 4,193 25,000 650,529 5,985 (28,501) 812 6,936,003 - 5,233,268 1,420,744 100,062 6,754,074 518,124 181,929 - 12,822,510 518,124 $ 13,004,439 WESTWOOD COMMUNITY CHURCH CONSOLIDATED STATEMENTS OF CASH FLOWS YEARS ENDED JULY 31, 2013 AND 2012 2013 CASH FLOWS FROM OPERATING ACTIVITIES Change in Net Assets Adjustments to Reconcile Change in Net Assets to Net Cash Used by Operating Activities: Depreciation and Amortization Loss on Sale and Transfer of Property and Equipment Contributions Restricted for Long-Term Purposes (Increase) Decrease in Current Assets: Accounts Receivable Prepaid Expenses Increase (Decrease) in Current Liabilities: Accounts Payable Accrued Payroll and Benefits Deferred Revenue Net Cash Used by Operating Activities $ CASH FLOWS FROM INVESTING ACTIVITIES Purchase of Property and Equipment CASH FLOWS FROM FINANCING ACTIVITIES Payments on Long-Term Debt Assumption of Assets through Capital Lease Obligation Payments on Capital Lease Loan Closing Costs Payments on Assessment Proceeds from Contributions Restricted for Long-Term Purposes Net Cash Provided by Financing Activities INCREASE IN CASH AND CASH EQUIVALENTS Cash and Cash Equivalents - Beginning of Year 2012 285,081 $ 181,929 1,063,649 652 (1,585,793) 1,080,624 28,501 (1,979,021) (174) (195,819) 2,364 (1,067) (24,097) 44,456 (10,418) (422,463) (110,890) 13,292 (1,432) (785,700) (152,421) (256,359) (560,106) (79,718) (34,160) (3,449) 1,585,793 908,360 (569,767) 17,043 (40,280) (3,449) 1,979,021 1,382,568 333,476 340,509 1,833,890 1,493,381 CASH AND CASH EQUIVALENTS - END OF YEAR $ 2,167,366 $ 1,833,890 SUPPLEMENTAL INFORMATION Cash Paid for Interest $ 582,341 $ 695,306 Transfer of Capital Lease to Westbrook Church $ - $ 13,477 Fixed Assets Financed with Capital Leases $ 243,350 $ - See accompanying Notes to Consolidated Financial Statements. (5) WESTWOOD COMMUNITY CHURCH NOTES TO CONSOLIDATED FINANCIAL STATEMENTS JULY 31, 2013 AND 2012 NOTE 1 SUMMARY OF SIGNIFICANT ACCOUNTING POLICIES Financial Reporting During 2011, Westwood Community Church (Westwood) established a new church plant, Westbrook Community Church (Westbrook), which was incorporated on June 23, 2011. Although Westwood did not control the Board of Directors of Westbrook, the two churches had the same Leadership Board in 2011 and a portion of 2012. As such, the operations of Westbrook have been included in these financial statements through July 31, 2012 when Westbrook began functioning independently and all assets and liabilities of Westbrook were transferred from Westwood to Westbrook. As such, the 2012 financial statements included operations of Westbrook but there were no longer any balances associated with Westbrook at July 31, 2013. The consolidated financial statements include the activities of Open Hands Foundation (the Foundation). Westwood Community Church exercises control over the Foundation’s Board of Trustees. All intercompany transactions and balances between Westwood, Westbrook, and the Foundation have been eliminated. The organizations are collectively referred to as “the Church” in these financial statements. Westwood Community Church Westwood Community Church began in January 1995 as a church plant of Wooddale Church in Eden Prairie. The Westwood church plant was part of a bold city-wide church planting strategy designed to attract unchurched people. Joel Johnson, who was the Outreach Pastor at Wooddale at the time, was asked to start a church in Chanhassen, an area underserved by churches. A core group of 90 met with the Johnsons in February and March for worship and training in ministry to prepare for the church launch. The group stepped out in faith and opened the doors to Westwood Community Church on Easter Sunday, 1995. Two worship services were offered in the intimate Fireside Theatre at the Chanhassen Dinner Theatres, but the church grew so quickly that just five months later, a move was made to the main Dinner Theatre, seating 450 at round tables. The tables, first seen as a detriment, facilitated wonderful interaction as church members began to get to know one another. Hundreds of new families came as news about Westwood’s informal atmosphere, wonderful worship and caring biblically-based messages began to spread. The Church experienced a boom in growth when it held its first public service on Easter Sunday - April 16, 1995. Westwood faced another challenge in the fall of 1997. The children’s ministry had grown so large that the current facilities could no longer accommodate their needs. By this time the new District 112 High School was built in Chaska, eight miles southwest of the Chanhassen Dinner Theatre. It was the only facility in the immediate region that could accommodate Westwood’s growing needs, though moving there raised costs significantly. After careful consideration, the decision was made and in December of 1997, Westwood relocated to the new high school. Rapid growth continued and a third service was soon added. (6) WESTWOOD COMMUNITY CHURCH NOTES TO CONSOLIDATED FINANCIAL STATEMENTS JULY 31, 2013 AND 2012 NOTE 1 SUMMARY OF SIGNIFICANT ACCOUNTING POLICIES (CONTINUED) Westwood Community Church (Continued) In January 1999, a Purchase Agreement was signed for 57 acres of land on the northwest corner of Cty Rd 5 and State Hwy 41. A member of the congregation identified this parcel of land which was owned by a friend, but not for sale. The land had been earmarked for construction of 80 luxury homes, but the landowner agreed to sell the land to Westwood as long as a church was constructed on the site. In August 1999, the architectural firm of Hammel Green and Abrahamson, Inc. (H.G.A.) of Minneapolis was selected to design and develop Westwood’s future facility. Witcher Construction was selected as the general contractor. The groundbreaking service for the 69,000 square foot Phase I was held on April 21, 2002. The facility, which includes worship space for 1,000, parking for 500 cars, 15 classrooms, kitchen, conference room and office space, was completed on schedule and under budget. The first services were held on July 13, 2003, with four services throughout the day. In the year following the move, attendance increased nearly 40%. Late in 2004, a second access road was added, providing a south access off of Highway 41 and increased visibility for Westwood with the additional of a beautiful monument sign at the intersection of Highway 41 and W. 78th Street. 135 parking spaces were also added at this time. The second access road was a condition of the city for any additional campus development. On Easter Sunday 2005, we celebrated our 10th anniversary as a church. To commemorate 10 years of God’s blessing, Westwood stepped out in faith and planted our first daughter church, Emmaus Road Church, which began services on Easter Sunday at the Hopkins Fine Arts Center. Westwood leadership had anticipated that planning and fund raising for a student center, the second building in our master plan, would also begin in 2005. The Lord directed differently, however, and the focus of the “Ground Work” capital campaign, which concluded successfully in the spring of 2005, was on reducing our short and long-term debt in order to strengthen our financial foundation. Having a campus has been a great blessing, which has facilitated the expansion of ministry, broadened our reach into additional communities and increased the age diversity of our congregation. In February of 2008, a special business meeting was held where the Westwood congregation approved, pending approval of a funding plan, to construct a Phase 2 facility (to the east of the current building) with additional space for children, students and adults. The congregation also approved spending funds for architectural and other planning costs as well as to conduct a capital campaign. The “Nothing Less Than Extraordinary” campaign was held in the spring of 2008 with the goals of building Phase 2, expanding local ministry and expanding our work in Malawi Africa (5% of funds raised will go to the Malawi work, up to $500,000). Funds from the campaign will also be applied to Phase 1 and 2 mortgage principal and interest and be used to help with additional operating costs for the new facility. Westwood leadership determined the scope and finance plan for Phase 2 which was approved by the congregation at a special business meeting in March of 2009. The plan is to build a 44,000 square foot facility on two floors but finish only a portion of that space: the two connecting/commons spaces on both floors, and student classrooms on the lower level and restrooms. A spring, 2009 capital campaign raised additional funds for the project. (7) WESTWOOD COMMUNITY CHURCH NOTES TO CONSOLIDATED FINANCIAL STATEMENTS JULY 31, 2013 AND 2012 NOTE 1 SUMMARY OF SIGNIFICANT ACCOUNTING POLICIES (CONTINUED) Westwood Community Church (Continued) A Groundbreaking Ceremony was held in June 2009 with construction beginning in late summer and continuing for the next year. Financing was secured on the project in October of 2009. The Phase 2 facility opened for ministry use in September of 2010, finished as described above. The remainder of the interior will be completed as funds allow. Highlights of 2010 included celebrating 15 years of ministry as a church and baptizing a record number of people during the year. Westwood has continued to grow in worship attendance, membership and giving. New service initiatives included a Service of Hope and Healing, Family services at Christmas Eve and a third off-site service at Easter to accommodate all those that wanted to worship with us. At the Annual Meeting in September of 2011, the congregation approved moving forward with a church plant. Kevin Sharpe, our Pastor of Community Life and Learning, leads the church plant, Westbrook Church, which opened its doors at Chaska’s Clover Ridge Elementary School on September 18, 2011, under Westwood’s umbrella. Also in the fall of 2011, Westwood held the “All In” capital campaign to raise funds over the next two years to reduce debt, service our existing mortgage and support ministry expansion. Participation in the campaign was the highest in the church’s history. With worship space now an issue on Sunday mornings, “Worship in the Link” was created, using technology to transmit the worship service and message to space in the Phase 2 building both on Sundays and, especially, on holidays. In February, Westwood also responded to our growth by adding a Saturday evening service, giving people an additional option and relieving some of the crowding on Sunday morning. Two task forces, created by the Leadership Board, reported findings that will shape our future. A Membership Task Force recommended raising awareness of membership and restructuring the membership process to ensure that more people that begin the process see it through to completion and active involvement in the mission and vision of the Church. A Vision2020 Task Force looked ten years ahead to discern needs and potential changes in the community around us and examined potential areas for Westwood ministry to intersect those needs. On September 16, 2012, Westbrook Church held its first Annual Meeting as a healthy, growing independent congregation. Westwood will continue to support Westbrook financially through 2014. (8) WESTWOOD COMMUNITY CHURCH NOTES TO CONSOLIDATED FINANCIAL STATEMENTS JULY 31, 2013 AND 2012 NOTE 1 SUMMARY OF SIGNIFICANT ACCOUNTING POLICIES (CONTINUED) Westwood Community Church (Continued) In 2013, a multi-site consultant was brought in to help Westwood leadership explore the option of better accomplishing our mission by expanding Westwood’s reach into the Twin Cities through establishing additional campuses within our sphere of influence. The multisite strategy is being used very effectively by churches in the Twin Cities and around the country by leveraging the brand strengths of the church, establishing campuses 15 miles or so away from the original campus, in communities where they are already known. A Multi-site Task Force was created by the Leadership Board to develop a proposed plan for multi-site implementation. Based on the consultant’s recommendation, the first step was to significantly upgrade our video technology to allow us to do “image magnification” in the main worship space. This was accomplished during the summer of 2013 and, beginning in the fall, the sermon portion of the service was projected on to the large screens in the current Worship Center, thereby showing people that watching sermons via screen is an effective and meaningful way to take in the message. Leadership also affirmed that prior to actual multi-site campuses; we would complete the shelled-in space on campus, and utilize the largest room as an alternate worship space, with live worship and the message relayed by video. This new space would also be used by students on Wednesday nights as growth in this ministry exploded in 2013, effectively filling up the expanded space built just three years ago. The timeline for completing the Phase 2 space included fundraising in the fall and early winter; with construction commencing in January, with the hopeful use of the space by Easter 2014. If this timeline is accomplished, the first multi-site could conceivably open by January of 2015, launching Westwood into an exciting new chapter of growth and expanded ministry. Organization The Church is organized to promote spiritual, educational and other interests of its members. The Church’s programs are as follows: Church – Promotes spiritual, educational and other interests of its members Ministry Groups – Ministers to youth, men, women and other identifiable groups within the Church Preschool – Serves a total of approximately 160 preschool students and their families with 2-day, 3-day and 4-day options throughout the normal school year Open Hands Foundation – Enhances community involvement in support opportunities (9) WESTWOOD COMMUNITY CHURCH NOTES TO CONSOLIDATED FINANCIAL STATEMENTS JULY 31, 2013 AND 2012 NOTE 1 SUMMARY OF SIGNIFICANT ACCOUNTING POLICIES (CONTINUED) Financial Statement Presentation Net assets and revenues, gains, and losses are classified based on donor imposed restrictions. Accordingly, net assets of the Church and changes therein are classified and reported as follows: Unrestricted – Resources over which the Leadership Board has discretionary control. Designated amounts represent those revenues which the board has set aside for a particular purpose. All furniture and equipment are considered unrestricted. Temporarily Restricted – Those resources subject to donor imposed restrictions which will be satisfied by actions of the Church or passage of time. Permanently Restricted – Those resources subject to a donor imposed restriction that they be maintained permanently by the Church. The Church had temporarily restricted net assets of $797,878 and $518,124 at July 31, 2013 and 2012, respectively, relating to building fund contributions. The Church has no permanently restricted net assets. Cash and Cash Equivalents The Church places its cash deposits with a financial institution and a money market mutual fund. At times, the balances on deposit with the financial institution may exceed Federal Deposit Insurance Corporation insurance limits. For the purposes of the statement of cash flows, cash and cash equivalents include all cash balances and highly liquid investments with an original maturity of three months or less. Property and Equipment Property and equipment purchases are stated at cost. Contributed items are recorded at fair market value at date of donation. If donors stipulate how long the assets must be used, the contributions are recorded as restricted support. In the absence of such stipulation, contributions of property and equipment are recorded as unrestricted. The Church uses the straight-line method of depreciation over the estimated useful lives of the asset. Depreciation expense was $1,005,451 and $1,058,608 for the years ended July 31, 2013 and 2012, respectively. Loan Closing Costs Loan closing costs included loan origination fees and loan modification fees that may be incurred during the life of the loan. Fees are recorded at cost and are amortized using the straight-line method over the remaining term of the loan. Amortization was $58,198 and $22,016 for the years ended July 31, 2013 and 2012, respectively. (10) WESTWOOD COMMUNITY CHURCH NOTES TO CONSOLIDATED FINANCIAL STATEMENTS JULY 31, 2013 AND 2012 NOTE 1 SUMMARY OF SIGNIFICANT ACCOUNTING POLICIES (CONTINUED) Contribution Pledges Revenue is recognized at the time an irrevocable pledge is made. No pledge receivables have been recognized for “All In” or “Nothing Less than Extraordinary” campaigns at July 31, 2013 or 2012 as the pledge agreements allow the donor to alter or revoke the pledge amount at any time. Deferred Revenue The deferred revenue at July 31, 2013 and 2012 consists primarily of preschool tuition and event registrations. Donated Materials and Services Contributions of noncash assets and materials are recorded at their fair values in the period received. Contributions of donated services that create or enhance nonfinancial assets or that require specialized skills, are provided by individuals possessing those skills, and would typically need to be purchased if not provided by donations, are recorded at their fair values in the period received. Fair Value Measurements In accordance with the standard on fair value measurement, the Church has categorized its financial instruments, based on the priority of the inputs to the valuation technique, into a three-level fair value hierarchy. The fair value hierarchy gives the highest priority to quoted prices in active markets for identical assets or liabilities (Level 1) and the lowest priority to unobservable inputs (Level 3). If the inputs used to measure the financial instruments fall within different levels of the hierarchy, the categorization is based on the lowest level input that is significant to the fair value measurement of the instrument. Financial assets and liabilities recorded on the consolidated statements of financial position are categorized based on the inputs to the valuation techniques as follows: Level 1 – Financial assets and liabilities whose values are based on unadjusted quoted prices for identical assets or liabilities in an active market that the Church has the ability to access. Level 2 – Financial assets and liabilities whose values are based on quoted prices in markets that are not active or model inputs that are observable either directly or indirectly for substantially the full term of the asset or liability. Level 2 inputs include the following: Quoted prices for similar assets or liabilities in active markets; Quoted prices for identical or similar assets or liabilities in non-active markets; Pricing models whose inputs are observable for substantially the full term of the asset or liability; and Pricing models whose inputs are derived principally from or corroborated by observable market data through correlation or other means for substantially the full term of the asset or liability. (11) WESTWOOD COMMUNITY CHURCH NOTES TO CONSOLIDATED FINANCIAL STATEMENTS JULY 31, 2013 AND 2012 NOTE 1 SUMMARY OF SIGNIFICANT ACCOUNTING POLICIES (CONTINUED) Fair Value Measurements (continued) Level 3 – Financial assets and liabilities whose values are based on prices or valuation techniques that require inputs that are both unobservable and significant to the overall fair value measurement. These inputs reflect management’s own assumptions about the assumptions a market participant would use in pricing the asset or liability. The Church follows a policy allowing the option of valuing certain financial instruments at fair value. This accounting policy allows entities the irrevocable option to elect fair value for the initial and subsequent measurement for certain financial assets and liabilities on an instrument-by-instrument basis. The Church has not elected to measure any existing financial instruments at fair value, however may elect to measure newly acquired financial instruments at fair value in the future. Functional Allocation of Expense Salaries and related expenses are allocated based on job descriptions and the best estimates of management. Expenses, other than salaries and related expenses that are not directly identifiable by program or supporting service are allocated based on the best estimates of management. Income Tax Status The Church and Open Hands Foundation are organized and operated as nonprofit, taxexempt religious organizations under Section 501(c)(3) of the Internal Revenue Code. They have been classified as organizations that are not private foundations under the Internal Revenue Code and charitable contributions by donors are tax deductible. As religious organizations they are exempt for filing a Form 990. The Church follows the income tax standard for recognition of uncertain tax positions. Under this standard, they have not identified any uncertain tax positions as of July 31, 2013. Generally, their position on the taxability of transactions is open for review for up to 6 years. Estimates Management uses estimates and assumptions in preparing financial statements in accordance with accounting principles generally accepted in the United States of America. Those estimates and assumptions affect the reported amounts of assets and liabilities, the disclosure of contingent assets and liabilities, and the reported revenues and expenses. Actual results could vary from the estimates that were used. Reclassifications Certain reclassifications have been made to the July 31, 2012 financial statements in order to present them in conformity with the July 31, 2013 financial statements. These reclassifications had no impact on net assets as previously reported. (12) WESTWOOD COMMUNITY CHURCH NOTES TO CONSOLIDATED FINANCIAL STATEMENTS JULY 31, 2013 AND 2012 NOTE 1 SUMMARY OF SIGNIFICANT ACCOUNTING POLICIES (CONTINUED) Subsequent Events The Church has evaluated events and transactions for potential recognition or disclosure in these consolidated financial statements through November 21, 2013, the date the consolidated financial statements were available to be issued. NOTE 2 PROPERTY AND EQUIPMENT Property and equipment consist of the following as of July 31, 2013 and 2012: 2013 4,702,613 2,680,229 22,576,910 29,959,752 (7,761,146) $ 22,198,606 Land and Land Improvements Furniture and Equipment Building and Building Improvements $ Less: Accumulated Depreciation Property and Equipment, Net 2012 4,702,613 2,609,807 22,496,441 29,808,861 (6,999,923) $ 22,808,938 $ Included in property and equipment is a road the Church constructed and put in service during 2005 to provide additional access to its property. Legal title to the road was transferred to the City of Chanhassen in 2006. Because the Church will continue to derive significant value from the road in future years, the road costs are included in property and equipment and are depreciated over 20 years, the expected economic useful life of the road. The Church substantially completed construction and occupied Phase II of the Church building in September 2010. NOTE 3 CAPITAL LEASE The Church entered into two new capital leases in 2013 for copiers and a phone system. Assets under capital leases included in equipment are as follows at July 31: Capital Leases Accumulated Depreciation Total $ $ (13) 2013 243,350 (42,950) 200,400 $ $ 2012 109,727 (73,151) 36,576 WESTWOOD COMMUNITY CHURCH NOTES TO CONSOLIDATED FINANCIAL STATEMENTS JULY 31, 2013 AND 2012 NOTE 3 CAPITAL LEASE (CONTINUED) Future minimum payments under capital leases at July 31, 2013 are as follows: Year Ending July 31, 2014 2015 2016 2017 2018 Total Minimum Lease Payments Imputed interest at .5% to 5% Less: Current Portion Long-Term Capital Lease NOTE 4 $ $ Amount 68,059 68,059 33,559 26,659 11,110 207,446 (11,494) (63,569) 132,383 OPERATING LEASES The Church has entered into various operating lease agreements as a lessee for a vehicle and for office equipment. Future minimum lease payments under those agreements are as follows: Year Ending July 31, 2014 2015 2016 2017 2018 Total $ $ Amount 19,265 19,265 8,748 1,764 441 49,483 Rent expense for these leases amounted to $20,473 and $22,406 of the years ended July 31, 2013 and 2012, respectively. Additionally, during the year ended July 31, 2012, the Church paid $45,155 on behalf of Westbrook for expenses relating to their facility lease and copier lease. NOTE 5 RETIREMENT PLAN The Church participates in a Section 403(b) retirement investment plan which covers substantially all employees who meet eligibility requirements. Employees may elect to defer a portion of their salary under the 403(b) portion of the plan. The plan provides that eligible employees receive Church contributions up to a maximum 5% of their annual compensation. Church contributions for the years ended July 31, 2013 and 2012 were $68,911 and $65,006, respectively. (14) WESTWOOD COMMUNITY CHURCH NOTES TO CONSOLIDATED FINANCIAL STATEMENTS JULY 31, 2013 AND 2012 NOTE 6 LONG-TERM DEBT Long-term debt consists of the following at July 31, 2013 and 2012: Description 2013 Note payable with monthly payments of principal and interest of $64,772 at a fixed rate of 3.79% through April 1, 2018 with subsequent interest rates set annually based on the 5-year LIBOR Swap Rate plus 388 basis points. The Note matures December 1, 2023 at which time it is payable in full. $ Note payable with monthly payments of principal and interest of $72,272 at a fixed rate of 5.9% effective through December 1, 2013 at which time the loan was refinanced. Note payable with monthly payments of principal and interest of $22,615 at a fixed rate of 3.79% through April 1, 2018 with subsequent interest rates set annually based on the 5-year LIBOR Swap Rate plus 388 basis points. The Note matures December 1, 2023 at which time it is payable in full. 2012 6,617,946 $ - - 7,087,936 4,136,664 - - 4,226,780 Note payable of up to $6,000,000, with interest-only payments of 5.84% due monthly from October 1, 2009 through August 1, 2011. Effective September 1, 2011, principal and interest payments are $27,489 per month through maturity, August 1, 2024, with a balloon payment due at maturity. The loan was refinanced March 29, 2013. Land assessment payable due in equal biannual installments over 10 years and bears interest of 6%. Total Long-Term Debt Current Portion of Long-Term Debt Net Long-Term Debt $ 36,051 39,500 10,790,661 11,354,216 (647,338) 10,143,323 (543,053) 10,811,163 $ The above notes payable are secured by the assets of the Church and are subject to various covenants. As of July 31, 2013 and 2012, the Church was not in compliance with certain debt covenants for which waivers were received from the bank. (15) WESTWOOD COMMUNITY CHURCH NOTES TO CONSOLIDATED FINANCIAL STATEMENTS JULY 31, 2013 AND 2012 NOTE 6 LONG-TERM DEBT (CONTINUED) Estimated maturities of long-term debt as of July 31, 2013 are as follows: Year Ending July 31, 2014 2015 2016 2017 2018 Thereafter Total Debt Less: Current Portion Long-Term Debt NOTE 7 $ $ Amount 647,338 672,605 697,892 726,098 751,144 7,295,584 10,790,661 647,338 10,143,323 LINE OF CREDIT The Church has a $250,000 line of credit with a maturity of January 31, 2014. The line of credit bears an interest rate of 5%. There were no amounts outstanding on the line of credit as of July 31, 2013 and 2012. (16)