AMB Country Risk Report

August 18, 2015

Our Insight, Your Advantage.

Australia

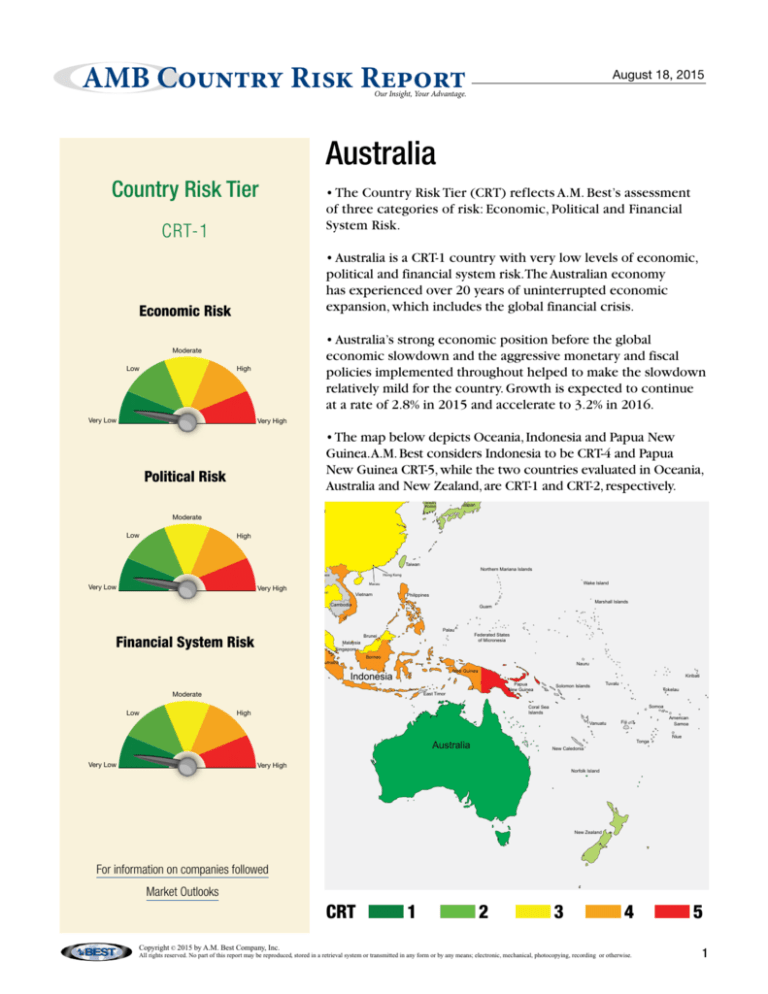

Country Risk Tier

• The Country Risk Tier (CRT) reflects A.M. Best’s assessment

of three categories of risk: Economic, Political and Financial

System Risk.

CRT-1

• Australia is a CRT-1 country with very low levels of economic,

political and financial system risk.The Australian economy

has experienced over 20 years of uninterrupted economic

expansion, which includes the global financial crisis.

Economic Risk

Finland

• Australia’s strong economic position before the global

economic slowdown and the aggressive monetary and fiscal

policies implemented

throughout helped to make the slowdown

Russia

relatively mild for the country. Growth is expected to continue

at a rate of 2.8% in 2015 and accelerate to 3.2% in 2016.

Moderate

Low

Estonia

High

Russia

Latvia

Lithuania

Belarus

Very Low

Poland

Slovakia

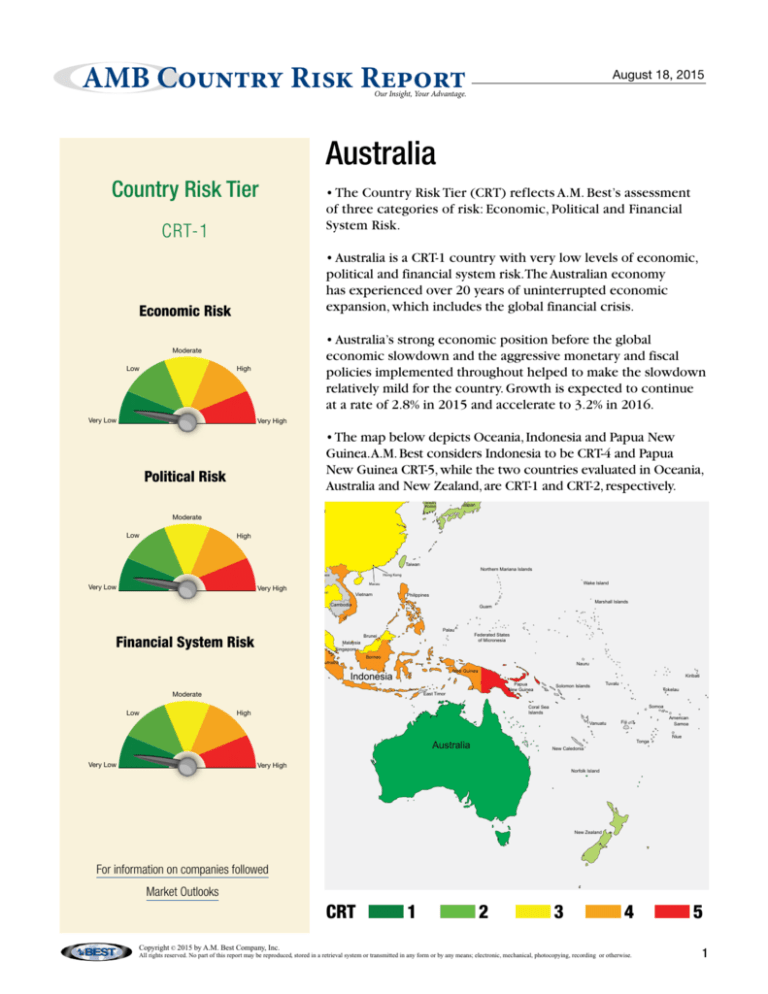

• The map below depicts Oceania, Indonesia and Papua New

Guinea.A.M. Best considers Indonesia to be CRT-4 and Papua

New Guinea CRT-5, while the two countries evaluated in Oceania,

Australia and New Zealand, are CRT-1 and CRT-2, respectively.

Kazakhstan

Republic of

Moldova

Hungary

Sakhalin

Very High

Ukraine

Mongolia

Romania

a

a & Serbia

vina

ontenegro

Political Risk

Russia

Bulgaria

Georgia

Macedonia

Armenia

Albania

Kyrgyzstan

Azerbaijan

Uzbekistan

Turkey

Greece

Cyprus

Turkmenistan

Syria

Lebanon

Iraq

Israel

Low

Kuwait

ya

Pakistan

Bahrain

Egypt

Nepal

Sudan

Bhutan

Bangladesh

Myanmar

India

Very Low

Very High

Yemen

Eritrea

Japan

High

U.A.E.

Oman

had

South

Korea

China

Qatar

Saudi Arabia

Taiwan

Northern Mariana Islands

Hong Kong

Laos

Wake Island

Macau

Thailand

Vietnam

Philippines

Cambodia

Somalia

Sri Lanka

l Africa Republic

Uganda

Financial System Risk

ia

Brunei

Sumatra

Tanzania

Moderate

Malawi

Comoros

Zimbabwe

Low

East Timor

Kiribati

Papua

New Guinea

Solomon Islands

Tuvalu

Tokelau

Somoa

Coral Sea

Islands

High

Australia

Reunion

Very Low

Very High

Lesotho

Cook

Islands

American

Samoa

Fiji

Mauritius

Madagascar

Swaziland

Nauru

New Guinea

Vanuatu

Mozambique

Botswana

Federated States

of Micronesia

Borneo

Indonesia

Seychelles

Zambia

Palau

Malaysia

Singapore

Kenya

Rwanda

Dem. Republic

Burundi

of Congo

a

Marshall Islands

Guam

Dijbouti

Ethiopia

s

nd

la

Is

North Korea

Tajikistan

Afghanistan

Moderate

Iran

Jordan

ril

Ku

Tonga

Niue

New Caledonia

Norfolk Island

South Africa

New Zealand

For information on companies followed

Market Outlooks

CRT 1 2 3 4 5

Copyright © 2015 by A.M. Best Company, Inc.

All rights reserved. No part of this report may be reproduced, stored in a retrieval system or transmitted in any form or by any means; electronic, mechanical, photocopying, recording or otherwise.

1

AMB Country Risk Report

Australia

Regional Summary: Oceania

• Oceania, whose largest two nations,

Australia and New Zealand, make up

the vast majority of economic activity,

is located in the South Pacific Ocean.

Australia and New Zealand have strong

political and cultural ties with the United

Kingdom, enjoy high living standards and

benefit from an educated population.

• Australia and New Zealand have close

economic ties with Southeast Asia. In

2009 the ASEAN-Australia and New

Zealand Free Trade Area (AANZFTA) was

established which has been successful in

increasing trade throughout the region,

representing over 620 million people and

$4.1 trillion USD.

• The region is expected to grow

modestly in the coming years, with both

Australia and New Zealand forecasted to

grow in the range of 2.5 to 3.5% in 2015

and 2016. Growth will likely be driven

by accommodative monetary policy, low

inflation, currency depreciation boosting

exports and weak fuel prices.

Vital Statistics 2014

Nominal GDP

Population

GDP Per Capita

Real GDP Growth

Inflation Rate

Premiums Written (Life)

Premiums Written (Non-Life)

Premiums Growth (2013 - 2014)

Country Risk Tier

CRT-1

CRT-4

CRT-2

CRT-3

CRT-2

CRT-1

Australia

Indonesia

Japan

Malaysia

New Zealand

Singapore

Source: IMF, Axco, Swiss Re and A.M. Best

Economic Growth

• The Australian economy is dominated

by its services sector, which accounts

for nearly 70% of GDP. The largest

components are finance, property, and

business services.

5

Real GDP

CPI Inflation

4.5

4

3.5

3

%

2.5

2

1.5

1

0.5

0

• With strong institutions, a flexible

economy and supportive monetary policy

it is likely the commodity lead weakness

will be short-lived.

1444.19

23.6

61,219

2.7

2.5

56,151

31,924

12.4

Regional Comparison

Economic Risk: Very Low

• Atypically slower growth of about 2.5%

is expected in 2015 due to a weakened

mining sector, low non-mining sector

investment, and slower external demand

as China cools and the eurozone remains

weak. Further monetary easing is

possible if the economy does not show

signs of improvement.

USD bn

mil

USD

%

%

USD mil

USD mil

%

2006

2007

2008

2009

2010

2011

2012

2013

2014

2015

2016

2017

2018

2019

2020

Source: IMF World Economic Outlook and A.M. Best

2

AMB Country Risk Report

Australia

Political Risk: Very Low

Political Risk Summary

• Most of Australia’s population and

economic activity is concentrated along

the country’s eastern coast.

Score 1 (best) to 5 (worst)

Australia

World Average

International Transactions

Policy

5

4

Legal System

• Australia’s legal system is very strong,

stable and transparent with minimal

corruption.The stable regulatory

environment and fair treatment of foreign

investors make the country a destination

for foreign direct investment.

Monetary Policy

3

2

1

Regional Stability

Fiscal Policy

0

Social Stability

Business Environment

Government Stability

• Projected weaker fiscal revenues in the

2015 budget will leave an estimated AUD

52 billion shortfall.The government still

hopes to reach a balanced budget by 2020

through budget initiatives, stronger tax

revenues with a recovery in commodity

prices and some fiscal conservatism. While

not ideal, Australia does have the financial

flexibility currently to run a budget deficit.

Labor Flexibility

Source: A.M. Best

GDP Per Capita and Population

for Selected Countries

Financial System Risk: Very Low

300

70,000

GDP Per Capita

• According to the World Bank, Australia’s

business environment is ranked #10 out of

189 countries in terms of their 2015 Ease

of Doing Business survey.

Population

60,000

250

50,000

200

• The Australian Prudential Regulation

Authority (ARPA) and the Australian

Securities and Investment Commission

(ASIC) are the ultimate regulatory

authorities for the insurance industry in

Australia. ARPA is the prudential regulator

of the entire financial services industry

and conforms to international standards.

USD

Millions

40,000

150

30,000

100

20,000

50

10,000

0

• Australian banks are sufficiently

capitalized and profitable; however, under

a stressed scenario, they have an outsized

exposure to the housing market through

mortgage lending.

Australia

Indonesia

Source: IMF and A.M. Best

Japan

Malaysia

New Zealand

Singapore

0

• The Reserve Bank of Australia lowered

the base lending rate by 50 basis points

to a rate of 2% in the first half of 2015 in

response to slower growth, low inflation

and weaker commodity prices.There is

potential for further cuts.

3

AMB Country Risk Report

Australia

GUIDE TO BEST’S COUnTry rISk TIErS

A.M. Best defines country risk as the risk that country-specific factors could adversely affect the claims-paying ability of an insurer. Country risk is

evaluated and factored into all Best’s Credit Ratings. Countries are placed into one of five tiers, ranging from “CRT-1” (Country Risk Tier 1), denoting

a stable environment with the least amount of risk, to “CRT-5” (Country Risk Tier 5) for countries that pose the most risk and, therefore, the greatest

challenge to an insurer’s financial stability, strength and performance.

A.M. Best’s Country Risk Tiers are not credit ratings and are not directly comparable to a sovereign debt rating, which evaluates the ability and

willingness of a government to service its debt obligations.

Country risk Tiers

Country risk Tier

Definition

CRT-1

Predictable and transparent legal environment, legal system and business infrastructure; sophisticated financial

system regulation with deep capital markets; mature insurance industry framework.

CRT-2

Predictable and transparent legal environment, legal system and business infrastructure; sufficient financial system

regulation; mature insurance industry framework.

CRT-3

Developing legal environment, legal system and business environment with developing capital markets; developing

insurance regulatory structure.

CRT-4

Relatively unpredictable and nontransparent political, legal and business environment with underdeveloped capital

markets; partially to fully inadequate regulatory structure.

CRT-5

Unpredictable and opaque political, legal and business environment with limited or nonexistent capital markets; low

human development and social instability; nascent insurance industry.

Country risk reports

A.M. Best Country Risk Reports are designed to provide a brief, high-level explanation of some of the key factors that determine a country’s Country

Risk Tier assignment. It is not intended to summarize A.M. Best’s opinion on any particular insurance market or the prospects for that market.

Categories of risk

Country Risk Reports provide scores for three categories of risk for each country. These scores are (1) Very Low; (2) Low; (3) Moderate; (4) High

and (5) Very High.

Category of risk

Definition

Economic Risk

The likelihood that fundamental weaknesses in a country’s economy will cause adverse developments for an insurer.

A.M. Best’s assessment of economic risk evaluates the state of the domestic economy, government finances and

international transactions, as well as prospects for growth and stability.

Political Risk

The likelihood that government or bureaucratic inefficiencies, societal tensions, inadequate legal system or

international tensions will cause adverse developments for an insurer. Political risk comprises the stability of the

government and society, the effectiveness of international diplomatic relationships, the reliability and integrity

of the legal system and of the business infrastructure, the efficiency of the government bureaucracy, and the

appropriateness and effectiveness of the government’s economic policies.

Financial System Risk

Financial system risk (which includes both insurance and non-insurance financial system risk) is the risk that financial

volatility may erupt due to inadequate reporting standards, weak banking system or asset markets, and/or poor

regulatory structure. In addition, it includes an evaluation of whether the insurance industry’s level of development and

public awareness, transparent and effective regulation and reporting standards, and sophisticated regulatory body will

contribute to a volatile financial system and compromise the ability of an insurer to pay claims.

Political risk Summary

To provide additional detail on the political risk in a given domicile the Country Risk Reports include the Political Risk Summary. The Political Risk

Summary is a radar chart that displays scores for nine different aspects of political risk scored on a scale of one to five with one being the least

amount of risk and five being the highest amount of risk.

Category

Definition

International Transactions

Policy

Measures the effectiveness of the exchange rate regime and currency management.

Monetary Policy

Measures the ability of a country to effectively implement monetary policy.

Fiscal Policy

Measures the ability of a country to effectively implement fiscal policy.

Business Environment

Measures the overall quality of the business environment and ease of doing business.

Labor Flexibility

Measures the flexibility of the labor market, including the company’s ability to hire and fire employees.

Government Stability

Measures the degree of stability in a government.

Social Stability

Measures the degree of social stability, including human development and political rights.

Regional Stability

Measures the degree of stability in the region.

Legal System

Measures the transparency and level of corruption in the legal system.

Country risk Tier Disclosure

A Country Risk Tier (CRT) is not a credit rating, rather it represents a component of A.M. Best’s Credit Rating Methodology that is applied to all

insurers. A CRT is not a recommendation to purchase, hold or terminate any security, insurance policy, contract or any other financial obligation

issued by a government, an insurer or other rated issuer, nor does it address the suitability of any particular policy, contract or other financial

obligation for a specific purpose or purchaser.

Copyright © 2015 by A.M. Best Company, Inc.

Version 091714

Copyright © 2015 by A.M. Best Company, Inc.

All rights reserved. No part of this report may be reproduced, stored in a retrieval system or transmitted in any form or by any means; electronic, mechanical, photocopying, recording or otherwise.

4