UNIFORM LIMITED PARTNERSHIP ACT (1976) WITH 1985

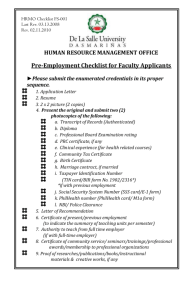

advertisement