course title - Rady School of Management

advertisement

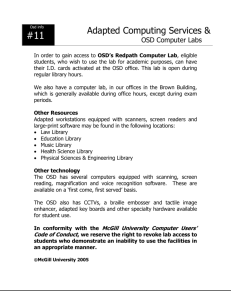

MGT 131B: Intermediate Accounting Undergrad, Winter 2013 PROFESSOR: Robert Houskeeper, CPA EMAIL: rvhous@cox.net PHONE: (760) 632-2650 OFFICE HOURS: TTH 11:30 AM TO 12:15 PM OFFICE LOCATION: Otterson Hall 3S119 OBJECTIVES The goals of this course are to provide the students with an understanding of (1) accounting for liabilities, (2) accounting for investments, (3) revenue recognition and (4) cash flow analysis. MATERIALS Required Kieso, Weygandt and Warfield (2012). Intermediate Accounting (14thed) ASSIGNMENTS Reading and homework assignments follow the course outline (by chapter). Graded homework must be submitted by the start of class on the subsequent Tuesday (no exceptions). GRADING Assignments Homework Exam I Exam II Points [or percentage] 10% 45% 45% Total 100 POINTS DISTRIBUTION A 95 - 100 Points A- 90 - 94 B+ 87 - 89 B 84 - 86 B- 80 - 83 C+ 77 - 79 C CD+ D DF 74 - 76 70 - 73 67 - 69 64 - 66 60 - 63 0 - 59 ATTENDANCE The course material necessitates each student’s proactive involvement. In addition to reading the text, problem solving in the classroom is essential to comprehension of the subject matter. SCHEDULE Date Jan 7 Class Topic & Activities Introduction to Liabilities Compensated Absences, Payroll Liabilities Homework Assignments Jan 9 (Ex 13-5, Ex 13-8) Jan 30 Feb 4 Feb 6 Feb 11 Chapter 13: Compensated Absences, Payroll Liabilities Chapter 14: Bond Premium & Discount Chapter 14: Continued Chapter 15: Dividends, Stock Splits Chapter 15: Continued Chapter 17: Fair Value, Equity Method of Accounting for Investments Chapter 17: Continued Chapter 18: Percentage of Completion Chapter 18: Continued Exam I Review Feb 13 Exam I Feb 18 Feb 20 Feb 25 Feb 27 Chapter 19: Accounting For Income Taxes Chapter 19: Continued Chapter 19: Continued Chapter 20: Accounting For Pensions Mar 4 Mar 6 Mar 11 Mar 13 Chapter 20: Continued Chapter 23: Statement of Cash Flows Chapter 23: Continued Final Exam Review Jan 14 Jan 16 Jan 21 Jan 23 Jan 28 (Ex 14-10, Ex 14-21) (Ex 15-1, Ex 15-2, Ex 15-14) (Ex 17-6, Ex 17-17) (Ex 18-12, Ex 18-13) (P 19-2, P 19-7) (Ex 20-2, Ex 20-3, Ex 20-4) (Ex 23-5, Ex 23-9) FINAL EXAM GRADED HOMEWORK Bold exercises and problems are due at the beginning of class on the subsequent Tuesday With the exception of Chapters 19 and 20 which are due March 4st and March 11th respectively. LEARNING OUTCOMES Chapter 13: Identify the basic characteristics of a liability. Distinguish between current and long term liabilities. Account for compensated absences. Account for payroll related liabilities. Chapter 14: Determine bond issue price when yield and stated interest rate fluctuations exist. Account for the issuance of bonds Account for bond premium and discount amortization. Account for the settlement of a debt Chapter 15: Identify the components of stockholder’s equity. Account for the issuance of both common and preferred stock Understand the accounting implications of shareholder dividends. Differentiate between accounting for stock splits and stock dividends. Chapter 17: Understand fair value option. Differentiate between accounting for trading vs. available for sale securities. Analyze and account for investments under the equity method of accounting. Chapter 18: Describe accounting issues associated with revenue recognition. Understand accounting guidelines related to the percentage of completion method. Account for contracts under the percentage of completion method. Chapter 19: Differentiate between pretax financial income and taxable income. Distinguish between permanent and temporary book tax differences. Calculate tax expense, taxes payable and deferred taxes. Analyze deferred taxes over multiple accounting periods. Chapter 20: Distinguish between defined contribution and defined benefit pension plans. Identify components of pension expense. Compute pension expense. Prepare pension worksheet. Chapter 23: Describe the purpose of the statement of cash flows. Identify major classifications of cash flows. Differentiate between cash and non-cash expenses. Analyze impact of balance sheet fluctuations on cash flow. Prepare statement of cash flows. Please note that the learning outcomes are not intended to be all inclusive. Topics may be added or deleted at the discretion of the instructor. ACADEMIC INTEGRITY Integrity of scholarship is essential for an academic community. As members of the Rady School, we pledge ourselves to uphold the highest ethical standards. The University expects that both faculty and students will honor this principle and in so doing protect the validity of University intellectual work. For students, this means that all academic work will be done by the individual to whom it is assigned, without unauthorized aid of any kind. The complete UCSD Policy on Integrity of Scholarship can be viewed at: http://senate.ucsd.edu/manual/Appendices/Appendix2.pdf How the Honor Code applies to this course: The University trusts each student to maintain high standards of honesty and ethical behavior. All assignments submitted in fulfillment of course requirements must be the student’s own work. STUDENTS WITH DISABILITIES A student who has a disability or special need and requires an accommodation in order to have equal access to the classroom must register with the Office for Students with Disabilities (OSD). The OSD will determine what accommodations may be made and provide the necessary documentation to present to the faculty member. The student must present the OSD letter of certification and OSD accommodation recommendation to the appropriate faculty member in order to initiate the request for accommodation in classes, examinations, or other academic program activities. No accommodations can be implemented retroactively. Please visit the OSD website for further information or contact the Office for Students with Disabilities at (858) 534-4382 or osd@ucsd.edu.