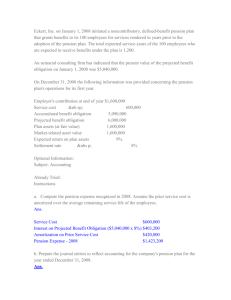

Accounting for Pensions and Postretirement Benefits 20

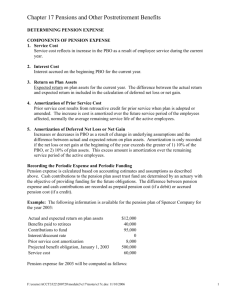

advertisement