Rates - GTE Financial

advertisement

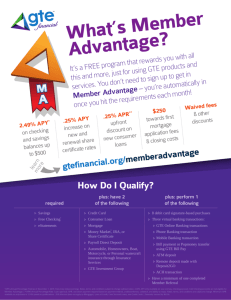

Rates Deposits Loans Checking Credit Cards Member Advantage under $500 $500 & over HSA Share Draft All Balances Dividend Rate 2.46% 0.00% Dividend Rate 0.40% APY 2.49% 0.00% APY* 0.40% * All cards offer, 25 day grace period and automatic payments. Card Visa Platinum APR* As Low As (special photo card option) 8.24% Visa Secured 16.99% Consumer Loans Savings Member Advantage $0 - $500 $500 & over Early Savers $0 - $500 $500 & over Dividend Rate 2.46% 0.10% Dividend Rate 2.46% 0.10% APY* 2.49% 0.10% APY* 2.49% 0.10% Dividend Rate 0.15% APY* 0.15% Money Market Balance $100+ Certificates & IRA Certificates Available in terms from 6 months to 5 years. Youth certificates also available. Call for rates or visit our website. Business Interest Checking Dividends of 0.15% APYǂ paid on checking balances. Autos APR* As Low As New Autos 1.99%** Used Autos Other Vehicles (New & Used) 2.24%** APR* As Low As Watercrafts/RVs Motorcycles Travel Trailers Other Loans 5.99%*** 8.99%*** 6.50%*** APR* As Low As Personal Line of Credit 10.65% 3.00% over share dividend rate of collateral account 2.00% over share dividend rate of collateral account 10.15%*** 5.49%-7.24%ǂǂ Share Secured Share Certificate Secured Signature Loan Private Student Loan Home Loans Home loans are available with a variety of terms to choose from. Call a Home Loan Specialist today! ǂ APY=Annual Percentage Yield. Yield, terms, and conditions are subject to change without notice. 2.49% rate only available on your primary savings account. * APR=Annual Percentage Rate. Rates, terms and conditions are subject to change without notice. The APR will be determined by your credit worthiness. ** Rates include enrollment in Member Advantage program. Rates are .25% higher without enrollment in the Member Advantage program. Auto rate does not apply to vehicles older than 8 model years. Qualifying vehicle loans over $30,000 with terms longer than 72 months are subject to a one percent higher percentage rate. 1.99% APR limited to 72 month term for new and for used autos. *** Rates are .5% higher without automatic payment option and Member Advantage status. ǂǂ After account opening, APR may vary each quarter based on changes in the Prime Rate as published in the Wall Street Journal, but may not be lower than 5.49% APR or exceed 18% APR. Actual loan rate may be higher than the lowest advertised rate, based on applicant and co-applicant’s credit qualifications. Loans are subject to credit approval, meeting and maintaining certain eligibility criteria and enrollment at an accredited, approved school and education program. gtefinancial.org 2/16 The following disclosure represents important details concerning GTE Financial credit cards. The information about costs of the card are accurate as of April 1, 2015. You can contact us at 813.871.2690 or 888.871.2690 or P.O. Box 172599, Tampa, FL 33672-0599 to inquire if any changes occurred since the effective date. INTEREST RATES and INTEREST CHARGES: Annual Percentage Rate (APR) for Purchases, Cash Advances, & Balance Transfers Paying Interest Minimum Interest Charge For Credit Card Tips from the Federal Reserve Board PLATINUM 8.24%, to 17.99% depending on your creditworthiness. APR will vary with the market based on the Prime Rate. SECURED 16.99% Your due date is at least 21 days after the close of each billing cycle. We will not charge you interest on purchases if you pay your entire balance by the due date each month. We will begin charging interest on cash advances and balance transfers on the transaction date. If you are charged interest, the charge will be no less than $0.50. To learn more about factors to consider when applying for or using a credit card, visit the website of the Consumer Financial Protection Bureau at http://www.consumerfinance.gov/learnmore FEES: Fees to Open or Maintain your Account – Annual Fee: – Visa Platinum – Visa Secured – Visa Platinum with CURewards – Application Fee: Transaction Fees – Convenience Check: – Balance Transfer: – Cash Advance: – Foreign Transaction Penalty Fees – Late Payment: – Over-the-Credit Limit: – Returned Payment: None None None $25.00* None None None None 1% of each transaction in U.S. dollars if the transaction involves a currency conversion 0.8% of each transaction in U.S. dollars if the transaction does not involve a currency conversion Up to $25.00 for the first offense, $35.00 for each additional offense until 6 consecutive on-time payments are received. None Up to $25.00 if your payment is returned for any reason *An annual fee for your Visa Platinum with CURewards card will be charged initially after the first 90 days and annually thereafter. The annual fee will be waived for Member Advantage Program members. For more information about Member Advantage refer to www.gtefinancial.org/MemberAdvantage. Visit www.gtefinancial.org/programrules for CURewards rules and conditions. How We Will Calculate Your Balance: We use a method called “average daily balance (including new purchases).” Other Fees: Payment by GTE Online Banking, Pay My Bill: Payment by CFC Transaction (from checking): Payment by Mail to Processing Center: Rush PIN Fee: Statement Copy: Rush Card Fee: Card Replacement Fee: Payment By Processor: Immediate Payment Fee: Convenience Check Copy Fee: Returned Convenience Check: Convenience Check Stop Payment Request: **Fee waived for Member Advantage program members. Free Free Free $15.00 (Available free if completed in branch) $1.00 $15.00 $6.95** $5.00 $3.00 $1.00 Up to $25.00 if a convenience check if declined for any reason Up to $29.00 if you stop payment of a convenience check for any reason 2/16