MBF3C - msmccormick

advertisement

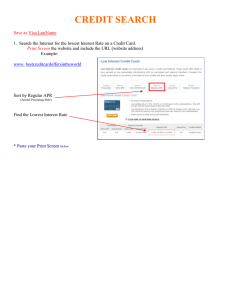

[Type here] BBI 20: Personal Finance Activity Credit Cards Students will research information about credit cards in order to deepen their understanding. Major credit cards such as VISA and MasterCard are associated with financial institutions. TD Canada Trust for example, is associated with VISA. Not all credit cards are the same. 1) What is a Credit Card? How do you get one (what criteria is it based on)? 2) What does APR stand for? 3) Why do you think some credit cards charge an annual fee? And/or offer rewards or incentives? 4) You are to compare three credit cards by filling in the table below. You must have one from a financial institution (bank) and one from a merchant (PC financial/Canadian Tire). Credit Card Name & Institution APR Additional Fees or Annual Fees Rewards or Incentives Credit card bills 5) Match the term with a definition. _____ Previous balance _____ credit limit _____ available credit _____new balance _____minimum payment _____billing date (due date) A. Amount you need to pay in that month to avoid notices of non-payment (and penalties to your credit score). B. Amount you owe from last month. C. When your bill needs to be paid by in order to avoid interest charges. D. Maximum amount you can charge to your credit card. E. Amount of money you spent in the current month F. Remaining amount of money you can still spend to reach your credit limit. [Type here] 6) What type of people benefit from a credit card with no annual fee, but a high interest rate? 7) What type of people would be better off with a low interest credit card, even if it has other fees? For the following activities go to my website msmccormick/pbworks.com to click the link to access the webpages. http://www.getsmarteraboutmoney.ca/ 8) Record the 8 things to know about your credit card 9) What are the 3 reasons not to borrow? 10) What are the 3 risks of borrowing too much? Watch the following video and one thing you found interesting by FunnyMoney [Type here] Credit Rating You will use the following websites to help find information about a credit report. http://money.howstuffworks.com/personal-finance/debt-management/credit-report.htm and http://www.yourmoney.cba.ca/students/inside/your_credit_profile/ a) What is a credit report? Include who makes the report and what it gets used for. b) List any 4 items that are found in your credit report. c) Based on How Lenders Interpret your Credit Report, list 2+ suggestions to improve your credit score? d) In summary how can you build a positive credit history? Watch the following video and record two things you learned. managing credit cards.