Market-based Deamand-Driven case studies - PICK-ME

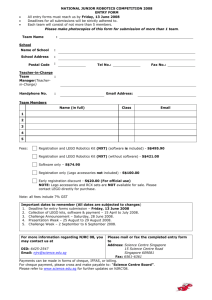

advertisement