Journal Entries from Bank Reconciliation

advertisement

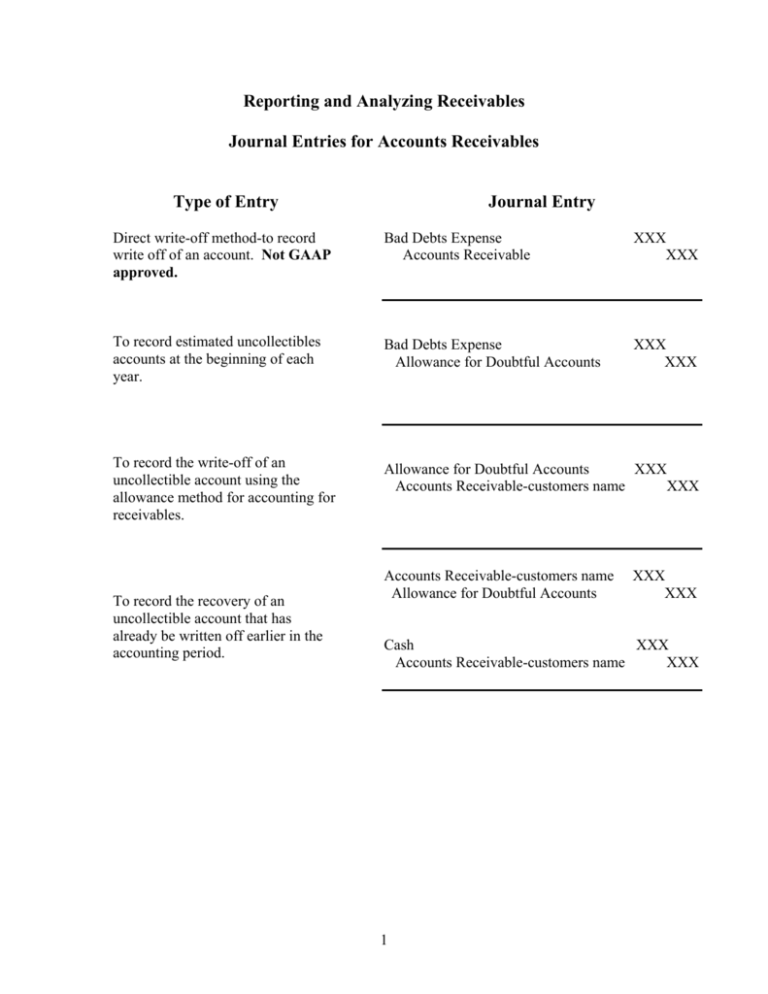

Reporting and Analyzing Receivables Journal Entries for Accounts Receivables Type of Entry Journal Entry Direct write-off method-to record write off of an account. Not GAAP approved. Bad Debts Expense Accounts Receivable XXX XXX To record estimated uncollectibles accounts at the beginning of each year. Bad Debts Expense Allowance for Doubtful Accounts XXX XXX To record the write-off of an uncollectible account using the allowance method for accounting for receivables. Allowance for Doubtful Accounts XXX Accounts Receivable-customers name XXX To record the recovery of an uncollectible account that has already be written off earlier in the accounting period. Accounts Receivable-customers name Allowance for Doubtful Accounts XXX XXX Cash XXX Accounts Receivable-customers name XXX 1 Reporting and Analyzing Receivables Journal Entries for Notes Receivables Type of Entries Journal Entry To record the making of a notes receivable for sale of merchandise Notes Receivable Sales Revenue To record the making of a notes receivable in exchange of an accounts receivable Notes Receivable XXX Accounts Receivable-customers name XXX To record the honoring (payment) of a notes receivable at the date of maturity when no interest has been accrued Cash Notes Receivable Interest Revenue XXX XXX XXX Cash Notes Receivable Interest Receivable Interest Revenue XXX To record the accrual of interest on a notes receivable before the maturity date and at the end of a fiscal period Interest Receivable Interest Revenue XXX To record the dishonoring (nonpayment) of a notes receivable when it is possible that the customer will be able to pay at a future date Accounts Receivable Notes Receivable Interest Receivable XXX To record the honoring (payment) of a notes receivable at the date of maturity when interest has been accrued 2 XXX XXX XXX XXX XXX XXX XXX XXX Reporting and Analyzing Receivables Journal Entries for Notes Receivables Type of Entries To record the dishonoring (nonpayment) of a notes receivable when there is no hope of future collection. Journal Entry Allowance of Doubtful accounts Notes Receivable Interest Receivable XXX XXX XXX Journal Entries for Credit Card Sales and Factoring of Receivables Type of Entries Journal Entry To record sale of merchandise on credit using national credit cards such as Visa or Mastercard Cash Service Charge Expense Sales Revenue XXX XXX XXX To record the sale of Receivables to a factor to provide a quick return of cash to the company Cash Service Charge Expense Accounts Receivable XXX XXX 3 XXX