2015 Federal Withholding Tax Table

advertisement

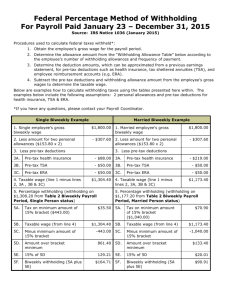

the wages it pays to the individuals that perform services for the employer. A payer designated under section 3504 performs tax duties under the service agreement using its own EIN. If the IRS designates a third party payer under section 3504, the designated payer and the employer are jointly liable for the employment taxes and related tax duties for which the third party payer is designated. For more information on a payer designated under section 3504, see Regulations section 31.3504-2. 17. How To Use the Income Tax Withholding Tables There are several ways to figure income tax withholding. The following methods of withholding are based on the information you get from your employees on Form W-4. See section 9 for more information on Form W-4. TIP Adjustments are not required when there will be more than the usual number of pay periods, for example, 27 biweekly pay dates instead of 26. Wage Bracket Method Under the wage bracket method, find the proper table (on pages 47–66) for your payroll period and the employee's marital status as shown on his or her Form W-4. Then, based on the number of withholding allowances claimed on the Form W-4 and the amount of wages, find the amount of income tax to withhold. If your employee is claiming more than 10 withholding allowances, see below. If you cannot use the wage bracket tables because wages exceed the amount shown in the last bracket of the table, use the percentage method of withholding described below. Be sure to reduce wages by the amount of total withholding allowances in Table 5 before using the percentage method tables (pages 45–46). Adjusting wage bracket withholding for employees claiming more than 10 withholding allowances. The wage bracket tables can be used if an employee claims up to 10 allowances. More than 10 allowances may be claimed because of the special withholding allowance, additional allowances for deductions and credits, and the system itself. Adapt the tables to more than 10 allowances as follows: 1. Multiply the number of withholding allowances over 10 by the allowance value for the payroll period. The allowance values are in Table 5 below. 2. Subtract the result from the employee's wages. 3. On this amount, find and withhold the tax in the column for 10 allowances. “10” column when your employee has more than 10 allowances, using the method above. You can also use any other method described next. Percentage Method If you do not want to use the wage bracket tables on pages 47–66 to figure how much income tax to withhold, you can use a percentage computation based on Table 5 below and the appropriate rate table. This method works for any number of withholding allowances the employee claims and any amount of wages. Use these steps to figure the income tax to withhold under the percentage method. 1. Multiply one withholding allowance for your payroll period (see Table 5 below) by the number of allowances the employee claims. 2. Subtract that amount from the employee's wages. 3. Determine the amount to withhold from the appropriate table on pages 45–46. Table 5. Percentage Method—2015 Amount for One Withholding Allowance Payroll Period One Withholding Allowance Weekly . . . . . . . . . . . . . . . . . . . . . . . . . . Biweekly . . . . . . . . . . . . . . . . . . . . . . . . . Semimonthly . . . . . . . . . . . . . . . . . . . . . . Monthly . . . . . . . . . . . . . . . . . . . . . . . . . . Quarterly . . . . . . . . . . . . . . . . . . . . . . . . . Semiannually . . . . . . . . . . . . . . . . . . . . . . Annually . . . . . . . . . . . . . . . . . . . . . . . . . Daily or miscellaneous (each day of the payroll period) . . . . . . . . . . . . . . . . . . . . . . . . . . $ 76.90 153.80 166.70 333.30 1,000.00 2,000.00 4,000.00 15.40 Example. An unmarried employee is paid $800 weekly. This employee has in effect a Form W-4 claiming two withholding allowances. Using the percentage method, figure the income tax to withhold as follows: 1. 2. 3. 4. 5 6. Total wage payment . . . . . . . . . . . One allowance . . . . . . . . . . . . . . Allowances claimed on Form W-4 . . Multiply line 2 by line 3 . . . . . . . . . Amount subject to withholding (subtract line 4 from line 1) . . . . . . . Tax to be withheld on $646.20 from Table 1—single person, page 45 . . . $76.90 2 $800.00 $153.80 $646.20 $81.43 To figure the income tax to withhold, you may reduce the last digit of the wages to zero, or figure the wages to the nearest dollar. Annual income tax withholding. Figure the income tax to withhold on annual wages under the Percentage Method for an annual payroll period. Then prorate the tax back to the payroll period. This is a voluntary method. If you use the wage bracket tables, you may continue to withhold the amount in the Publication 15 (2015) Page 43 Example. A married person claims four withholding allowances. She is paid $1,000 a week. Multiply the weekly wages by 52 weeks to figure the annual wage of $52,000. Subtract $16,000 (the value of four withholding allowances for 2015) for a balance of $36,000. Using the table for the annual payroll period on page 46, $3,187.50 is withheld. Divide the annual tax by 52. The weekly income tax to withhold is $61.30. Wage bracket percentage method tables (for automated payroll systems), and Combined income, social security, and Medicare tax withholding tables. Some of the alternative methods explained in Publication 15-A are annualized wages, average estimated wages, cumulative wages, and part-year employment. Alternative Methods of Income Tax Withholding Rather than the Wage Bracket Method or Percentage Method described in this section, you can use an alternative method to withhold income tax. Publication 15-A describes these alternative methods and contains: Formula tables for percentage method withholding (for automated payroll systems), Page 44 Publication 15 (2015) Percentage Method Tables for Income Tax Withholding (For Wages Paid in 2015) TABLE 1—WEEKLY Payroll Period (a) SINGLE person (including head of household)— (b) MARRIED person— If the amount of wages If the amount of wages (after subtracting The amount of income tax (after subtracting withholding allowances) is: to withhold is: withholding allowances) is: Not over $44 . . . . . . . . . . $0 Not over $165 . . . . . . . . . Over— But not over— of excess over— Over— But not over— $44 —$222 . . $0.00 plus 10% —$44 $165 —$520 . . $222 —$764 . . $17.80 plus 15% —$222 $520 —$1,606 . . $764 —$1,789 . . $99.10 plus 25% —$764 $1,606 —$3,073 . . $1,789 —$3,685 . . $355.35 plus 28% —$1,789 $3,073 —$4,597 . . $3,685 —$7,958 . . $886.23 plus 33% —$3,685 $4,597 —$8,079 . . $7,958 —$7,990 . . $2,296.32 plus 35% —$7,958 $8,079 —$9,105 . . $7,990 . . . . . . . . . . . . $2,307.52 plus 39.6% —$7,990 $9,105 . . . . . . . . . . . . TABLE 2—BIWEEKLY Payroll Period The amount of income tax to withhold is: $0 of excess over— $0.00 plus 10% —$165 $35.50 plus 15% —$520 $198.40 plus 25% —$1,606 $565.15 plus 28% —$3,073 $991.87 plus 33% —$4,597 $2,140.93 plus 35% —$8,079 $2,500.03 plus 39.6% —$9,105 (a) SINGLE person (including head of household)— (b) MARRIED person— If the amount of wages If the amount of wages (after subtracting The amount of income tax (after subtracting withholding allowances) is: to withhold is: withholding allowances) is: Not over $88 . . . . . . . . . . $0 Not over $331 . . . . . . . . . Over— But not over— of excess over— Over— But not over— $88 —$443 . . $0.00 plus 10% —$88 $331 —$1,040 . . $443 —$1,529 . . $35.50 plus 15% —$443 $1,040 —$3,212 . . $1,529 —$3,579 . . $198.40 plus 25% —$1,529 $3,212 —$6,146 . . $3,579 —$7,369 . . $710.90 plus 28% —$3,579 $6,146 —$9,194 . . $7,369 —$15,915 . . $1,772.10 plus 33% —$7,369 $9,194 —$16,158 . . $15,915 —$15,981 . . $4,592.28 plus 35% —$15,915 $16,158 —$18,210 . . $15,981 . . . . . . . . . . . . $4,615.38 plus 39.6% —$15,981 $18,210 . . . . . . . . . . . . TABLE 3—SEMIMONTHLY Payroll Period The amount of income tax to withhold is: $0 of excess over— $0.00 plus 10% —$331 $70.90 plus 15% —$1,040 $396.70 plus 25% —$3,212 $1,130.20 plus 28% —$6,146 $1,983.64 plus 33% —$9,194 $4,281.76 plus 35% —$16,158 $4,999.96 plus 39.6% —$18,210 (a) SINGLE person (including head of household)— (b) MARRIED person— If the amount of wages If the amount of wages (after subtracting The amount of income tax (after subtracting withholding allowances) is: to withhold is: withholding allowances) is: Not over $96 . . . . . . . . . . $0 Not over $358 . . . . . . . . . Over— But not over— of excess over— Over— But not over— $96 —$480 . . $0.00 plus 10% —$96 $358 —$1,127 . . $480 —$1,656 . . $38.40 plus 15% —$480 $1,127 —$3,479 . . $1,656 —$3,877 . . $214.80 plus 25% —$1,656 $3,479 —$6,658 . . $3,877 —$7,983 . . $770.05 plus 28% —$3,877 $6,658 —$9,960 . . $7,983 —$17,242 . . $1,919.73 plus 33% —$7,983 $9,960 —$17,504 . . $17,242 —$17,313 . . $4,975.20 plus 35% —$17,242 $17,504 —$19,727 . . $17,313 . . . . . . . . . . . . $5,000.05 plus 39.6% —$17,313 $19,727 . . . . . . . . . . . . TABLE 4—MONTHLY Payroll Period The amount of income tax to withhold is: $0 of excess over— $0.00 plus 10% —$358 $76.90 plus 15% —$1,127 $429.70 plus 25% —$3,479 $1,224.45 plus 28% —$6,658 $2,149.01 plus 33% —$9,960 $4,638.53 plus 35% —$17,504 $5,416.58 plus 39.6% —$19,727 (a) SINGLE person (including head of household)— If the amount of wages (after subtracting The amount of income tax withholding allowances) is: to withhold is: Not over $192 . . . . . . . . . $0 Over— But not over— of excess over— $192 —$960 . . $0.00 plus 10% —$192 $960 —$3,313 . . $76.80 plus 15% —$960 $3,313 —$7,754 . . $429.75 plus 25% —$3,313 $7,754 —$15,967 . . $1,540.00 plus 28% —$7,754 $15,967 —$34,483 . . $3,839.64 plus 33% —$15,967 $34,483 —$34,625 . . $9,949.92 plus 35% —$34,483 $34,625 . . . . . . . . . . . . $9,999.62 plus 39.6% —$34,625 Publication 15 (2015) (b) MARRIED person— If the amount of wages (after subtracting withholding allowances) is: Not over $717 . . . . . . . . . Over— But not over— $717 —$2,254 . . $2,254 —$6,958 . . $6,958 —$13,317 . . $13,317 —$19,921 . . $19,921 —$35,008 . . $35,008 —$39,454 . . $39,454 . . . . . . . . . . . . The amount of income tax to withhold is: $0 of excess over— $0.00 plus 10% —$717 $153.70 plus 15% —$2,254 $859.30 plus 25% —$6,958 $2,449.05 plus 28% —$13,317 $4,298.17 plus 33% —$19,921 $9,276.88 plus 35% —$35,008 $10,832.98 plus 39.6% —$39,454 Page 45 Percentage Method Tables for Income Tax Withholding (continued) (For Wages Paid in 2015) TABLE 5—QUARTERLY Payroll Period (a) SINGLE person (including head of household)— (b) MARRIED person— If the amount of wages If the amount of wages (after subtracting The amount of income tax (after subtracting withholding allowances) is: to withhold is: withholding allowances) is: Not over $575 . . . . . . . . . $0 Not over $2,150 . . . . . . . . Over— But not over— of excess over— Over— But not over— $575 —$2,881 . . $0.00 plus 10% —$575 $2,150 —$6,763 . . $2,881 —$9,938 . . $230.60 plus 15% —$2,881 $6,763 —$20,875 . . $9,938 —$23,263 . . $1,289.15 plus 25% —$9,938 $20,875 —$39,950 . . $23,263 —$47,900 . . $4,620.40 plus 28% —$23,263 $39,950 —$59,763 . . $47,900 —$103,450 . . $11,518.76 plus 33% —$47,900 $59,763 —$105,025 . . $103,450 —$103,875 . . $29,850.26 plus 35% —$103,450 $105,025 —$118,363 . . $103,875 . . . . . . . . . . . . $29,999.01 plus 39.6% —$103,875 $118,363 . . . . . . . . . . . . TABLE 6—SEMIANNUAL Payroll Period The amount of income tax to withhold is: $0 of excess over— $0.00 plus 10% —$2,150 $461.30 plus 15% —$6,763 $2,578.10 plus 25% —$20,875 $7,346.85 plus 28% —$39,950 $12,894.49 plus 33% —$59,763 $27,830.95 plus 35% —$105,025 $32,499.25 plus 39.6% —$118,363 (a) SINGLE person (including head of household)— (b) MARRIED person— If the amount of wages If the amount of wages (after subtracting The amount of income tax (after subtracting withholding allowances) is: to withhold is: withholding allowances) is: Not over $1,150 . . . . . . . . $0 Not over $4,300 . . . . . . . . Over— But not over— of excess over— Over— But not over— $1,150 —$5,763 . . $0.00 plus 10% —$1,150 $4,300 —$13,525 . . $5,763 —$19,875 . . $461.30 plus 15% —$5,763 $13,525 —$41,750 . . $19,875 —$46,525 . . $2,578.10 plus 25% —$19,875 $41,750 —$79,900 . . $46,525 —$95,800 . . $9,240.60 plus 28% —$46,525 $79,900 —$119,525 . . $95,800 —$206,900 . . $23,037.60 plus 33% —$95,800 $119,525 —$210,050 . . $206,900 —$207,750 . . $59,700.60 plus 35% —$206,900 $210,050 —$236,725 . . $207,750 . . . . . . . . . . . . $59,998.10 plus 39.6% —$207,750 $236,725 . . . . . . . . . . . . TABLE 7—ANNUAL Payroll Period The amount of income tax to withhold is: $0 of excess over— $0.00 plus 10% —$4,300 $922.50 plus 15% —$13,525 $5,156.25 plus 25% —$41,750 $14,693.75 plus 28% —$79,900 $25,788.75 plus 33% —$119,525 $55,662.00 plus 35% —$210,050 $64,998.25 plus 39.6% —$236,725 (a) SINGLE person (including head of household)— (b) MARRIED person— If the amount of wages If the amount of wages (after subtracting The amount of income tax (after subtracting withholding allowances) is: to withhold is: withholding allowances) is: Not over $2,300 . . . . . . . . $0 Not over $8,600 . . . . . . . . Over— But not over— of excess over— Over— But not over— $2,300 —$11,525 . . $0.00 plus 10% —$2,300 $8,600 —$27,050 . . $11,525 —$39,750 . . $922.50 plus 15% —$11,525 $27,050 —$83,500 . . $39,750 —$93,050 . . $5,156.25 plus 25% —$39,750 $83,500 —$159,800 . . $93,050 —$191,600 . . $18,481.25 plus 28% —$93,050 $159,800 —$239,050 . . $191,600 —$413,800 . . $46,075.25 plus 33% —$191,600 $239,050 —$420,100 . . $413,800 —$415,500 . . $119,401.25 plus 35% —$413,800 $420,100 —$473,450 . . $415,500 . . . . . . . . . . . . $119,996.25 plus 39.6% —$415,500 $473,450 . . . . . . . . . . . . TABLE 8—DAILY or MISCELLANEOUS Payroll Period The amount of income tax to withhold is: $0 of excess over— $0.00 plus 10% —$8,600 $1,845.00 plus 15% —$27,050 $10,312.50 plus 25% —$83,500 $29,387.50 plus 28% —$159,800 $51,577.50 plus 33% —$239,050 $111,324.00 plus 35% —$420,100 $129,996.50 plus 39.6% —$473,450 (a) SINGLE person (including head of household)— If the amount of wages (after subtracting withholding allowances) divided by the number of The amount of income tax days in the payroll period is: to withhold per day is: Not over $8.80 . . . . . . . . . $0 Over— But not over— of excess over— $8.80 —$44.30 . . $0.00 plus 10% —$8.80 $44.30 —$152.90 . . $3.55 plus 15% —$44.30 $152.90 —$357.90 . . $19.84 plus 25% —$152.90 $357.90 —$736.90 . . $71.09 plus 28% —$357.90 $736.90 —$1,591.50 . . $177.21 plus 33% —$736.90 $1,591.50 —$1,598.10 . . $459.23 plus 35% —$1,591.50 $1,598.10 . . . . . . . . . . . . $461.54 plus 39.6% —$1,598.10 Page 46 (b) MARRIED person— If the amount of wages (after subtracting withholding allowances) divided by the number of days in the payroll period is: Not over $33.10 . . . . . . . . Over— But not over— $33.10 —$104.00 . . $104.00 —$321.20 . . $321.20 —$614.60 . . $614.60 —$919.40 . . $919.40 —$1,615.80 . . $1,615.80 —$1,821.00 . . $1,821.00 . . . . . . . . . . . . The amount of income tax to withhold per day is: $0 of excess over— $0.00 plus 10% —$33.10 $7.09 plus 15% —$104.00 $39.67 plus 25% —$321.20 $113.02 plus 28% —$614.60 $198.36 plus 33% —$919.40 $428.17 plus 35% —$1,615.80 $499.99 plus 39.6% —$1,821.00 Publication 15 (2015)