N

SE E G R O U

PL

H EDGE F UND A DVISORY

LC

H EN

ES

FOR IMMEDIATE RELEASE

For further information contact:

Hennessee Group LLC

212-857-4400

www.hennesseegroup.com

HEDGE FUNDS OUTPERFORM IN THE “LOST DECADE”

Hedged Equity Investing Pays Off for Investors

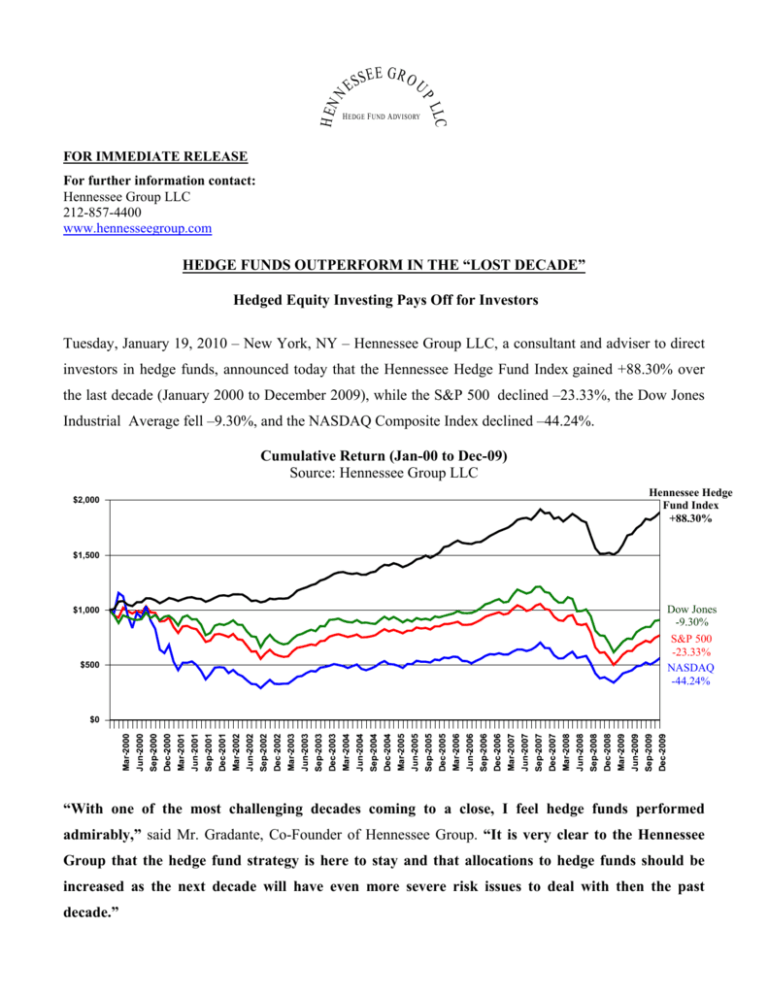

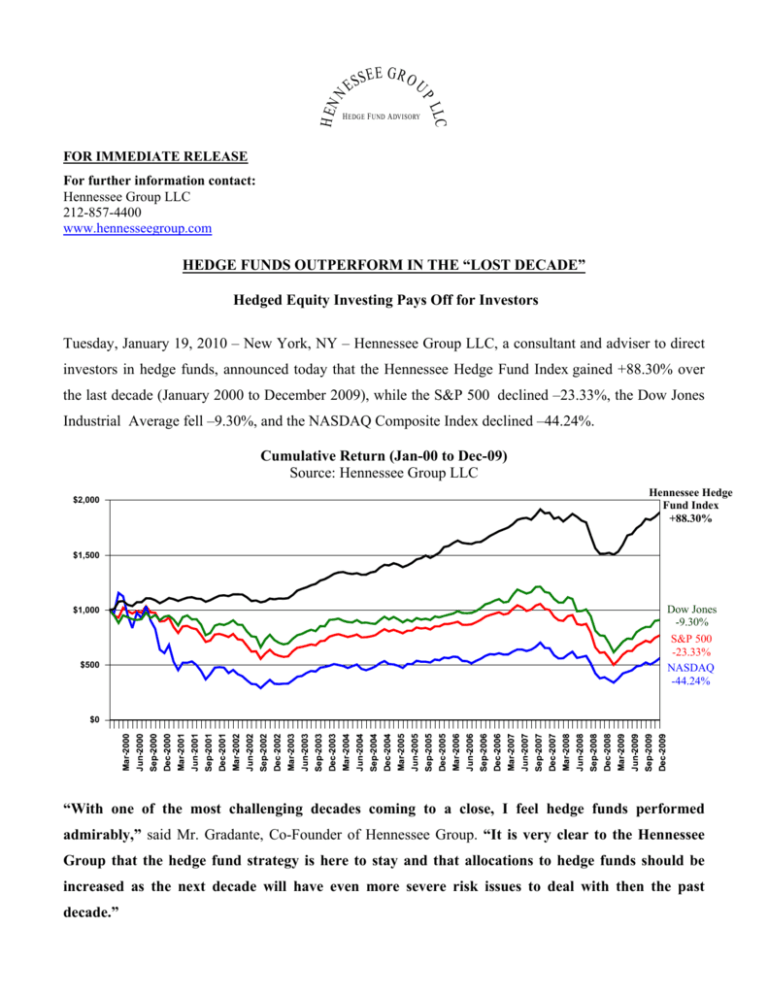

Tuesday, January 19, 2010 – New York, NY – Hennessee Group LLC, a consultant and adviser to direct

investors in hedge funds, announced today that the Hennessee Hedge Fund Index gained +88.30% over

the last decade (January 2000 to December 2009), while the S&P 500 declined –23.33%, the Dow Jones

Industrial Average fell –9.30%, and the NASDAQ Composite Index declined –44.24%.

Cumulative Return (Jan-00 to Dec-09)

Source: Hennessee Group LLC

$2,000

Hennessee Hedge

Fund Index

+88.30%

$1,500

$1,000

$500

Dow Jones

-9.30%

S&P 500

-23.33%

NASDAQ

-44.24%

$0

“With one of the most challenging decades coming to a close, I feel hedge funds performed

admirably,” said Mr. Gradante, Co-Founder of Hennessee Group. “It is very clear to the Hennessee

Group that the hedge fund strategy is here to stay and that allocations to hedge funds should be

increased as the next decade will have even more severe risk issues to deal with then the past

decade.”

“There has been a lot of talk about the ‘lost decade’ for stocks [referring to the fact that investors

lost money in stocks over the last decade]. However, there has not been much said about the

performance of hedge funds,” said Mr. Gradante. “While stocks actually declined in value at an

annualized rate of -2.62% per year [for the S&P 500], hedge funds posted an annualized positive

return of +6.54%.”

Cumulative

Return

Annualized

Return

Annualized

Volatility

Hennessee Hedge Fund Index

+88.30%

6.54%

6.81%

S&P 500

-23.33%

-2.62%

16.13%

NASDAQ

-44.24%

-5.67%

26.92%

Dow Jones Ind. Avg.

-9.30%

-0.97%

15.63%

Jan-00 to Dec-09

“Not only did hedge funds outperform stocks on a relative basis by more than +9% per year versus

the S&P 500, they did so with significantly less volatility,” said E. Lee Hennessee, Managing Principal

of Hennessee Group. “Hedge funds exhibited a standard deviation of 6.8% over the last decade

while the S&P 500 had a standard deviation of 16.1%.”

Risk vs. Return Chart (Jan-00 to Dec-09)

Source: Hennessee Group

10.00%

7.50%

Hennessee Hedge

Fund Index

5.00%

2.50%

0.00%

Dow Jones

Ind. Avg.

-2.50%

S&P 500

-5.00%

NASDAQ

-7.50%

0.00%

5.00%

10.00%

15.00%

20.00%

25.00%

30.00%

Annualized Standard Deviation

Down Market Performance

In analyzing the performance of the Hennessee Hedge Fund Index, the ability to outperform over the past

ten years was in large part due to the ability to minimize drawdowns. The Hennessee Hedge Fund Index

experienced only two down years (2002 and 2008), while the S&P 500 had four down years (2000, 2001,

2002, and 2008).

This is also evident when analyzing the monthly returns of the Hennessee Hedge Fund Index versus the

S&P 500. In months when the S&P 500 generated a positive return, hedge funds were able to capture

slightly more than 50% of the upside (+1.6% for the Hennessee Hedge Fund Index versus +3.0% for the

S&P 500). In months when the S&P 500 declined in value, hedge funds only participated in -20% of

the loss (-0.8% for the Hennessee Hedge Fund Index versus -4.2% for the S&P 500). This ability to

protect capital in the down markets allowed hedge funds to average a positive monthly return of +0.5%,

while the S&P 500 declined in value at an average monthly rate of -0.1%. This helped hedge funds

compound higher absolute returns relative to traditional equity benchmarks with less volatility.

Average Monthly Return (Jan-00 to Dec-09)

Source: Hennessee Group LLC

4.0%

3.0%

3.0%

1.6%

2.0%

1.0%

0.5%

0.0%

-0.1%

-1.0%

-0.8%

-2.0%

-3.0%

-4.0%

-4.2%

-5.0%

All Months

Hennessee Hedge Fund Index

Up Months

Down Months

S&P 500

“This down market analysis demonstrates that you do not need to outperform in up months in

order to outperform,” said Mr. Gradante. “The most value-added characteristic of hedge funds is

their down side risk management, which is really where they generate alpha.”

Hedge Fund Strategies & Managers

By selecting either the top performing hedge fund strategies or by selecting the top performing hedge fund

managers, investors were able to outperform the overall Hennessee Hedge Fund Index and other

benchmarks by a significant margin.

The top performing strategies over the past decade were: 1) Financial Equities funds, which performed

well in 2008, as they were able to foresee many of the financial problems and generate gains shorting, and

well in 2009 participating in a sharp snapback; 2) Healthcare and Biotech funds, which posted outsized

years in 2000, 2003 and 2009; and 3) Distressed funds, which posted strong performance after default

cycles in 2003, 2004 and 2009.

Annualized Return

Cumulative Return

1. Hennessee Financial Equities Index

+11.8%

+206.0%

2. Hennessee Healthcare and Biotech Index

+9.1%

+138.5%

3. Hennessee Distressed Index

+8.9%

+134.8%

Jan-00 to Dec-09

This analysis also demonstrates the need for experienced hedge fund manager selection. An average

hedge fund that performed in the top half of the Hennessee Hedge Fund Index each year over the past ten

years significantly outperformed a hedge fund that performed in the bottom half.

Annualized Return

Cumulative Return

Top Half Performer

16.10%

444.70%

Bottom Half Performer

-5.50%

-43.20%

Jan-00 to Dec-09

* It should be noted that many funds did not perform in the top half every year or the bottom half every year.

*************************************************************************************

For more information on hedge fund strategy performance in 2009, please see the Hennessee Hedge

Fund Review, our monthly hedge fund publication, at: http://www.hennesseegroup.com/hhfr/index.html.

About the Hennessee Group LLC

Hennessee Group LLC is a Registered Investment Adviser that consults direct investors in hedge funds on asset allocation, manager

selection, and ongoing monitoring of hedge fund managers. Hennessee Group LLC is not a tracker of hedge funds. The Hennessee Hedge

®

Fund Indices are for the sole purpose of benchmarking individual hedge fund manager performance. The Hennessee Group does not sell a

hedge fund-of-funds product nor does it market individual hedge fund managers.

For additional Hennessee Group Press Releases, please

visit the Hennessee Group’s website. The Hennessee Group also publishes the Hennessee Hedge Fund Review monthly, which provides a

comprehensive hedge fund performance review, statistics, and market analysis; all of which is value added to hedge fund managers and

investors alike.

®

Description of Hennessee Hedge Fund Indices

®

The Hennessee Hedge Fund Indices are calculated from performance data reported to the Hennessee Group by a diversified group of over

®

1,000 hedge funds. The Hennessee Hedge Fund Index is an equally weighted average of the funds in the Hennessee Hedge Fund Indices .

The funds in the Hennessee Hedge Fund Index are derived from the Hennessee Group’s database of over 3,500 hedge funds and are net of

fees and unaudited. Past performance is no guarantee of future returns. ALL RIGHTS RESERVED. This material is for general information

only and is not an offer or solicitation to buy or sell any security including any interest in a hedge fund.