Operating Leverage - Stanford Graduate School of Business

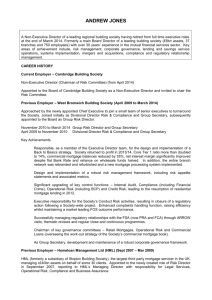

advertisement