ANDREW JONES - Association of Financial Mutuals

advertisement

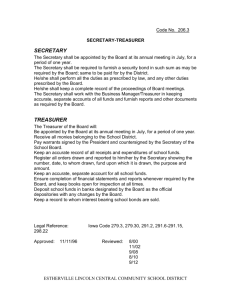

ANDREW JONES A Non-Executive Director of a leading regional building society having retired from full time executive roles at the end of March 2014. Formerly a main Board Director of a leading building society (£6bn assets, 37 branches and 750 employees) with over 30 years’ experience in the mutual financial services sector. Key areas of achievement include, risk management, corporate governance, lending and savings service operations, systems implementation, mergers and acquisitions, compliance and regulatory relationship management. CAREER HISTORY Current Employer – Cambridge Building Society Non-Executive Director (Chairman of Risk Committee) (from April 2014) Appointed to the Board of Cambridge Building Society as a Non-Executive Director and invited to chair the Risk Committee. Previous Employer – West Bromwich Building Society (April 2009 to March 2014) Approached by the newly appointed Chief Executive to join a small team of senior executives to turnaround the Society. Joined initially as Divisional Director Risk & Compliance and Group Secretary, subsequently appointed to the Board as Group Risk Director. November 2010 to March 2014 Group Risk Director and Group Secretary April 2009 to November 2010 Divisional Director Risk & Compliance and Group Secretary Key Achievements Responsible, as a member of the Executive Director team, for the design and implementation of a Back to Basics strategy. Society returned to profit in 2013/14, Core Tier 1 ratio more than doubled to 14%, commercial mortgage balances reduced by 35%, net interest margin significantly improved despite flat Bank Rate and reliance on wholesale funds halved. In addition, the entire branch network was rebranded and refurbished and a new mortgage processing system implemented. Design and implementation of a robust risk management framework, including risk appetite statements and associated metrics. Significant upgrading of key control functions – Internal Audit, Compliance (including Financial Crime), Operational Risk (including BCP) and Credit Risk, leading to the resumption of residential mortgage lending in 2012. Executive responsibility for the Society’s Conduct Risk activities, resulting in closure of a regulatory action following a Society-wide project. Enhanced complaints handling function, raising efficiency whilst maintaining a market leading FOS outcome performance. Successfully managing regulatory relationships with the FSA (now PRA and FCA) through ARROW visits, thematic reviews and regular close and continuous programmes. Chairman of key governance committees – Retail Mortgages, Operational Risk and Commercial Loans (overseeing the work-out strategy of the Society’s commercial mortgage book). As Group Secretary, development and maintenance of a robust corporate governance framework. Previous Employer – Homeloan Management Ltd (HML) (Sept 2007 – Mar 2009) HML (formerly a subsidiary of Skipton Building Society), the largest third party mortgage servicer in the UK, managing c£40bn assets on behalf of some 30 clients. Appointed to the newly created role of Risk Director in September 2007, reporting to HML’s Managing Director with responsibility for Legal Services, Operational Risk, Compliance and Business Assurance. Key achievements: A member of the Operational Board and Senior Management team. Chairman of three Board Committees: Audit & Compliance, Operational Risk and the Operational Loss Group. Leading HML’s Treating Customers Fairly project. Improving the control culture and establishment of a dedicated Operational Risk function. Leading investigations into a number of operational issues and resolution with clients and HML’s insurers. Previous Employer – Portman Building Society (April 1985 to August 2007) October 1999 to August 2007 Director of Compliance and Group Secretary Key Achievements: Secretary to the Main Board, Pension Trustees and several Board Committees. Responsible for ensuring compliance with the UK Corporate Governance Code. Society regulatory lead in the mergers with Staffordshire (2003), Lambeth (2006) and Nationwide (2006/7) and acquisition of Sun Bank (2001). FSA relationship manager from 2000. Anti-money laundering activity (MLRO from 2001), including the implementation of a transaction monitoring system. Compliance lead during the implementation of mortgage regulation (2002/3). Earlier roles with Portman: Sept 98 to Sept 99 – responsible for direct marketing, mortgage retention and customer complaints Jun 95 to Aug 98 – responsible for providing support activities to the branch network. Sept 86 to May 95 – managing savings and lending operations, including major systems implementations. Apr 85 to Aug 86 – Branch Manager Other employers: Oct 79 to Apr 85 – West Bromwich Building Society Aug 78 to Sep 79 – Lucas Group Services ACADEMIC/PROFESSIONAL QUALIFICATIONS Jun 96 Mar 90 Nov 87 Jun 78 Chartered Diploma in Accounting and Finance Fellow of Chartered Secretaries and Administrators Fellow of Chartered Institute of Bankers BSc (Hons) in Mathematics at Bristol University PERSONAL DETAILS Address 56 Queens Park West Drive, Bournemouth, BH8 9DD Email arj56@outlook.com Phone 01202 397135 (home) 07887 830014 (mobile) DOB 21 April 1957 (age 57)