Jack

advertisement

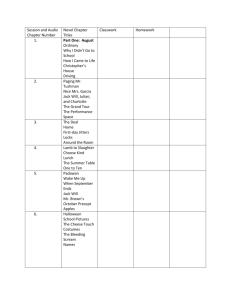

INTRODUCES: Black Jack Kristin Bell – Joy Belser – Jamie Hackbarth – Megan McEvoy TABLE OF CONTENTS BLACK JACK OVERVIEW Campaign Introduction……............…......................…......................…......................….........................3 Situation Analysis (SWOT) ..................…......................…......................…......................…....................4 Target Market…......................…......................…......................…......................…...............................5-­‐6 COMPETITOR ANALYSIS Whiskey Competitors............…......................…......................…...........................….............................7 Target Market Competitors..........…......................…......................…...........................…......................7 Competitor’s Threats ..........…......................…......................…...........................…...............................7 PRODUCT Black Jack features ..........…......................…......................…...........................…....................................8 Packaging ..........…......................…......................…...........................….................................................8 Brand Image ..........…......................…......................…...........................….............................................8 PRICING Pricing Strategy ..........…......................…......................…...........................…........................................9 PROMOTION STRATEGY Promotion of Channel Members .......…......................…...........................................…........................10 Promotion of Product .......…......................…...........................................….........................................11 Budget & Timeline .......…......................…...........................................…..............................................12 RETURN ON INVESTMENT Target Subculture ROI.......…......................…...........................................….........................................10 Additional Reasons .......…......................…...............................................................….........................10 WORKS CITED APPENDIX 2 CAMPAIGN INTRODUCTION The Black Jack campaign allows the Jack Daniel’s brand to expand its reach to target markets they may not have reached before. The American brand honors itself on being the oldest registered distillery in the U.S. where its Tennessee Whiskey is a completely natural product. The traditional Jack Daniel’s consumer consists of 80% males, which is due in large part to the targeted marketing and the historical iconic symbol of masculinity that is paired with this dark liquor. Last year, Jack Daniel’s expanded its brand with the release of Tennessee Honey-­‐ its first flavored alternative to Jack Daniel’s traditional. This was Jack Daniel’s first nod at recognizing the possibilities of also targeting women as consumers. The target subculture that Black Jack will target is Gen Y professional women between the ages of 21-­‐29 with disposable income. Gen Y as a whole constitutes 21% of annual buying and is very interested in recreational activities. Our entire campaign caters to this subculture market while still sustaining a strong relationship with our male market. The Black Jack campaign expands the historical brand farther with the black cherry flavor alternative partnered with engaging marketing efforts through platforms directly aimed to reach women. Our marketing efforts include social media, Internet advertising, magazine advertising and interpersonal advertising through happy hours, drink recipe books and more. The focus of the Jack Black campaign targets three main areas we hope to improve: campaign our expansion and exposure to the young professional women subculture; sustaining the historical brand image, and engaging with our publics across a spectrum of channels. We predict strong profitability from this campaign based on Gen Y women’s buying power and interest in recreational lifestyle. Along with probability this campaign will lead to long-­‐term brand recognition by Gen Y professional women through the marketing relationship we are creating with them. 3 SITUATIONAL ANALYSIS Through our secondary research we found three main areas we will focus on improving or sustaining through our campaign. 1. Expansion and Exposure: While Jack Daniel’s is the highest selling whiskey in the world, it has never been seen as a ‘female-­‐friendly’. The Black Jack campaign aims to open the brand up to target women through engaging promotional material. 2. Sustaining the historical brand image: As we expand to targeting women directly we want to ensure the historical masculinity of the brand stays intact. By doing this we will be promoting to both audiences with the Jack 3. Engaging with our publics: Jack Daniel’s is known for its strong marketing and promotional material. Through the Jack Black campaign we want to reach our target publics in-­‐person, online, in-­‐print and in everyday life. STRENGTHS • Highest selling whiskey globally • Quality at affordable price • Customer loyalty • Strong historical brand image WEAKNESSES • The strong masculine image may turn away women from buying product • Not a large target audience OPPORTUNITIES • Widen target market • Financial ability to expand brand • Offering variety of products • Innovative promotional material THREATS • Competitors at cheaper price • Not reaching all target markets, or losing some • Intense competition 4 TARGET MARKET SUBCULTURE The target subculture for this Jack Daniel’s campaign is young women between the ages of 21 and 29 pursuing a professional career. This subculture includes all ethnicities that fall within the previous stated characteristics. Professional occupations are diverse and fall under 10 main categories: management; business and financial operations; computer and mathematical science; architecture and engineering; life, physical, and social science; community and social service; legal; education, training, and library; arts, entertainment, sports, and media; and healthcare practitioner and technical occupations (The Young Professional Workforce Fact Sheet 1). The subculture of young professional women includes anyone who currently has a professional career or is in the process of pursuing a professional degree. This subculture target marketing aims toward the urban city dweller. These women fall under Generation Y, a segment including people born between 1978-­‐1994, which makes up 25% of the world’s population. This is the first generation whose numbers will eventually exceed the powerful Baby Boomer generation in the workforce in the coming years (Puybaraud 16). POPULATION SIZE Nearly 21 million young women between the ages of 20 and 29 make up the US population (US Census Bureau). In October 2012, approximately 16.3 million young professionals between ages 22 and 35 were employed in a professional occupation. Young women made up 53.5% of that overall 16.3 million, constituting a population of young professional women 9 million strong within the United States. It is important to note that women pursuing a degree are not included in these numbers but are still part of the target subculture (The Young Professional Workforce Fact Sheet 1). DEMOGRAPHICS The ages of the young professional women subculture are between 21 and 29. On the education side, 11 million of the 16.3 million young professionals have obtained a Bachelor’s degree or higher (The Young Professional Workforce Fact Sheet 2013). Generation Y is the most educated generation to date. The income of the young professional women subculture varies depending on the specific professional occupation of each individual woman. On average, a female business graduate’s starting salary is just over $38,000. After 5 years of experience, many of these women’s salaries will increase to $50,000 or more, again depending on her specific professional occupation (Corbett 12). GEOGRAPHICS Members of Generation Y typically prefer workplaces in an urbanized location with access to social and commercial facilities, a good public infrastructure, and the ability to either use public transportation or drive to work (Puybaraud 7). Because of this, women with young professional careers are more likely to live in urban areas. Geographically, this subculture tends to live primarily in top metropolitan cities including Chicago, Boston, New York City, Seattle, Denver and Minneapolis, among others. 5 TARGET MARKET PROFITABILITY GEN Y INFLUENCES Generational aspects highly influence this subculture’s working behaviors, buying behaviors, and overall preferences. Gen Y sees the workplace as a social construct and believe work should be social. This is an important attribute because it can lead to meetings after hours, or happy hours in bars, where we could market our product to them. Gen Y women in the workplace crave autonomy and self-­‐direction in their career. Overall, they want a sense of equality with male counterparts. They are driven to have a career that they love, while maintaining a balanced lifestyle (Barrett 13). Technology is a major influence on Gen Y’s buying behavior because it is where they find and compare products, how they shop, and how they share opinions about their products. They rate quality, cost, immediacy of service, and the experience as big impacts on purchase, and use social media platforms to research products. Advertising has little influence over Gen Y women, as they do not trust it. Forty-­‐six percent of Gen Y women search the web, consulting as many as 6 sources prior to making a product purchase. Women look at blogs for information about daily living (Escalera). Gen Y is more open to exploring and trying new products compared to the general population. The majority of Gen Y women are noted as preferring for beer, but are buying more liquor and wine than older generations did at the same age. The willingness of Gen Y to experiment with new alcohol products make Gen Y women an ideal target market for Jack Daniel’s (Lukovitz). An important attribute of Generation Y to keep in mind when marketing toward them is that they want to feel the brand cares about them, and possibly be rewarded for using the brand. They are constantly mobile and connected, and are accepting of change. Seventy-­‐five percent of Generation Y have a social networking presence and will like and/or follow about 20 brands of their liking. The family structure for the majority of Generation Y-­‐ers is single professional. Some of them have a spouse, or a young family (Puyabraud 7). BUYING POWER Generation Y’s buying power as a whole is $200 billion annually and constitutes 21% of total annual spending in the US (Escalera). Young professional women within Gen Y have a unique buying power, because half of them are still dependent on their parents’ money due to their entering the workforce during the recession. Gen Y women are unlike their mothers because they remain single for longer period of time, they value individualism, and they see buying as a way of life rather than buying for necessity purposes. It is important to market towards women in Gen Y because 67% of Gen X women look to them as trendsetters and advocates of what to buy. Also, when Generation Y women like a brand or product they are 61% more likely to share it with friends across a spectrum of social media platforms than other generations (Pekala, 2). For this project, their buying power lies within how much disposable income these young women have to spend on recreational products like Jack Daniel’s. Women working full time between ages 18 and 24 earning $35,000 to $99,999 make up 19.2% of their age group demographic. Women working between the ages 25 to 29 earning $35,000 to $99,999 a year account for 44.6% of their age group demographic. Both of these percentages show that women between ages 21-­‐29 earning $35,000+ are a large and valuable group to market towards with the potential of large profitability (US Census Bureau). As a team we predict a strong sense of profitability from this target market through the sense of building a strong brand relationship with them through our promotional efforts and their ability to buy. Their influential momentum within society may allow us to reach secondary markets as well, such as Gen X women. 6 COMPETITOR ANALYSIS WHISKEY COMPETITORS Our top competitors, according to the Hoovers database, are Beam Inc., Constellation Brands (Svedka, Black Velvet Whiskey), and Diageo (Johnnie Walker, Jose Cuervo). These parent companies own brands such as Jim Beam, Maker’s Mark, Johnnie Walker, and other types of alcohol. Other brands our team has deemed as competitors are ones that target our same target market such as SkinnyGirl. SkinnyGirl was recently bought by Beam Inc. and targets women who want to drink liquor, but are not looking just for some fruity cocktail but rather a simple and sophisticated drink that doesn’t pack all the calories (Hoovers Database). Sales Levels and Market Share of the Competition • Beam Inc.: $2.5 Billion in Sales Volume and Market Share is 6.62%. • Constellation Brands: $2.6 Billion in Sales Volume and Market Share is 7.11%. • Diageo: $16 Billion in Sales Volume and Market Share is 45.04%. (Hoover’s Database) COMPETITOR TARGETS • Beam Inc. spent most of its marketing efforts on men. However, in 2009 it introduced a black cherry-­‐infused Jim Beam flavor and gave it the title Red Stag. After its pitch, sales increased dramatically and Beam Inc. made the surprising discovery that women were buying the sweet drink at almost three times the rate they typically bought bourbon. The company then began to make new marketing programs that targeted women which led to a major opportunity within the female market. This discovery has led Beam Inc. to create other extended brands such as a flavored Courvoisier cognac and the new acquisition of the company SkinnyGirl cocktails which targets women with 100 calories per serving (Stanford 1). • Constellation Brands offers many wine, spirits, and beer brands. North American President, Jay Wright, has sought out younger customers via the web and mobile applications. Due to the company’s new digital marketing effort, it is now targeting Millennial (21-­‐34 year-­‐olds) who have now become the fastest-­‐growing segment of wine drinkers (Stanford 1). • Diageo has recently been shifting its product targeting to three major groups: the more affluent consumer, female consumers, and the middle class in developing nations. The luxury customer was targeted with its launch of a “super premium” vodka, Ciroc, and growth of its expensive Johnnie Walker lines. Female consumers were attracted to the company when it came out with Smirnoff Whipped Cream and Fluffed Marshmallow flavors. Lastly, the middle class was targeted by pushing brands such as “heritage” brands like Haig whiskey. All of these efforts were launched with over 80 products for these groups in just six short months (Warc 1). COMPETITOR THREATS The biggest competitor threats to Jack Daniels are seen to be Beam Inc. and Constellation Brands. This is due to the fact that they target a similar group as Jack Daniels with their products Red Stag and SkinnyGirl. Constellation Brands is viewed as a threat because as a distillery, they produce more sales than Brown-­‐Forman who owns Jack Daniels. 7 PRODUCT OVERVIEW BLACK JACK FEATURES Black Jack is a new whiskey brand produced by Jack Daniels that meets the company’s standards of class and high quality, yet with a new sophisticated twist. Black Jack is a smooth whiskey with a hint of black cherry flavor. This original recipe is just as classy as the original Tennessee whiskey yet with a modern flair to appeal to our new target market. It will be sold nationally as a limited edition product. The product packaging will resemble the classic Jack Daniels image but with a slightly darker side conveying mystery and sleekness. The flavor we have chosen, black cherry, is sweet yet still packs the same simplistic superiority that all Jack Daniels’ products convey. PACKAGING The bottle for Black Jack will be unmistakably recognizable as a Jack Daniels product, yet with a more feminine touch. The bottle will be slimmer, touching on past Jack Daniels’ special edition products’ packaging. The coloring will be black with hints of red to visually resemble the flavor. The leaner bottle adds a feminine touch to the product while the classic Jack Daniels resemblance packs the same power and recognition. BRAND IMAGE Black Jack’s image relies on a mix of the Jack Daniels’ brand recognition with added eye-­‐catching qualities. The product speaks to the consumers’ sophistication, sensuality, and respectability. It’s strong and reliable, with a no-­‐nonsense attitude. The added hint of black cherry flavor makes for a delicious nightcap on the rocks or a fabulous happy hour Black Jack original cocktail. The Black image through packaging and the product name pulls together the design, emotion, and flavor of the product to attract the customer to everything that it has to offer. When Black Jack is purchased or is being consumed in public, it conveys a confident vibe of the drinker to everyone around. Sources: www.jackdaniels.com, http://management.fortune.cnn.com/2011/12/08/jack-­‐daniels-­‐jim-­‐stengel-­‐grow/, http://www.knoxnews.com/news/2011/may/20/a-­‐sweet-­‐blend-­‐of-­‐old-­‐new/ 8 PRICING STRATEGY PRICING STRATEGY OVERVIEW The pricing strategy will be a mix of competition, premium, and psychological. The price of Black Jack will be able to compete against Beam, Makers, and other notable whiskey brands. Since it is limited edition, some aspects of the premium pricing strategy will be relevant. Also, Jack Daniels uses psychological pricing already, and young women take into account pricing when making purchases, therefore psychological pricing will also be implemented in that sense. WHY THESE STRATEGIES? The price point has been set mostly due to competition, as Jack Daniels has stable sales and brand loyalty, yet as a new product, we want to stay relevant with competitors. Since Black Jack is a limited edition product however, there is reason for premium pricing, noting that the Black Jack price is higher than Jack Daniels original Tennessee Whiskey. Psychological pricing comes into play in the sense that we have noticed Jack Daniels currently uses this strategy, and our target market is more likely to pay attention to price versus Jack Daniel’s current market. This price fits into the brand’s pricing points. It is reasonable compared to the original and competitive with other brands. Also, it fits in the higher category showing that it is more of a premium than the original, similar to other special editions such as Sinatra or the 160th birthday bottle. Our main competitors, such as Beam, Makers, and Johnny Walkers are all similarly priced as well. DOES IT DIFFER FROM OTHER PRODUCTS? The price will be $28.99 per 750ml bottle. Jack Daniels original whiskey sells for around $20.00 for a 750ml bottle and the first Jack Daniels product with hints of flavor, Jack Daniels Honey, sells for about $24.99. We feel that due to the new product introduction, the success of Honey, and the limited edition aspect, $28.99 is a strategic price point for Black Jack. It is on the lower end of the special edition Jack products; however, we are going for a more universal selling vantage versus already converted whiskey lovers. PACKAGING New Design Packaging CHANNEL MEMBER PROMOTION Happy Hours How-­‐To Kit Drink Recipe Book Liquor Store Promotions PROMOTION OF PRODUCT Social Media Advertising Promotional Tweet Internet Advertising Magazine Advertising $200,000 $25,000 $33,000 $3,000 $15,000 $0 $200,000 $500,000 $600,000 9 PROMOTION OF CHANNEL MEMBERS 1 PRIMARY CHANNEL MEMBERS This includes bars, restaurants and nightclubs that already carry Jack Daniel’s or carry competitors’ whiskey. The main goal of targeting these members is to reach our target publics in a social setting while engaging them in memorable experiences with our product. SECONDARY CHANNEL MEMBERS We will target liquor stores; once we have successfully reached the target publics through the primary channel members they hopefully will purchase Jack Black at their local liquor store to keep in their home. The main selling point towards liquor stores are the strong probability other Jack Daniel’s products have throughout the nation. CHANNEL MEMBER INCENTIVES The following incentives will be used to reach our channel members audience along with our target market in an engaging and memorable manner. It will provide the channel members with promotional material, free samples, along with interactive material to carry out with their consumers. Black Jack Sponsored Happy Hours: The targeted bars, restaurant and nightclubs will be offered a happy hour sponsored by Black Jack. The happy hour will allow bar patrons to enjoy a free Black Jack mixed drink. It is casino themed and drinks consist of casino chips, spin the wheel and roll the dice. We chose 50 top bars in top metropolitan areas to host these events. We will distribute invitations1 to the bars, as well as promotional signs2. The average cost for Black Jack to sponsor this is $500 each. Black Jack ‘How To’ Kit: The Black Jack kit will consist of three bottles of the limited edition Jack Daniel’s Black Cherry whiskey, a can of black cherries, exclusive Black Jack whiskey glasses and shot glasses, casino chips, a pair of dice and a Black Jack spinning wheel, posters and exclusive coupons to hand out to bar patrons. Along with these materials there will be instructions on how to serve interactive mix drinks and shots to the bar patrons. This will be distributed to bars who were not apart of the happy hour each kit will cost $110. This will be sent out to 250 bars nationally. Black Jack Exclusive Drink Book: When channel members carry Black Jack products they will receive an exclusive Black Jack drink recipe book3. The drink-­‐recipe book consists of 20 exclusive Black Jack recipes ranging from mixed drinks, shots and more. This allows the bar to expand on several levels. The cost will be $15 with shipping and handling to 200 bars. Liquor Store Promotional Material: Even if customers are not aware of the Black Jack extension we want them to notice it when they walk into the liquor store. This leaves us with a product shelving system that will grab their attention. Set up at the front of the liquor aisle upon a table backdrop that looks like a blackjack table and lights. At each liquor store, the 100th person to buy the bottle will receive it for free, as stated on the sign. This is up to the store manager’s disclosure and they must pay close attention to the recipes. The estimated cost with shipping is $50 to 300 bars. 1 1 Appendix A 2 Appendix B 3 Appendix C 10 PROMOTION OF PRODUCT 2 LIMITED EDITION Black Jack will be released nationwide, but only for a limited time. For a year's time, this product will be available in liquor stores across the country. Depending on its success, it may be re-­‐released after the initial time frame is up. This aspect of the product will be advertised to increase the appearance of the exclusivity of the product. As discussed in the Target Market Profitability section on page 6, Gen Y is more prone to explore and try new things. Thus, we feel that releasing Black Jack as limited edition will increase the allure and push the women in this demographic to branch out and try it while it lasts (Lukovitz). ADVERTISING Social Media Our social media campaign will consist of promotions through the original Jack Daniel's Facebook page, along with creation of a Black Jack Facebook page4; creation of a new Twitter account exclusively for BlackJack5 (tweets will include cheeky sayings and quips), as well as promoting the release of the new product through the current Jack Daniel's Twitter account. On the day of the launch, we will release a promoted tweet on Twitter; and a Pinterest account6 exclusively for Black Jack where pins will include recipes for drinks, ladies who exemplify the brand extension, career tips, and lifestyle tips for the young professional socialite. All of these social media websites will have links to the sites on the Facebook page for easy navigation. Internet Advertising Advertising will take place on web pages where we believe the young professional woman would be spending a good amount of her time. This includes business news pages, such as the New York Times, Yahoo, and the Huffington Post. On the New York Times homepage, for example, there will be an advertisement using the Home Page Auto-­‐Expand Pushdown7. There will be an ad8 that is 970x66 when retracted and expand to 970x418 once per user per day for 7 seconds. The user must click to expand the ad and subsequently click to close ("New York Times Media Kit"). Magazine Advertising Magazine ads will also be placed in those publications that we believe our target market primarily reads. This includes Oprah Magazine, BUST, Woman's Day, and Lucky (Brown). There will be three different advertisements9 that will run in these magazines. We believe these advertisements will appeal to our target market because of the off-­‐color and provocative nature of them. They portray a sense of strength and sophistication, as well as femininity and fun. Other traditional advertising means such as billboards, television, and radio advertisements may not be effective because, as was said in the Target Market Profitability section on page 6, Gen Y women are more skeptical of advertising and tend not to trust it. 2 4 Appendix D 5 Appendix E 6 Appendix F 7 Appendix G 8 Appendix H 9 Appendix I 11 RETURN ON INVESTMENT The initial investment into the Black Jack campaign is 50 million. Brown-­‐Foreman Inc., the parent company of Jack Daniel’s, is predicting a large return on investment from the launch of Black Jack, a black cherry flavor whiskey due to its successful launch of Tennessee Honey flavored whiskey in 2012. Currently, Jack Daniel’s Tennessee Honey holds 19% of market share in the U.S. of flavored brown spirits (Brown Foreman 2012 Annual Report). Along with its substantial market share, Tennessee Honey alone rose Jack Daniel’s 2 points of the 9% sales increase in 2012. The success of Tennessee Honey’s launch and return on investment is a positive foreshadowing of the expansion of flavored whiskey with the launch of Black Jack. We are predicting a 100 million return on investment from the marketing campaign and launch partnered with Black Jack. Along with financial purposes, the launch of Black Jack will expand our brand furthermore into the flavored whiskey market. With expansion, we are directly marketing and engaging with a subculture the brand does not directly market towards. Through this launch we hope to create a strong relationship with Gen Y professional women through our marketing efforts. In the end, we hope the experiences they have with Black Jack will leave them with a high brand recognition of the Jack Daniel’s brand overall and to buy our products within other sectors as well. Overall, the return of investment with the Black Jack launch will bring higher profitability, brand expansion, and reach new markets they have not reached before. 12 WORKS CITED Barrett, Karen Nichols, comp. Gen Y Women in the Workplace Focus Group Summary Report. Rep. Business and Professional Women's Foundation, Apr. 2011. Web. 3 Mar. 2013. Brown, Amanda. "Top 10 Women's Magazines." All Women Stalk. n. page. Web. 28 Apr. 2013. <http://allwomenstalk.com/top-­‐10-­‐womens-­‐magazines>. Corbett, Christianne, and Catherine Hill. Graduating to a Pay Gap: The Earnings of Women and Men One Year after College Graduation. Rep. Washington, DC: American Association of University Women, 2012. Web. Escalera , Karen Weiner. “Generation Y: Luxury’s Most Buoyant Market.” Luxury Society. Web. 5 Mar. 2013. <http://luxurysociety.com> "Experience Jack Daniel's." Jack Daniel's Tennessee Whiskey. N.p.. Web. 4 Mar 2013. <http://www.jackdaniels.com/experience>. Lukovitz, Karlene. "Gen Y Changing Alcoholic Beverages Marketplace." Marketing Daily. Nielsen Millennial Study, 14 Jan. 2011. Web. 05 Mar. 2013. Novellino, Teresa. "At Beam Inc., It’s Ladies Night."Upstart: A Business Journal. 07 Oct 2011: 1. Web. 5 Mar. 2013. "Online: Audience ." The New York Times Media Kit . N.p., n.d. Web. 29 Apr 2013. <http://nytmarketing.whsites.net/mediakit/online>. Puybaraud, Maria, Dr. Generation Y and The Workplace Annual Report 2010. Rep. London: Johnson Controls, 2010. Global Workplace Innovation. Generation Y and the Workplace Annual Report 2010. Johnson Controls, 2010. Web. 3 Mar. 2013. Ramirez, David. "Brown-­‐Forman Corporation-­‐Competitors." (2013): n.pag. Hoovers. Web. 4 Mar 2013. Standford, Duane. "Jim Beam Maker Chases Women With Skinnygirl Cocktails: Retail."BloombergBusinessweek Magazine. 03 Oct 2011: 1. Web. 4 Mar. 2013. Stanford, Duane. "Targeting Millennial Wine Drinkers Online." BloomberBusinessweek Magazine. 12 May 2011: 1. Web. 5 Mar. 2013. "The Jack Daniel's Store." Jack Daniel's Tennessee Whiskey. N.p.. Web. 4 Mar 2013. <http://jackdaniels.summitmg.com/jdc/Default.asp>. The Young Professional Workforce Fact Sheet 2013. Rep. Department for Professional Employees, Jan. 2013. Web. 3 Mar. 2013. United States. Census Bureau. Current Population Survey, Annual Social and Economic Supplement. “Table 1: Population by Age and Sex: 2011” United States Census 2011. Washington: US Census Bureau, 2011. Web Nov. 2012. <http://www.census.gov/population/age/data/files/2011/2011gender_table1.csv> United States. Census Bureau. Current Population Survey, Annual Social and Economic Supplement. “Table 19: Earnings of Full-­‐Time, Year-­‐Round Workers by Sex and Age: 2010” United States Census 2011. Washington: US Census Bureau, 2011. Web Nov. 2012. <http://www.census.gov/population/age/data/files/2011/2011gender_table19.csv> Warc. "Diageo targets new consumers." Warc. 13 Feb 2012: 1. Web. 5 Mar. 2013. 13 Appendix A Happy Hour Invitations Invitation Template for bars to send out to select patrons for the exclusive happy hours introducing Black Jack. 14 Appendix B Happy Hour Materials Promotional sign used for Black Jack promotions within bars, restaurants, and even liquor stores. Also used interchangeable with interactive kits with change of information (i.e. delete the Happy Hour). 15 Appendix C Recipe Book 16 Appendix D 17 Appendix E 18 Appendix F 19 Appendix G 20 Appendix H Retracted Expanded Close (X) 21 Appendix I 22