CHAPTER 4 Examining the Income Statement

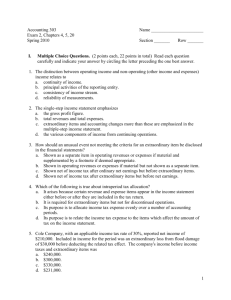

advertisement