archive-FID-043 /50.47 KB

advertisement

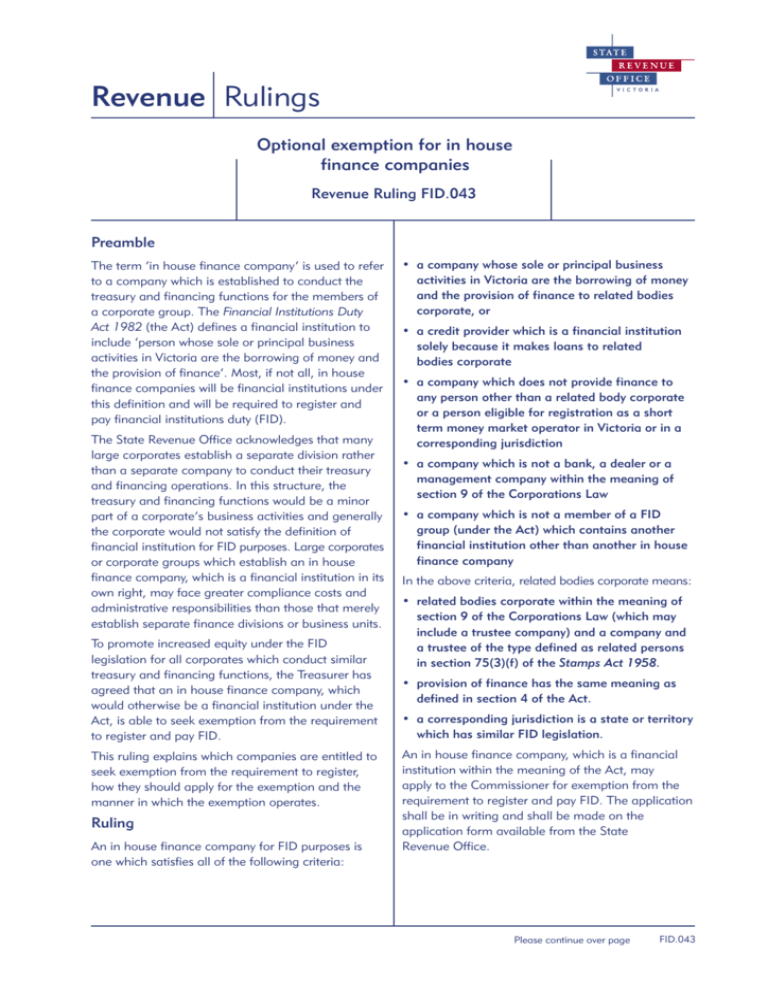

Revenue Rulings Optional exemption for in house finance companies Revenue Ruling FID.043 Preamble The term ‘in house finance company’ is used to refer to a company which is established to conduct the treasury and financing functions for the members of a corporate group. The Financial Institutions Duty Act 1982 (the Act) defines a financial institution to include ‘person whose sole or principal business activities in Victoria are the borrowing of money and the provision of finance’. Most, if not all, in house finance companies will be financial institutions under this definition and will be required to register and pay financial institutions duty (FID). The State Revenue Office acknowledges that many large corporates establish a separate division rather than a separate company to conduct their treasury and financing operations. In this structure, the treasury and financing functions would be a minor part of a corporate’s business activities and generally the corporate would not satisfy the definition of financial institution for FID purposes. Large corporates or corporate groups which establish an in house finance company, which is a financial institution in its own right, may face greater compliance costs and administrative responsibilities than those that merely establish separate finance divisions or business units. To promote increased equity under the FID legislation for all corporates which conduct similar treasury and financing functions, the Treasurer has agreed that an in house finance company, which would otherwise be a financial institution under the Act, is able to seek exemption from the requirement to register and pay FID. This ruling explains which companies are entitled to seek exemption from the requirement to register, how they should apply for the exemption and the manner in which the exemption operates. Ruling An in house finance company for FID purposes is one which satisfies all of the following criteria: • a company whose sole or principal business activities in Victoria are the borrowing of money and the provision of finance to related bodies corporate, or • a credit provider which is a financial institution solely because it makes loans to related bodies corporate • a company which does not provide finance to any person other than a related body corporate or a person eligible for registration as a short term money market operator in Victoria or in a corresponding jurisdiction • a company which is not a bank, a dealer or a management company within the meaning of section 9 of the Corporations Law • a company which is not a member of a FID group (under the Act) which contains another financial institution other than another in house finance company In the above criteria, related bodies corporate means: • related bodies corporate within the meaning of section 9 of the Corporations Law (which may include a trustee company) and a company and a trustee of the type defined as related persons in section 75(3)(f) of the Stamps Act 1958. • provision of finance has the same meaning as defined in section 4 of the Act. • a corresponding jurisdiction is a state or territory which has similar FID legislation. An in house finance company, which is a financial institution within the meaning of the Act, may apply to the Commissioner for exemption from the requirement to register and pay FID. The application shall be in writing and shall be made on the application form available from the State Revenue Office. Please continue over page FID.043 Where the Commissioner is satisfied that the applicant satisfies all the criteria of an in house finance company, he will arrange for the applicant to be prescribed in the Financial Institutions Duty Regulations 1992 (the Regulations) as a person to whom the Act does not apply. The applicant will then be excluded from the definition of financial institution found in section 3(1) by paragraph (t) of that definition which refers to a person, or class of persons, to which the Act does not apply. An in house finance company will not acquire exempt status until such time as its name is published in the Regulations. However, the Commissioner has ruled that a new company, or an existing company which changes its activities so that it becomes a financial institution, will be granted a three month period of grace during which time it may apply for exempt status without being treated as a financial institution in the interim. The period of grace will commence on the date of incorporation or the date on which the company’s business activities changed, whichever applies. The Commissioner may review a prescribed company’s status at any time to ensure that it continues to be an in house finance company. Any company which has been listed in the Regulations must notify the State Revenue Office as soon as it is no longer entitled to the exemption. Where a company ceases to be an in house finance company as defined in this ruling, the Commissioner shall revoke the exemption by causing the company’s name to be removed from the Regulations. The commencement date of this Ruling is 1 February 1997. Please note that rulings do not have the force of law. Each decision made by the State Revenue Office is made on the merits of each individual case having regard to any relevant ruling. All rulings must be read subject to Revenue Ruling GEN.01. Denzil Griffiths Commissioner of State Revenue 1 February 1997 ictoria ON THE MOVE FID.043